5 Reasons You Should Use YONO SBI App for UPI Payments - Yono

5 Reasons You Should Use YONO SBI App for UPI Payments

18 Apr, 2024

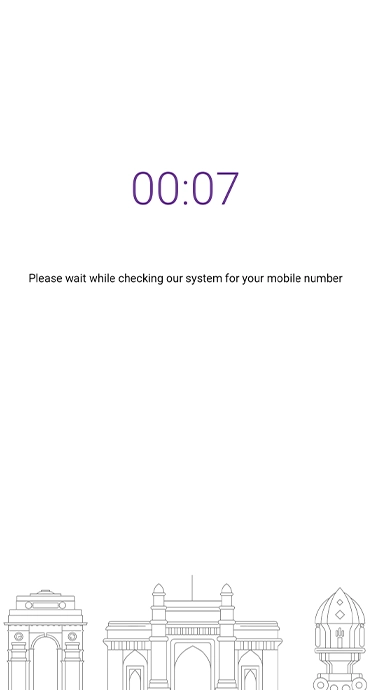

registration upi payments

Your Guide to Effortless UPI Payments with YONO SBI

The phenomenal growth of the Unified Payments Interface (UPI) in India is transforming digital transactions. As per the latest data, over 16 billion UPI payments amounting to ₹ 21.96 trillion were processed in February 2025 alone, reflecting significant growth compared to previous years. But first, what is UPI payment? It is a real-time payment system developed by the National Payments Corporation of India (NPCI) that enables instant money transfers between bank accounts using a mobile device. Driving this adoption are intuitive payment apps that offer both simplicity and security.

