Customer Liability in Unauthorised Transactions | SBI Guide - Yono

Tackling Unauthorised Transactions Together - Know Your Rights and Stay Secure

07 Apr, 2025

cybersecurity

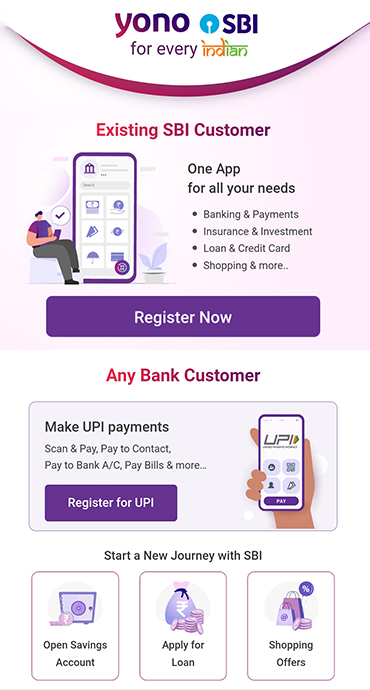

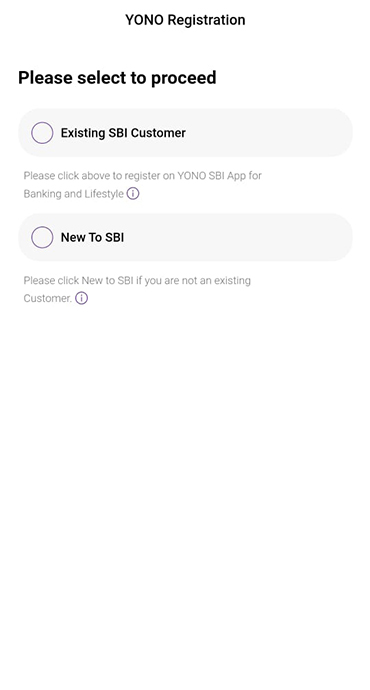

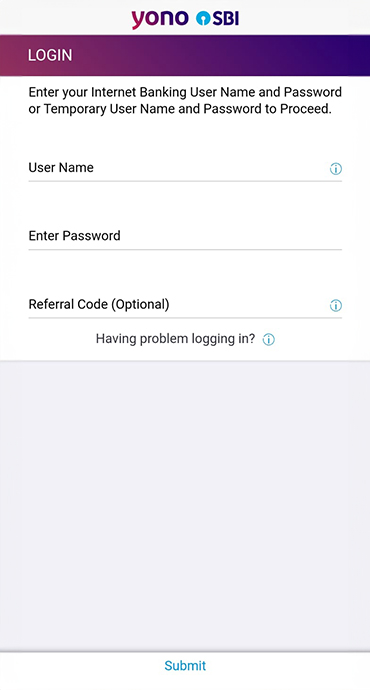

