How to Open an NPS Account in YONO SBI App | Plan your Retirement Smartly - Yono

Plan your retirement through smart investment in National Pension System (NPS)

18 Apr, 2024

investments nps

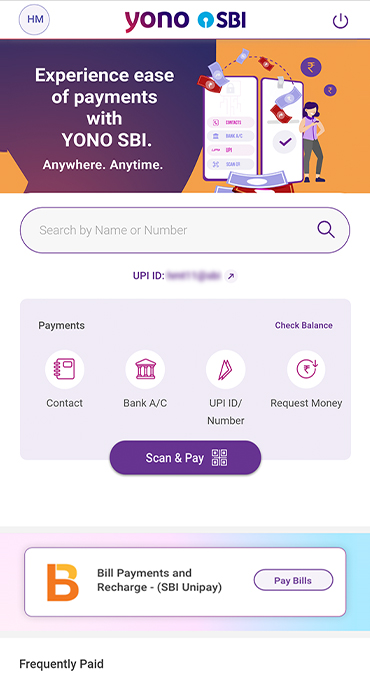

Planning for a secure future has never been more important in this fast-paced world. The National Pension System (NPS) offers a golden opportunity to build a financial cushion for your retirement. And now, it's even easier to kickstart your NPS journey with the YONO SBI App, your one-stop solution for seamless banking and financial transactions. In this comprehensive guide, we'll walk you through the process of opening an NPS account online through the YONO SBI App, making sure you're well-prepared for a comfortable retirement.

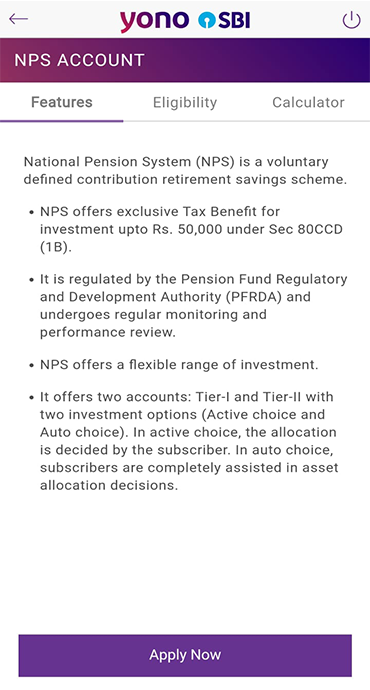

Embracing the Future: NPS Explained

Before we dive into the step-by-step guide, let's take a moment to understand what the National Pension System (NPS) is all about. NPS is a government-backed retirement savings scheme that allows Indian citizens to contribute towards their retirement fund. It's a voluntary, long-term investment platform that offers both equity and fixed-income investment options, making it a versatile choice for individuals seeking financial security post-retirement.

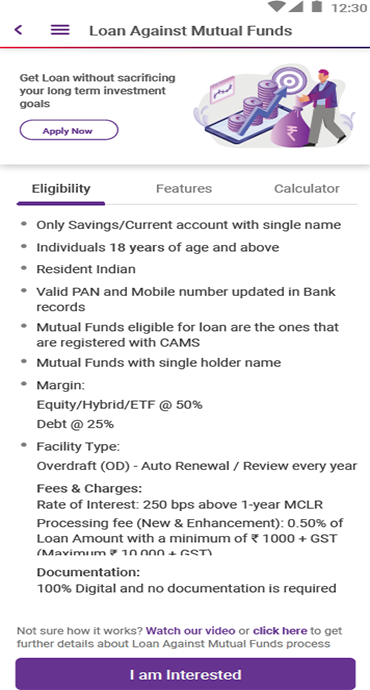

The National Pension System (NPS) provides two account types – Tier I and Tier II – to contribute towards retirement savings. While both accounts aim to build a retirement corpus, they differ across various aspects:

Tier I Account

This is the primary NPS account focused on long-term retirement savings. Some key features include:

- Eligibility: Available to Indian citizens between 18-70 years of age

- Minimum Investment: ₹500 initially with minimum annual contribution of Rs. 1000.

- Tax Benefits: Up to ₹2 lakh under Section 80C and 80CCD (1B)

- Withdrawals: Up to 60% of the corpus can be withdrawn at the retirement age of 60. The remaining 40% must be used to purchase an annuity plan

- Lock-in: Corpus has a lock-in period till age 60

Tier II Account

This acts as an investment account offering more flexibility than the Tier I account. Key aspects are:

- Eligibility: Can only open a Tier II account along with a Tier I account

- Minimum Investment: ₹1,000 while opening

- No mandatory annual contribution requirement in a Tier II NPS account

- Tax Benefits: No tax benefits available

- Withdrawals: Can withdraw partially or fully anytime without restrictions

- Lock-in: No lock-in period allows investors access to money as needed

Under PFRDA (Pension Fund Regulatory and Development Authority) guidelines, NPS funds can be managed by certified fund houses, including SBI Pension Funds, ICICI Prudential Pension Funds, Kotak Pension Fund, UTI Retirement Solutions, HDFC Pension Funds, LIC Pension Fund, among others. Based on risk appetite, investors can choose from active and auto-choice funds across asset classes like equity, corporate bonds, and government securities. This provides optimised growth potential for the retirement corpus.

How to Open an NPS Account through YONO SBI: NPS Account Opening Online

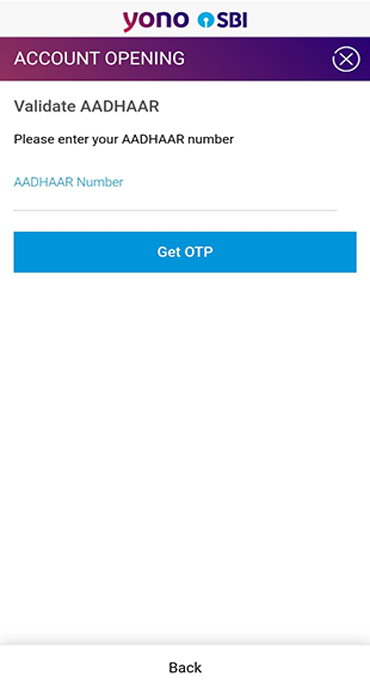

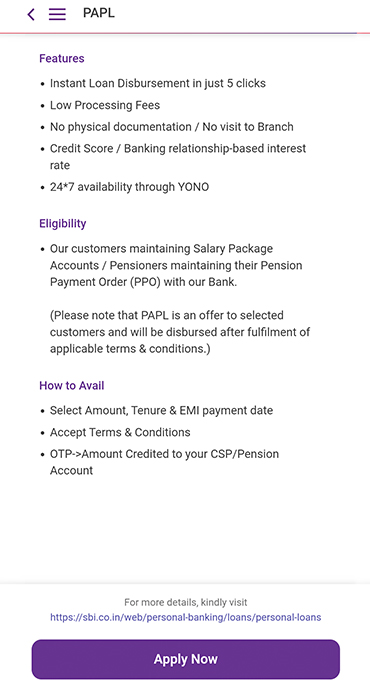

Gone are the days of time-consuming processes and lengthy paperwork. So, how to open an NPS account in the YONO SBI app? You can open NPS through YONO SBI from the comfort of your home. Here's how you can do it:

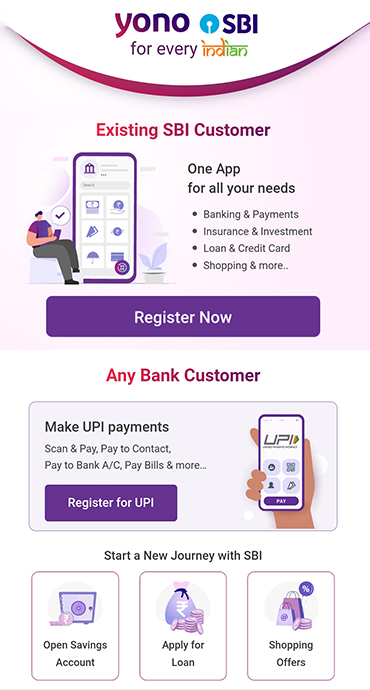

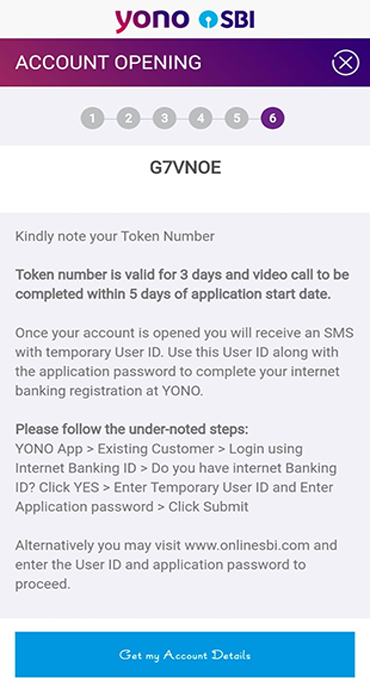

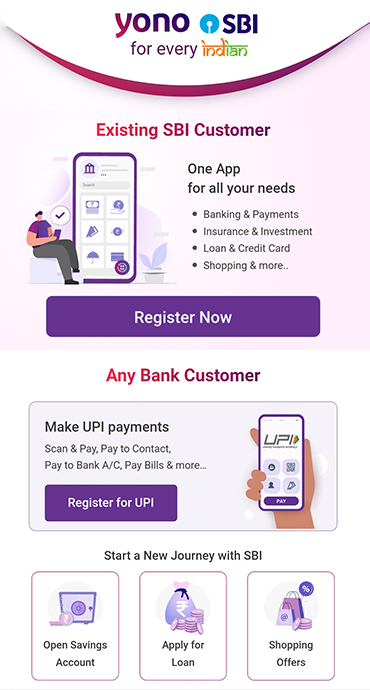

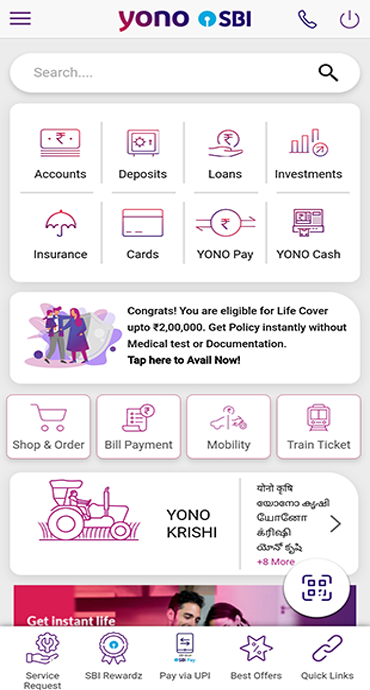

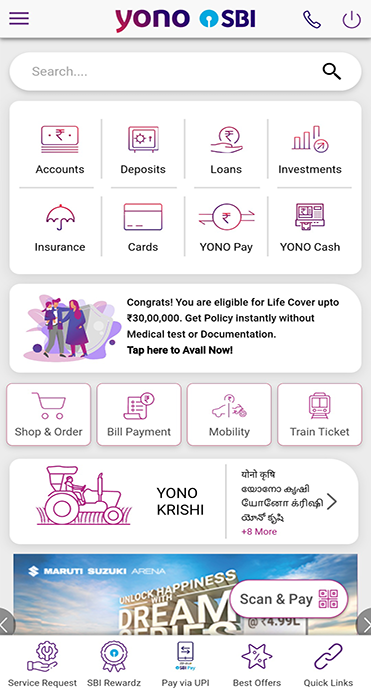

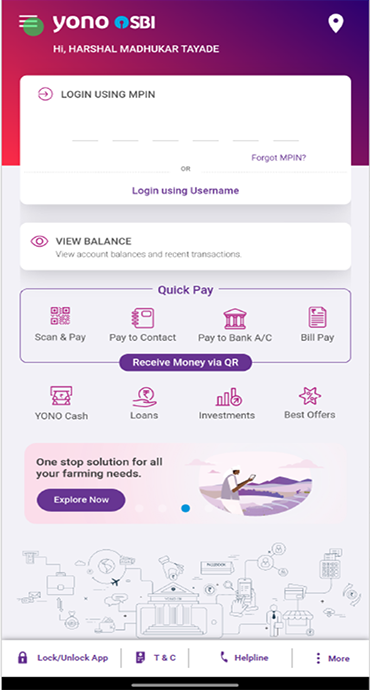

Step 1: Download and Install the YONO SBI App

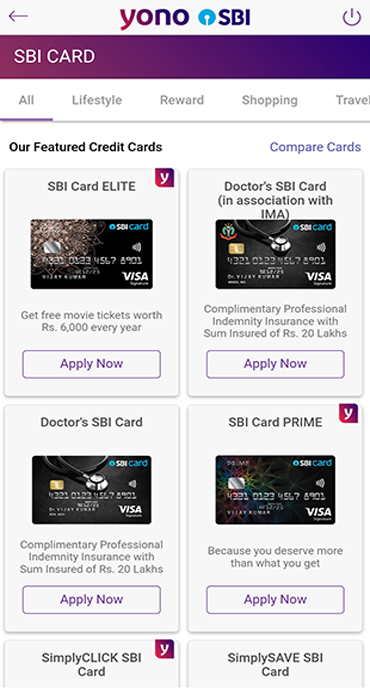

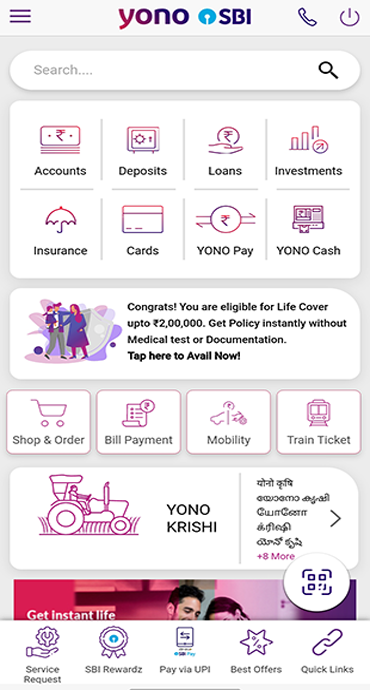

If you haven't already, head to Google Playstore /App store and download the YONO SBI App. It's available for both Android and iOS devices.