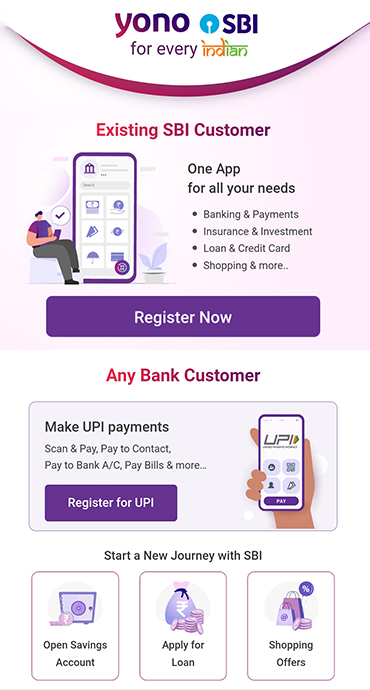

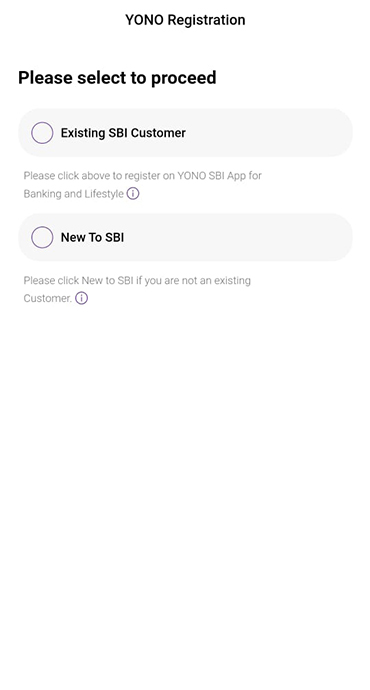

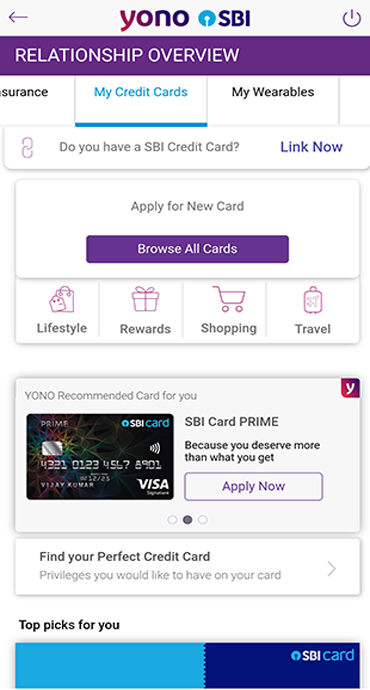

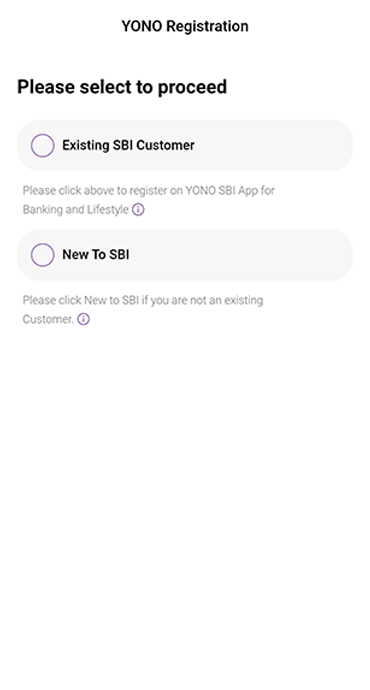

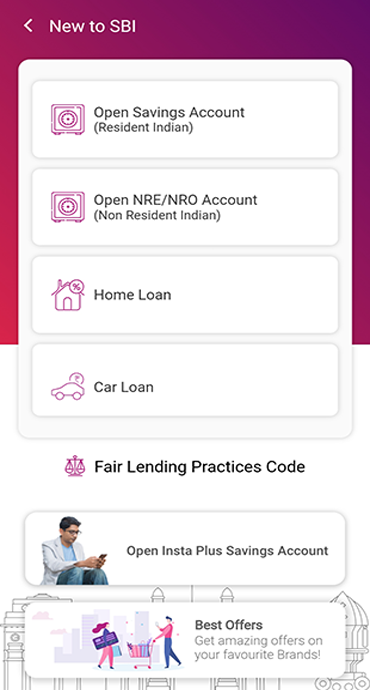

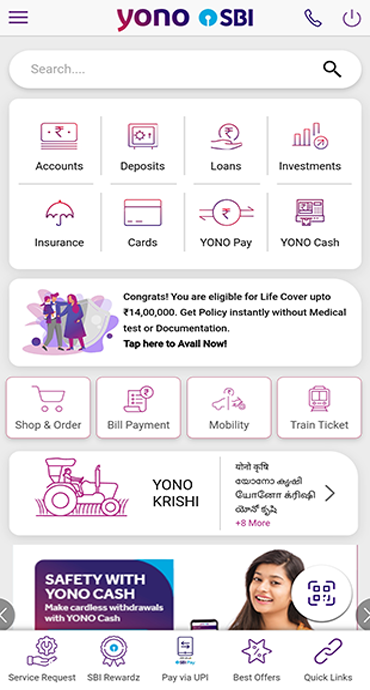

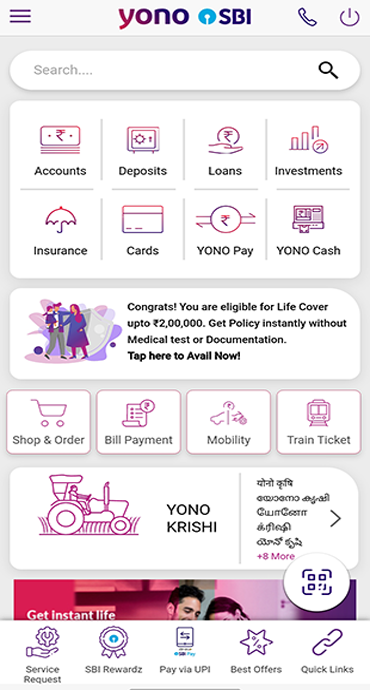

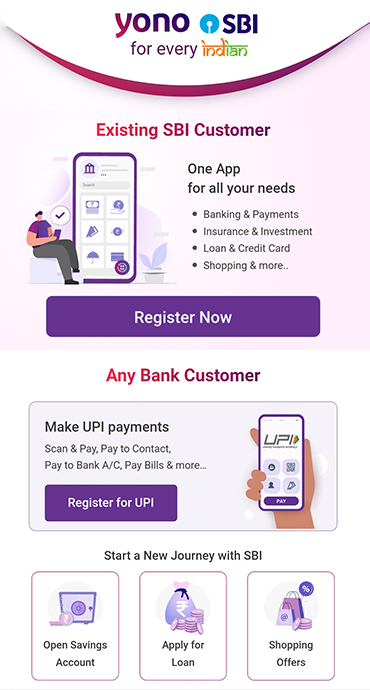

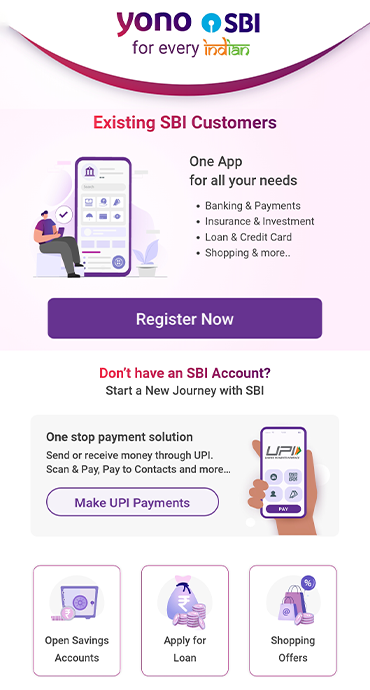

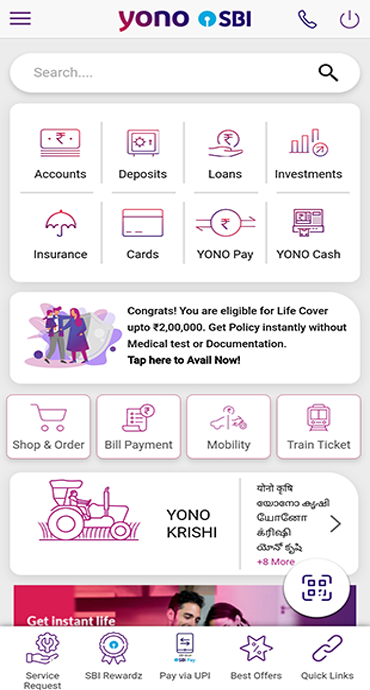

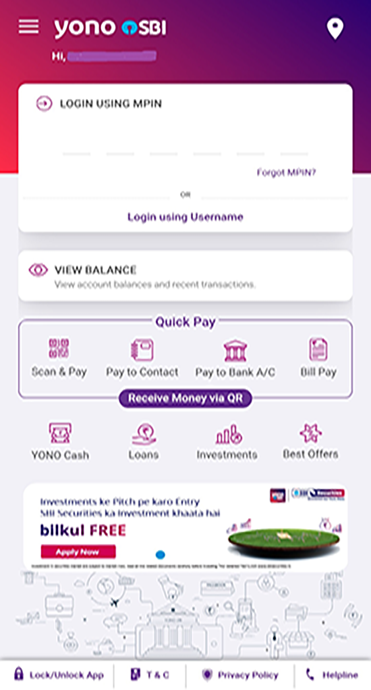

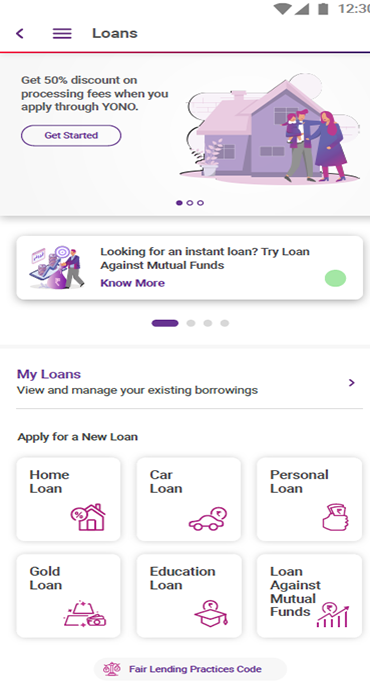

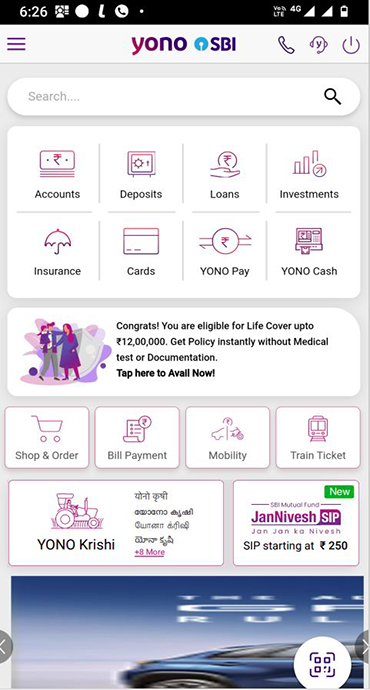

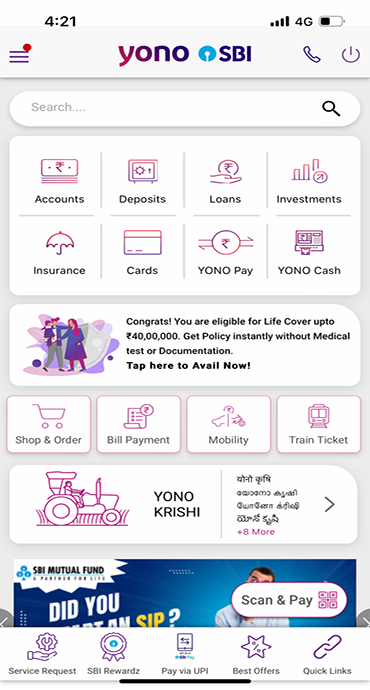

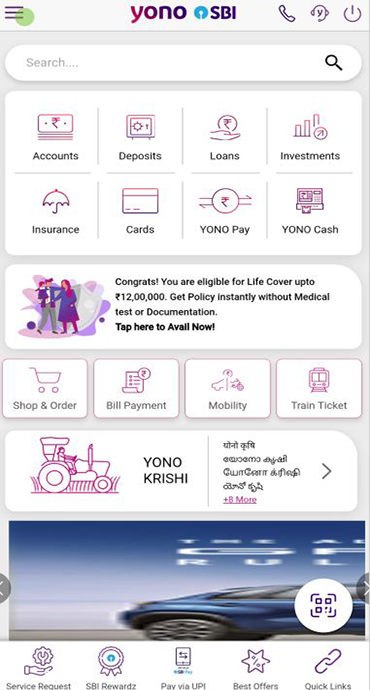

One such app that has quickly emerged as a popular choice for UPI transactions is YONO SBI App. With over 100 million downloads, YONO SBI lets customers integrate bank