How to Get a Personal Loan with YONO SBI App | Instant Approval - Yono

How to Get a Pre-Approved Personal Loan Using YONO SBI App?

18 Apr, 2024

personal loan

Whenever you need it - whether it’s for a medical emergency, planning a holiday, or any important event - you can count on us to be there. The State Bank of India (SBI) understands these needs and hence has come up with a perfect solution of pre-approved personal loan in YONO SBI app. In this guide, let us show you how you can secure a pre-approved personal loan via YONO SBI app to get help from financial assistance instantly.

Understanding the Power of Pre-Approved Personal Loans

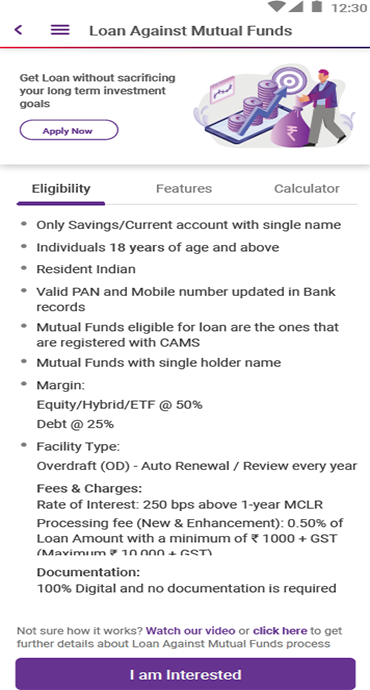

A pre-approved personal loan helps a borrower to have a financial backup available with no prior application. Pre-qualified loan applications provide a more streamlined and convenient experience compared to traditional loan processes. Unlike standard applications, which requires you to start from scratch and undergo a thorough credit evaluation, pre-qualified loans leverage your existing creditworthiness. Once you're pre-approved, accessing funds becomes much simpler, allowing you to bypass the possible time-consuming steps involved in loan approval. This approach not only saves time but also reduces the stress of securing financing when you need it most.

