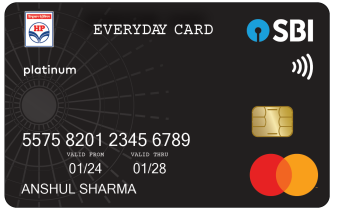

HPCL Co-Branded Debit Card - Personal Banking

HPCL Co-Branded Debit Card

एचपीसीएल को-ब्रांडेड डेबिट कार्ड (एवरीडे कार्ड)

विशेषताएँ

विशेष ऑफ़र:

- एचपीसीएल आउटलेट्स मे PoS से खर्च पर- हर 200 रुपये के खर्च पर 2X पॉइंट अर्जित करें

- अन्य ऑफ़र/फ़ीचर्स$:

|

क्रम संख्या |

ऑफ़र/फ़ीचर्स$ |

||||||||||

|

1 |

कॉम्प्लिमेंट्री लाउंज एक्सेस- भारत में चुनिंदा घरेलू लाउंज पर (1 विजिट/तिमाही) |

||||||||||

|

2 |

कॉम्प्लिमेंट्री बीमा कवर:

* यह सुविधा दुर्घटना की तिथि से पिछले 90 दिनों के दौरान किसी भी चैनल, जैसे एटीएम/पीओएस/ईकॉम पर वित्तीय लेनदेन के लिए कम से कम एक बार उपयोग किए गए डेबिट कार्ड के लिए उपलब्ध है। # यह सुविधा दुर्घटना की तिथि से पिछले 90 दिनों के दौरान किसी भी चैनल जैसे एटीएम/पीओएस/ईकॉम पर वित्तीय लेनदेन के लिए कम से कम एक बार उपयोग किए गए डेबिट कार्ड के लिए उपलब्ध है, बशर्ते कि हवाई यात्रा के लिए हवाई टिकट उस डेबिट कार्ड का उपयोग करके खरीदा गया हो। |

||||||||||

|

3 |

एचपीसीएल द्वारा ऑफर (एचपीसीएल द्वारा प्रबंधित):

|

$ कार्डधारक मास्टरकार्ड द्वारा प्लैटिनम वैरिएंट डेबिट कार्ड के लिए दी जाने वाली विभिन्न छूट और कॉम्प्लिमेंट्री सेवाओं का लाभ भी उठा सकते हैं, जैसे कि हवाई टिकट, होटल, रेस्तरां, कार किराये आदि पर छूट। ऑफर विवरण और ऑफर का लाभ कैसे लेना है, इसके लिए कृपया मास्टरकार्ड वेबसाइट पर जाएँ।

एसबीआई रिवार्ड्ज़

हर महीने 10,000 एसबीआई रिवॉर्ड प्वाइंट्स तक अर्जित करें। प्रति लेनदेन अधिकतम अर्जन सीमा 1,000 रिवॉर्ड प्वाइंट्स तक है।

स्टैंडर्ड रिवॉर्ड पॉइंट: अपने एसबीआई डेबिट कार्ड से ऑनलाइन या इन-स्टोर खरीदारी पर खर्च किए गए प्रत्येक 200 रुपए पर 2 रिवॉर्ड पॉइंट पाएं।

अतिरिक्त रिवॉर्ड पॉइंट: एचपीसीएल आउटलेट्स पर PoS से एवरीडे कार्ड के उपयोग पर प्रत्येक 200 रुपये के खर्च पर 2X रिवॉर्ड प्वाइंट्स अर्जित करें।

एक्टिवेशन बोनस: जारी होने के 2 महीने के भीतर न्यूनतम 2,000/- रुपये प्रत्येक लेनदेन की राशि के साथ 3 PoS या ई-कॉम लेनदेन करके 300 बोनस रिवार्ड पॉइंट तक निम्न रूप से अर्जित करें:

1st पहला उपयोग- 50

2nd दूसरा उपयोग – 100

3rd तीसरा उपयोग -150

माइलस्टोन बोनस: एक महीने में ₹1 लाख या उससे अधिक के PoS और ई-कॉम खर्च पर 1,000 बोनस रिवार्ड पॉइंट अर्जित करें। (MCC-6540 पर किया गया खर्च शामिल नहीं)