accounts from SBI and other leading banks onto a single platform. By allowing interoperability and instant money transfers, it has become the app of choice for both SBI account holders and non-SBI customers.

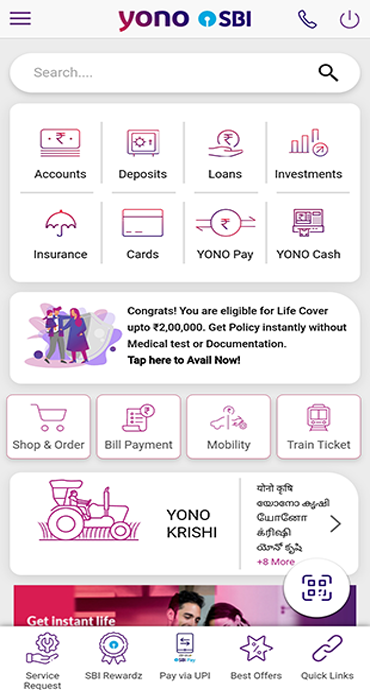

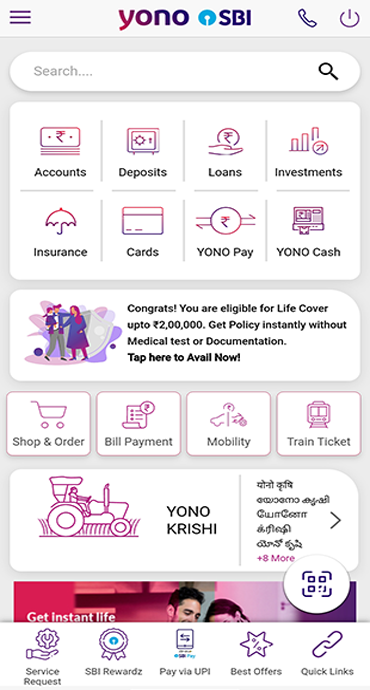

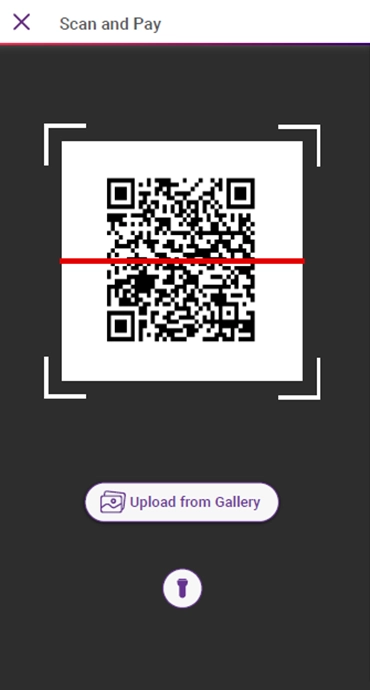

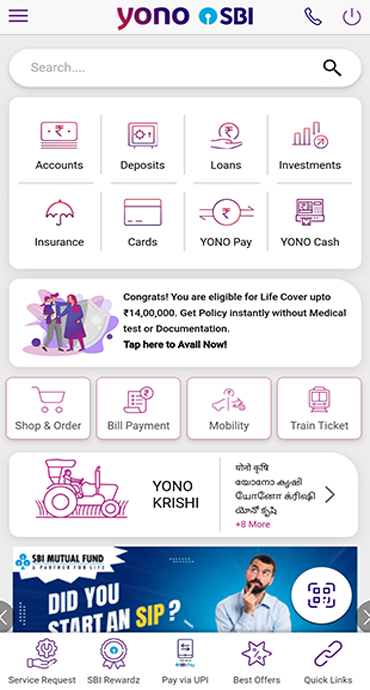

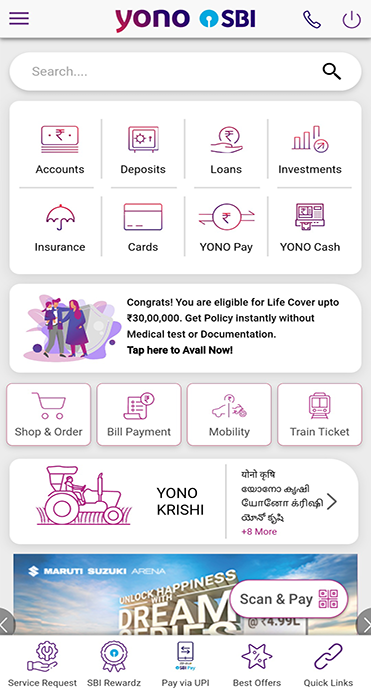

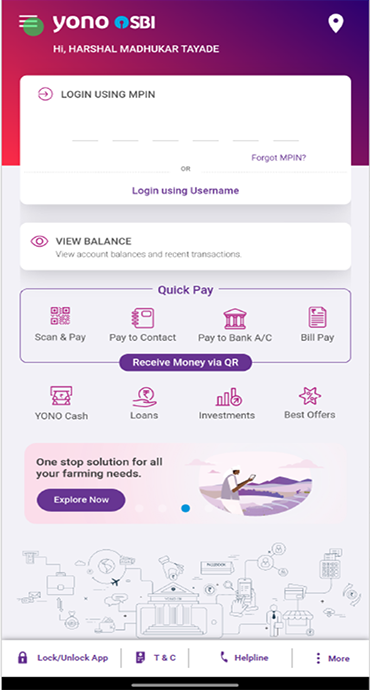

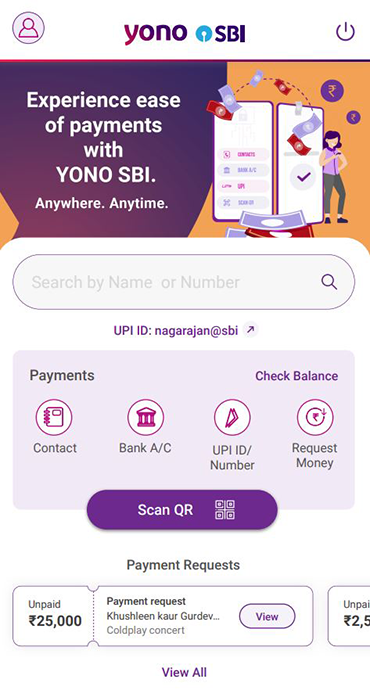

The YONO SBI app sets itself apart with an interface that suggests contacts for payments, scans QR codes and enables transactions across banks through a few simple taps. Biometric login, account integration, and exciting offers all under one roof makes YONO SBI a valuable addition to any smartphone.