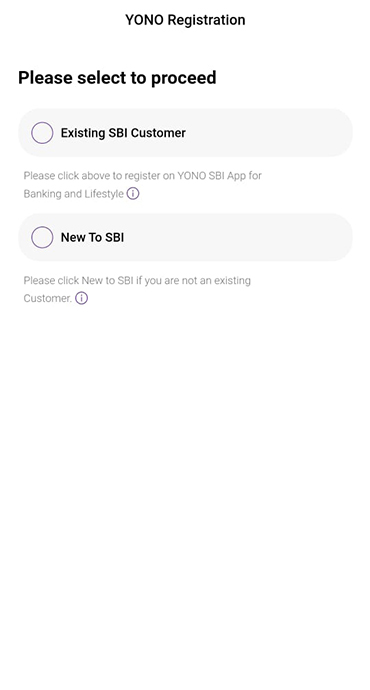

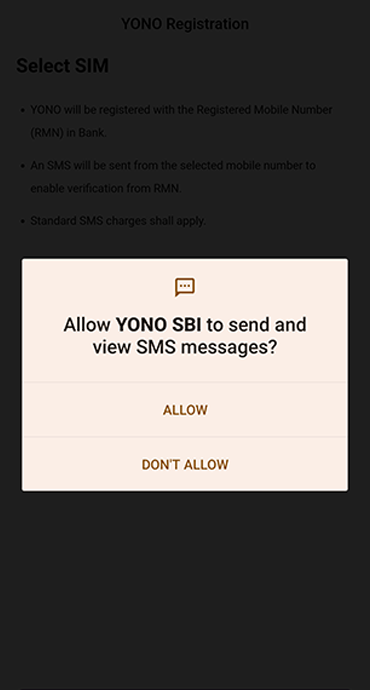

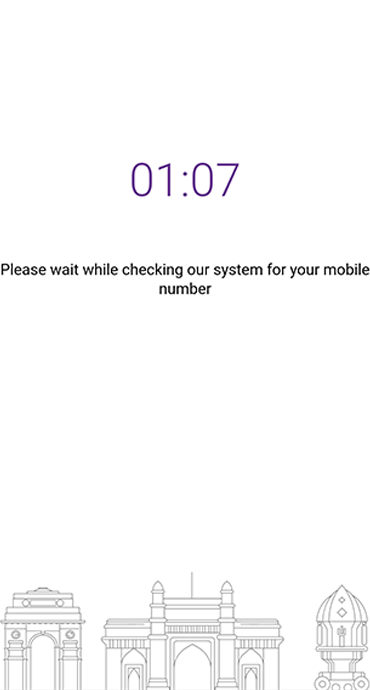

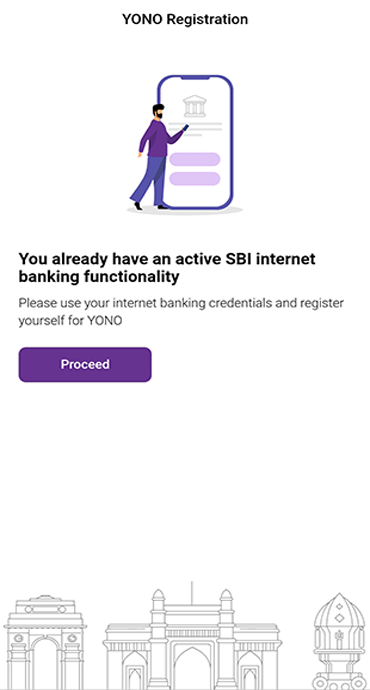

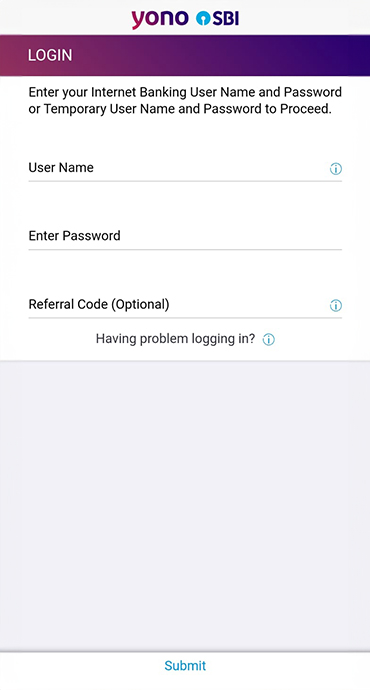

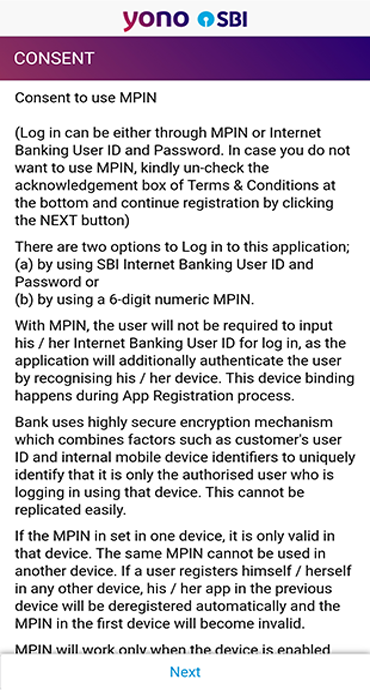

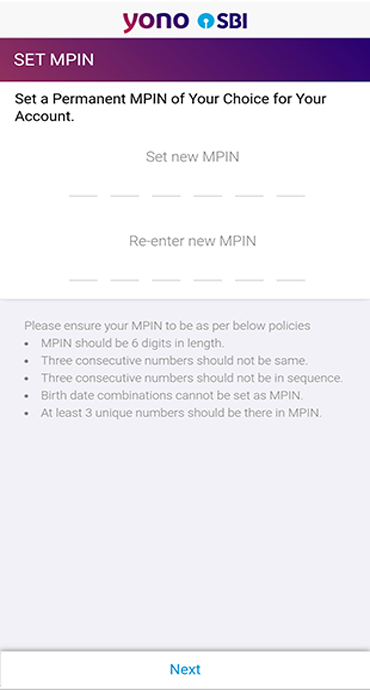

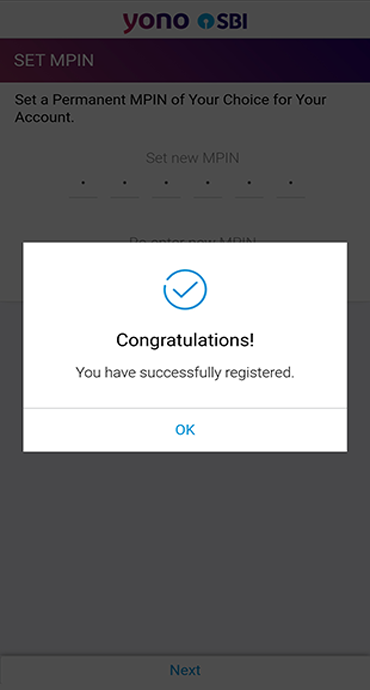

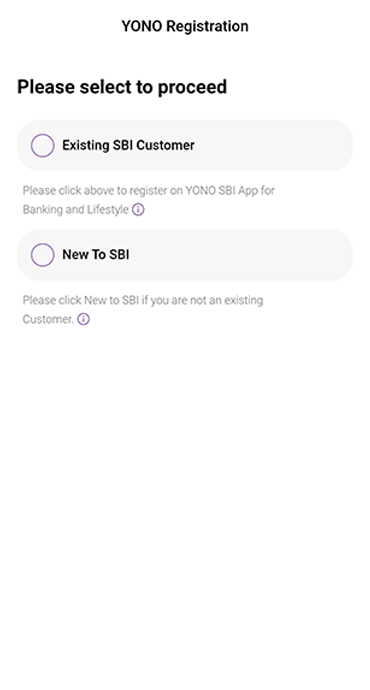

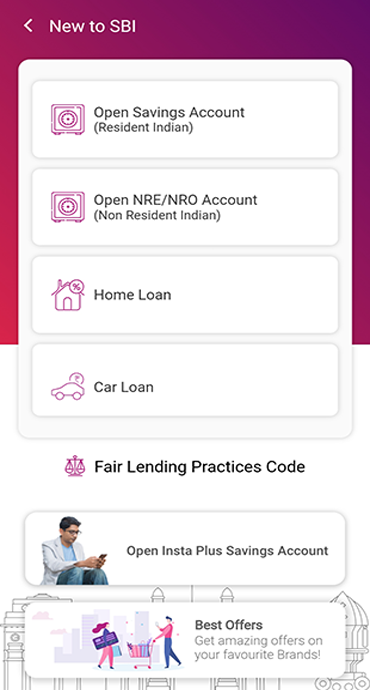

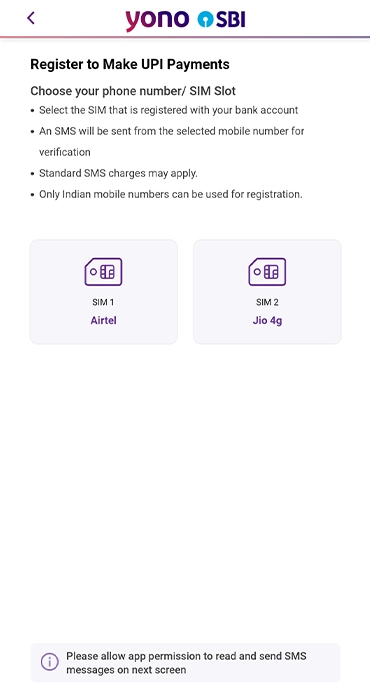

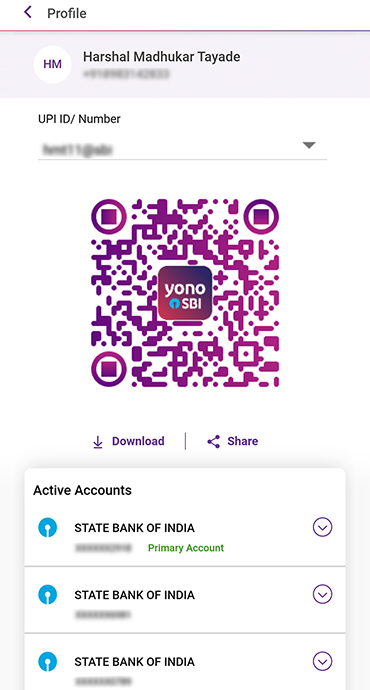

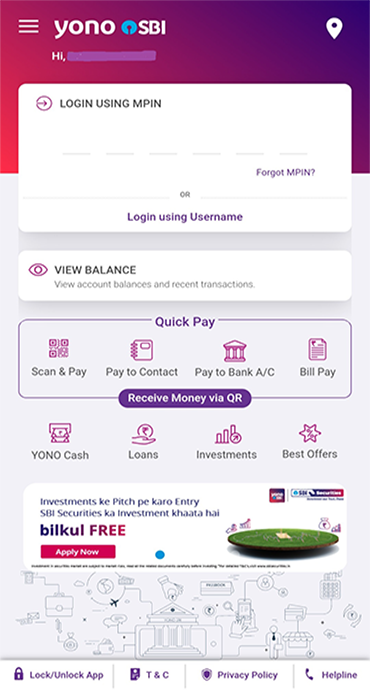

Step 2: Register or Log In

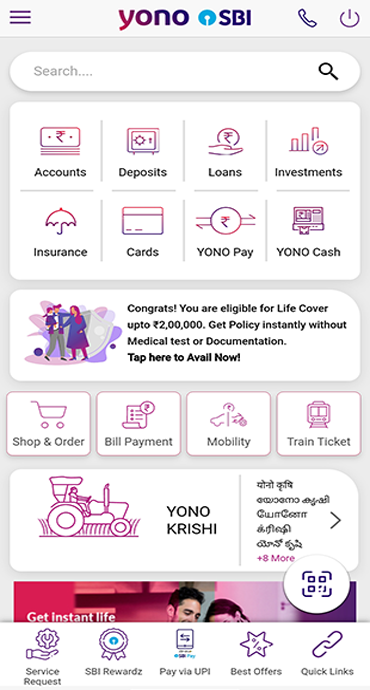

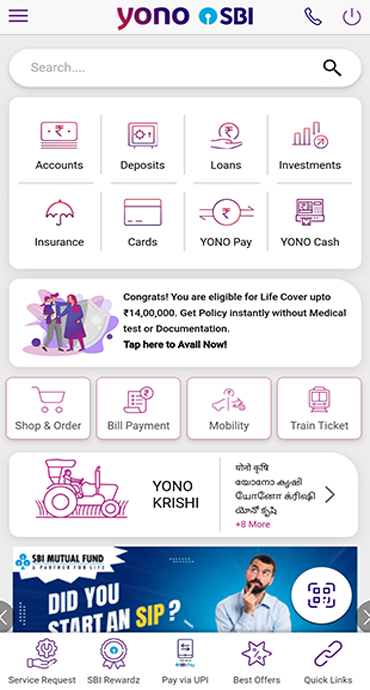

If you're new to the app, follow the registration process. For existing users, simply log in using your credentials.

