Loan Against Mutual Funds at SBI: A Quick Guide - Yono

Loan Against Mutual Funds at SBI: A Quick Guide

04 Apr, 2025

loan against mutual fund loan

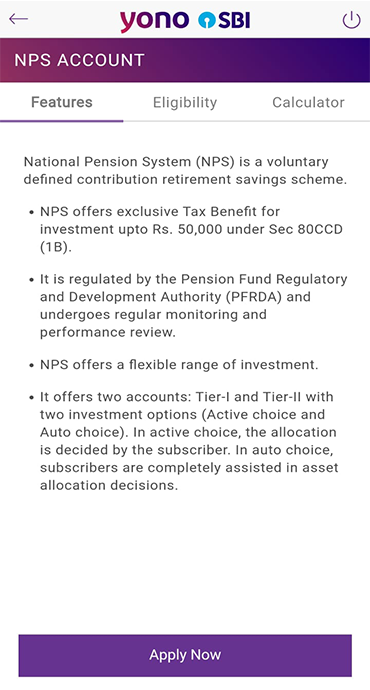

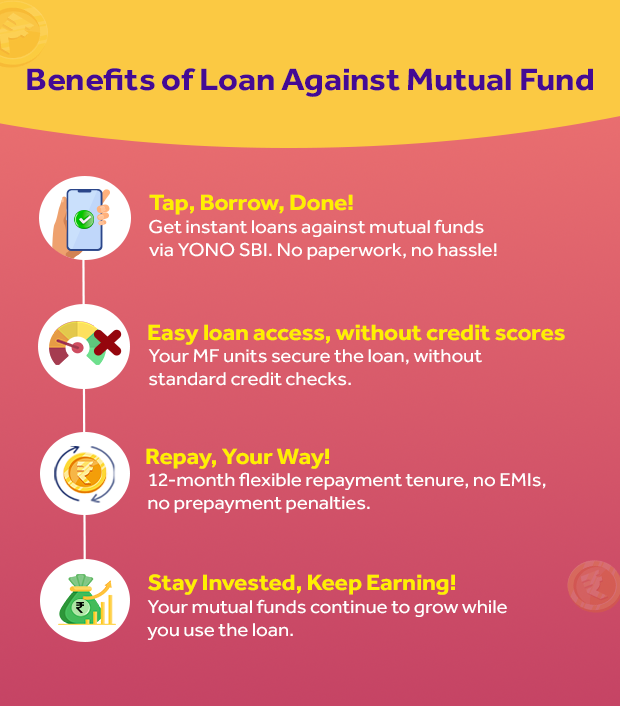

In current dynamic financial landscape, State Bank of India (SBI) offers innovative solutions to meet your immediate financial requirements while preserving your long-term investments. The Loan Against Mutual Funds facility enables you to leverage mutual fund investments to secure financing without liquidating your portfolio.

Key Features of SBI's Loan Against Mutual Funds

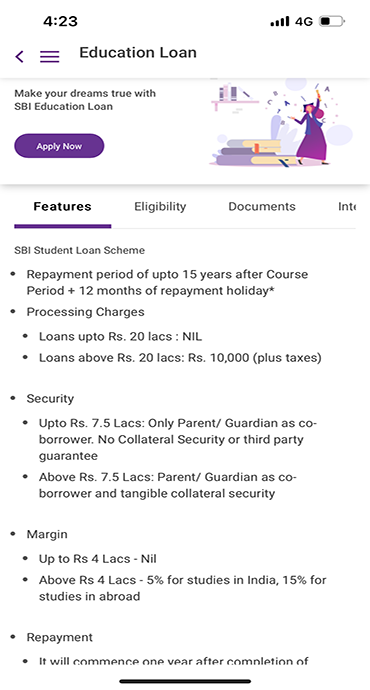

SBI offers loans on mutual funds to meet various financial needs. By availing a loan against mutual funds, you can manage both temporary and immediate financial requirements. These include educational expenses, business funding, personal expenses, or medical emergencies. For immediate needs, such as urgent bill payments, unexpected travel, or emergency repairs, this loan provides a quick and convenient solution

The minimum loan amount starts at ₹ 25,000, making it accessible for various financial needs. For those investing in equity mutual funds, one can avail loans up to ₹. 10 lakh at effective interest rates starting from 10.10% per annum. If any one holds debt funds, the maximum loan amount extends to ₹ 5 crores, providing substantial financing options for larger requirements. SBI ensures flexibility with structured overdraft facilities and a tenure of 12 months, which can be renewed annually, catering to diverse financial goals.