As digital payments rise steeply, customers seek apps that are intuitive, secure, reward-focused and remove the hassle of managing multiple banks. This blog shares five compelling benefits of using the YONO SBI payments and lifestyle app that simplifies your fintech needs.

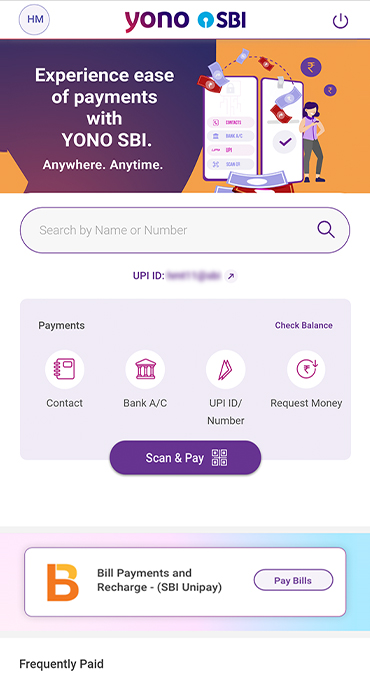

1. Simple and Convenient Mode of Making Payments

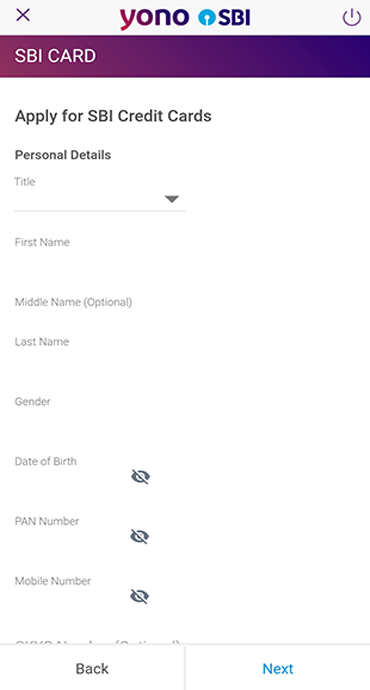

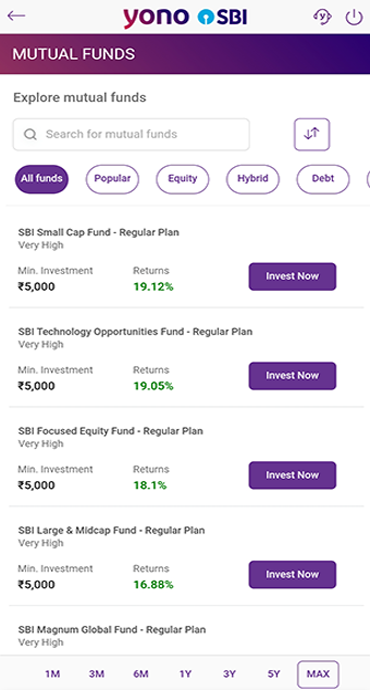

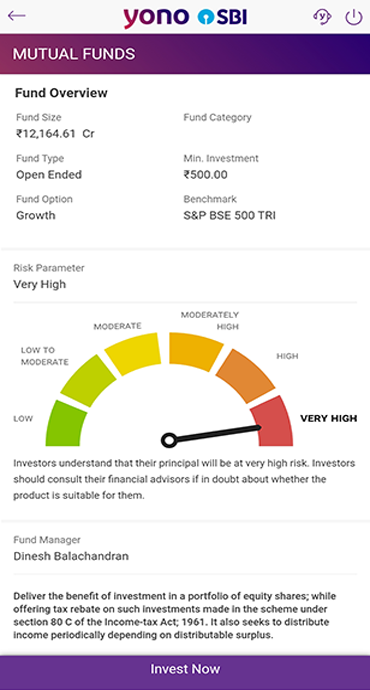

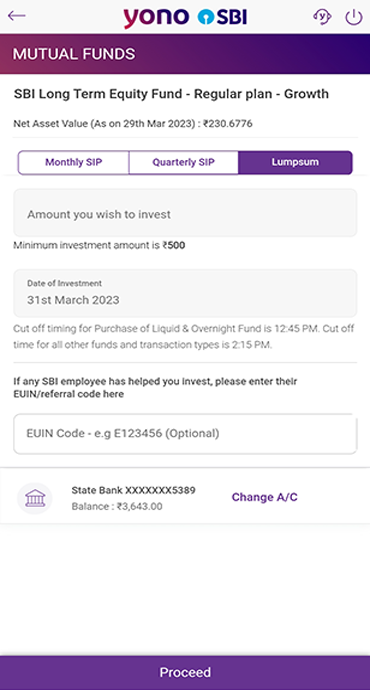

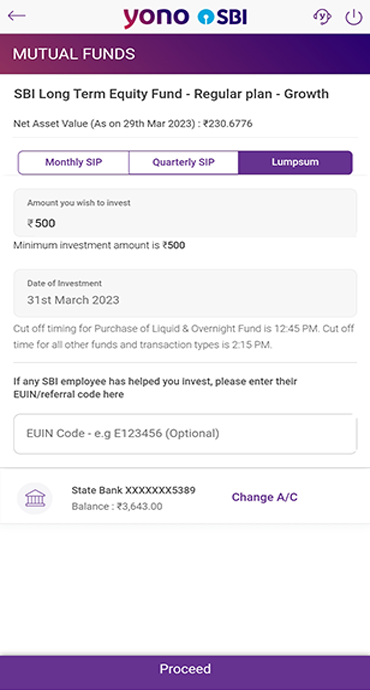

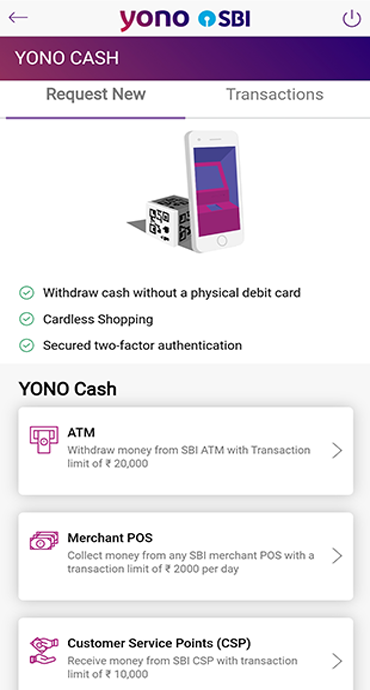

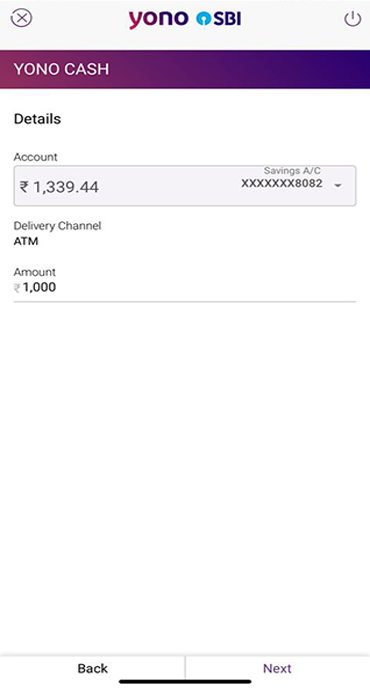

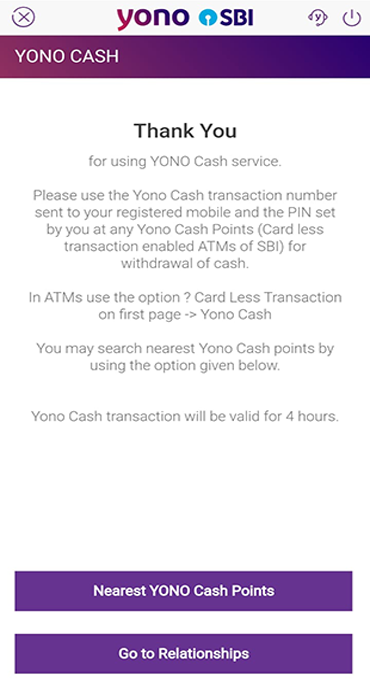

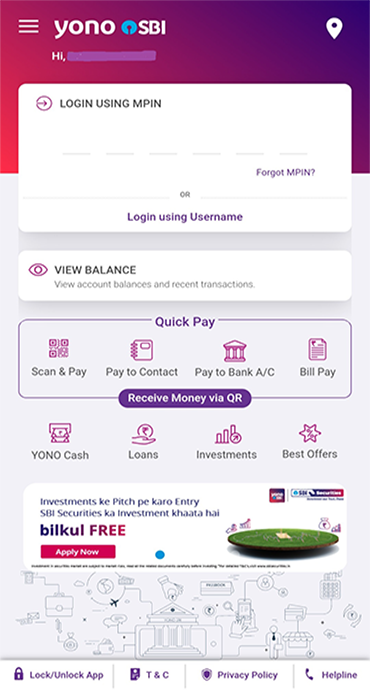

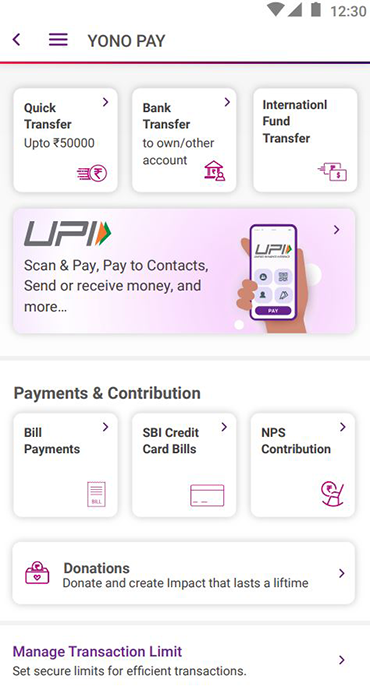

The YONO SBI app offers an extremely straightforward interface for sending or receiving UPI payments instantly. You can instantly search and pay your contacts or type recipient’s UPI ID/VPA to transfer money in just a few taps. The process is intuitive, and handy features like scanning any QR code, real-time suggestions as you type, saved contact lists etc., makes payments faster. You also get payment confirmation alerts and can easily download statements or share receipts.