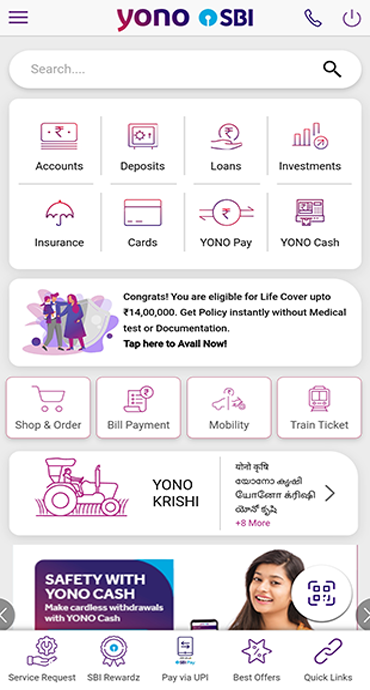

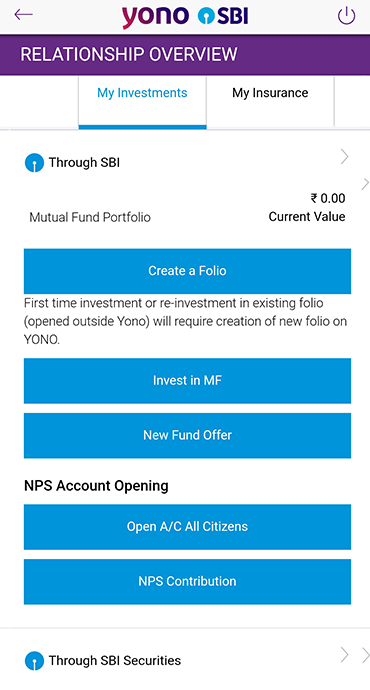

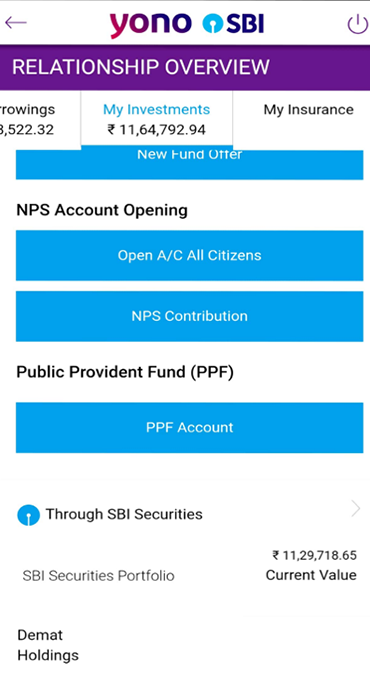

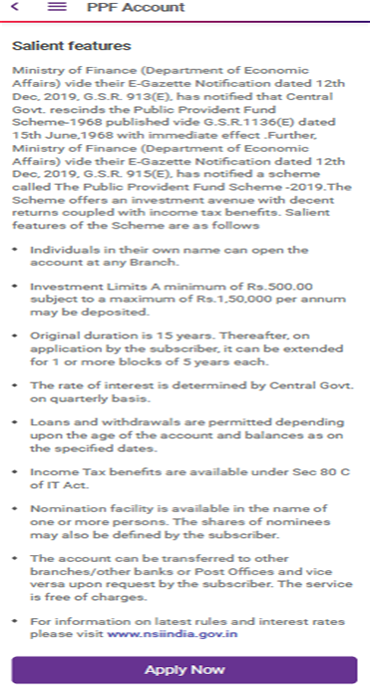

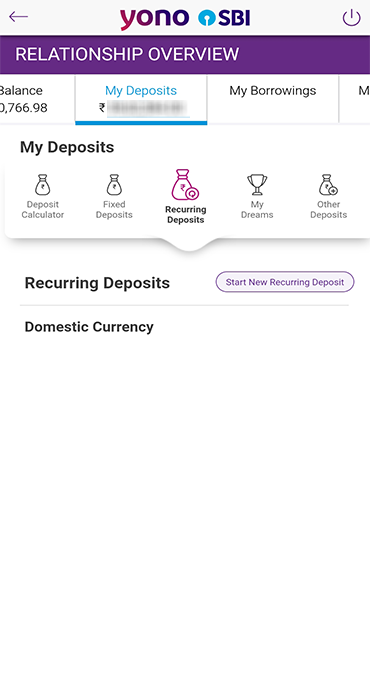

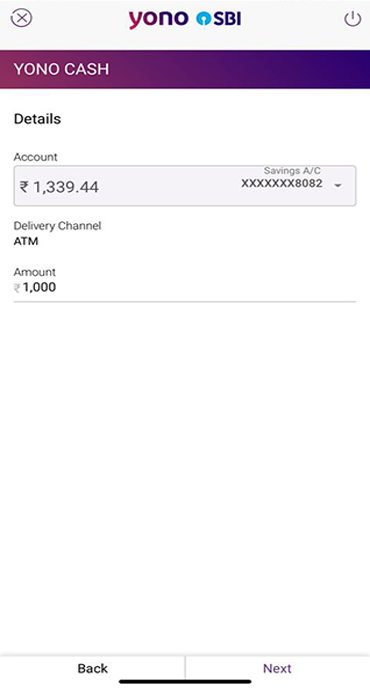

Step 3: Navigate to NPS Account Opening

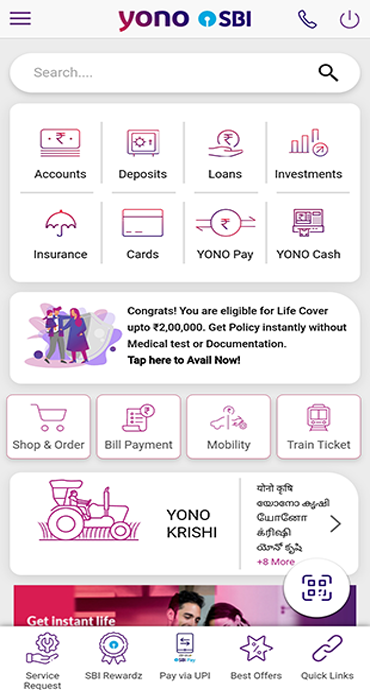

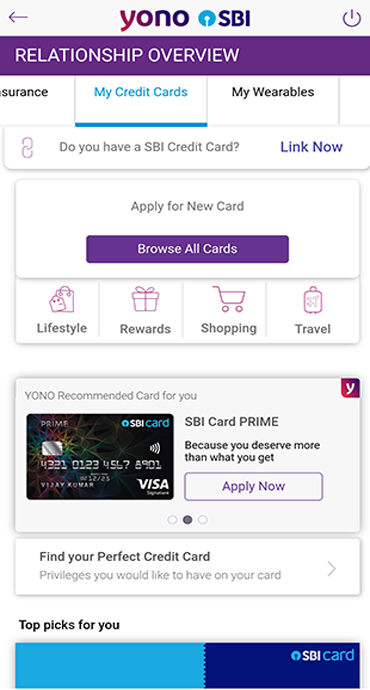

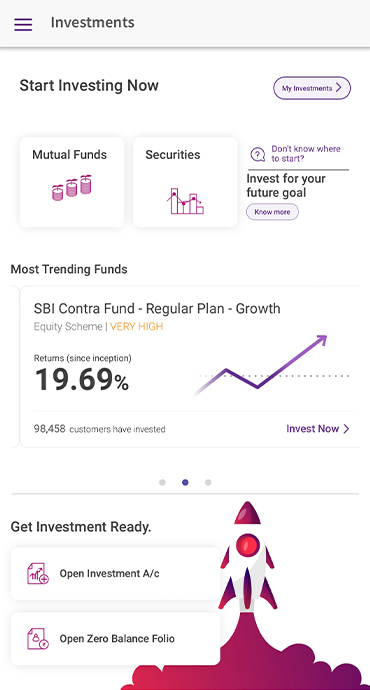

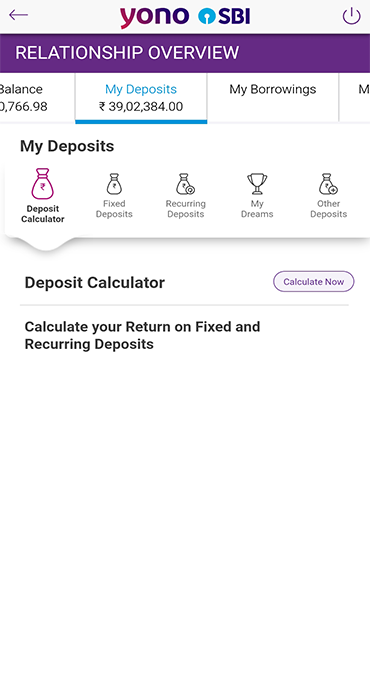

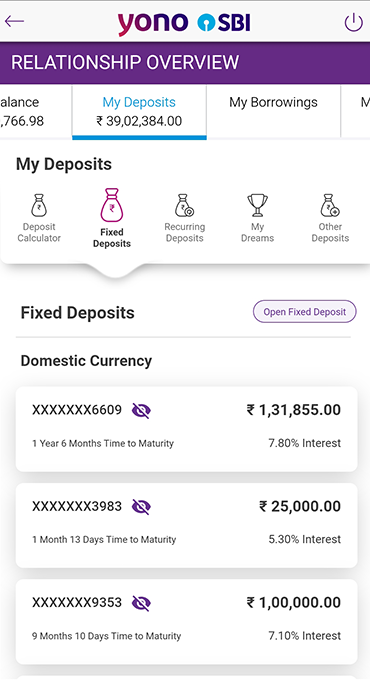

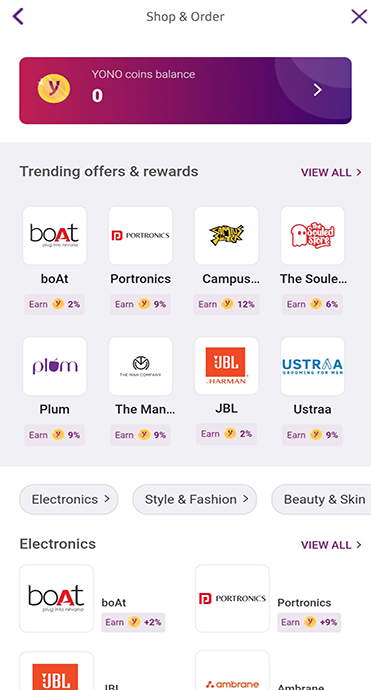

Once you're in the app, navigate to the 'Investments' section. Here, you'll find the key features/ benefits of NPS and the option to open an NPS account.