The Convenience of YONO Pre-Approved Personal Loans

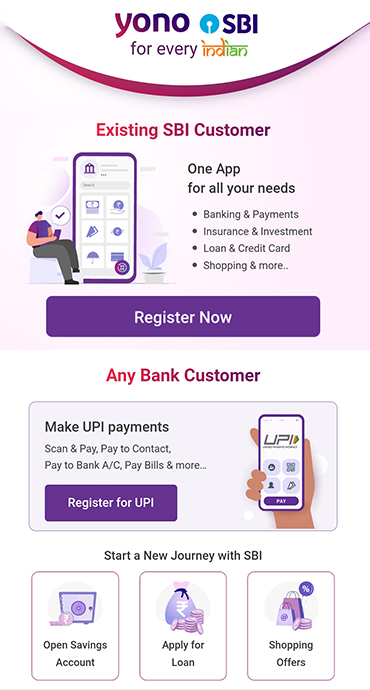

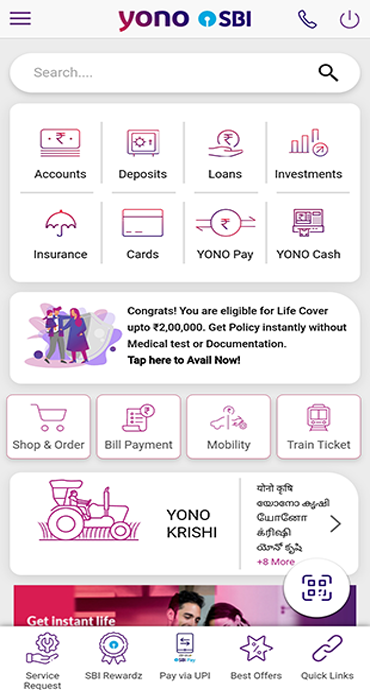

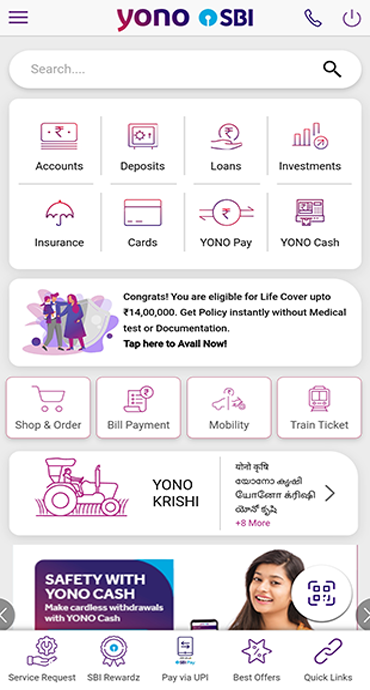

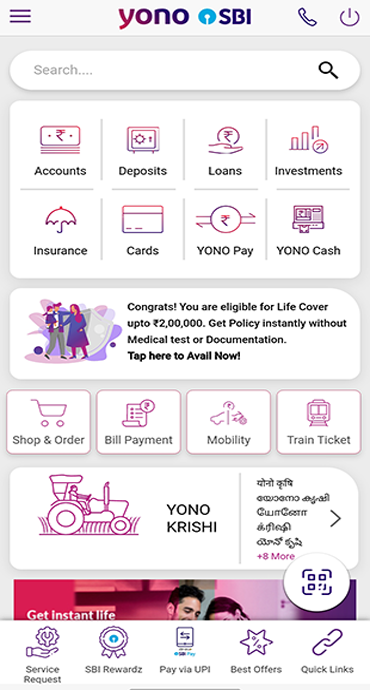

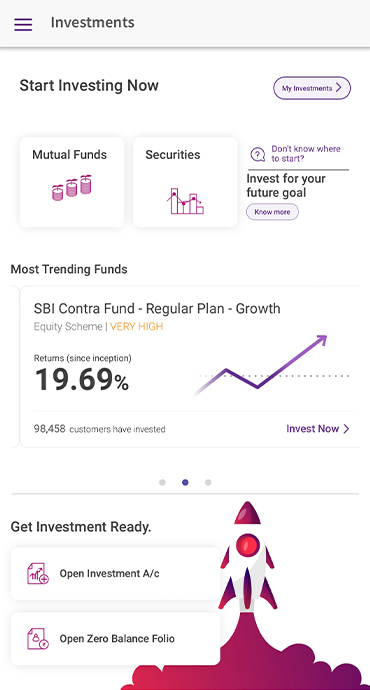

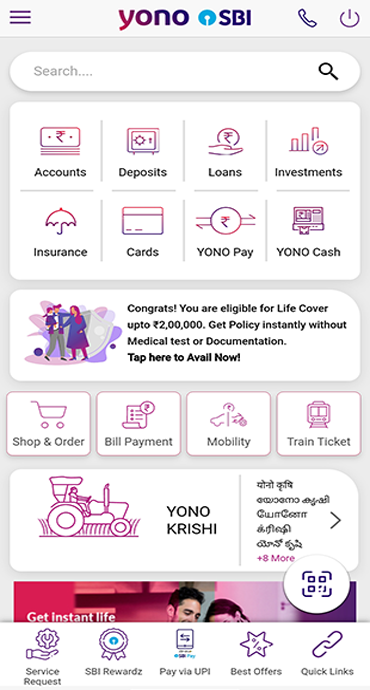

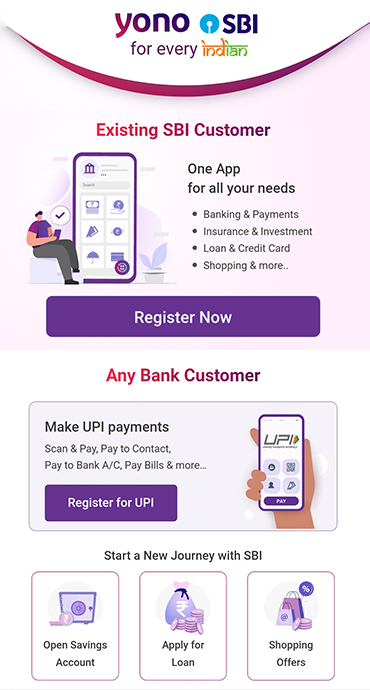

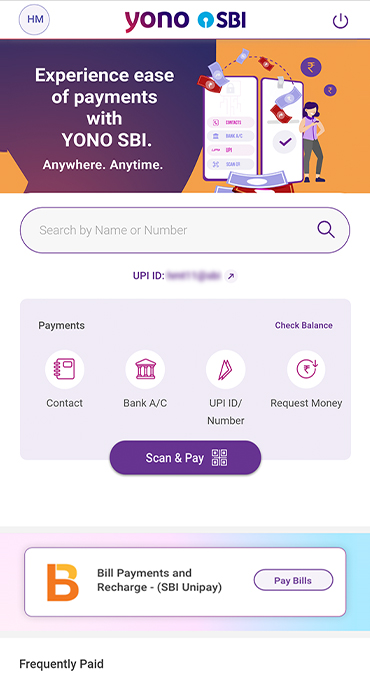

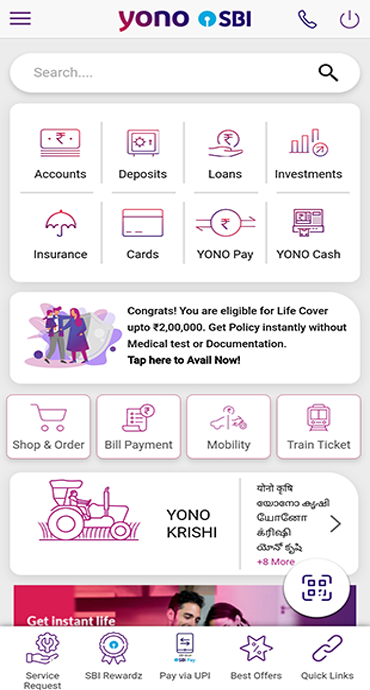

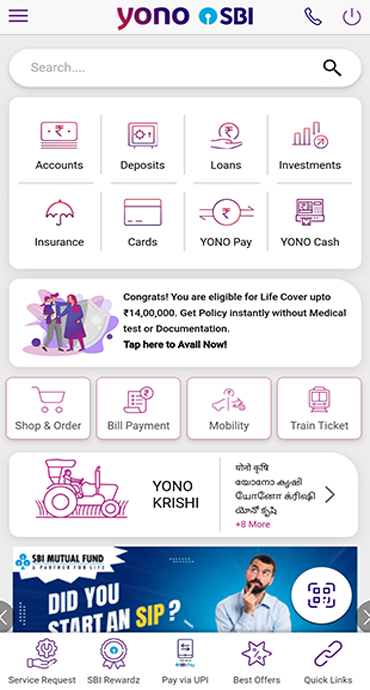

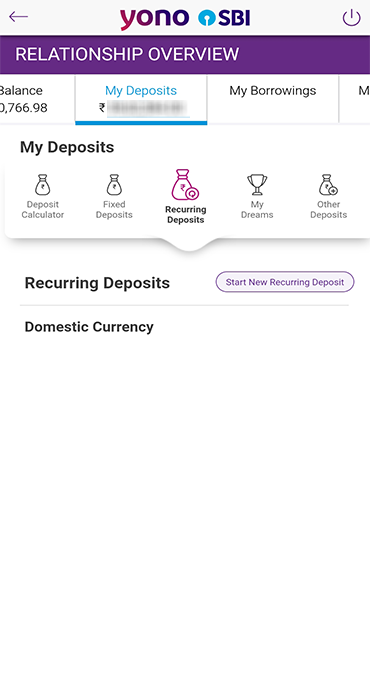

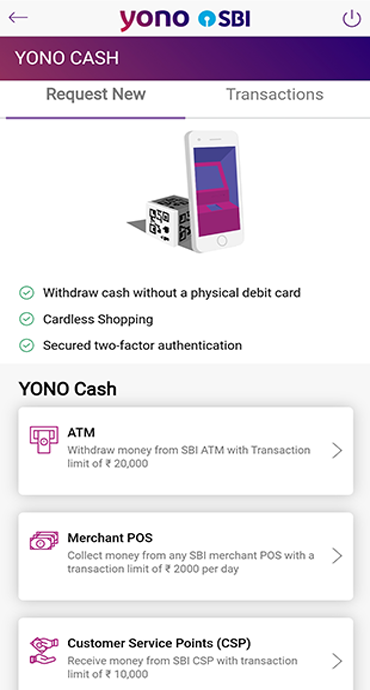

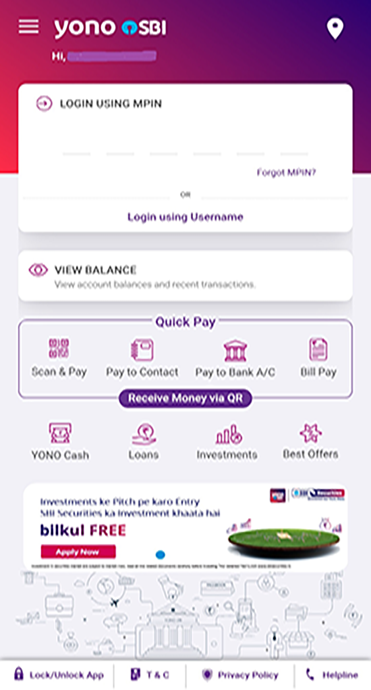

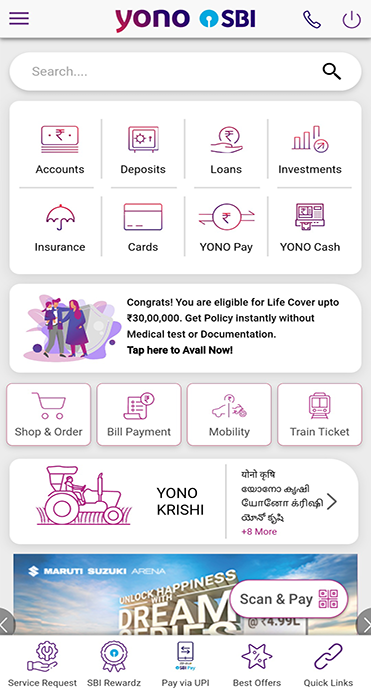