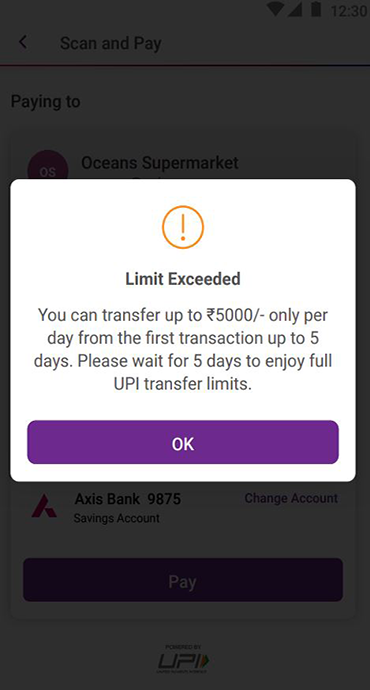

Moreover, the app allows users to transfer funds efficiently, upto the permissible maximum money transfer through UPI without any hassle, thus ensuring that even high-value transactions are seamless and secure.

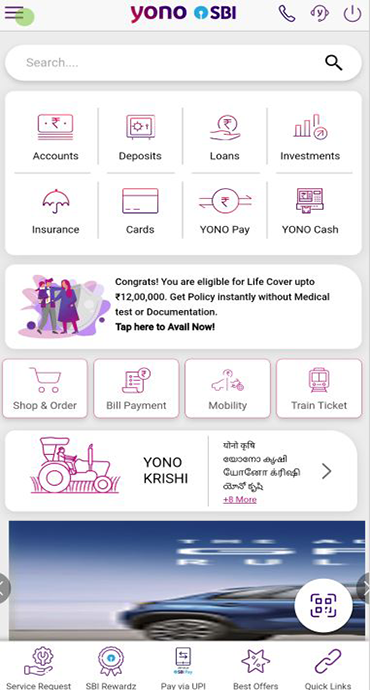

With SBI Unipay (SBI’s own Bharat Bill Payment System application) on YONO SBI, you can now conveniently pay bills for DTH, electricity, mobile recharges, property taxes, and even pay your credit card bills anytime, anywhere. Plus, enjoy the flexibility to pay using different payment modes such as debit card, credit card, UPI, internet banking, account transfer.

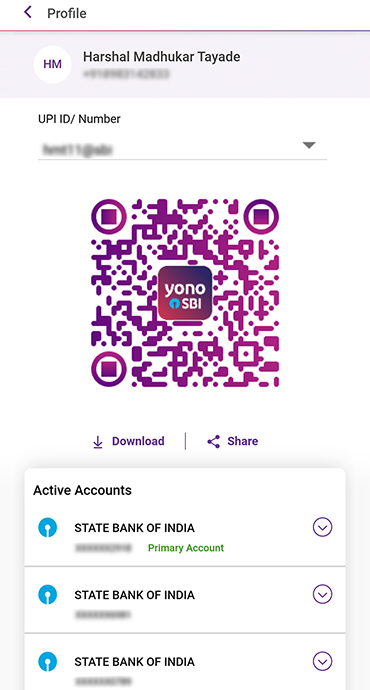

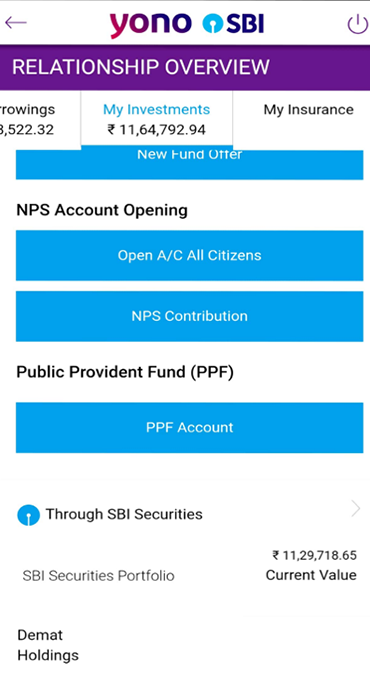

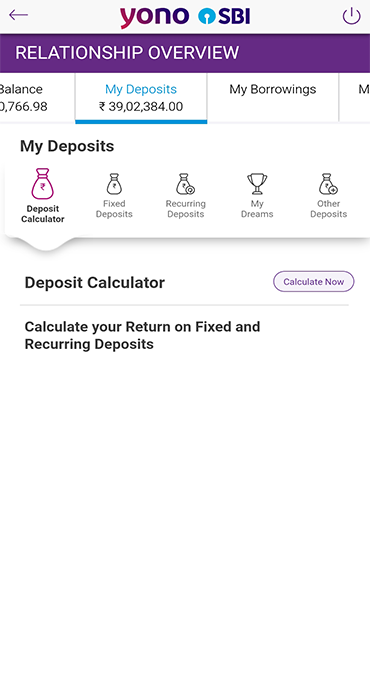

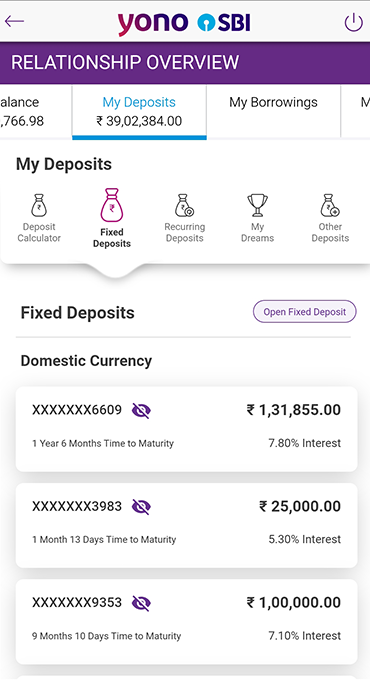

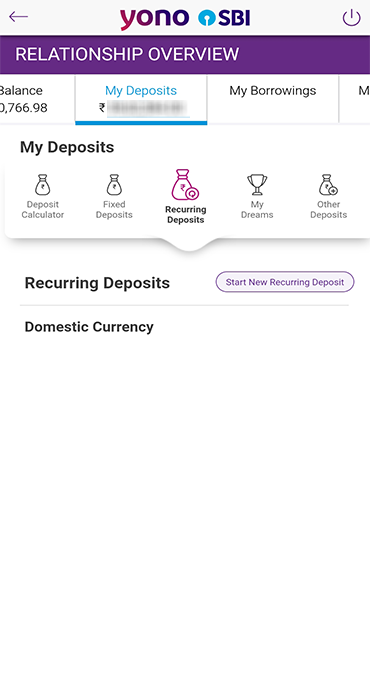

2. Multiple Bank Accounts Integration

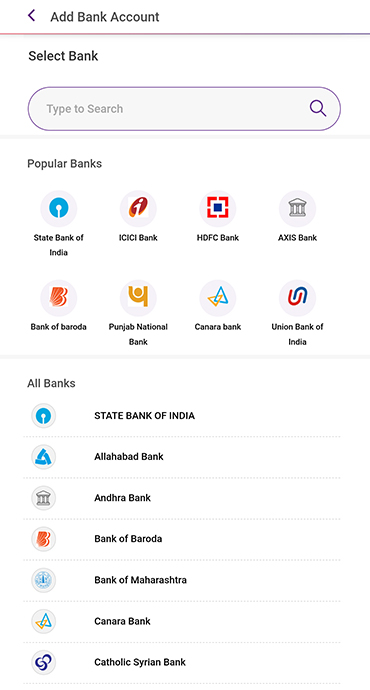

YONO SBI lets you integrate and manage savings/current accounts from multiple banks under one platform. If you have accounts with SBI as well as any other bank, you can add them all onto the YONO SBI app and make frictionless payments from any account. This eliminates the need to use separate apps from different banks.