जन्मदिन बोनस: अपने जन्मदिन के महीने में अपने डेबिट कार्ड से किए गए खर्च पर 2x रिवॉर्ड पॉइंट पाएं।

अंतरराष्ट्रीय भुगतान:: अंतरराष्ट्रीय ऑनलाइन या इन-स्टोर खर्च पर 2x रिवॉर्ड पॉइंट पाएं।

पार्टनर ब्रांड्स: पार्टनर ब्रांड्स के साथ एसबीआई रिवार्ड्ज़ के ज़रिए खरीदारी पर अतिरिक्त रिवार्ड पॉइंट्स अर्जित करें। साथ ही, ऑनलाइन, इन-स्टोर और एसबीआई रिवार्ड्ज़ के ज़रिए खरीदारी पर पार्टनर ब्रांड्स पर रिवार्ड पॉइंट्स रिडीम करें।

रिवॉर्ड पॉइंट रिडीम करें: आप अपने SBI रिवॉर्ड पॉइंट को हमारी वेबसाइट "rewardz.sbi" और SBI रिवॉर्डज ऐप के ज़रिए आकर्षक मर्चेंडाइज़, FASTag रिचार्ज, बिल भुगतान, DTH रिचार्ज और बहुत कुछ के लिए रिडीम कर सकते हैं। वेबसाइट को Yono और SBI ऑनलाइन बैंकिंग के ज़रिए भी एक्सेस किया जा सकता है। चुनिंदा आउटलेट पर PoS मशीनों के ज़रिए रिडीम करने की सुविधा भी उपलब्ध है।

मूवी टिकट: अपने रिवार्ड पॉइंट्स का उपयोग bookmyshow.com पर मूवी टिकट खरीदने के लिए करें।

यात्रा: अपने रिवॉर्ड पॉइंट्स को फ्लाइट टिकट, बस और होटल बुकिंग के लिए रिडीम करें । SBI रिवॉर्डज़ के माध्यम से फ्लाइट टिकट बुकिंग पर कोई सुविधा शुल्क नहीं।

कैपिंग और एक्सलुशन- एसबीआई रिवॉर्ड पॉइंट्स नियम और शर्तों के अधीन हैं। कैपिंग, बहिष्करण और अन्य नियमों एवं शर्तों के बारे में विस्तृत जानकारी के लिए, कृपया "rewardz.sbi" या एसबीआई रिवॉर्डज़ ऐप पर जाएँ।

दैनिक नकद निकासी और लेनदेन सीमा:

|

विवरण |

घरेलू |

घरेलू |

|

अधिकतम एटीएम नकद निकासी सीमा |

40,000/- रुपए प्रतिदिन |

40,000/- रुपए के बराबर यूएसडी प्रतिदिन । |

|

अधिकतम PoS लेनदेन सीमा |

2,00,000/- रुपए प्रतिदिन

|

2,00,000/- रुपए के बराबर यूएसडी प्रतिदिन । |

|

अधिकतम ई-कॉम लेनदेन सीमा |

2,00,000/- रुपए प्रतिदिन |

1,00,000/- रुपए प्रतिदिन व 1,50,000/- रुपए प्रति माह के बराबर यूएसडी । |

|

अधिकतम संपर्करहित लेनदेन सीमा |

प्रति लेनदेन 5,000/- रुपए. |

|

कार्ड जारी करने की लागत एवं वार्षिक रखरखाव शुल्क*

|

विवरण |

शुल्क |

|

जारी करने का शुल्क |

350/- रुपए + जीएसटी |

|

वार्षिक रखरखाव शुल्क |

350/- रुपए + जीएसटी |

|

कार्ड प्रतिस्थापन शुल्क |

300/- + प्लस जीएसटी |

* समय-समय पर संशोधन के अधीन।

Last Updated On : Thursday, 03-07-2025

ब्याज दर

2.70% प्रति वर्ष.

से प्रभावी>3.00% प्रति वर्ष.

10 करोड़ रुपए व अधिक, 15.10.2022 से प्रभावी

6.00%

₹2 लाख तक की ऋण राशि के लिए

8.15%

₹2 लाख से अधिक और ₹6 लाख तक की ऋण राशि के लिए