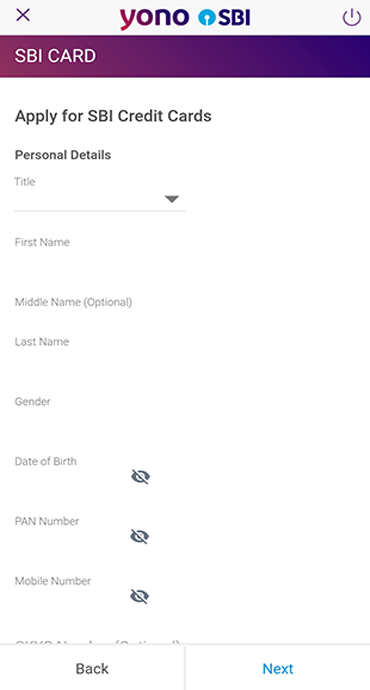

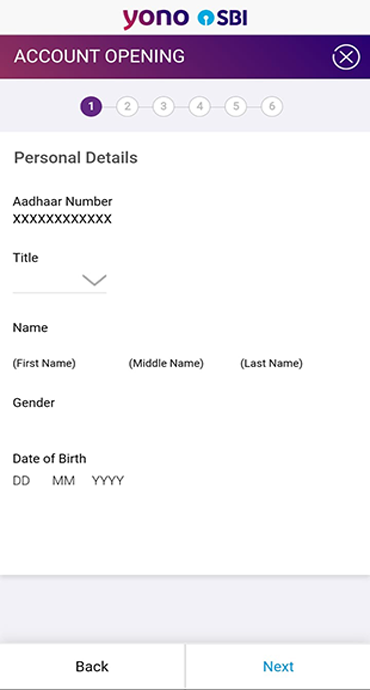

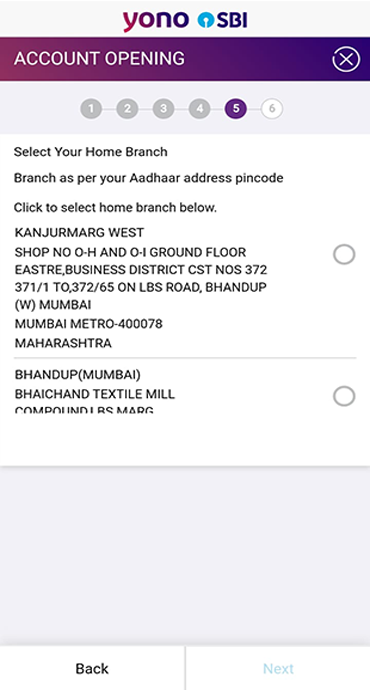

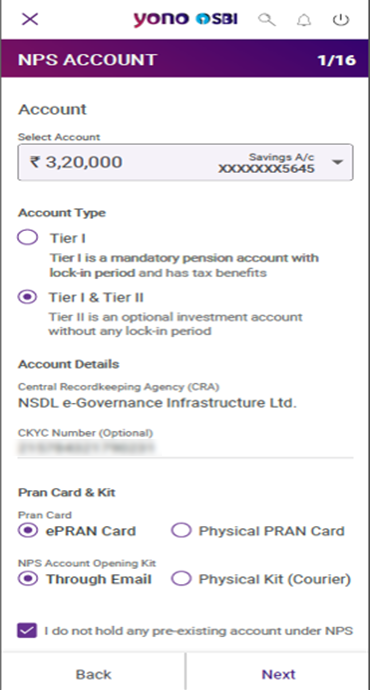

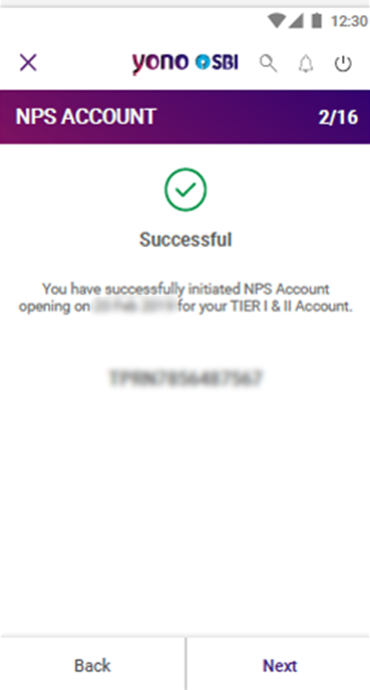

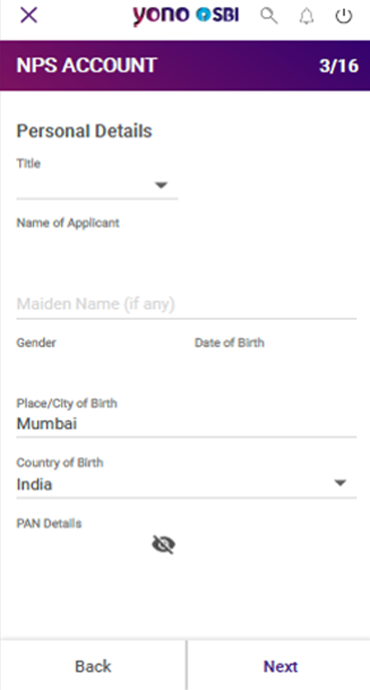

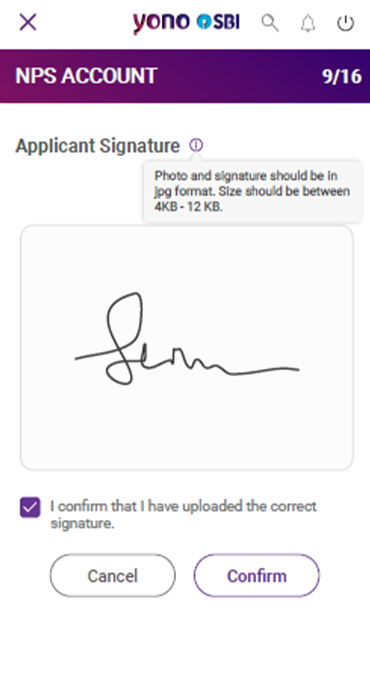

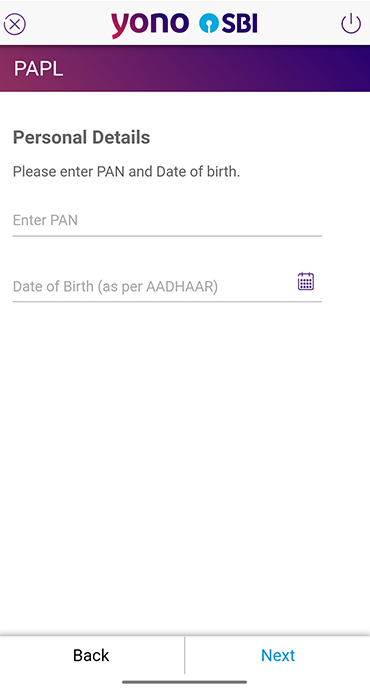

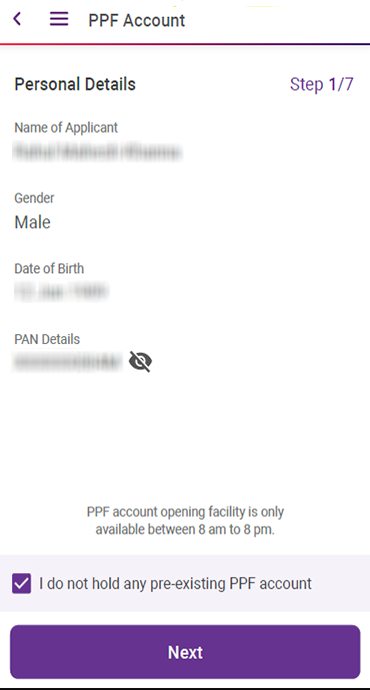

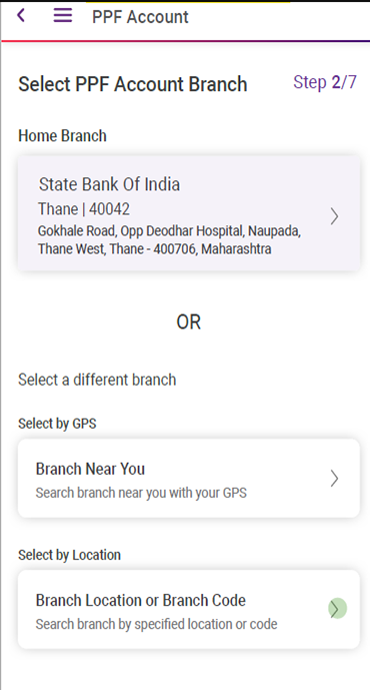

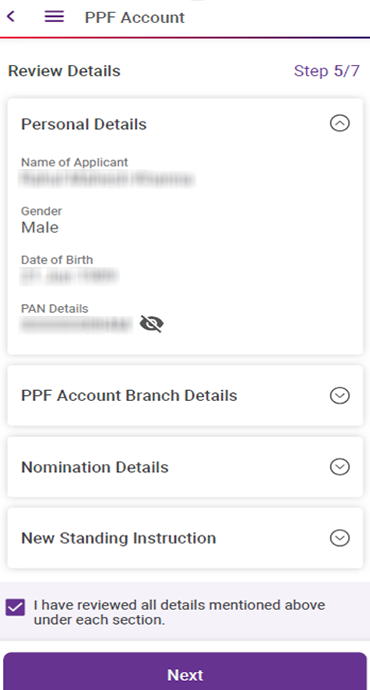

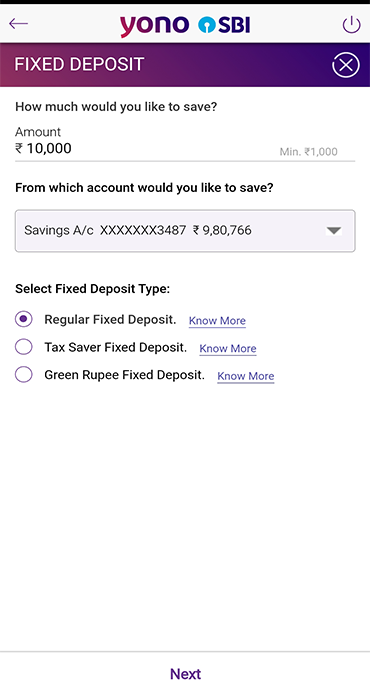

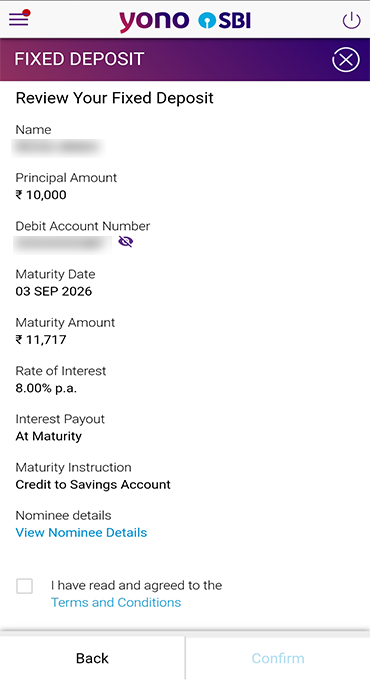

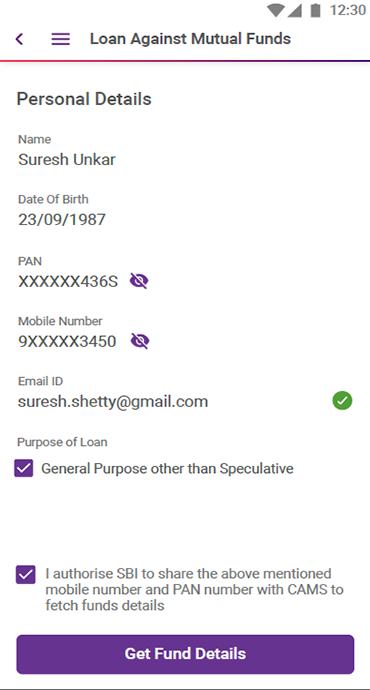

Step 4: Provide Necessary Details

