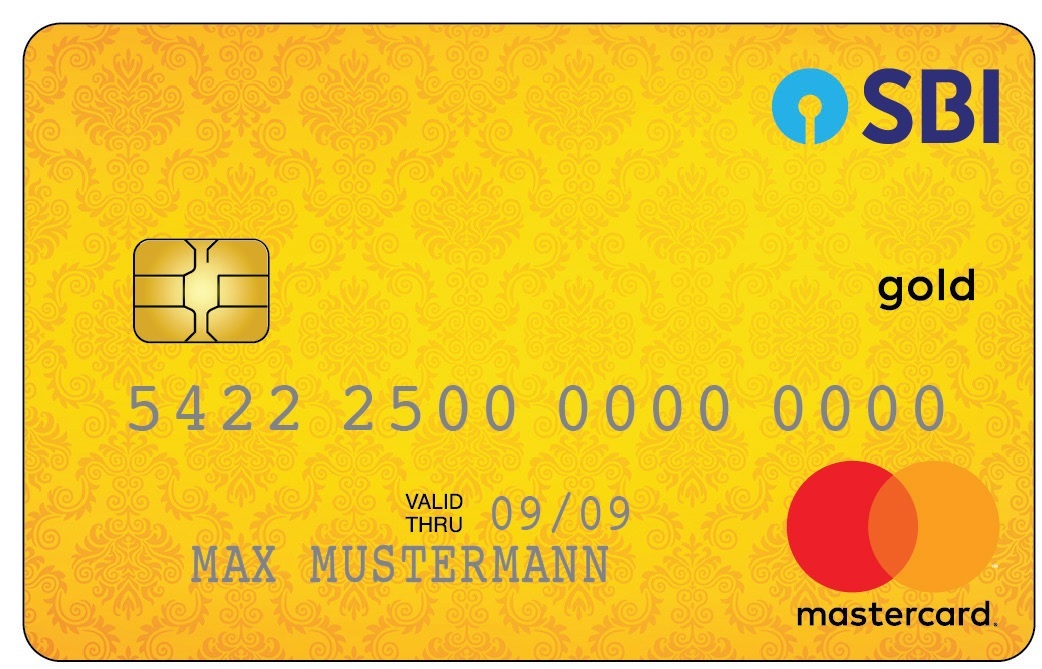

- Variant under Defence Salary Package

- GOLD: Up to Master Chief Petty Officer- I

- Diamond: Sub Lieutenant, Lieutenant, Lieutenant Commander

- Platinum: Commander, Captain, Commodore, Rear Admiral, Vice Admiral and Admiral

- Zero Balance Account with no penalty for Minimum Average Balance maintenance

- Unlimited number of transaction free at all Bank’s ATM in India

- Auto Sweep Facility (Optional)

- Free Multi City Cheques, Demand Drafts, SMS Alerts

Note 1: Benefits under salary package are subject to classification of Savings Bank Account to respective Salary Package and Variant in banks system. All Customers Drawing Salary through SBI Accounts are required to apply along with proof of Salary and Proof of employment to their home branch for conversion of savings account to respective Salary Package/Variant(Conversion Forms).

Note 2: In case, monthly salary is not credited into the account for more than 3 consecutive months, the account will be converted to normal savings account and all the features offered under Salary Package will stand withdrawn. All the Charges shall be levied as applicable to normal Savings Bank Account.

For Serving Personnel

- Personal Accident Insurance (Death) Cover* ₹ 50 lakh at Account Level

- Air Accident Insurance (Death) Cover* ₹ 1 Core

- Permanent Total Disability Cover* up to ₹ 50 lakh

- Permanent Partial Disability Cover* up to ₹ 50 lakh

- Higher Education (Graduation) for 1 Child (18-25 age) *: Up to ₹ 5 lakh

- ₹ 10 lakh additional Insurance for death in action against terrorist/ Naxalites/ foreign enemy*

Note 1: Benefits under salary package are subject to classification of Savings Bank Account to respective Salary Package and Variant in banks system. All Customers Drawing Salary through SBI Accounts are required to apply along with proof of Salary and Proof of employment to their home branch for conversion of savings account to respective Salary Package/Variant(Conversion Forms).

Note 2: In case, monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under Salary Package will stand withdrawn and the account shall be treated as Normal Savings Account under our standard charges structure, and all charges shall be levied and applied as applicable to normal savings accounts.

- Free Gold Debit Card (For Gold Variant) and Platinum Variant Debit Card (for Diamond and Platinum Variants)

- No annual Maintenance Charges on Debit Card

- Free Debit Card for joint account holder

- Concession in Annual Locker Rental

- Gold : 10%

- Diamond : 15%

- Platinum : 25%

Note 1: Benefits under salary package are subject to classification of Savings Bank Account to respective Salary Package and Variant in banks system. All Customers Drawing Salary through SBI Accounts are required to apply along with proof of Salary and Proof of employment to their home branch for conversion of savings account to respective Salary Package/Variant(Conversion Forms).

Note 2: In case, monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under Salary Package will stand withdrawn and the account shall be treated as Normal Savings Account under our standard charges structure, and all charges shall be levied and applied as applicable to normal savings accounts.

- Zero Balance Account with no penalty for Minimum Average Balance maintenance

- Unlimited number of transaction free at all Bank’s ATM in India

- Free Multi City Cheques, Demand Drafts, SMS Alerts

- Personal Accident Insurance (Death) Cover* ₹ 50 lakh at Account Level

- Air Accident Insurance (Death) Cover* ₹ 1 Core

- Permanent Total Disability Cover* up to ₹ 50 lakh

- Permanent Partial Disability Cover* up to ₹ 50 lakh

- ₹ 10 lakh additional Insurance for death in action against terrorist/ Naxalites/ foreign enemy*

- Free Gold Debit Card

- No annual Maintenance Charges on Debit Card

- Free Debit Card for joint account holder

- Concession in Annual Locker Rental: 10 %

Note 1: Benefits under salary package are subject to classification of Savings Bank Account to respective Salary Package and Variant in banks system. All Customers Drawing Salary through SBI Accounts are required to apply along with proof of Salary and Proof of employment to their home branch for conversion of savings account to respective Salary Package/Variant(Conversion Forms).

Note 2: In case, monthly salary is not credited into the account for more than 3 consecutive months, the special features offered under Salary Package will stand withdrawn and the account shall be treated as Normal Savings Account under our standard charges structure, and all charges shall be levied and applied as applicable to normal savings accounts.