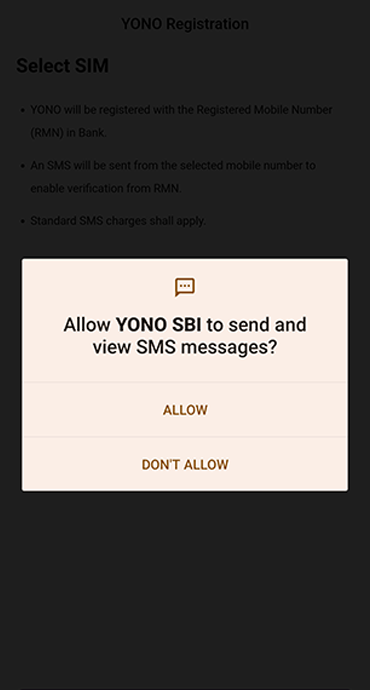

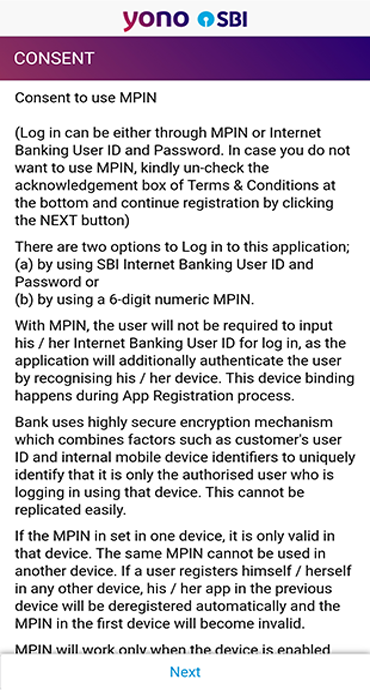

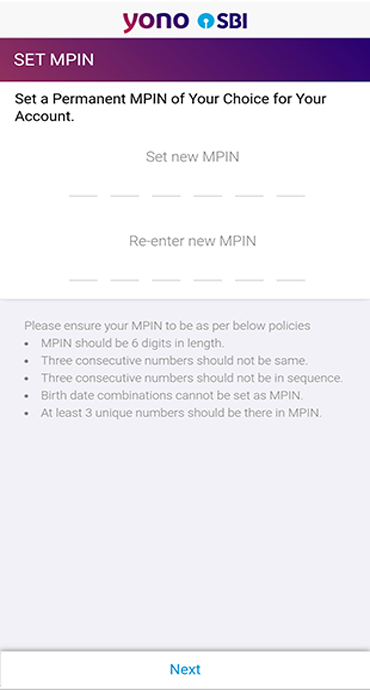

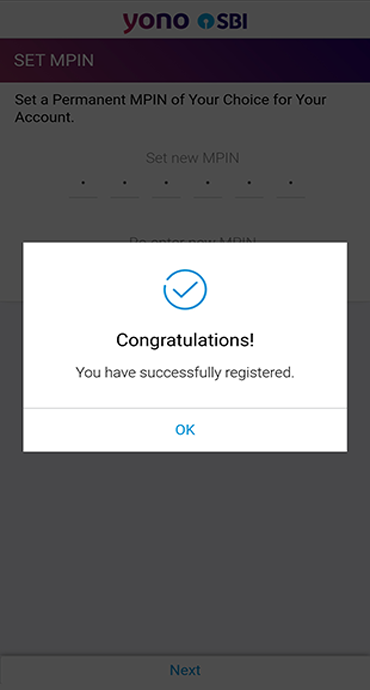

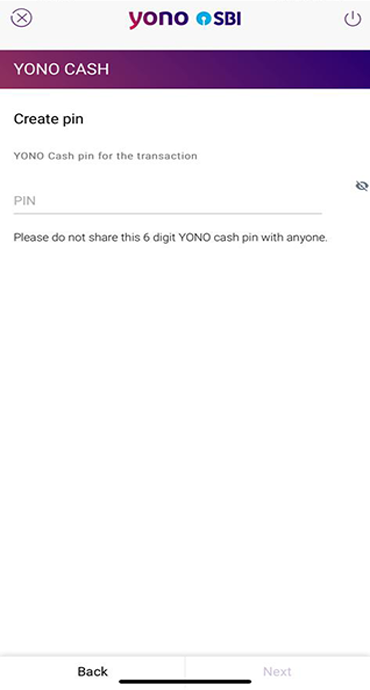

3. Strong Security

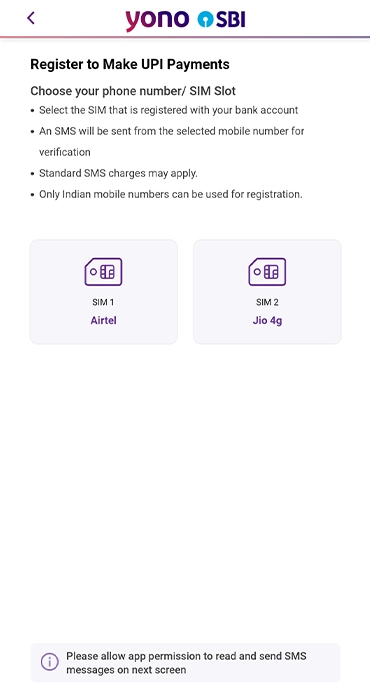

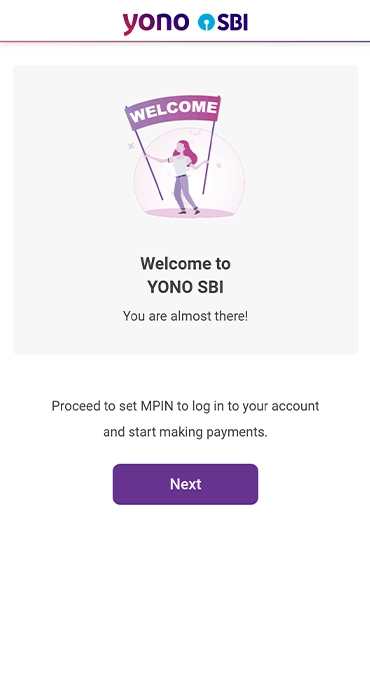

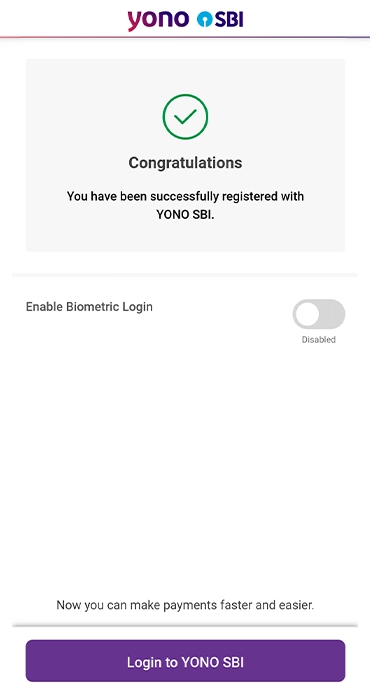

YONO SBI employs multiple security layers to keep your money safe, including biometric login, unique 6-digit MPIN generation, and many more. Your payment details are secured by advanced encryption, and additional factor of authentication like UPI PIN for facilitating UPI Payments.

These security mechanisms ensure seamless and risk-free payments so that you never have to worry when transferring money. Your accounts and transactions remain fully protected.

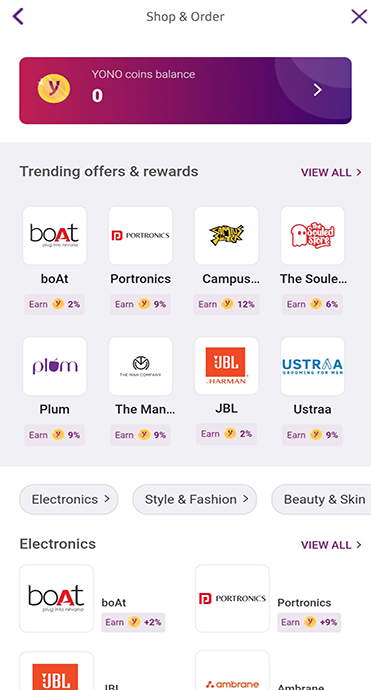

4. Rewarding Experience

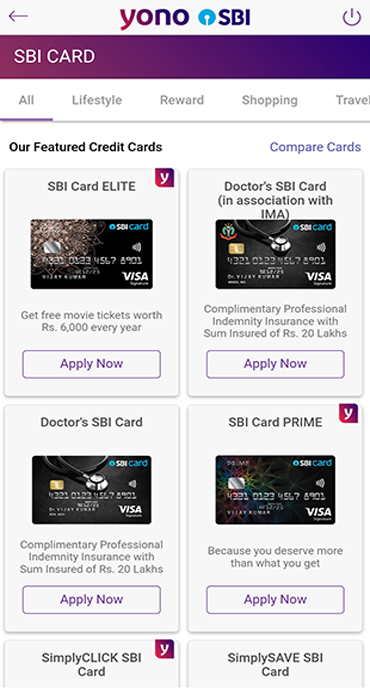

Top brands have partnered with YONO SBI to bring attractive discounts and deals when you shop using the app.

This creates a rewarding payment experience - you not only enjoy the convenience of instant money transfers but also save extra on every transaction you make!