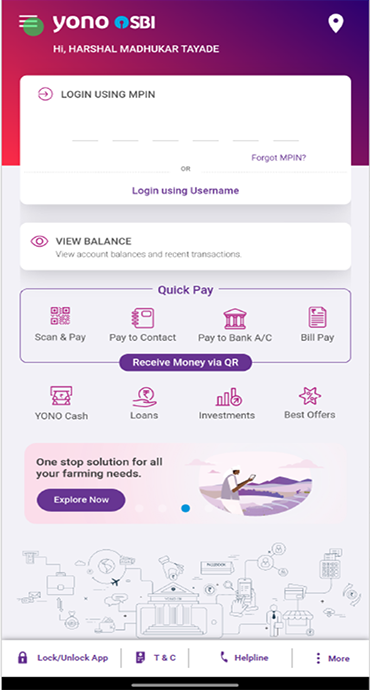

SBI's YONO app, which stands for "You Only Need One," is an all-in-one digital platform that provides a range of financial services at your fingertips.

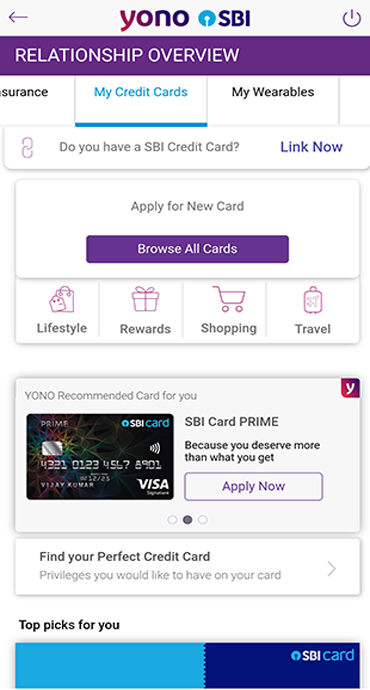

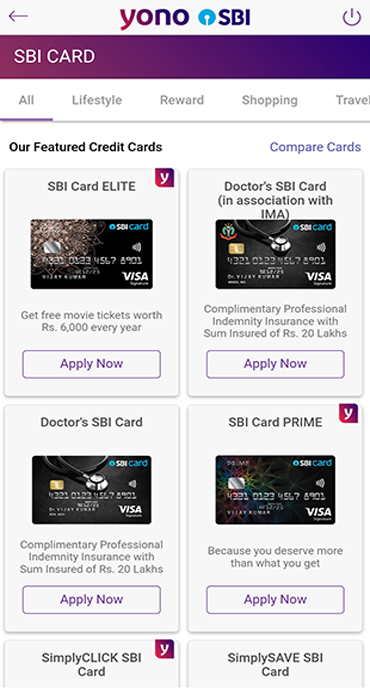

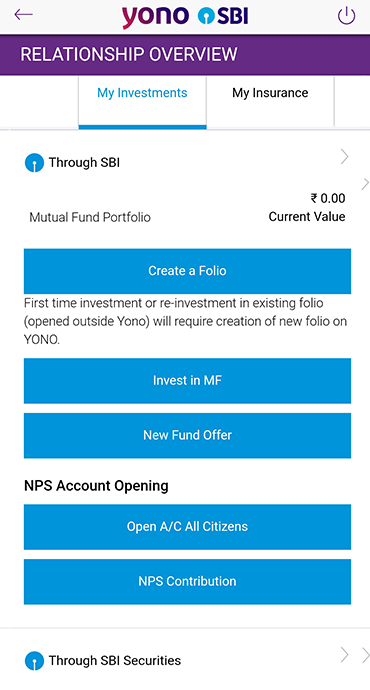

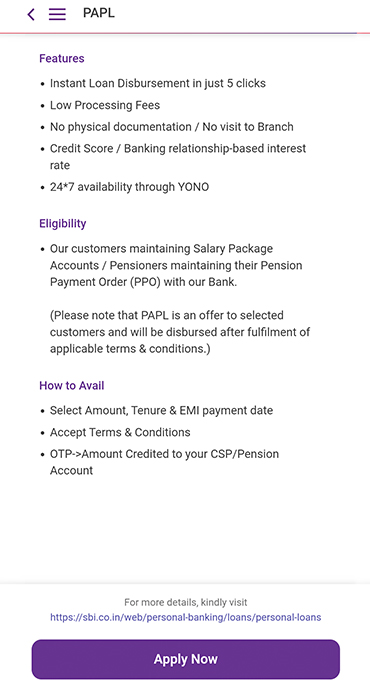

With YONO, applying for a pre-approved personal loan from SBI is a breeze. There are 9 variants of Pre-Approved Personal Loans catering to salary account customers, non-salary customers, pensioners, family pensioners and Top-Up loans. Here's how you can do it:

