The fact that we have been able to establish ourselves as the largest bank in the country is largely due to our customer-centricity and constant dedication towards improving the experience of our customers.

CLIC (Customer Liability Identification Centre)

We have established a centralised dedicated cell, CLIC, across all 17 circles. This cell expedites the resolution of complaints related to unauthorised electronic debit transactions (UAED), ensuring a swift and efficient customer experience.

Customer Engagement Metrics

To measure customer satisfaction and loyalty, we have implemented the following metrics:

- CSAT (Customer Satisfaction): We assess customer experience after every transaction, be it financial or non-financial, on all our platforms. This helps us understand and improve customer satisfaction levels.

- NPS (Net Promoter Score): Our NPS measurement enables us to gauge customer loyalty and satisfaction, providing insights into the likelihood of customers recommending our products and services to others.

- CES (Customer Effort Score): We evaluate the ease of use and resolution of customer issues with our products and services. This helps us identify areas where we can reduce customer effort and enhance their experience.

Incognito Branch Visits

To ensure optimal service quality, we conducted incognito visits to 4,930 branches across India. These visits assessed various aspects such as infrastructure availability, staff readiness, and overall branch activity. The insights gathered from these visits were implemented to further improve customer experience.

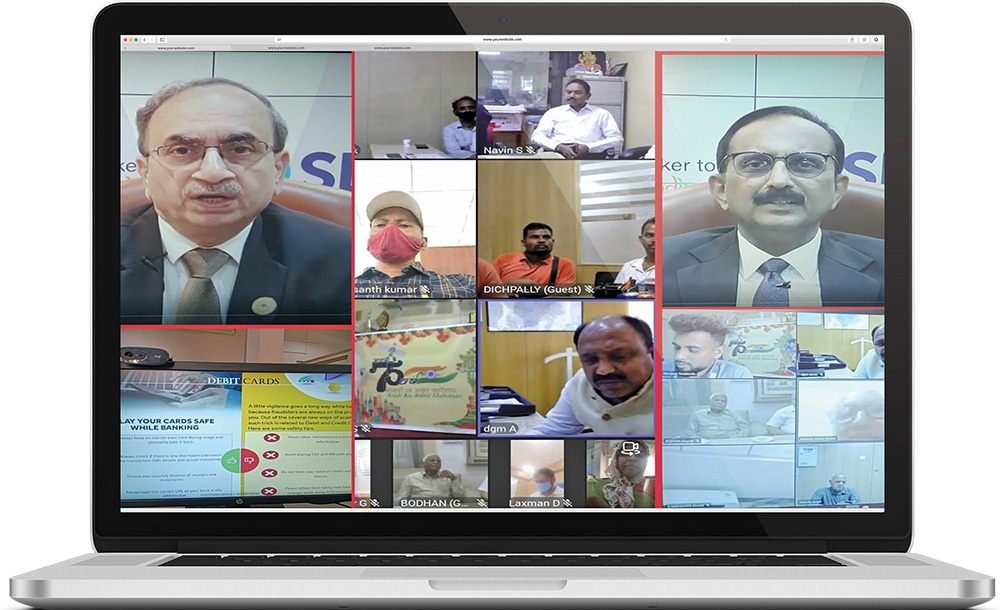

Town Hall Meetings

To better understand the preferences and expectations of millennial, Gen Y, and Gen Z customers, we organised town hall meetings as a part of the "Azadi Ka Amrit Mahotsav" celebrations. Open house interactions were held at 1,488 centres across metro and district headquarters, engaging with customers directly. These interactions revealed that 95.33% of customers prefer digital channels, while the remaining 4.67% opt for other channels.