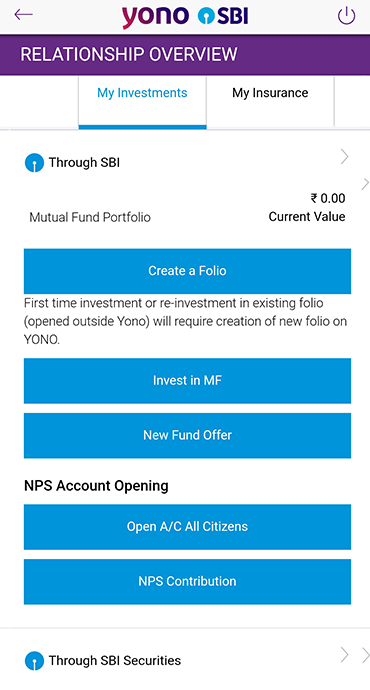

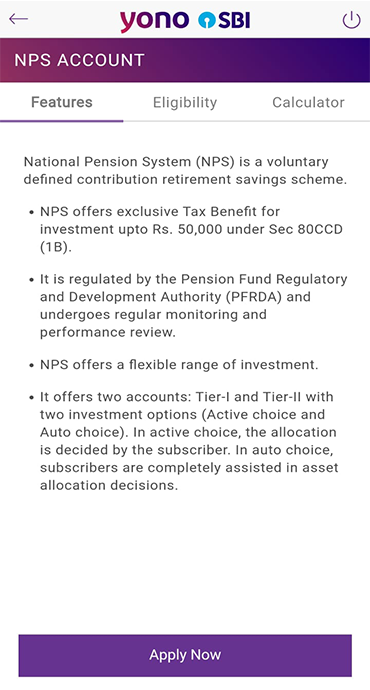

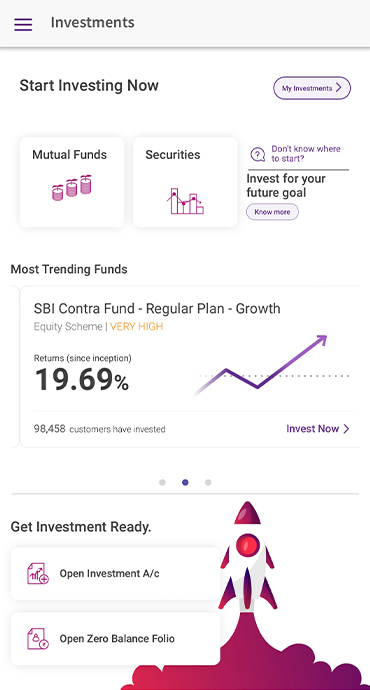

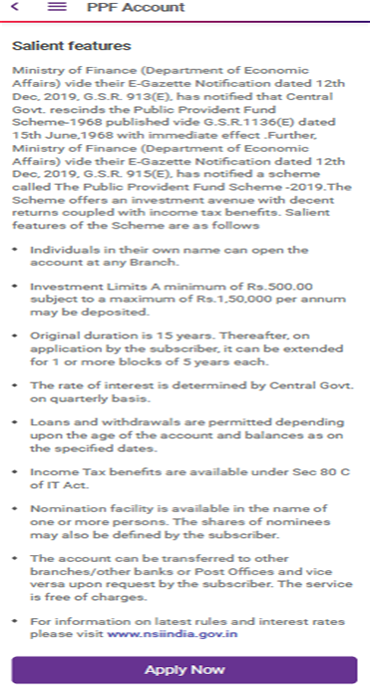

Additionally, users can access a wide array of banking and lifestyle facilities, including:

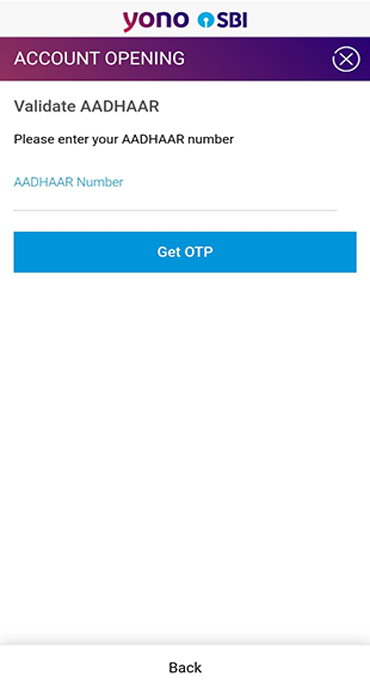

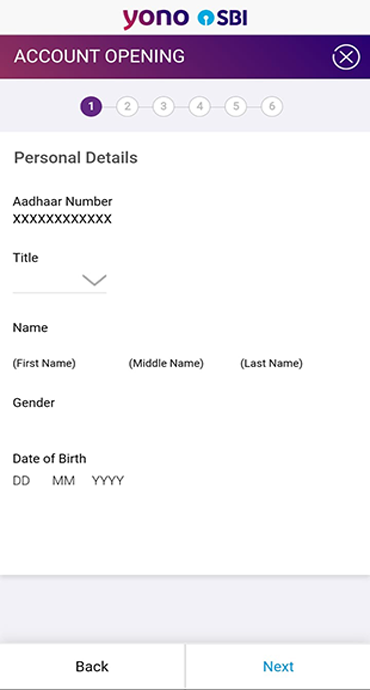

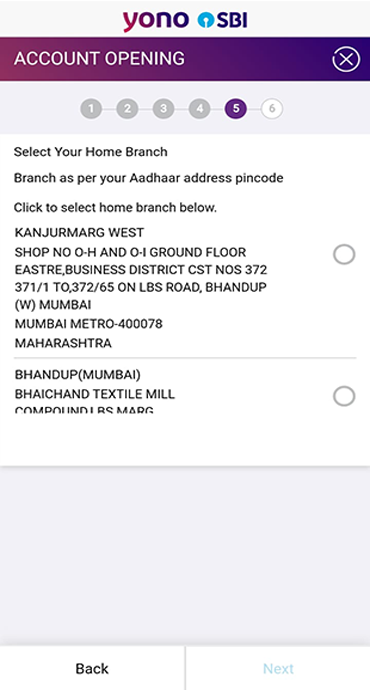

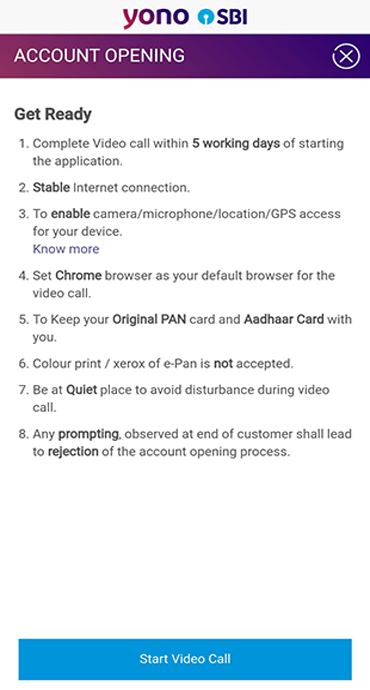

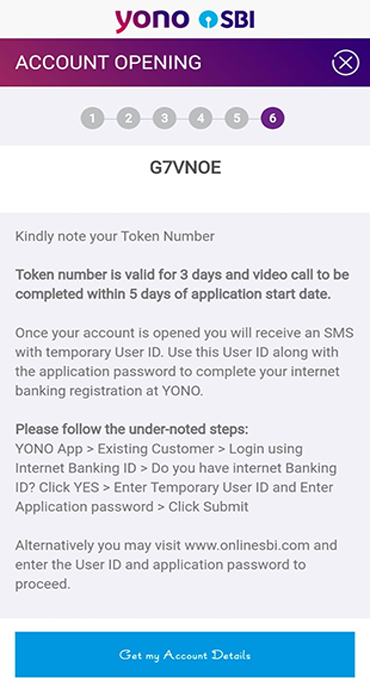

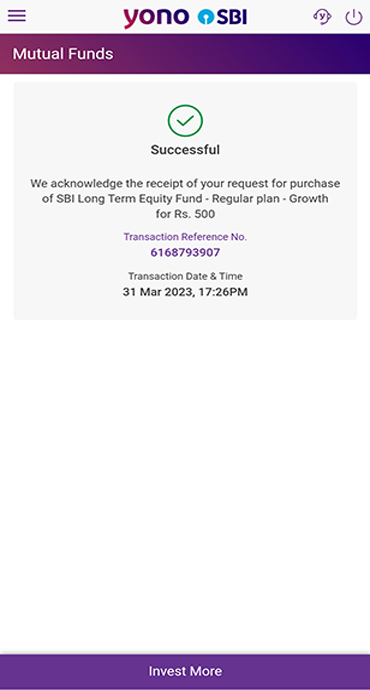

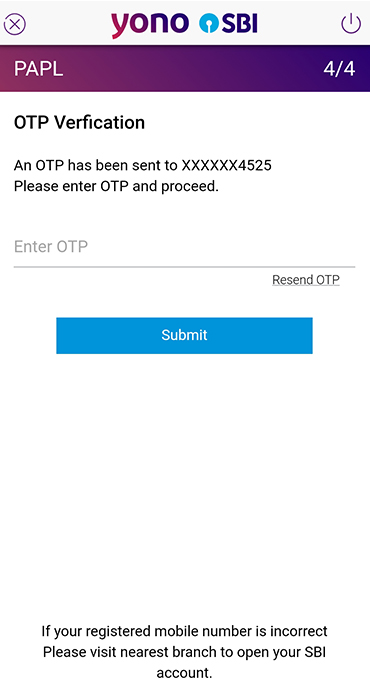

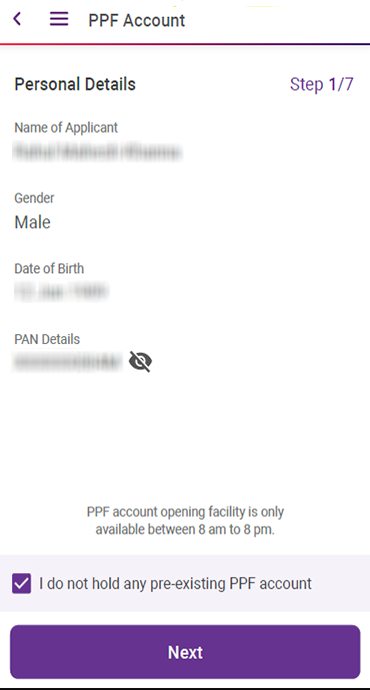

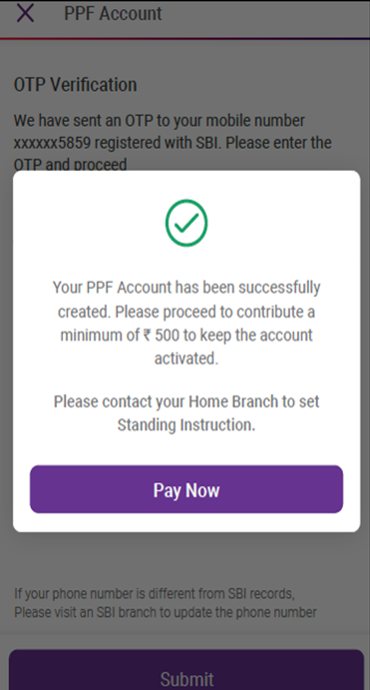

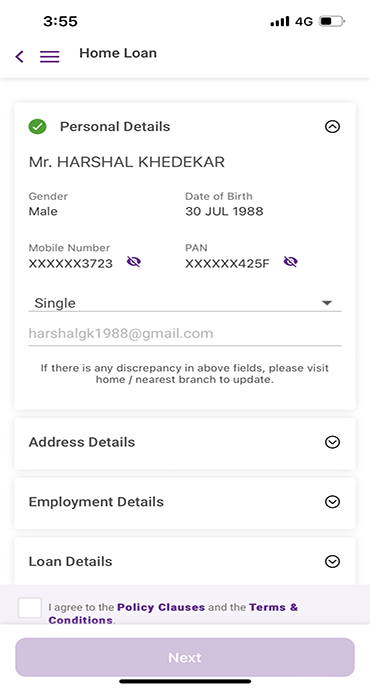

- Open Digital Savings Accounts using Video KYC: Open a fully digital savings account instantly through video verification.