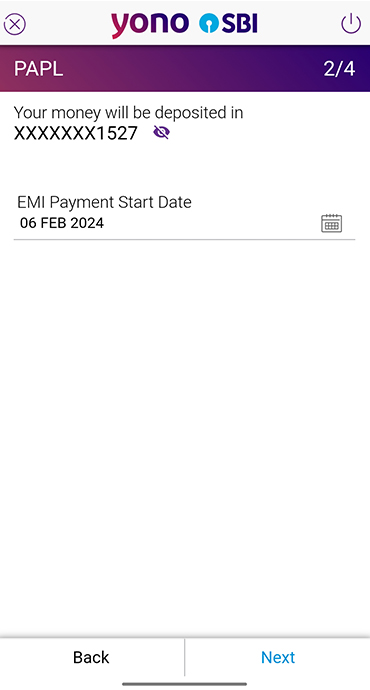

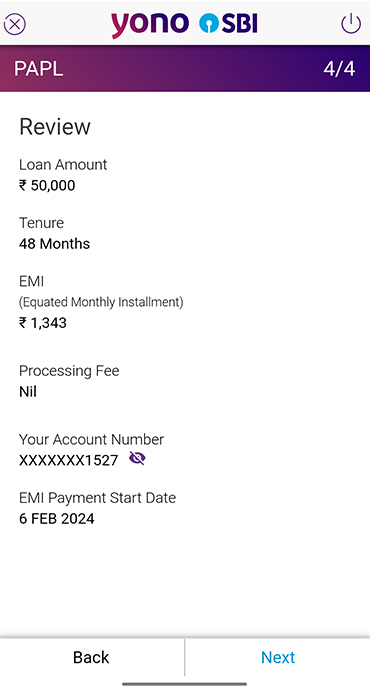

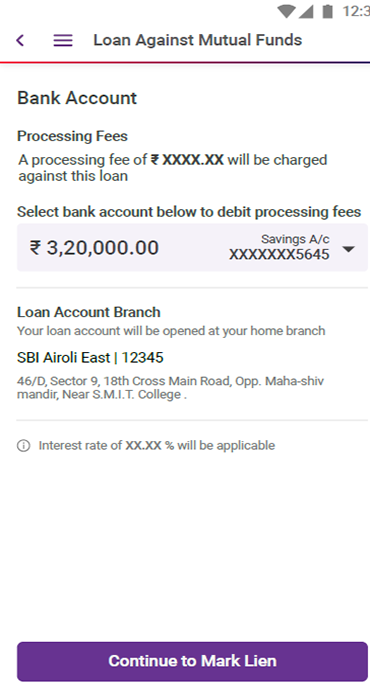

You'll be prompted to select the account from which initial contribution would be made towards Tier I and /or Tier II. Basic details are auto populated while details such as place, country of birth, Parent details and other relevant information are to be filled/uploaded. Make sure to double-check the accuracy of the information.

Step 5: Nomination

Designate a nominee for your NPS account. Maximum 3 nominees are permitted in each Tier. Nominee for Tier I and Tier II may be same or different.