- Download and Install the YONO SBI App

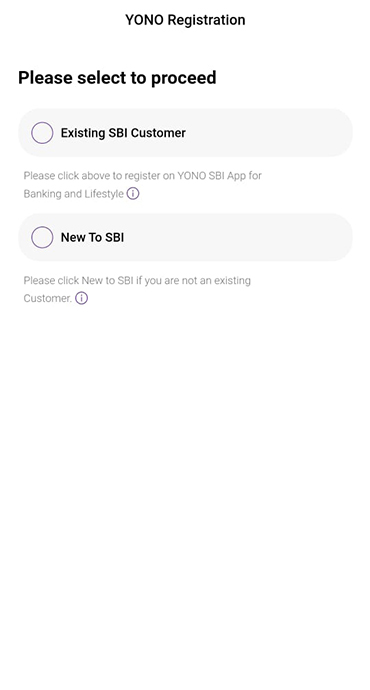

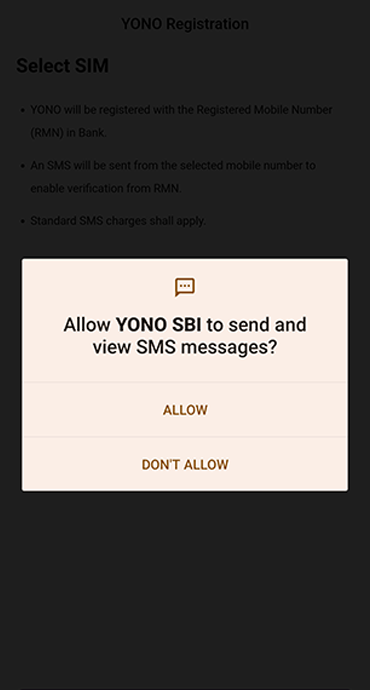

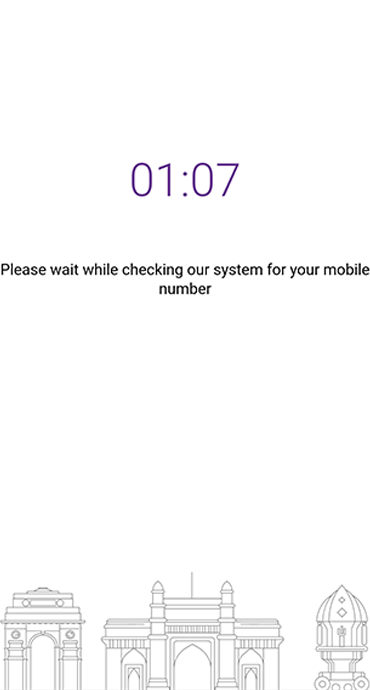

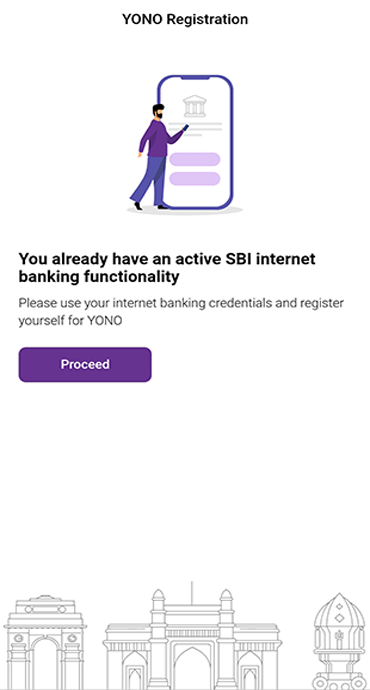

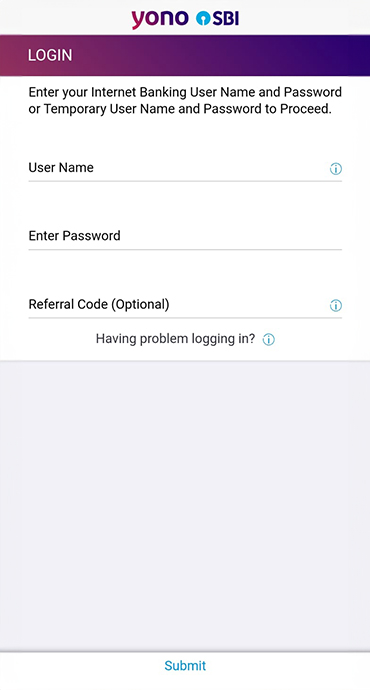

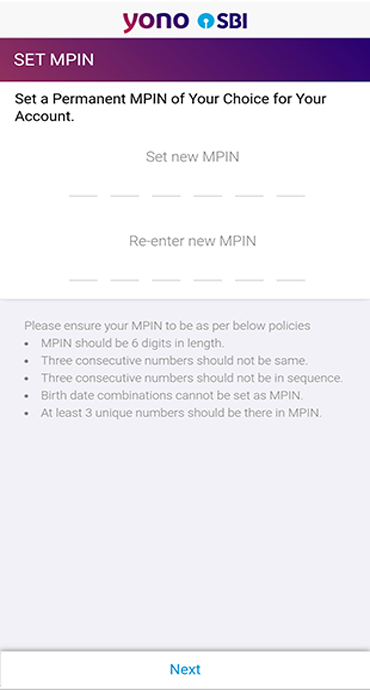

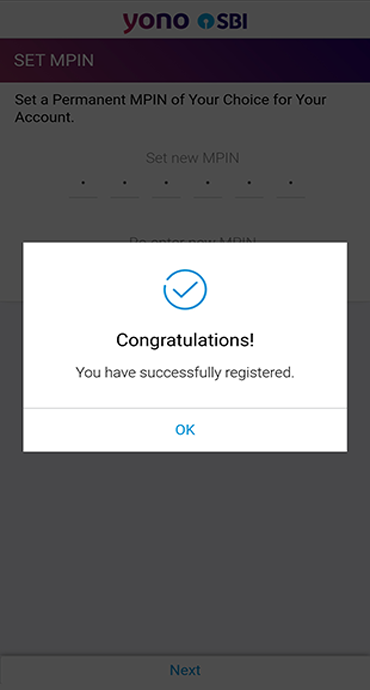

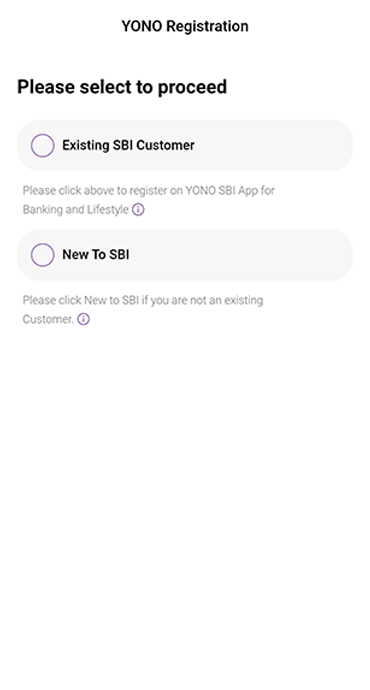

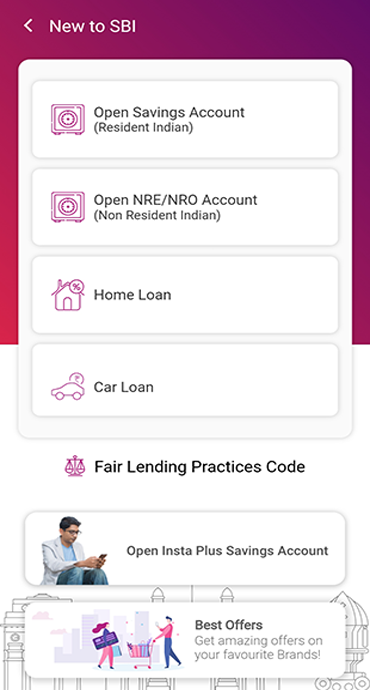