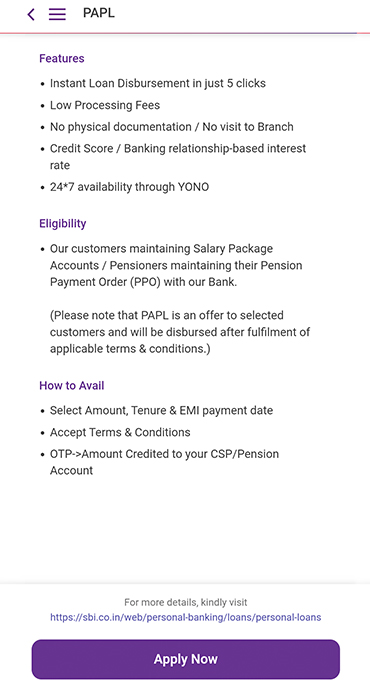

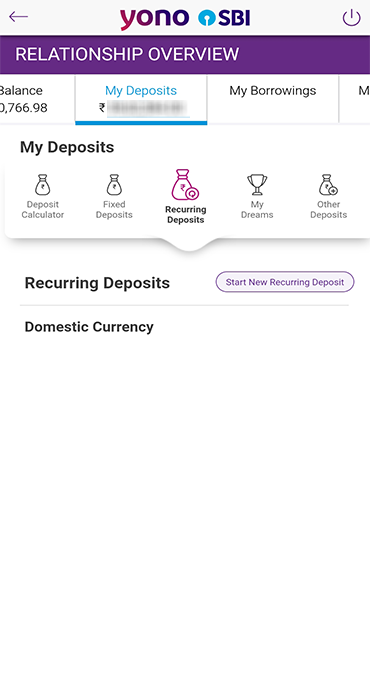

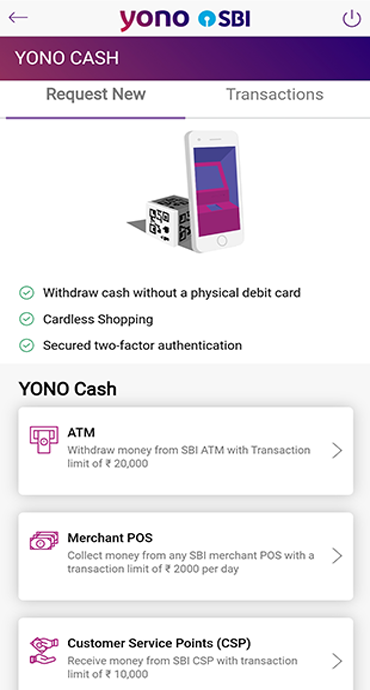

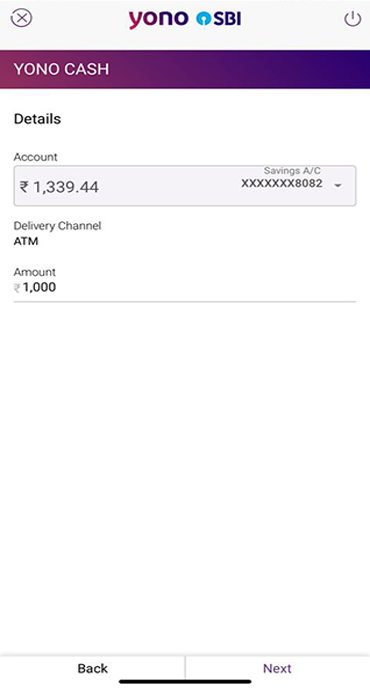

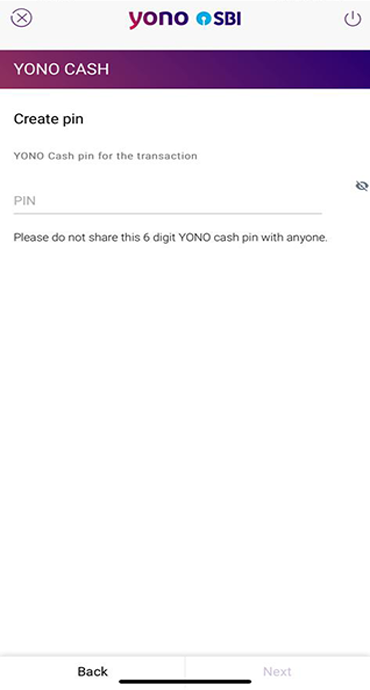

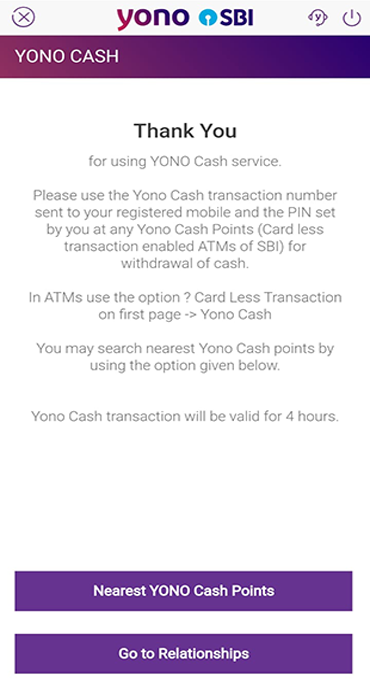

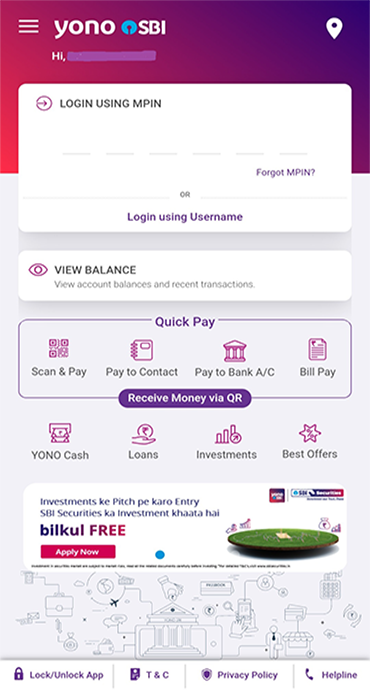

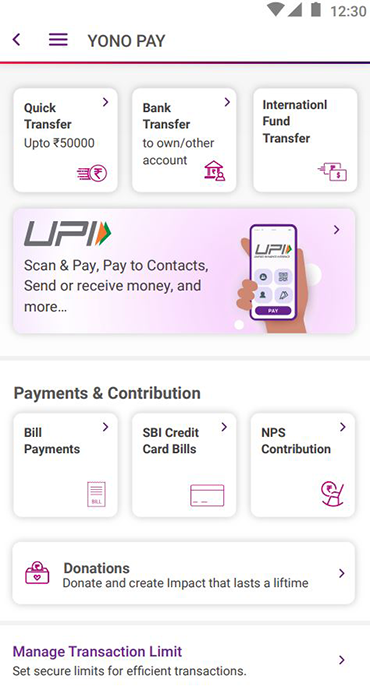

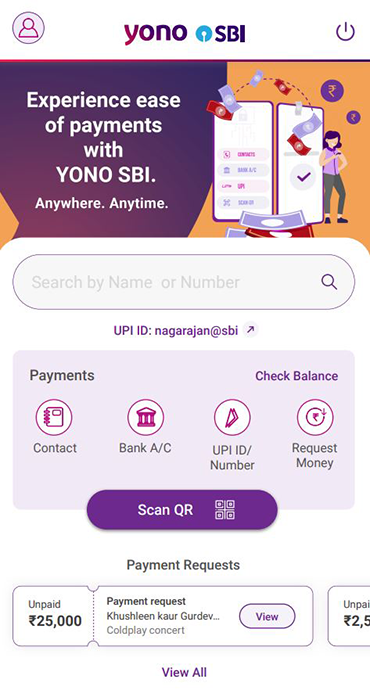

Facility available as an Overdraft Account

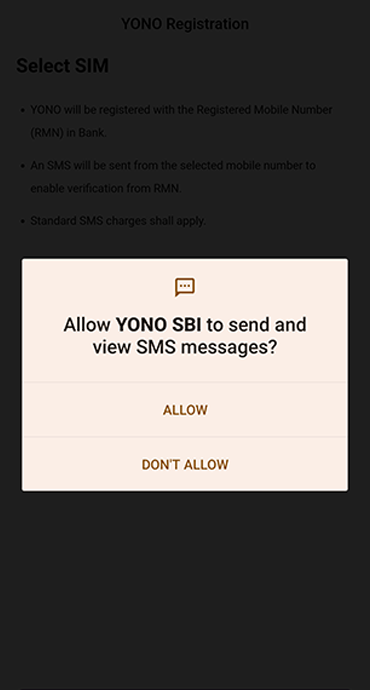

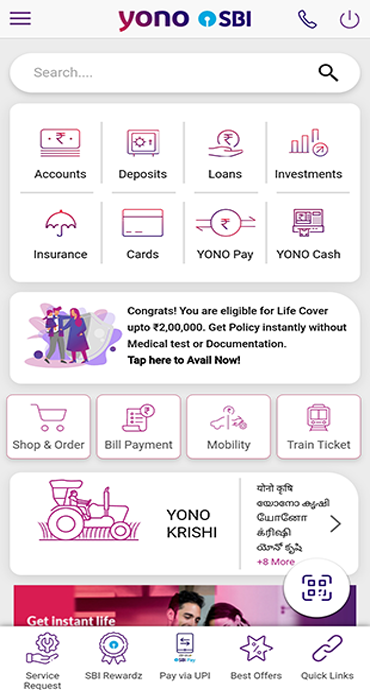

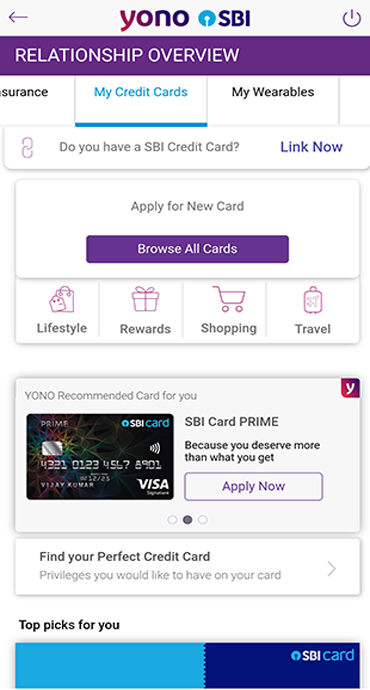

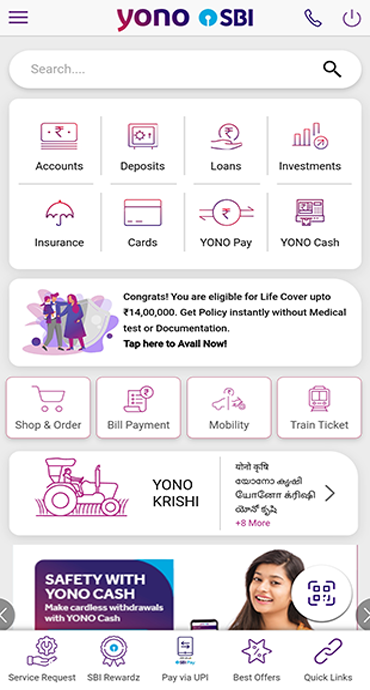

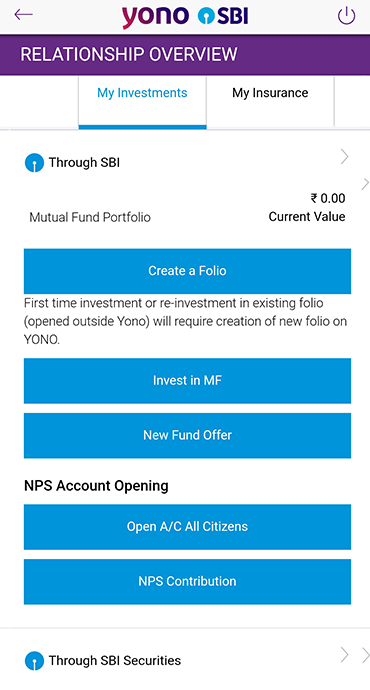

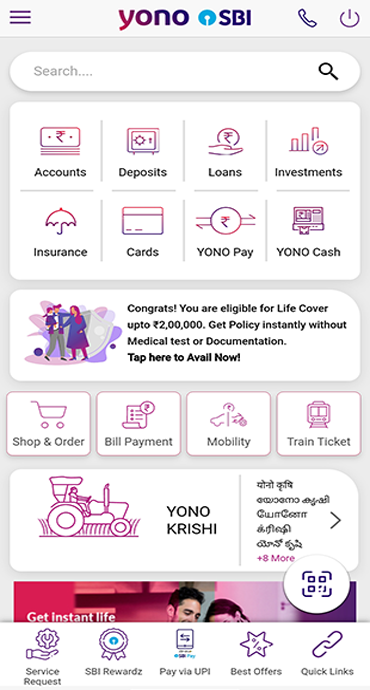