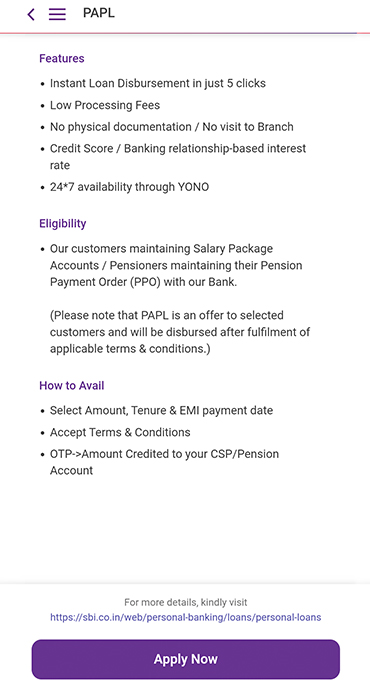

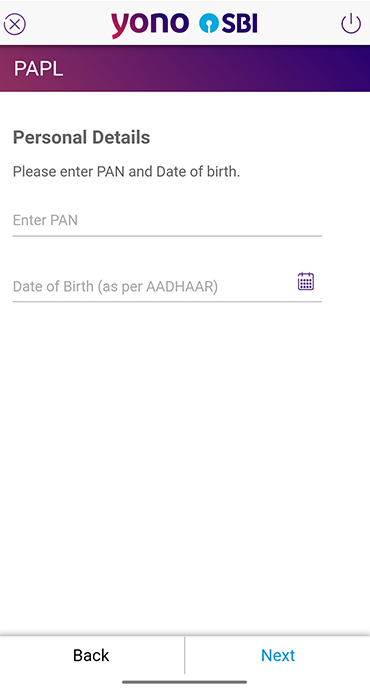

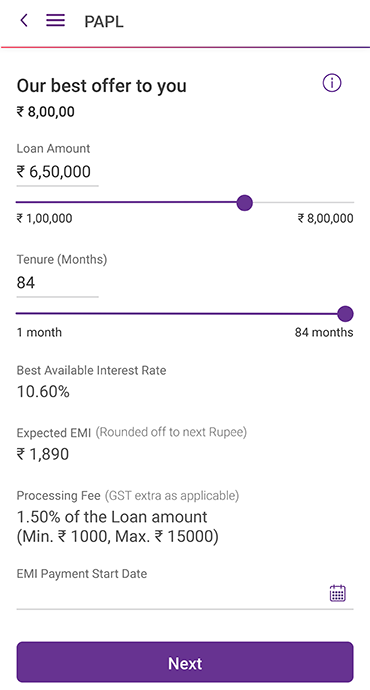

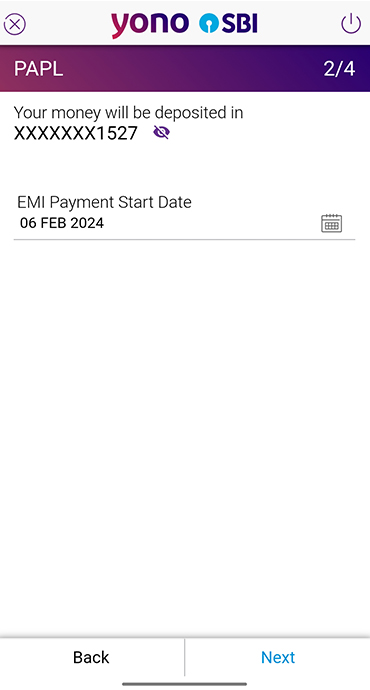

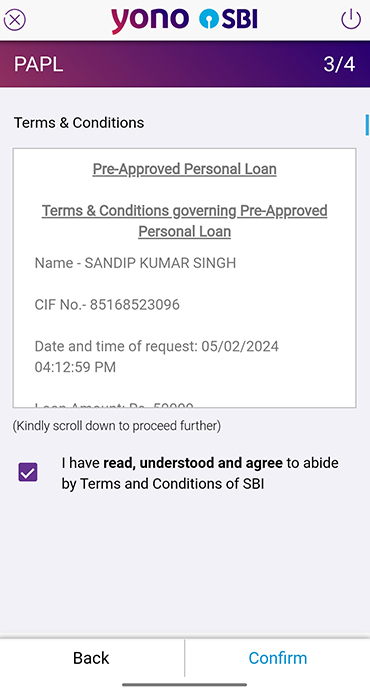

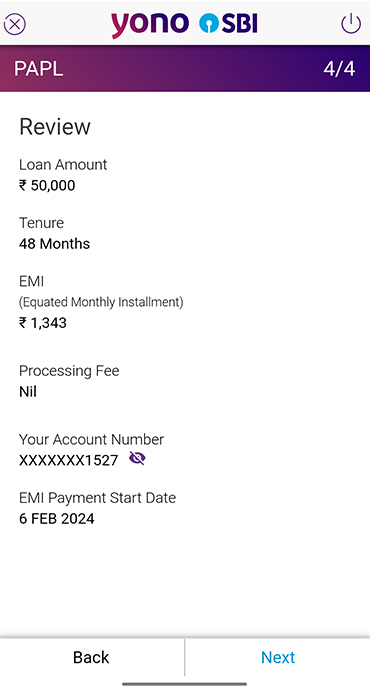

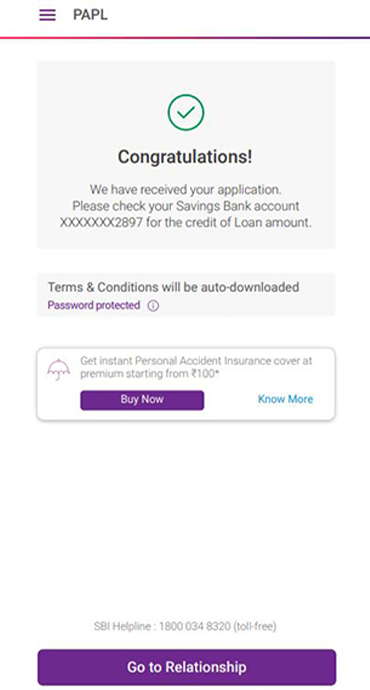

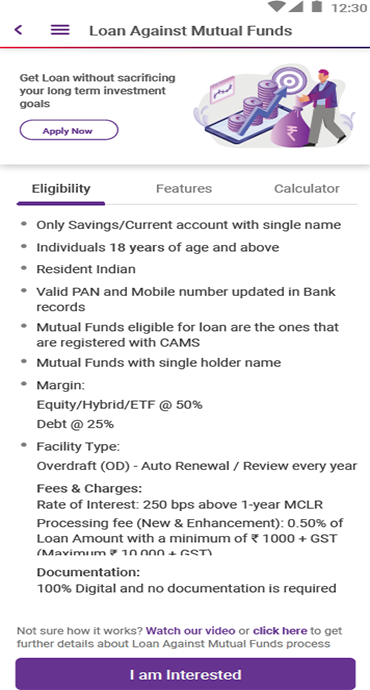

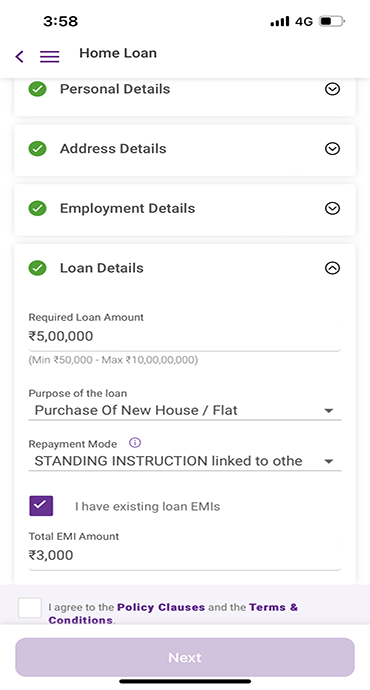

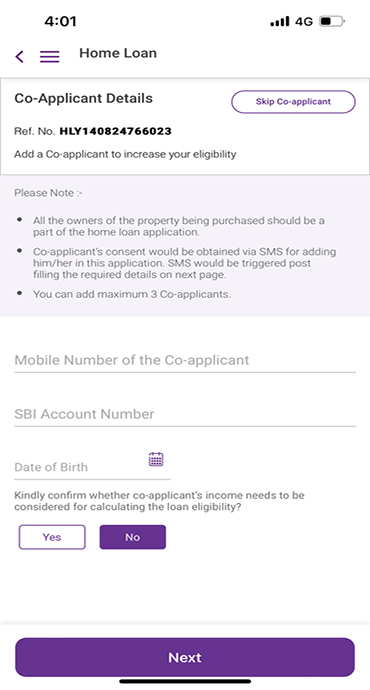

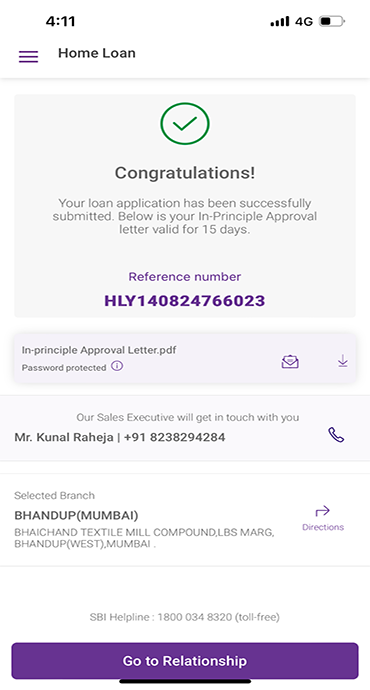

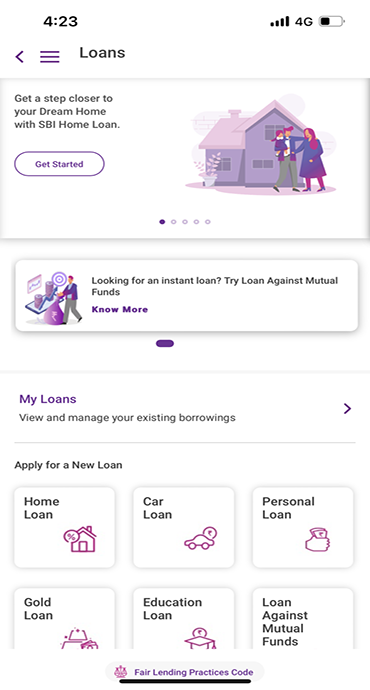

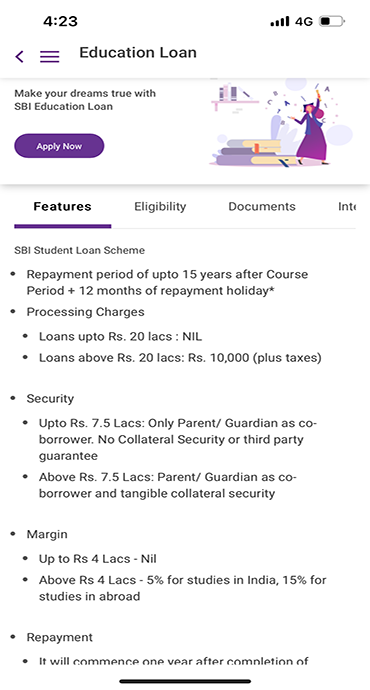

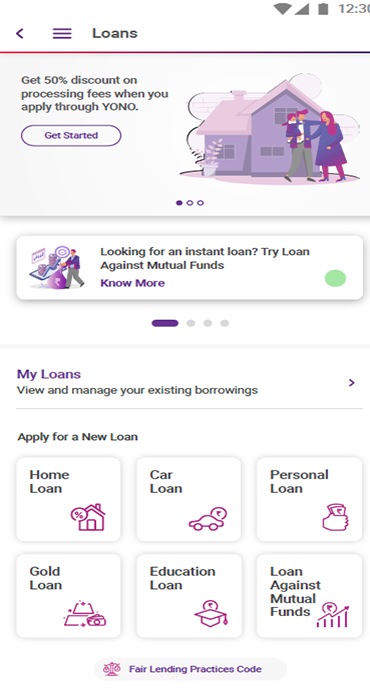

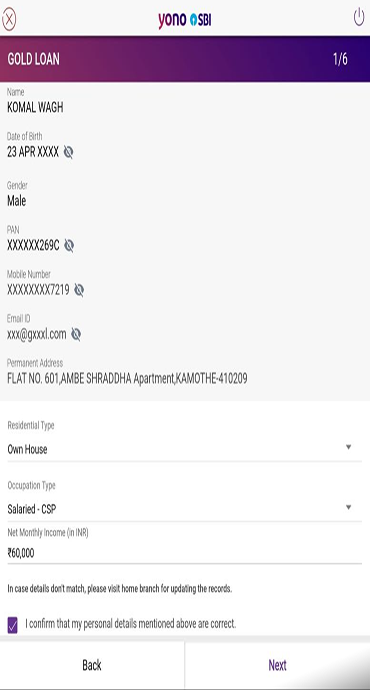

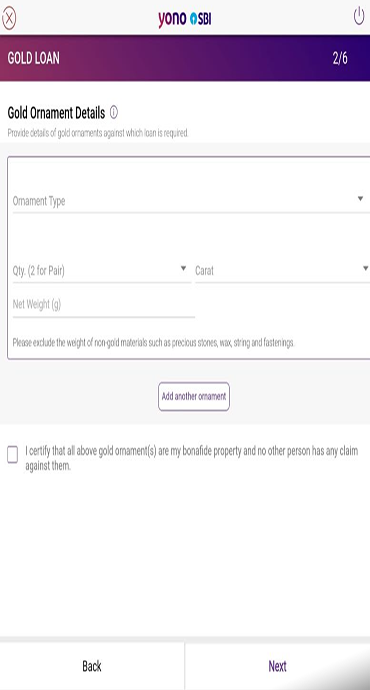

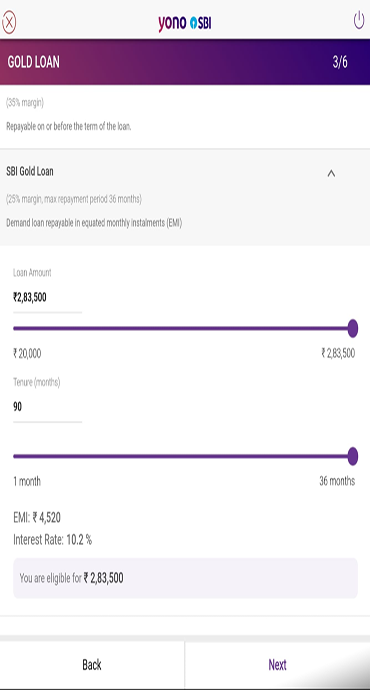

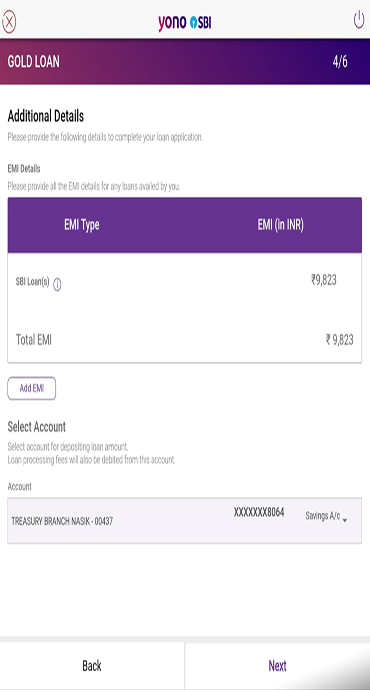

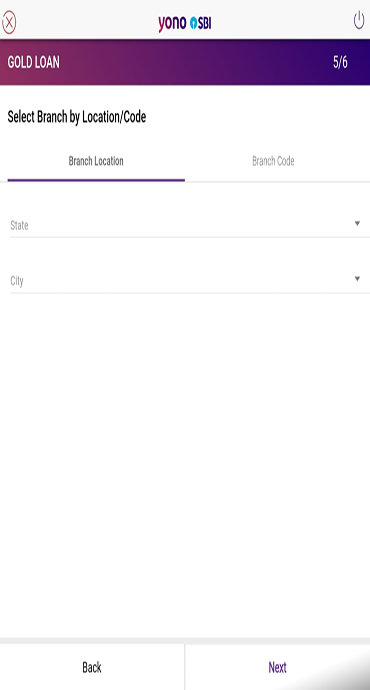

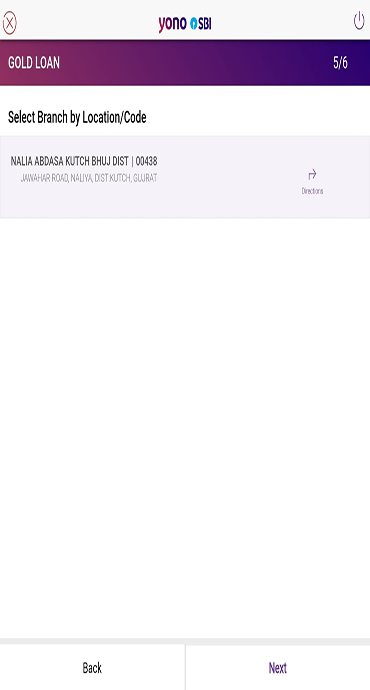

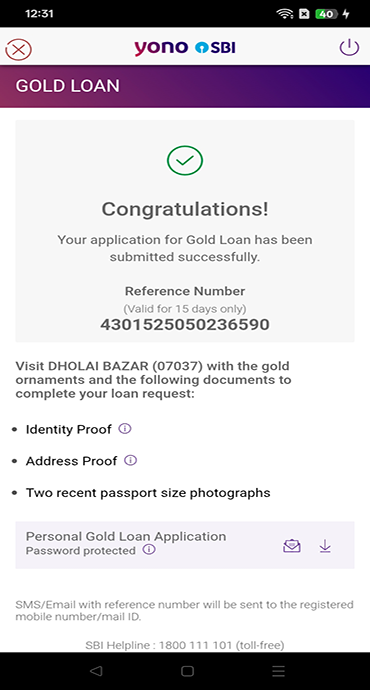

- Apply for Pre-approved Digital Loans: Check your eligibility and apply for quick disbursal personal loans on YONO SBI.

- Explore Shopping Offers from Premium Brands: Avail deals and discounts from top online shopping sites when accessing them through YONO SBI.

5. Zero Transaction Charges

YONO SBI does not charge for UPI payments. There are no hidden transaction fees or costs levied to use the platform.

With the YONO SBI app, enjoy complete access to full-fledged banking services and UPI features at no cost.

This means more savings as you retain the entire transferred amounts when performing fund transfer (P2P) or Merchant payments (P2M) transactions.

Experience the Future of Banking with YONO SBI

As seen above, the YONO SBI app brings together the best of simplified payments, multi-bank integration, security, rewards, and affordability. For customers who want the perfect fusion between high-tech banking and lifestyle needs, YONO SBI emerges as an essential app.

So, if you are an SBI customer or want to leverage UPI payments, download the YONO SBI app now. Even if you bank with another bank, you can still use YONO to enjoy seamless UPI-based payments and offers. It's one of the best mobile apps for accessing banking services and making digital payments on the go.

Related Blogs That May Interest You