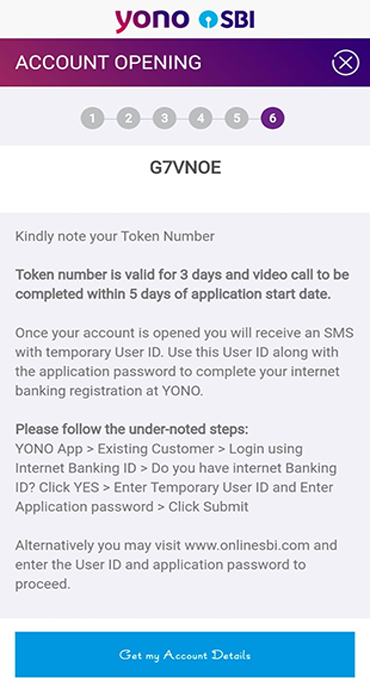

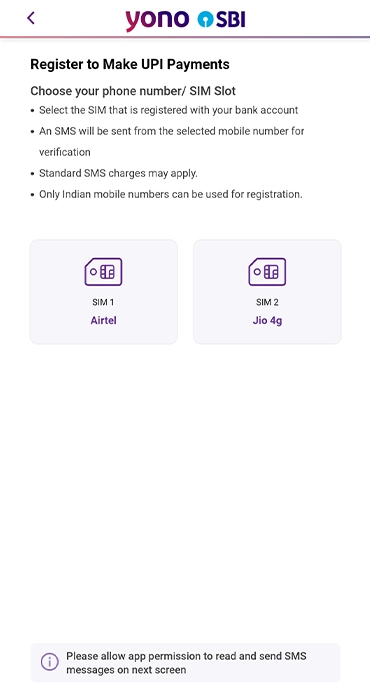

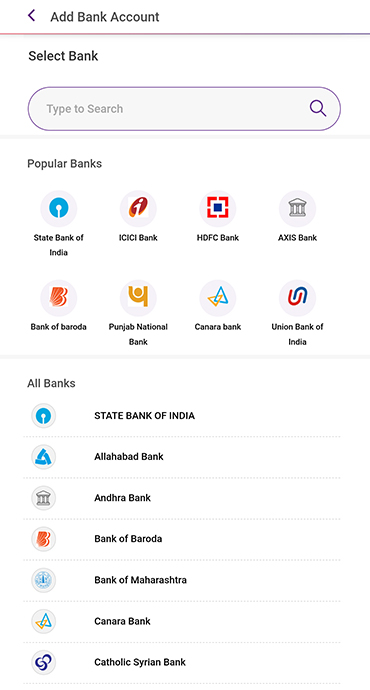

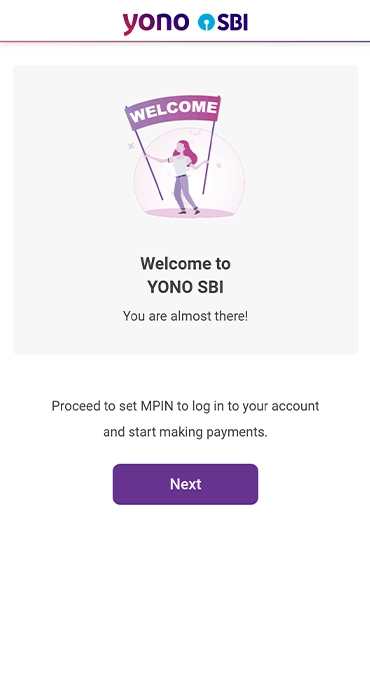

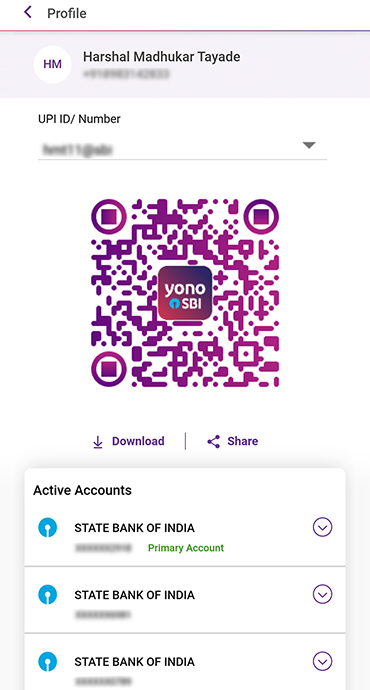

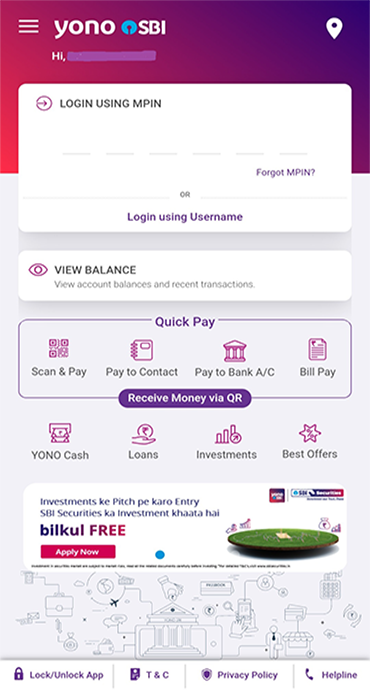

Start by downloading the YONO SBI app from Google Playstore/App store. It is available for both Android and iOS users. - Login or Register