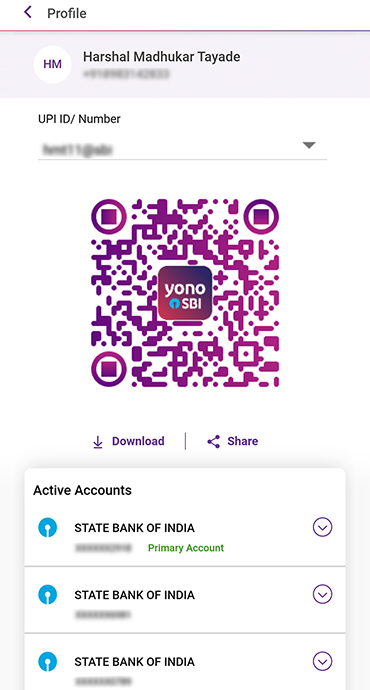

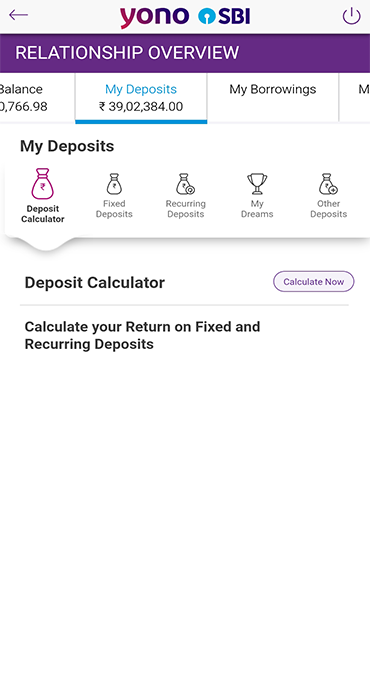

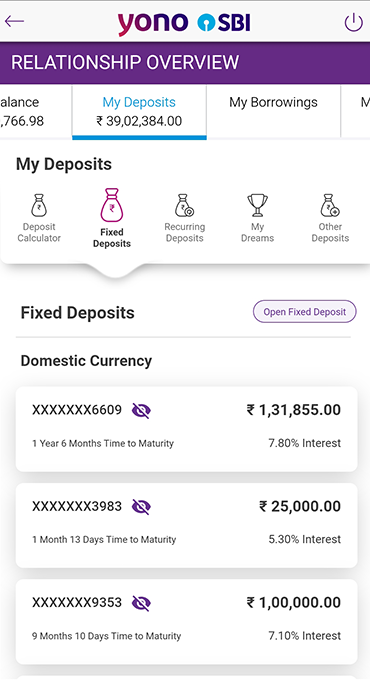

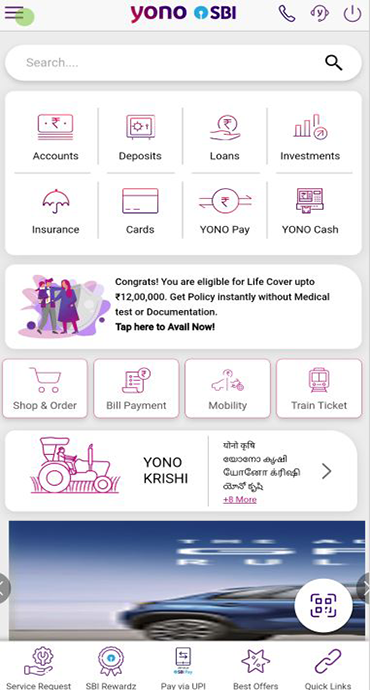

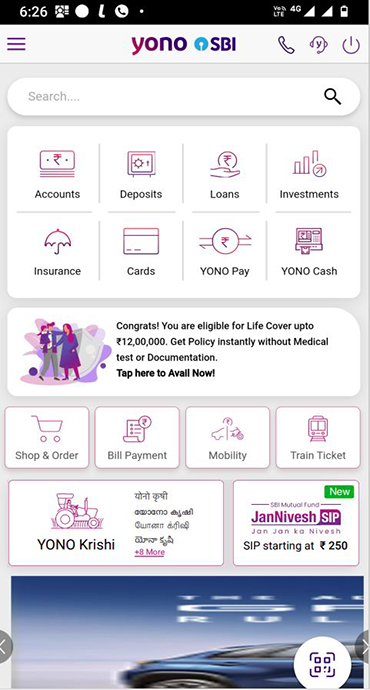

The facility is available as an Overdraft Account, allowing borrowers to conveniently monitor loan utilization and interest charges through the YONO SBI App. It offers easy access and repayment flexibility, providing a seamless experience for managing finances. Additionally, you can close the loan using your Savings Account or Current account balance via the YONO SBI App, users have the option to initiate loan closure directly via the app, making the process more efficient and user-friendly.