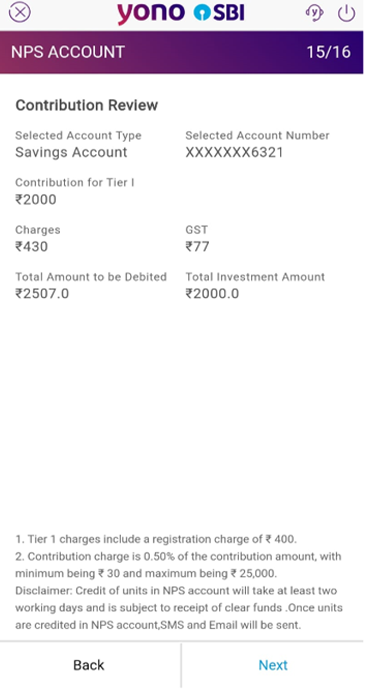

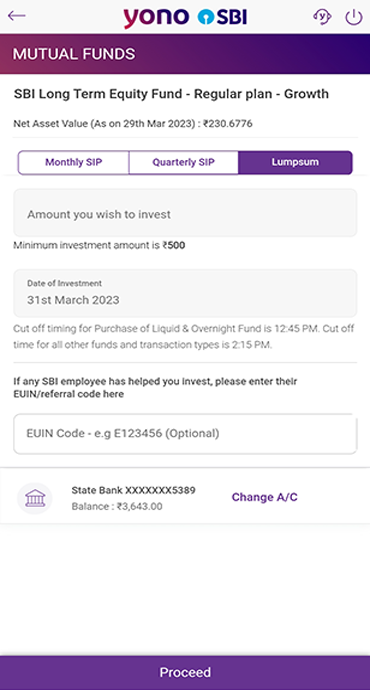

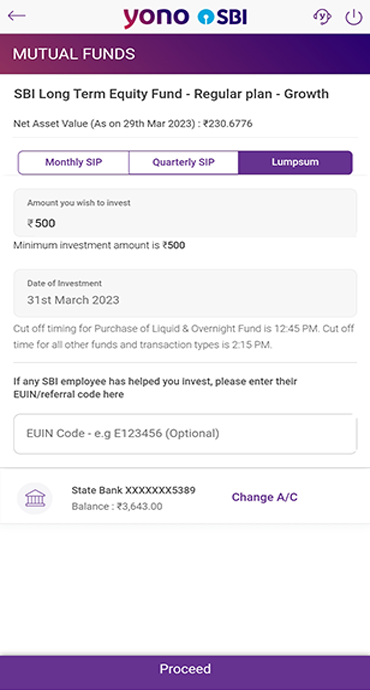

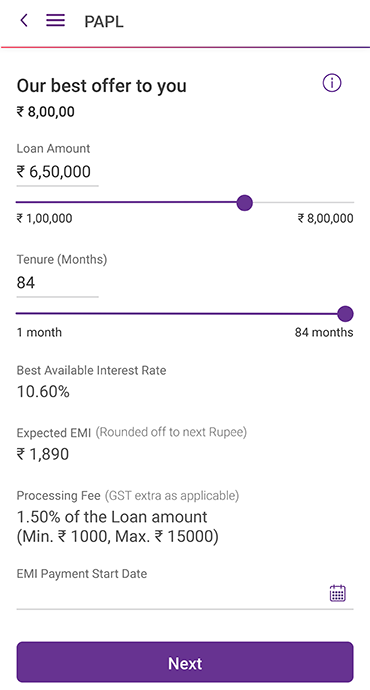

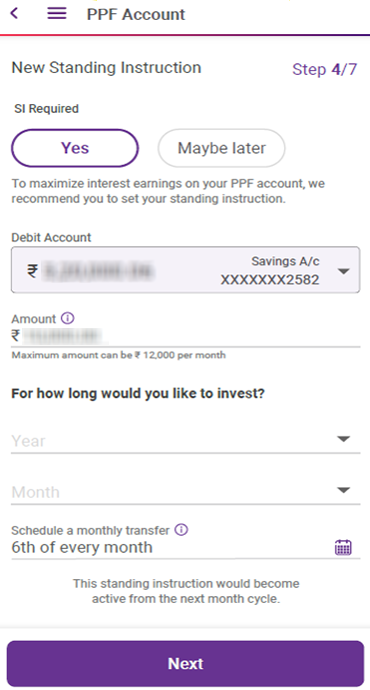

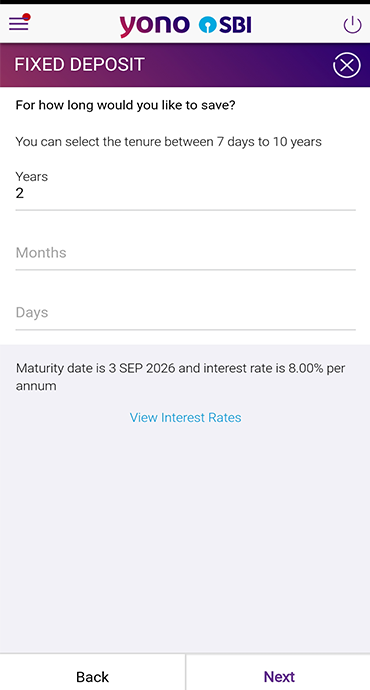

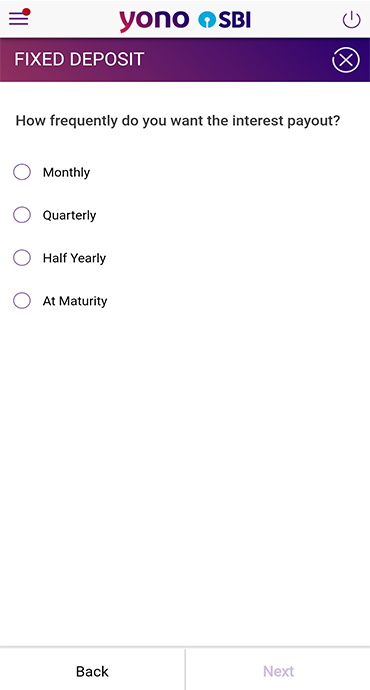

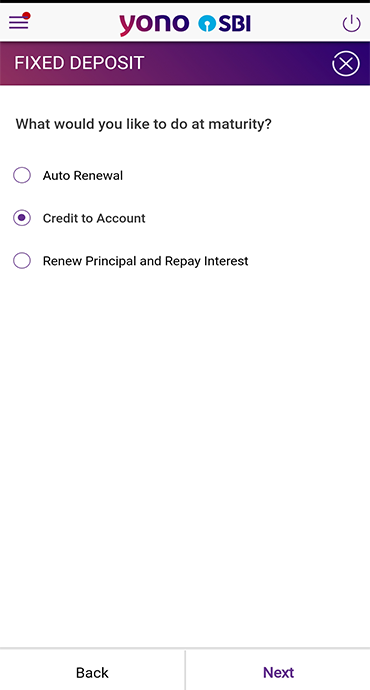

Step 6: Choose Your Investment Preferences and payment

The YONO NPS account allows you to select your investment preferences based on your risk appetite. You can choose between various fund managers and investment options, tailoring your NPS account to suit your financial goals.

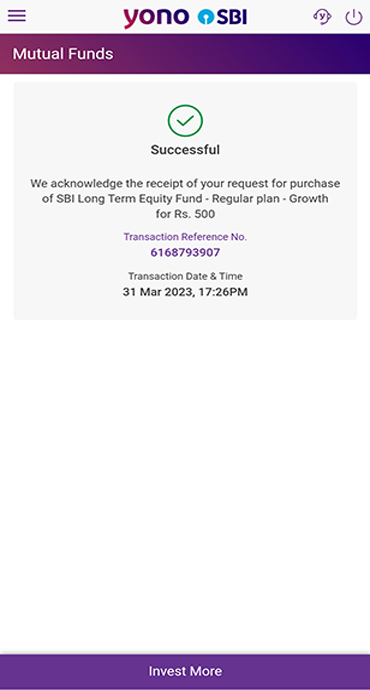

The minimum initial contribution amount in Tier I required to open an NPS account is ₹500.

The minimum initial contribution amount in Tier II required while opening NPS account is ₹1000.