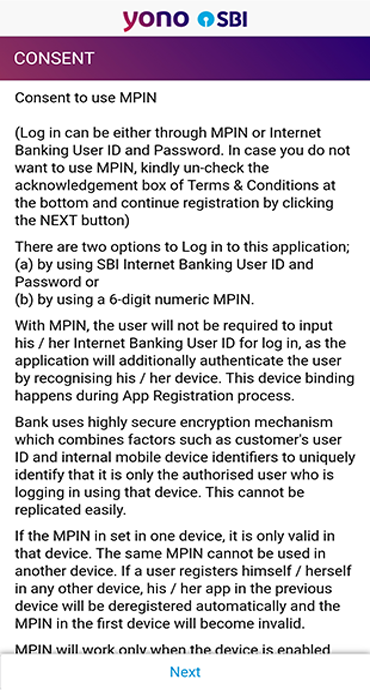

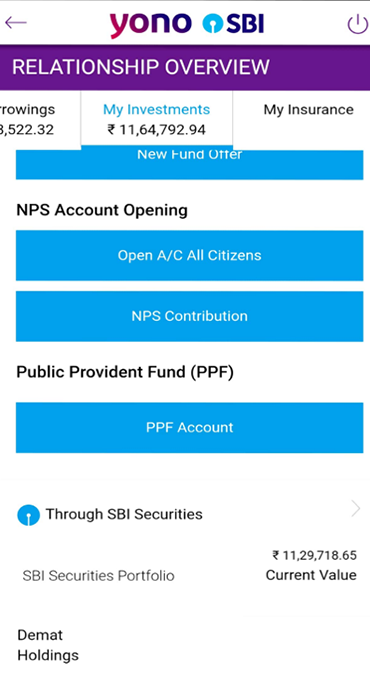

If you are an existing SBI customer, log in using your credentials. - Navigate to 'Pre-Approved Loans'