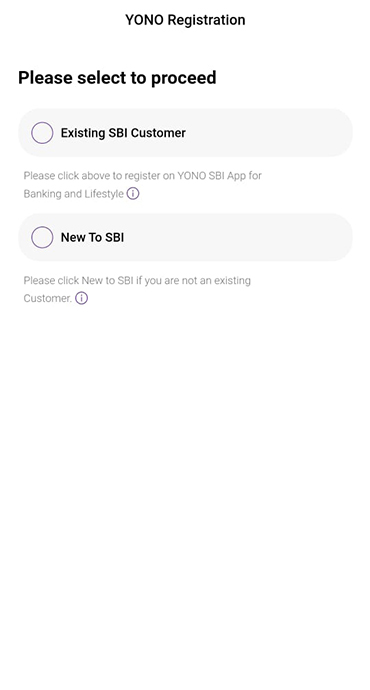

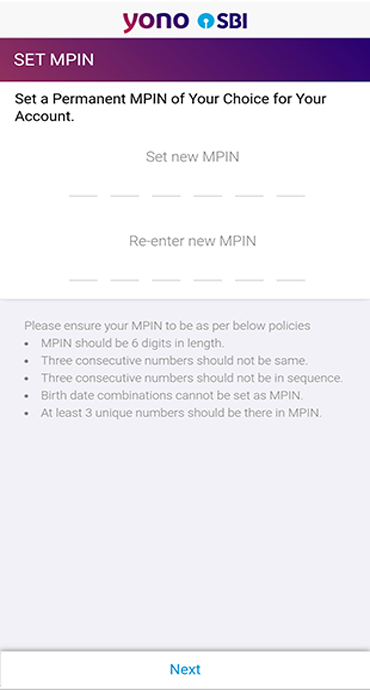

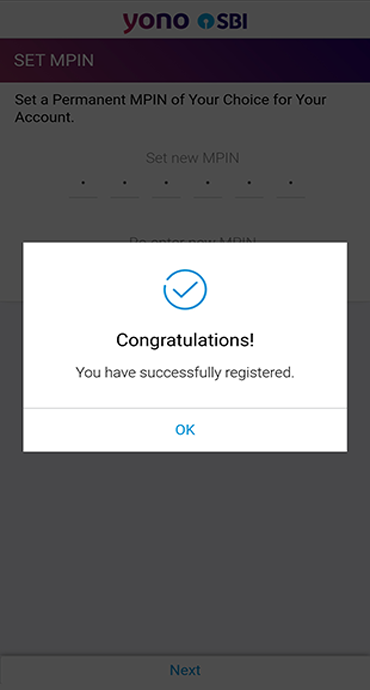

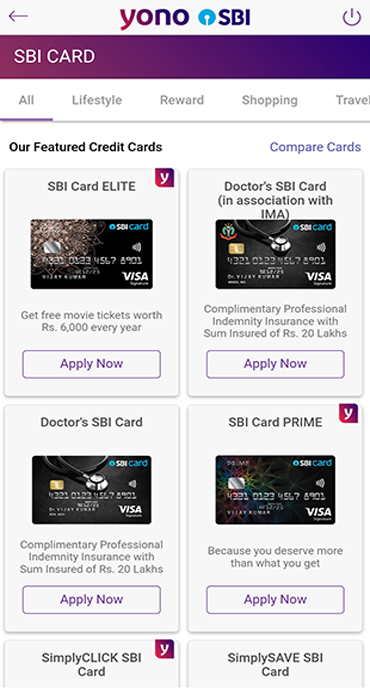

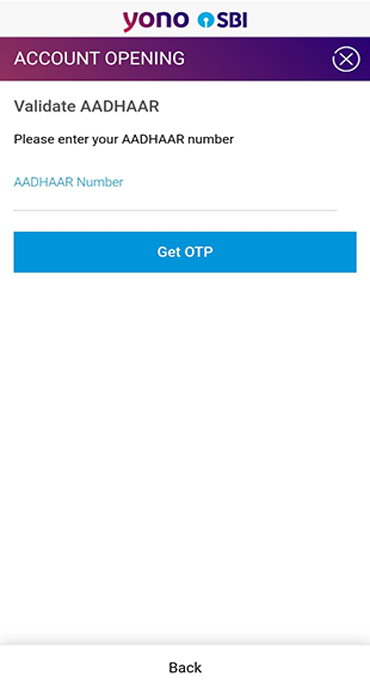

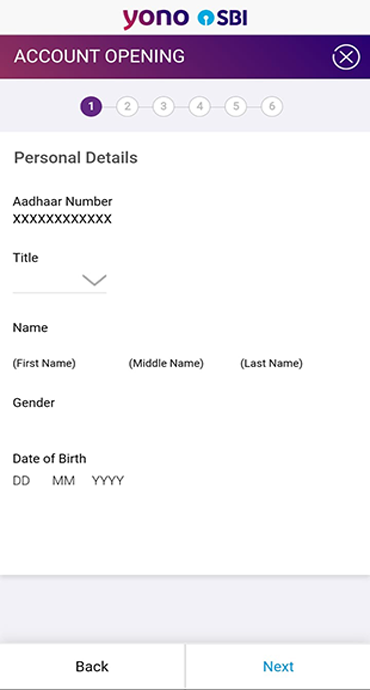

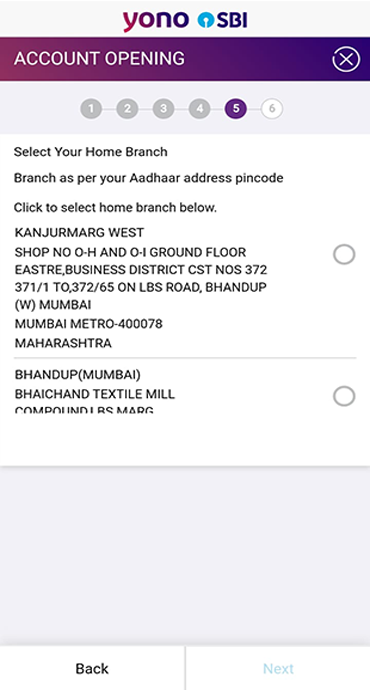

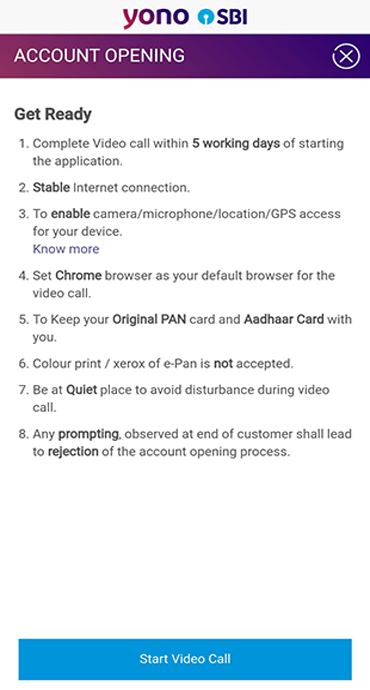

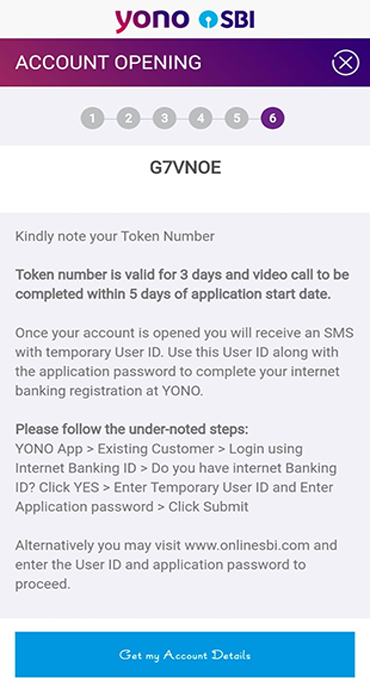

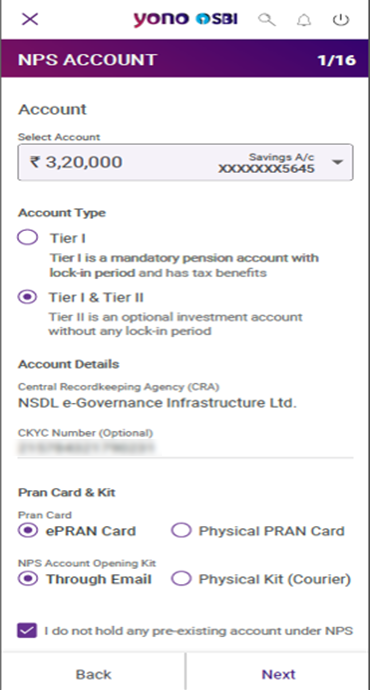

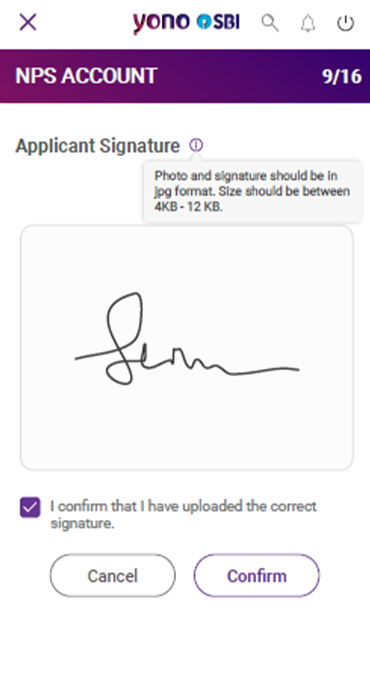

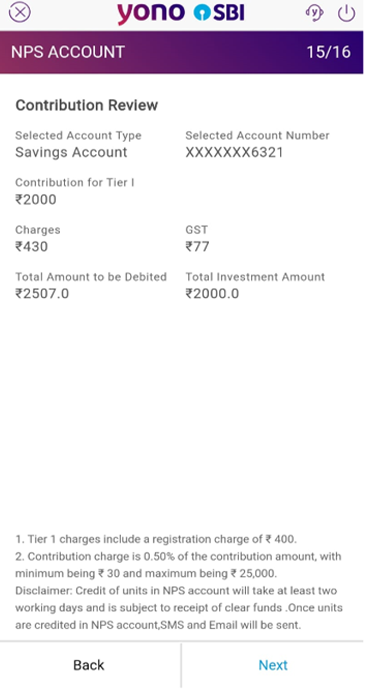

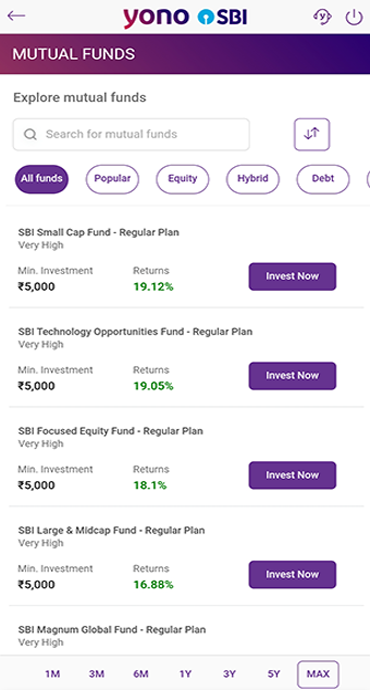