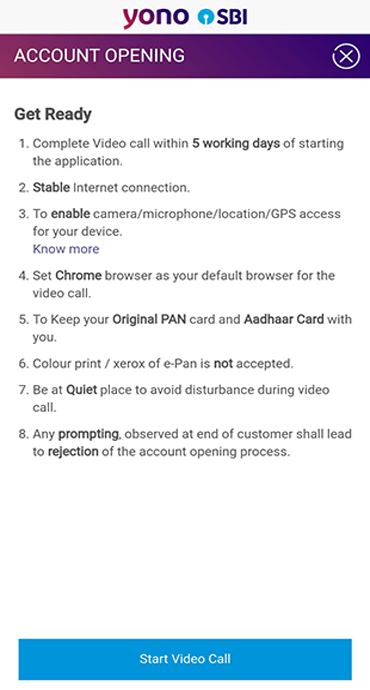

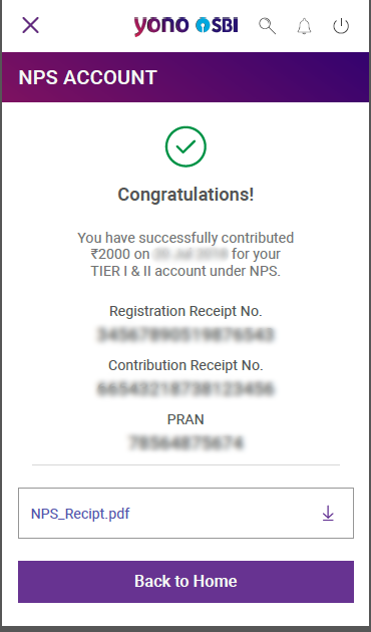

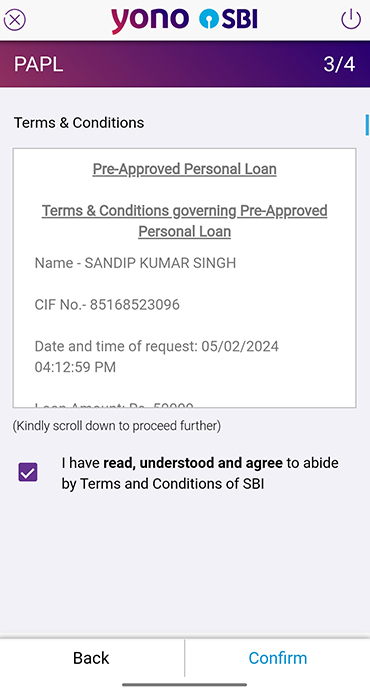

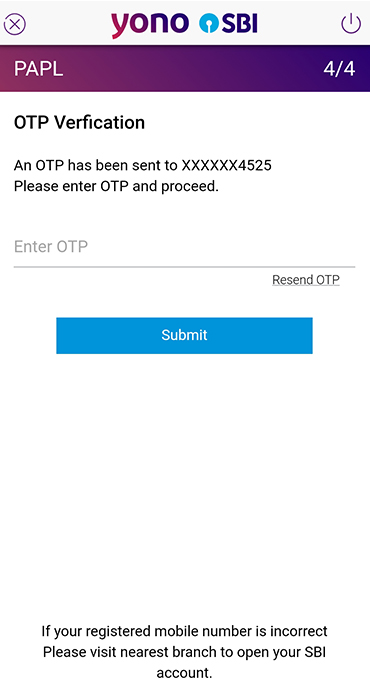

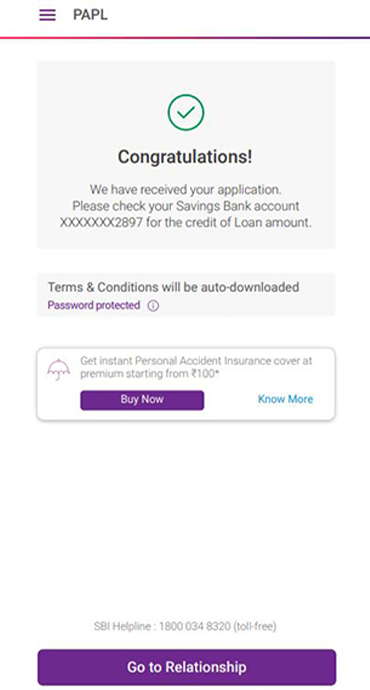

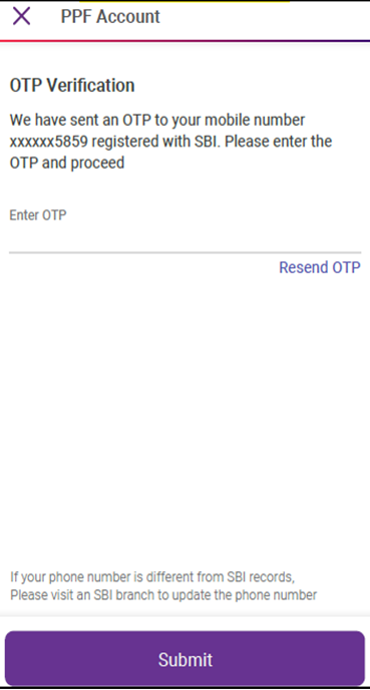

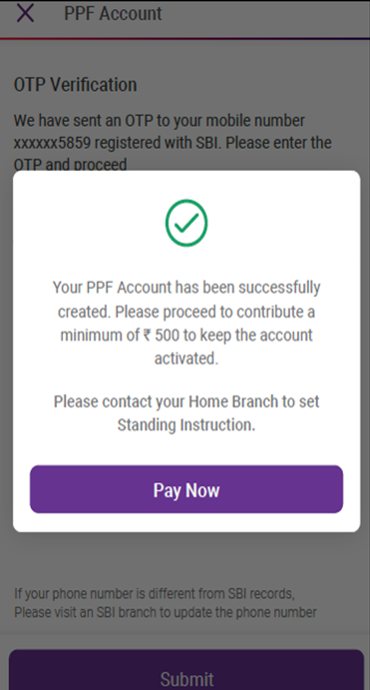

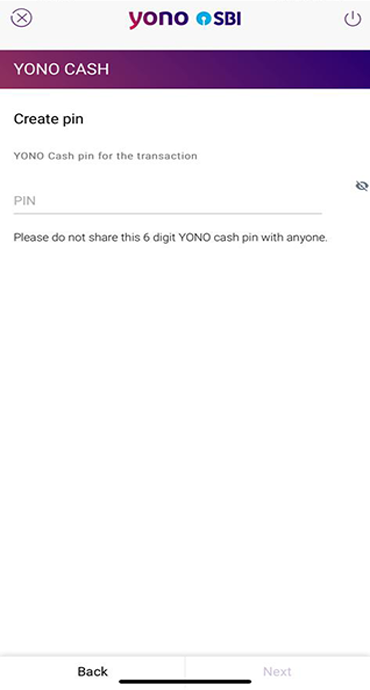

Step 7: Digital Consent through OTP

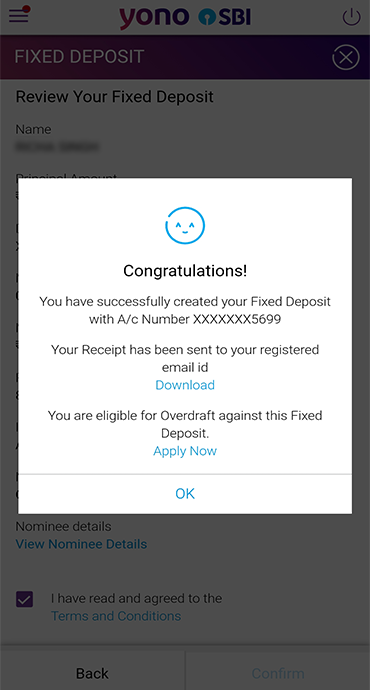

Complete the process by entering OTP sent on registered mobile number to submit your digital consent .This digital consent ensures the authenticity of your application.

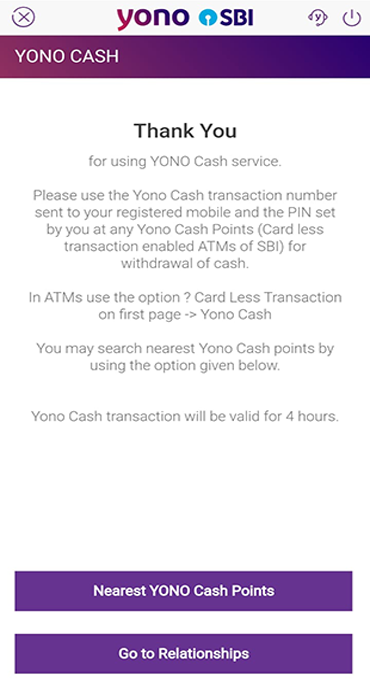

YONO SBI NPS Account Opening: Your Gateway to a Secure Retirement

Opening an NPS account through the YONO SBI App isn't just about convenience; it's about taking control of your financial future. Here's why you should consider this seamless option:

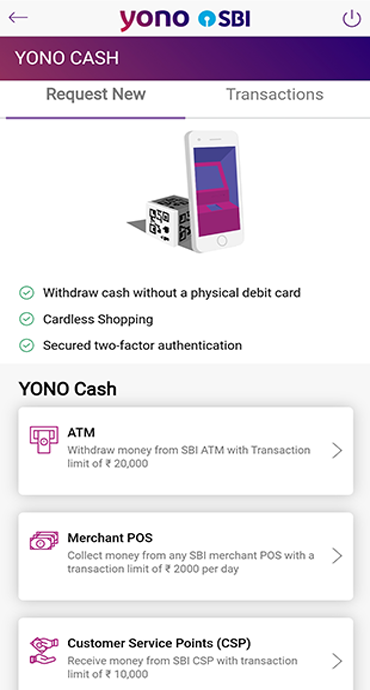

- User-Friendly Interface : YONO SBI’s intuitive interface guides you through each step, ensuring a smooth and hassle-free process.

- Paperless and Swift : Say goodbye to the paperwork. With the YONO SBI App, everything is digital, reducing the time and effort required to open an NPS account.

- Investment Flexibility : YONO SBI offers a range of NPS investment options, allowing you to tailor your portfolio to your risk tolerance and financial objectives.

Conclusion

Planning for your retirement has never been easier or more accessible. With the YONO SBI App, NPS account opening becomes a seamless and efficient process, putting you on the path to a secure financial future. Embrace the power of technology and take the first step towards building a comfortable retirement with the National Pension System.

Related Blogs That May Interest You