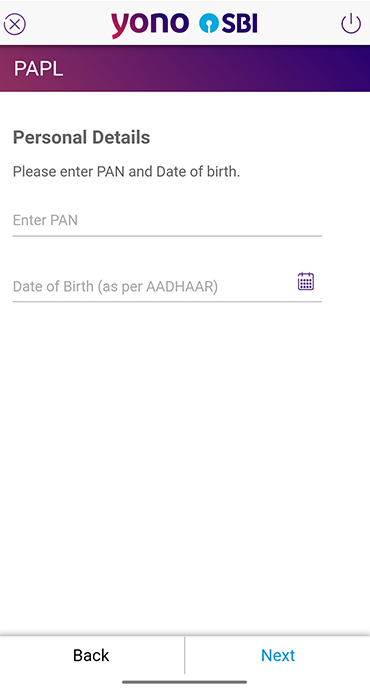

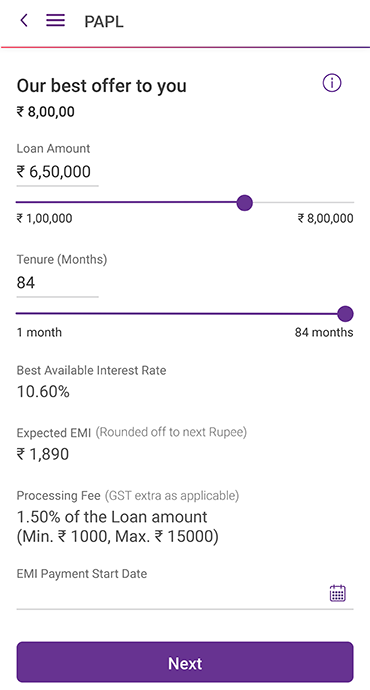

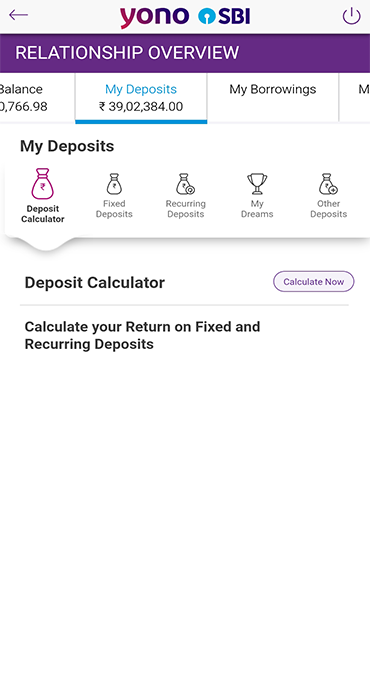

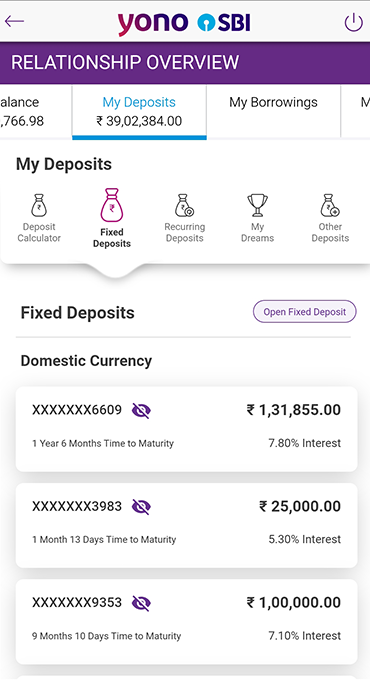

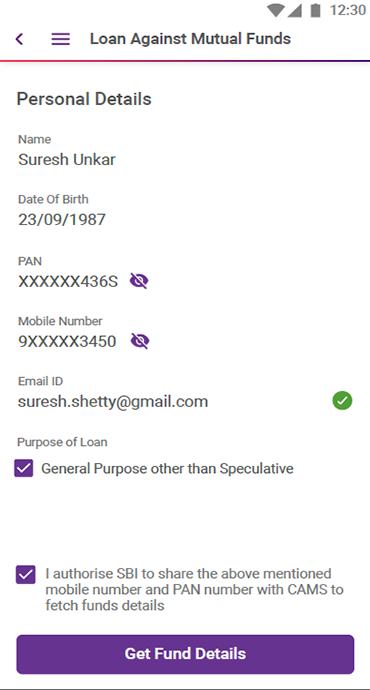

Once you are logged in, depending upon your eligibility, you will be able to see the “Pre-Approved Loan" offer banner on the homepage. You can also go to hamburger menu and go to ‘Offers for You’ to check your offer. - Offer details

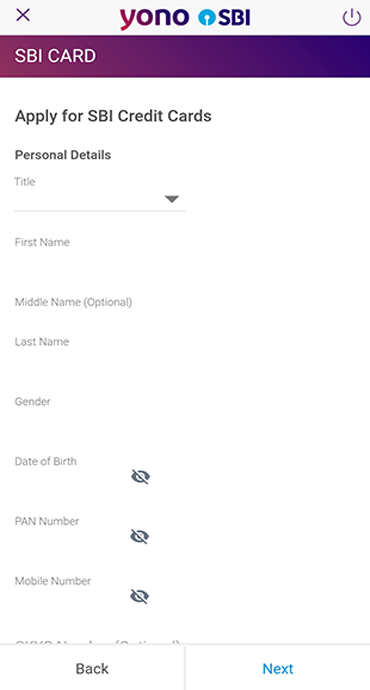

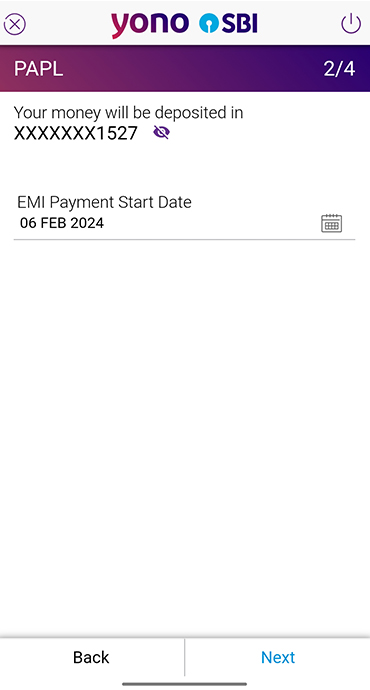

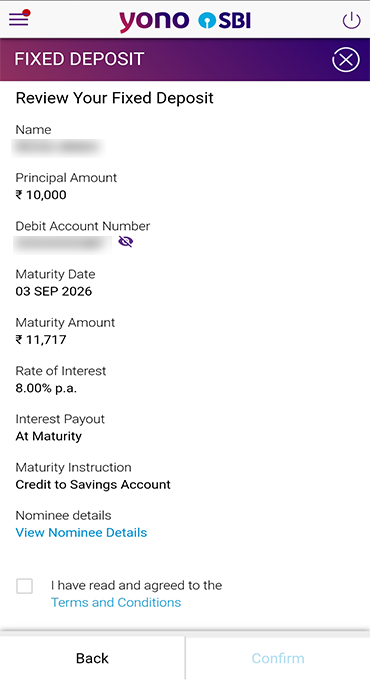

Click your pre-approved personal loan offer and validate your Permanent Account Number (PAN), Date of Birth, the desired amount, tenure and the repayment date that suits you the most. - Review and Confirm