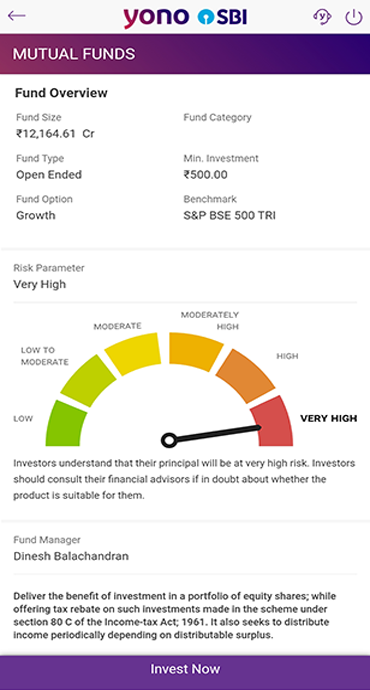

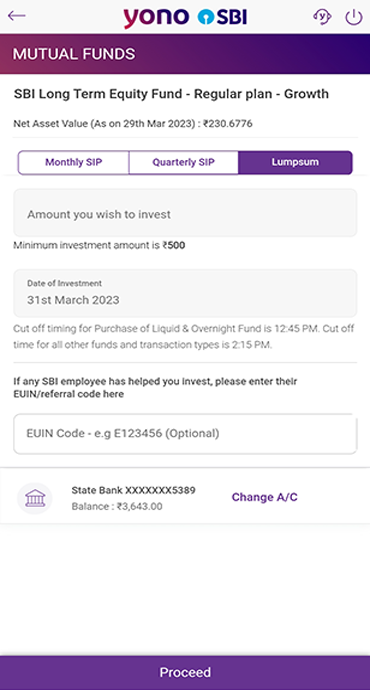

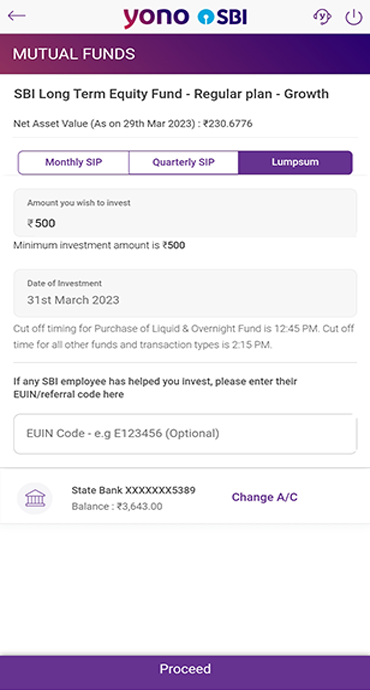

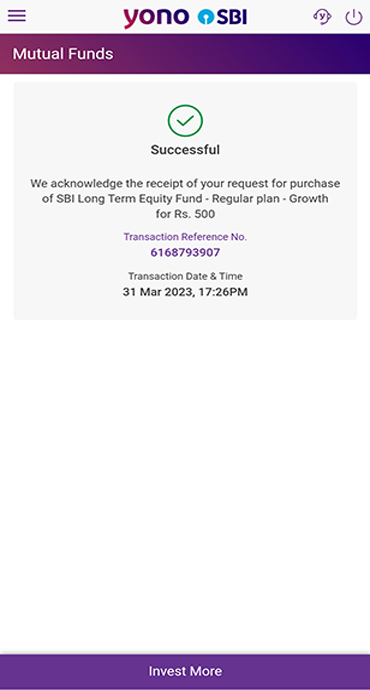

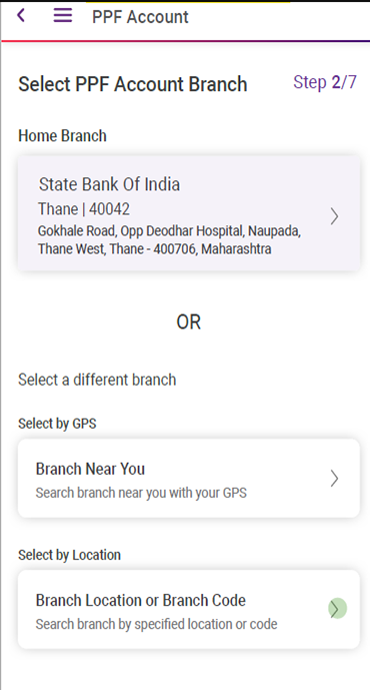

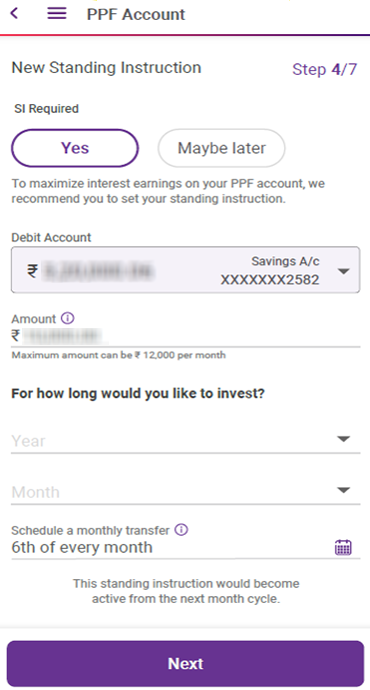

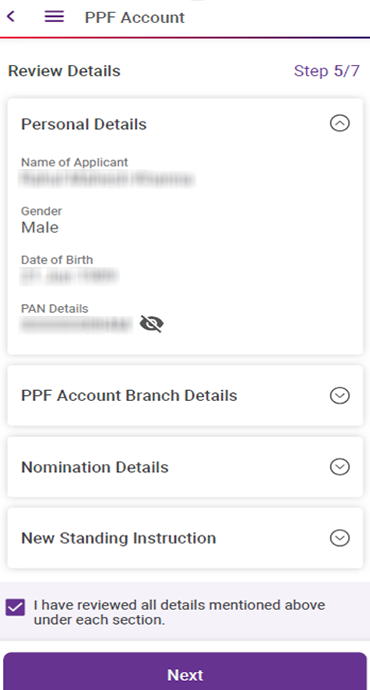

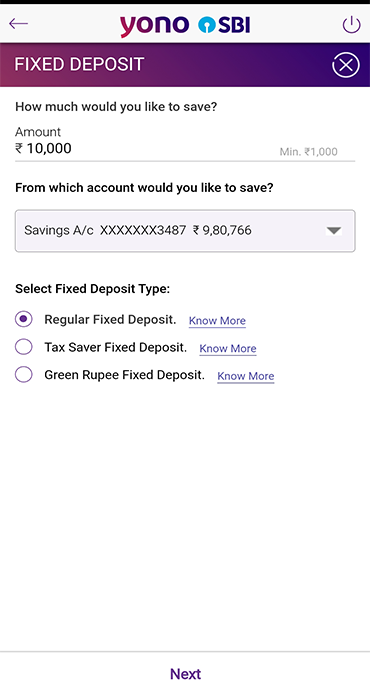

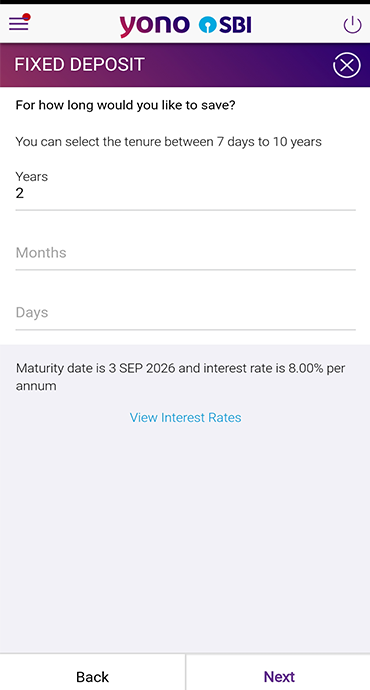

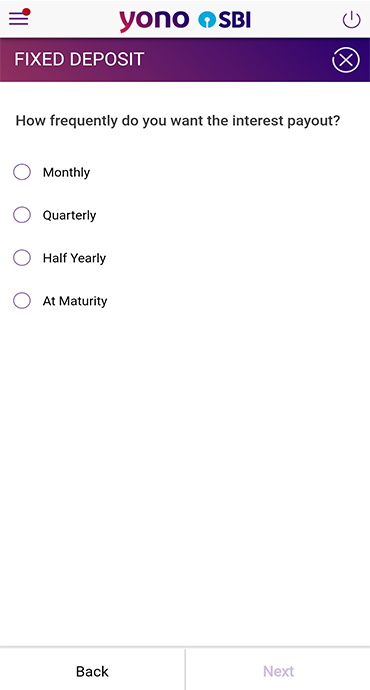

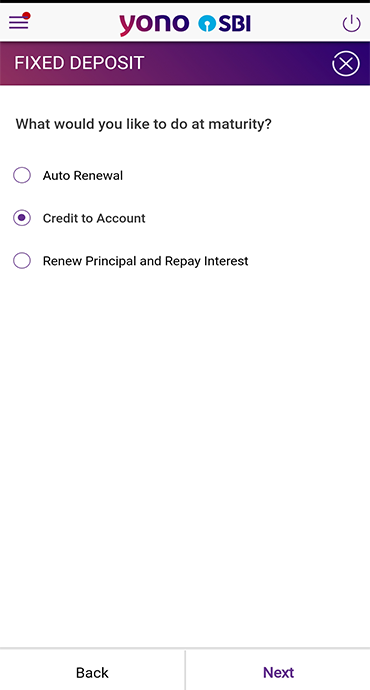

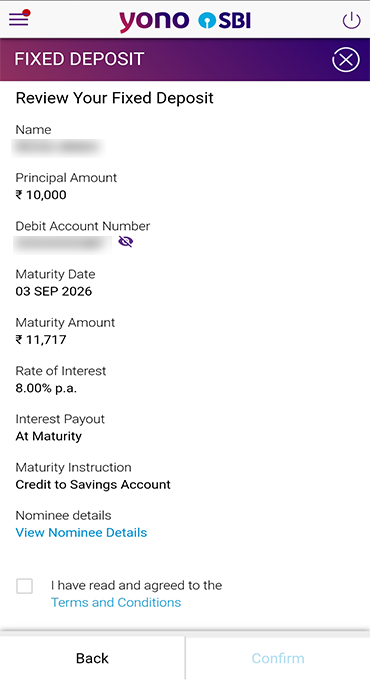

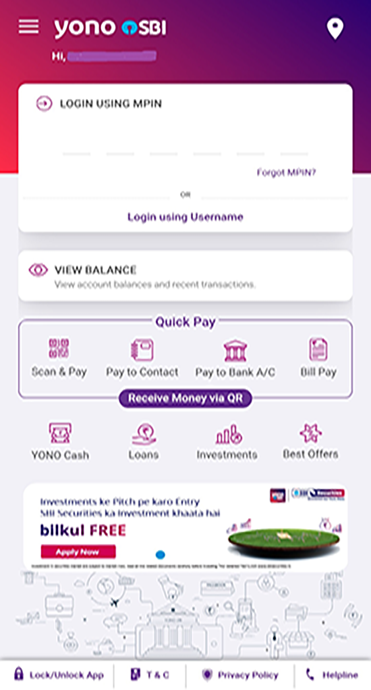

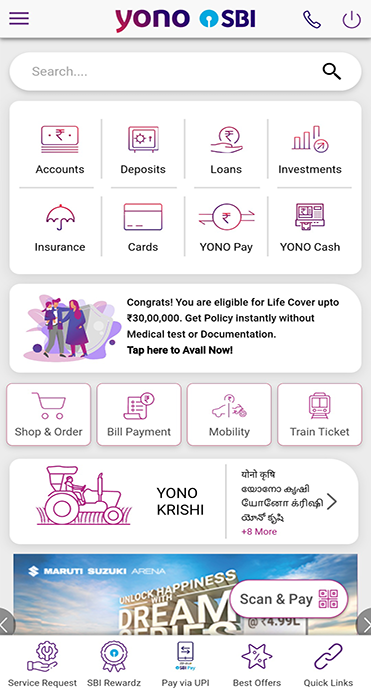

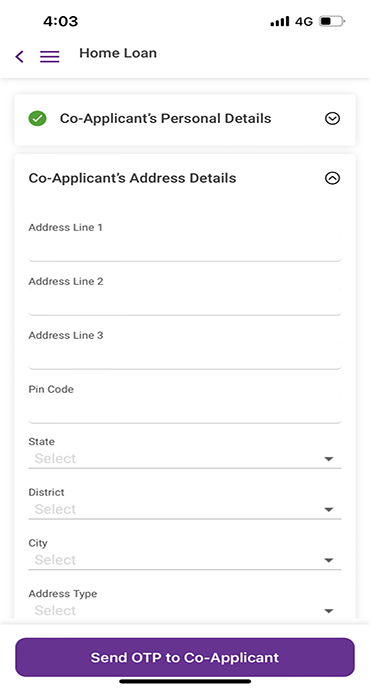

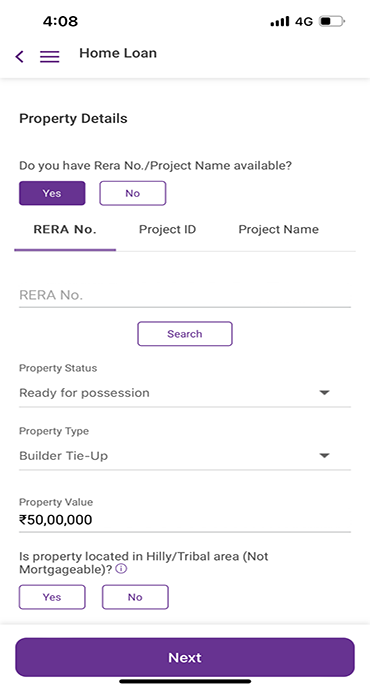

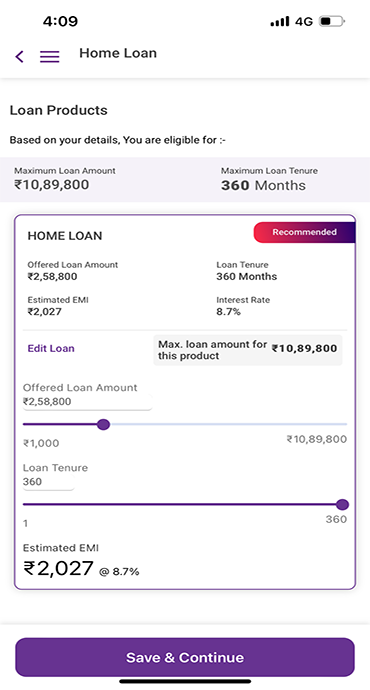

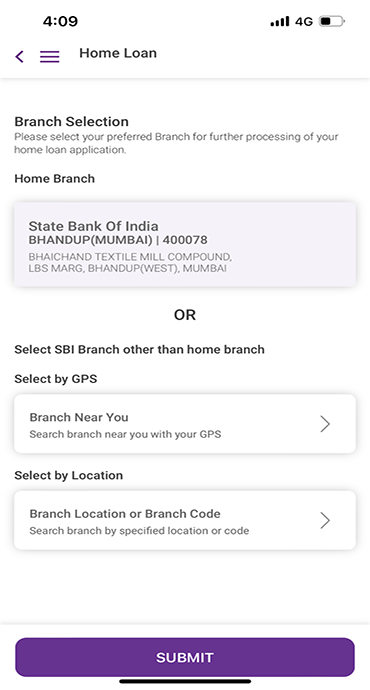

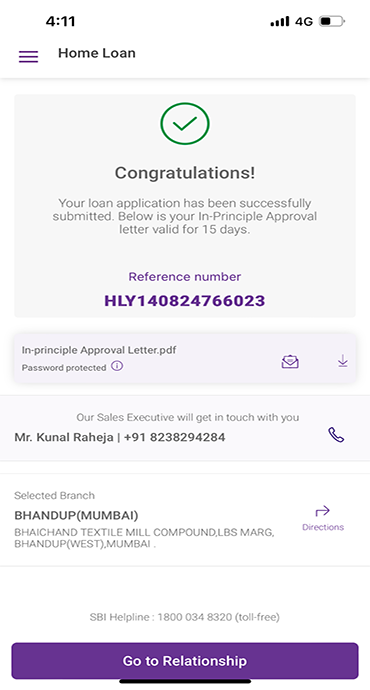

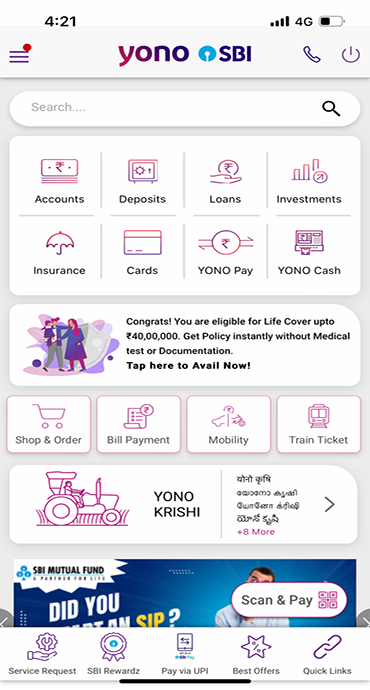

Step-by-Step Application Process Through YONO SBI

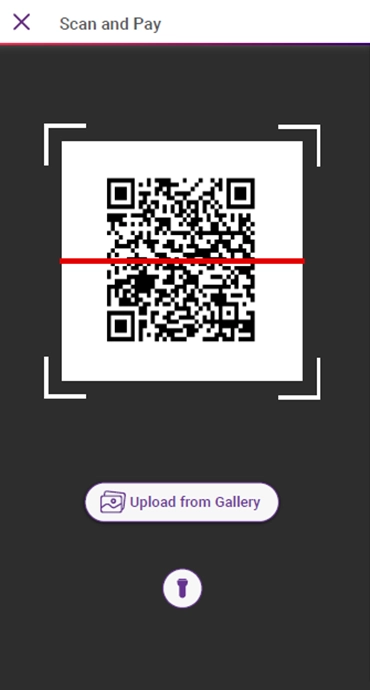

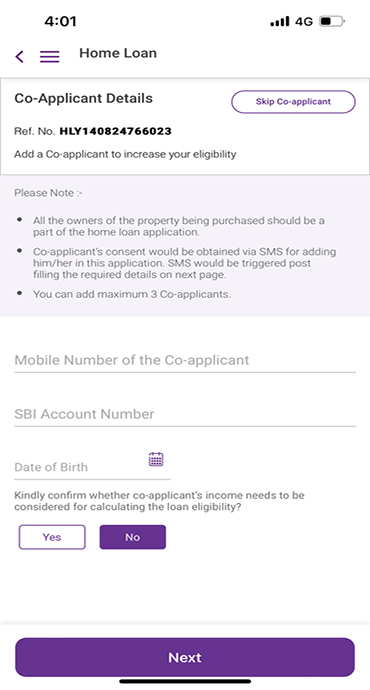

Follow these steps to apply for a Loan Against Mutual Funds:

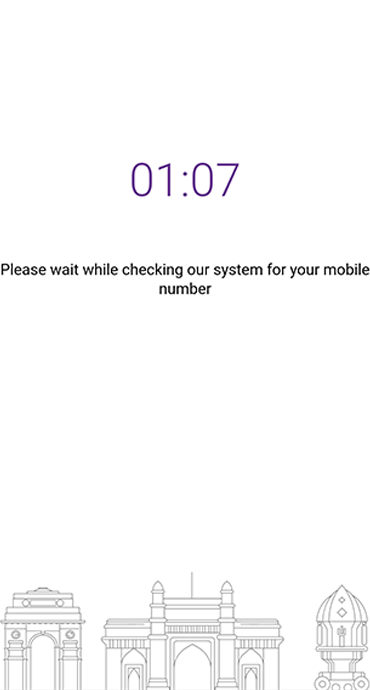

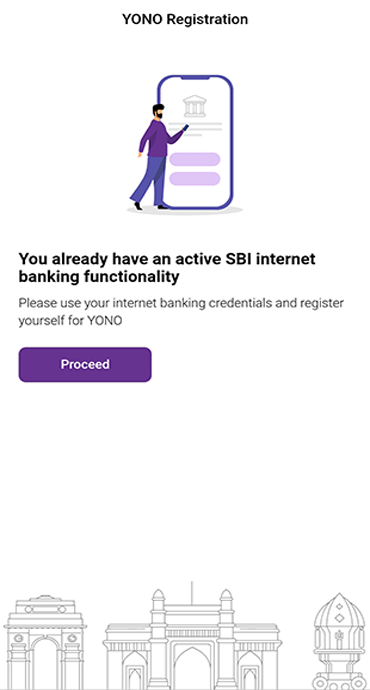

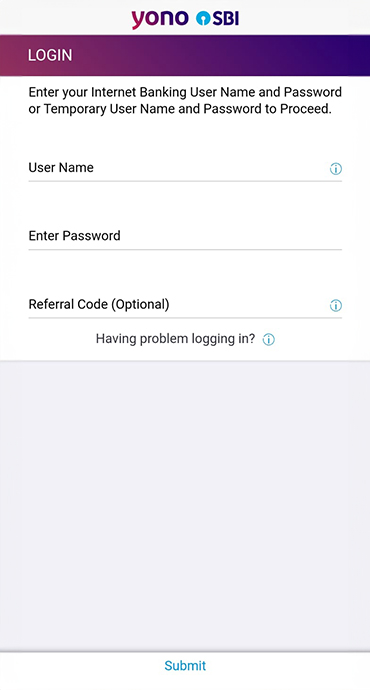

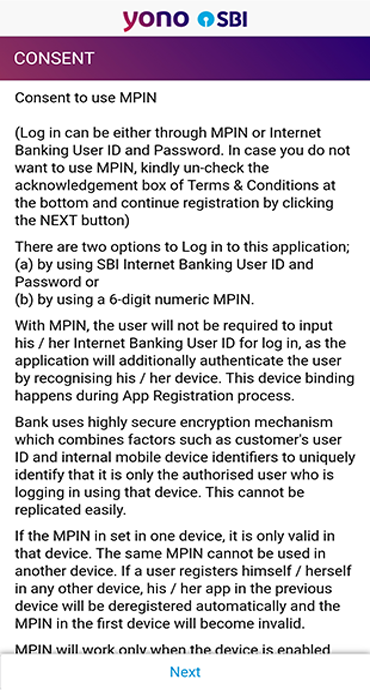

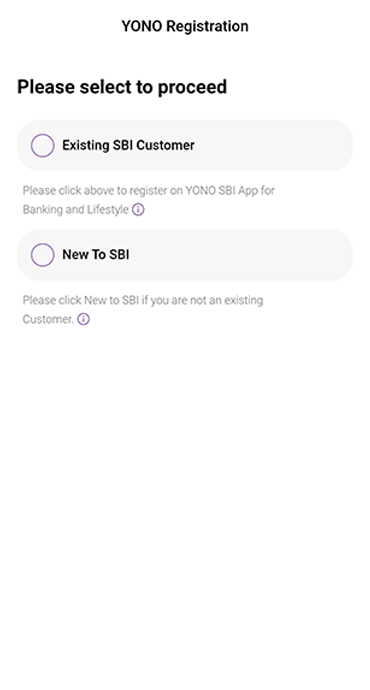

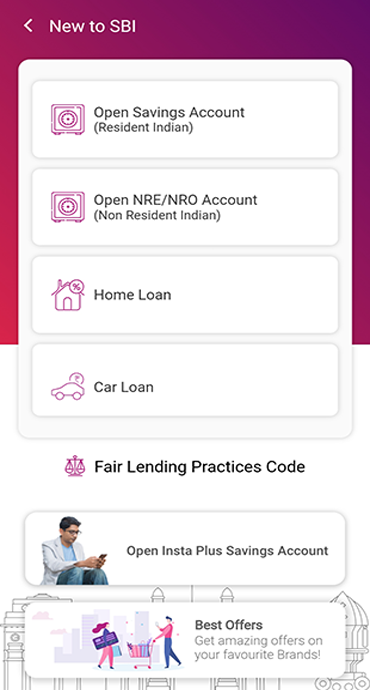

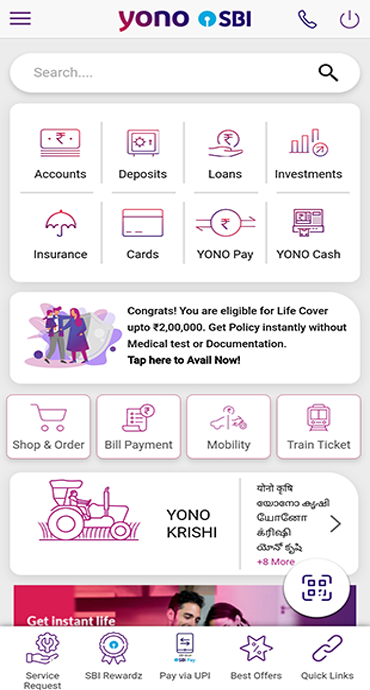

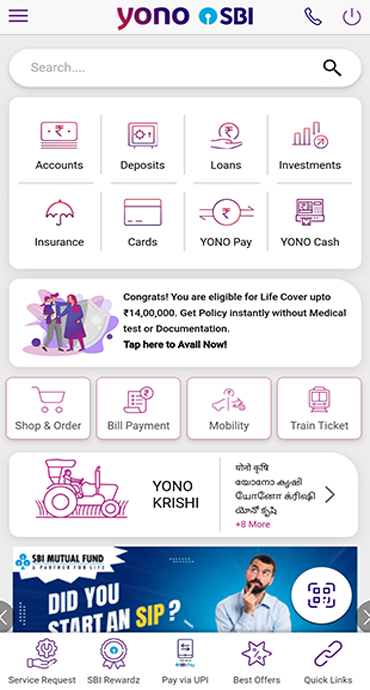

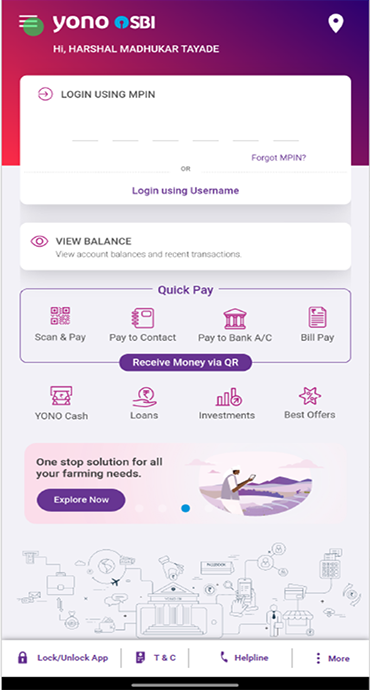

- Login to YONO SBI App

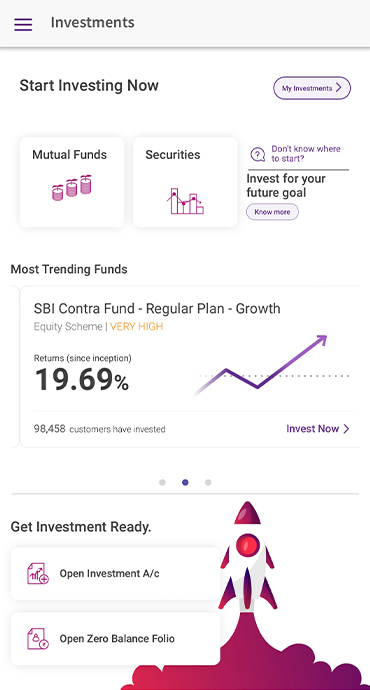

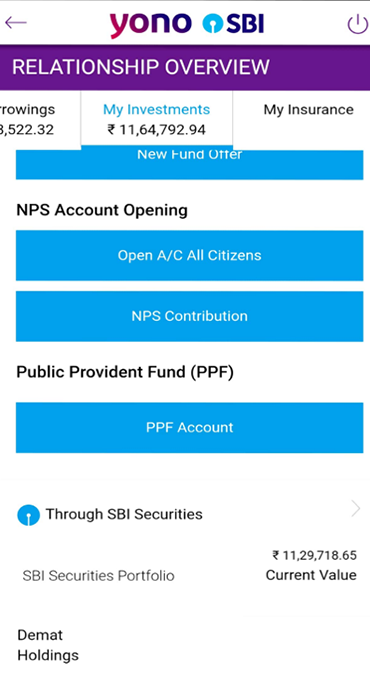

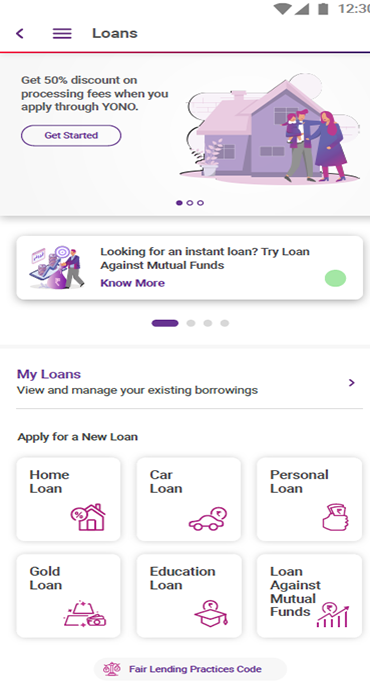

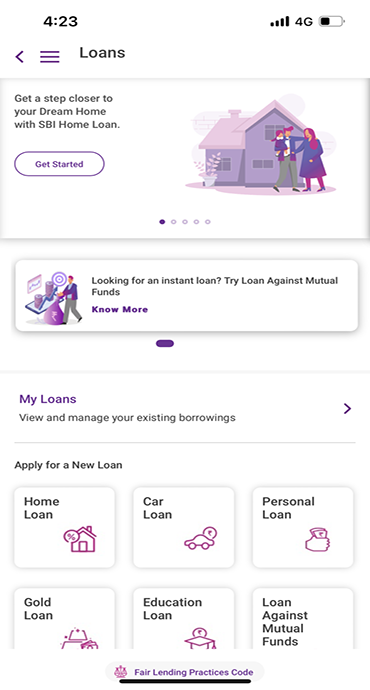

- Navigate to Loans > Loan Against Mutual Fund

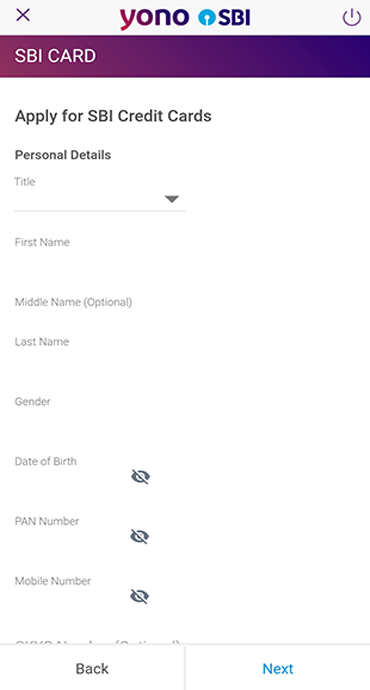

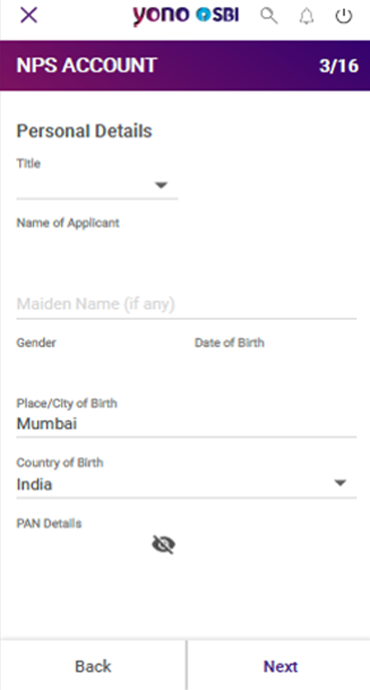

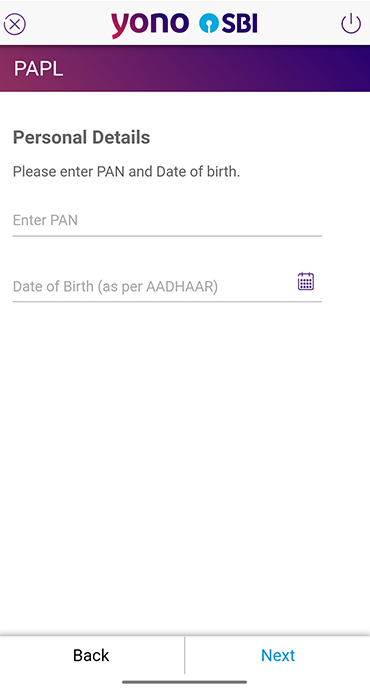

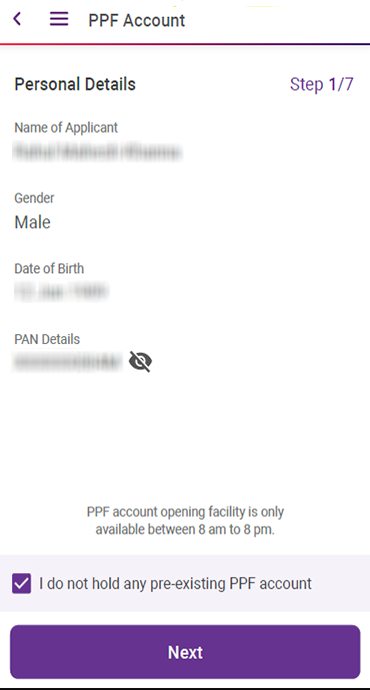

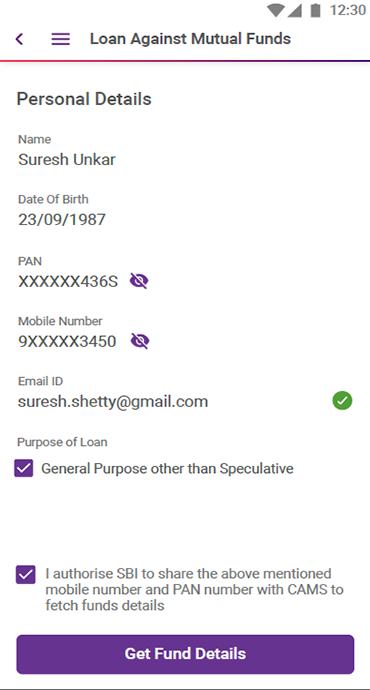

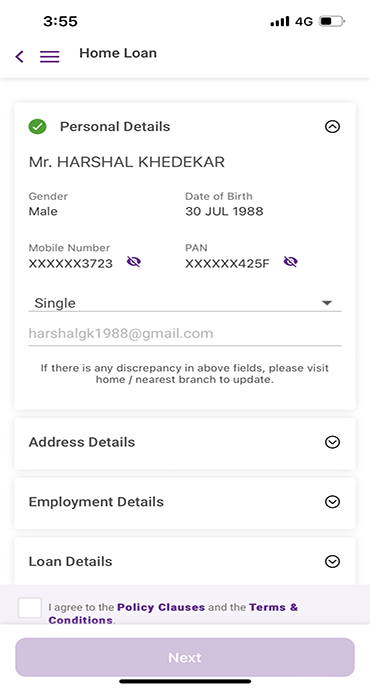

- Complete review of personal details (PAN, mobile, email)