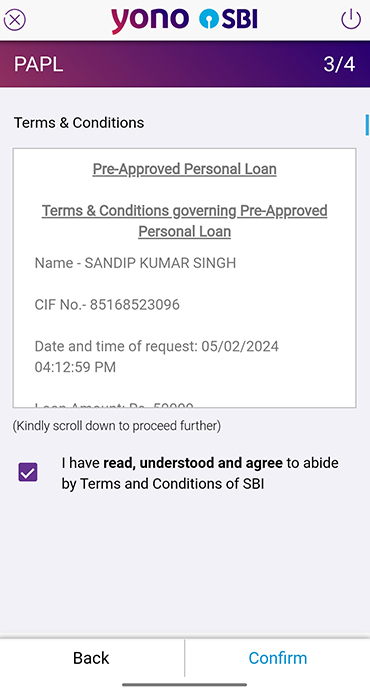

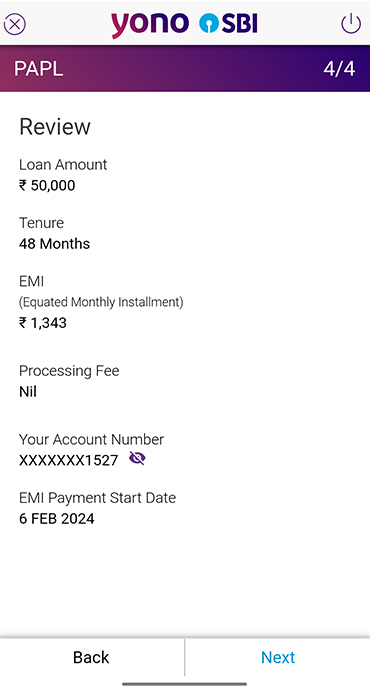

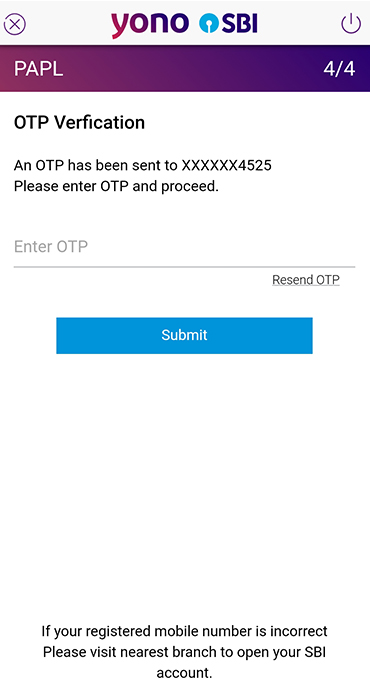

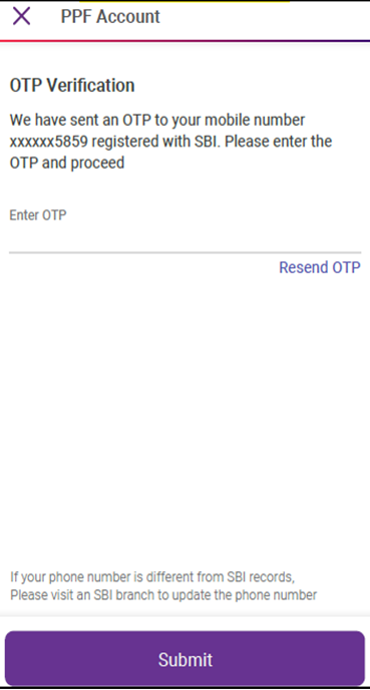

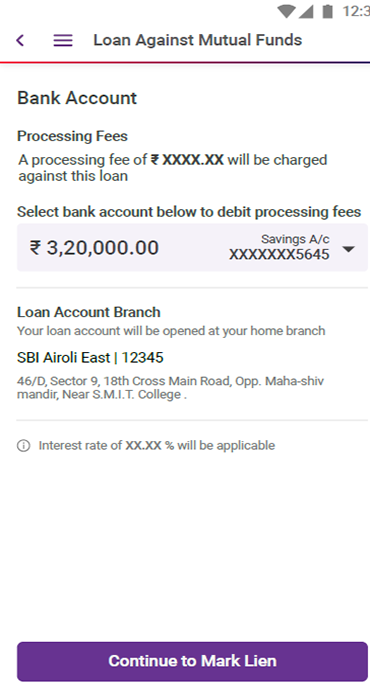

Take a moment to review the loan amount, interest rate, repayment terms and proceed to confirm your acceptance in just a few clicks. - Accept T&Cs

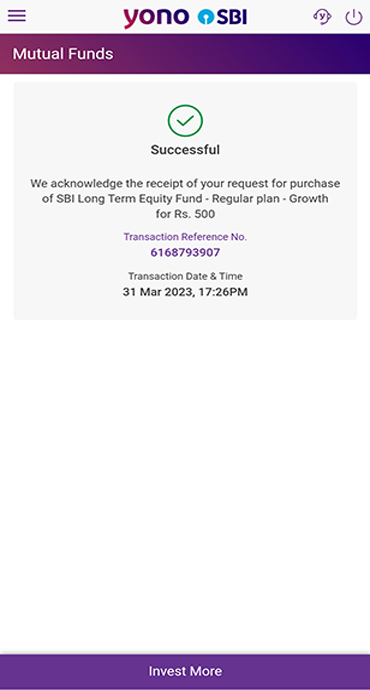

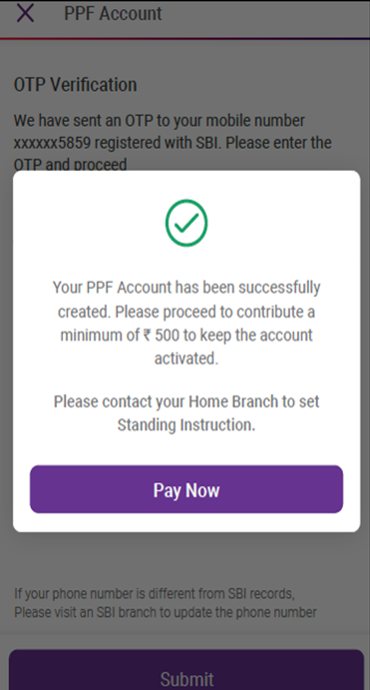

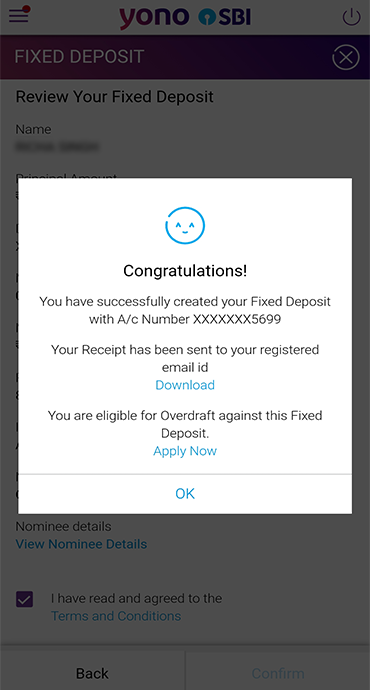

You need to accept the Terms & Conditions (T&Cs) and validate through One-Time Password (OTP). - Access Funds instantly

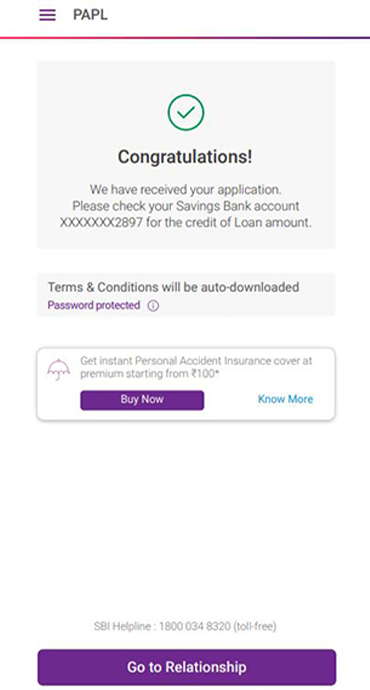

The loan amount will be instantly credited to your designated bank account. You can use these funds for your intended purpose without any further delays.

Conclusion

When financial emergencies strike, having a pre-approved personal loan from YONO SBI can provide you with the financial flexibility you need. The YONO app's intuitive interface and SBI's trusted reputation make obtaining a pre-approved personal loan a convenient and secure process. Remember, reading the terms and conditions before accepting any loan offer is essential. So, why wait? Download the YONO SBI app today and empower yourself to access funds at your fingertips.

आपकी रुचि से संबंधित ब्लॉग