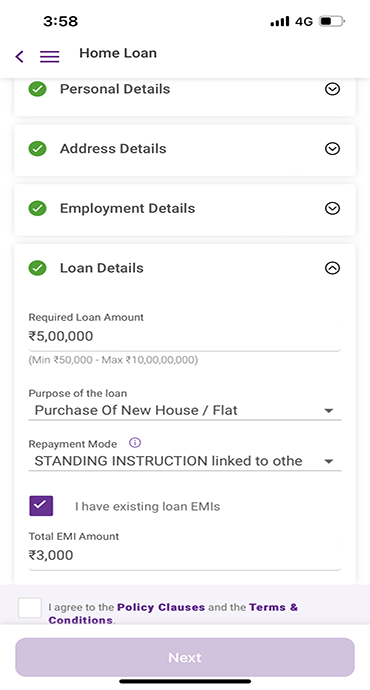

- Review current fund value and maximum eligible loan amount

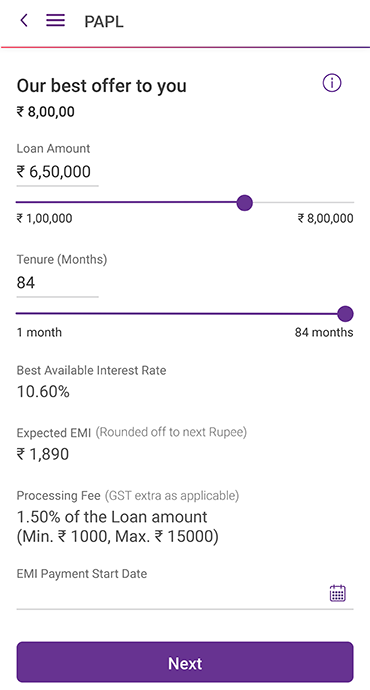

- Select desired loan amount within eligible limits

- Choose funds for pledging as collateral

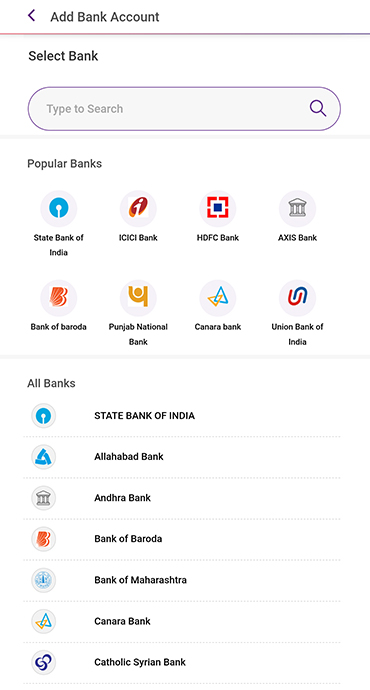

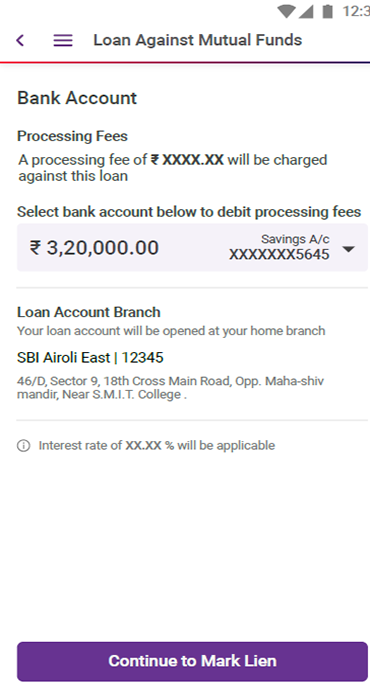

- Select bank account for processing the fees

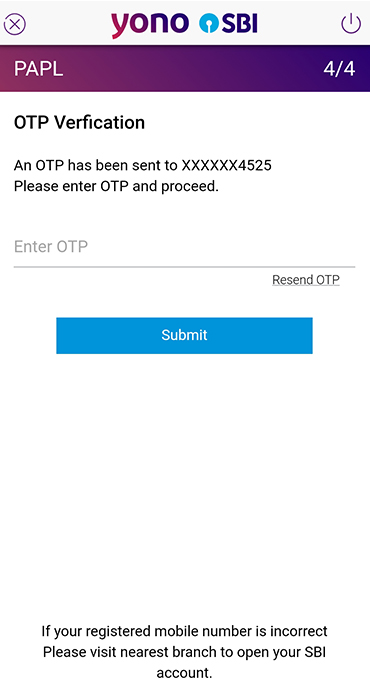

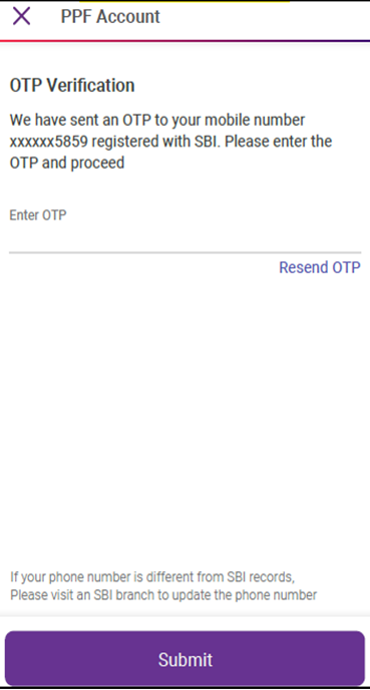

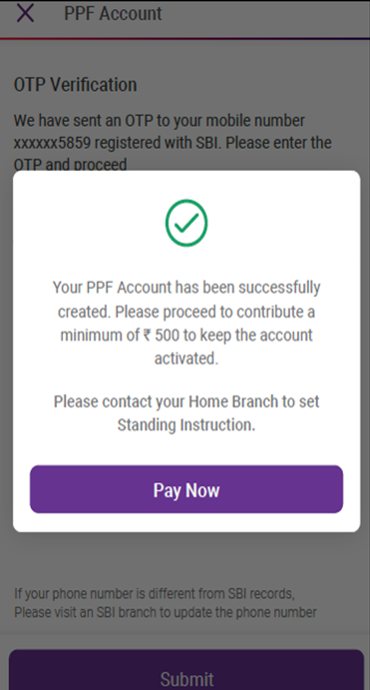

- Provide consent through OTP for lien marking

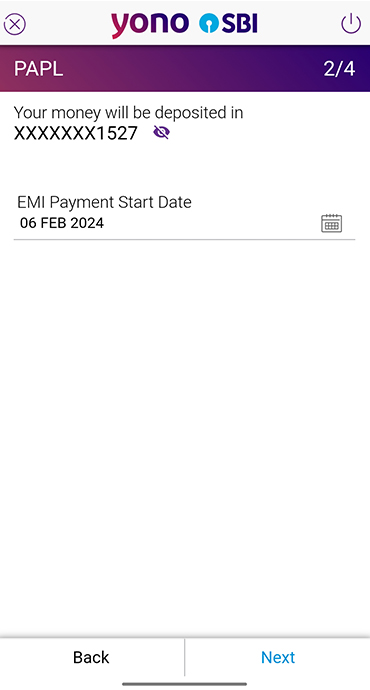

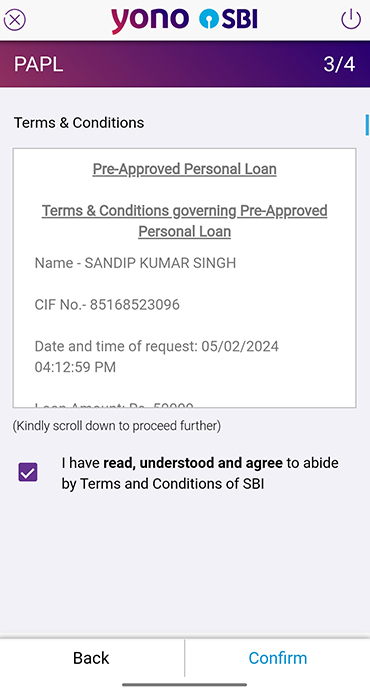

- Review loan details and accept terms and conditions

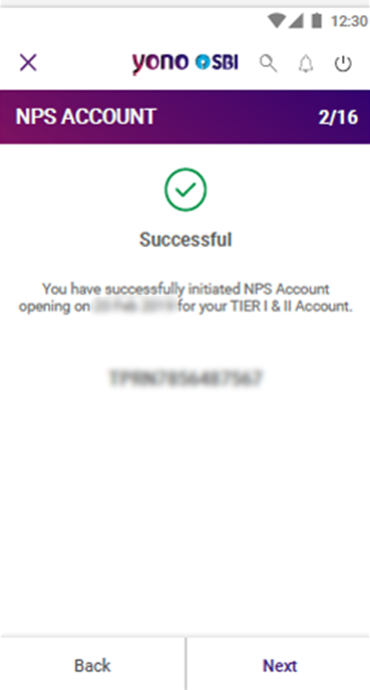

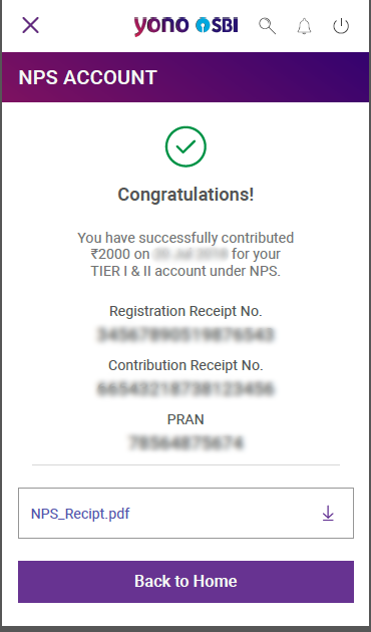

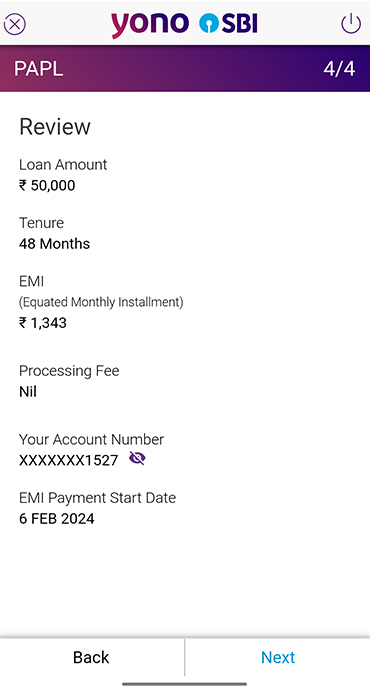

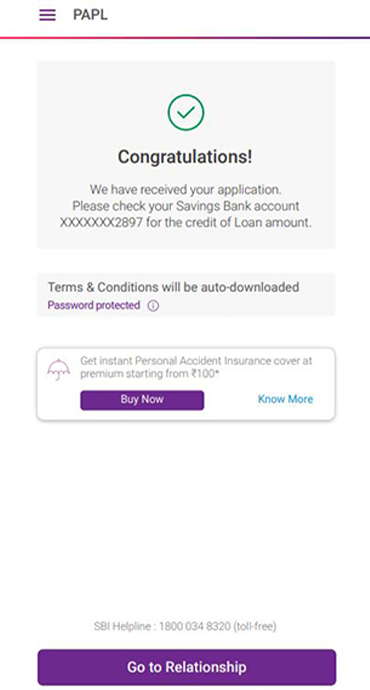

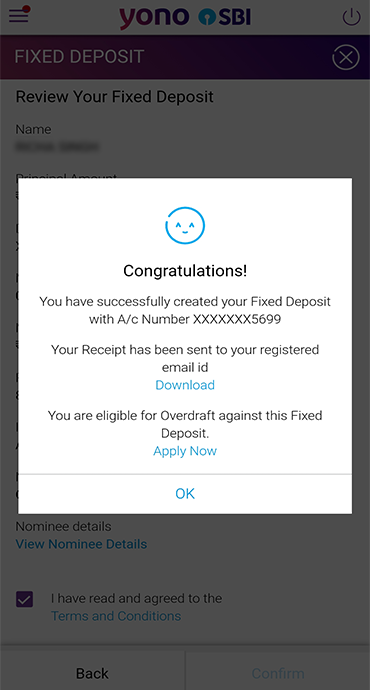

- OD account is opened, and services are enabled instantly

Post approval, access your loan account details in the "My Borrowing" section of the YONO SBI app.

Note: The funds should not be used for speculative purposes.

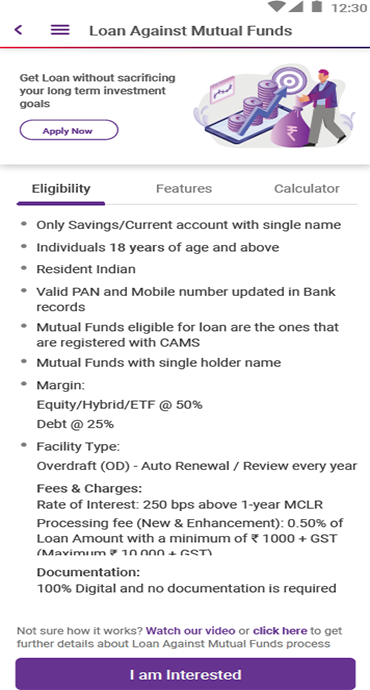

Eligibility Criteria for Availing Loan Against Mutual Fund

Here are the basic conditions you should satisfy to avail of a loan against mutual funds online or through the YONO SBI app.

- Indian citizens over the age of 18.

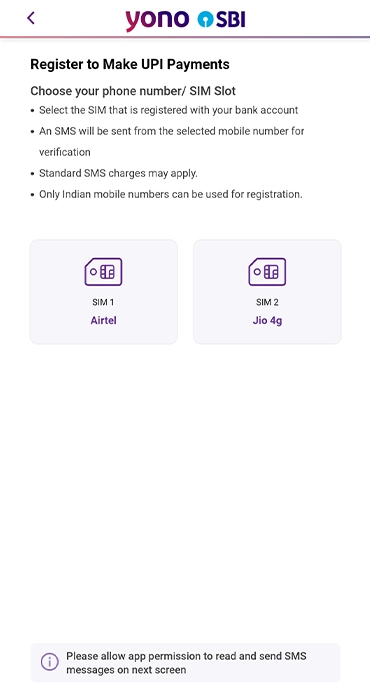

- SBI current/savings account operated under a single name.

- Mobile and PAN available in the bank records

- Your bank account and the mutual funds should be under the same PAN and mobile number.

- No documents are needed for loans against mutual funds through the online option.

- In the case of a savings/current account in joint names, loans against mutual funds can be sanctioned only through the SBI branches.

Take Advantage of SBI's Loan Against Mutual Funds Today

Get access to instant funds with SBI's Loan Against Mutual Funds! Experience a seamless digital journey on the YONO SBI App that's both secure and hassle-free. Whether you need funds for personal expenses, business requirements, or emergency situations, this facility enables you to leverage your mutual fund investments effectively.

For more information or to apply, visit your nearest SBI branch or download the YONO SBI App.

Related Blogs That May Interest You