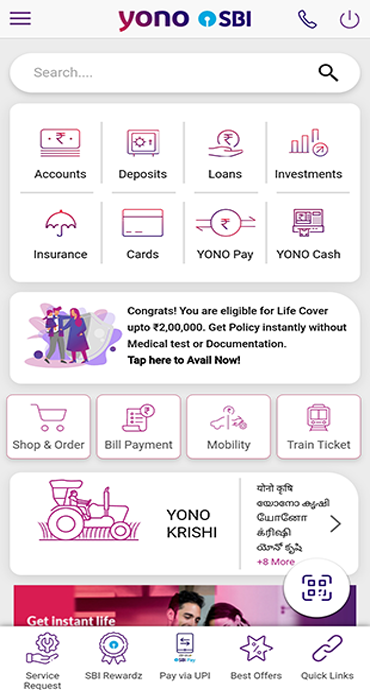

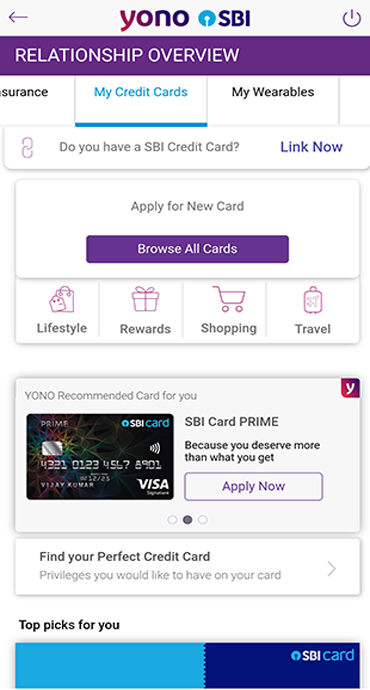

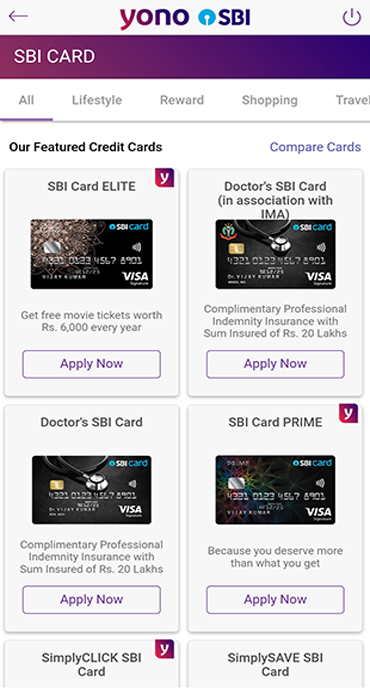

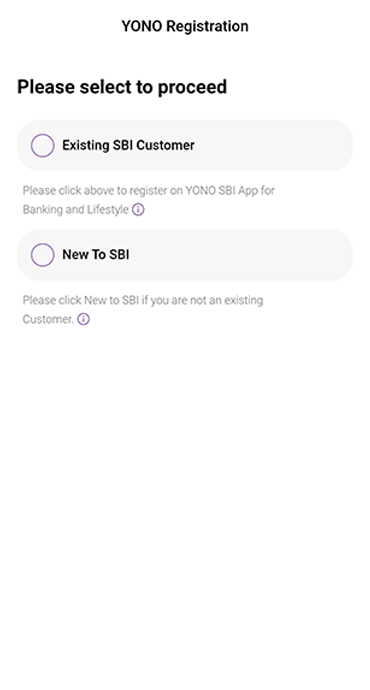

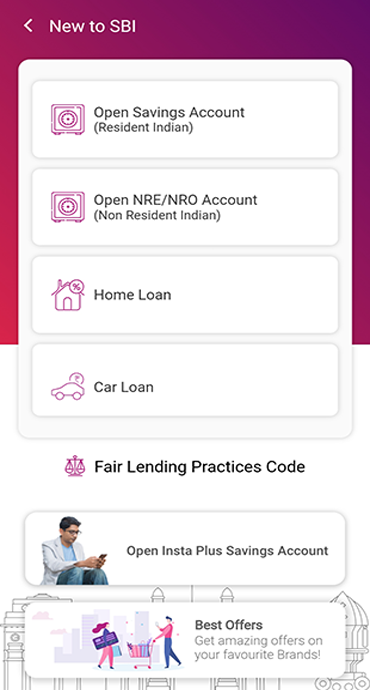

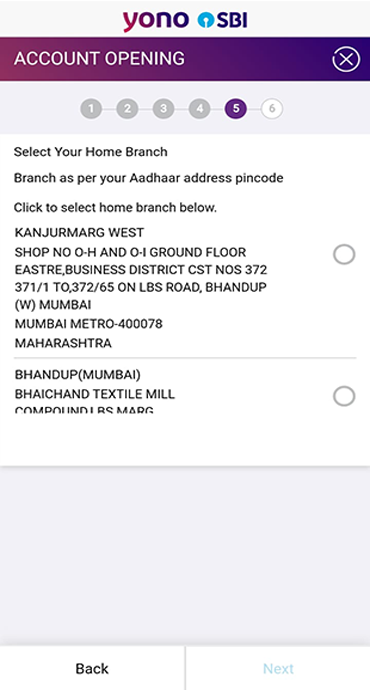

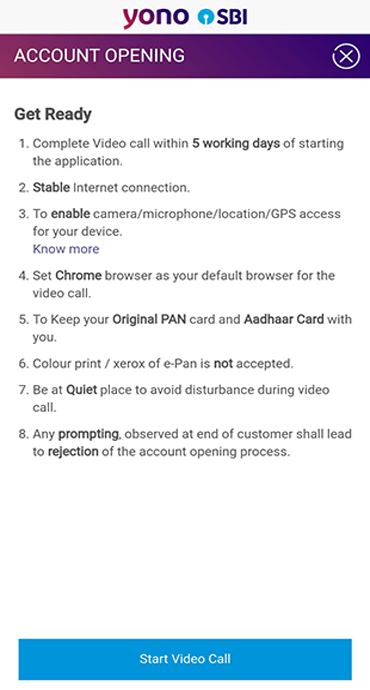

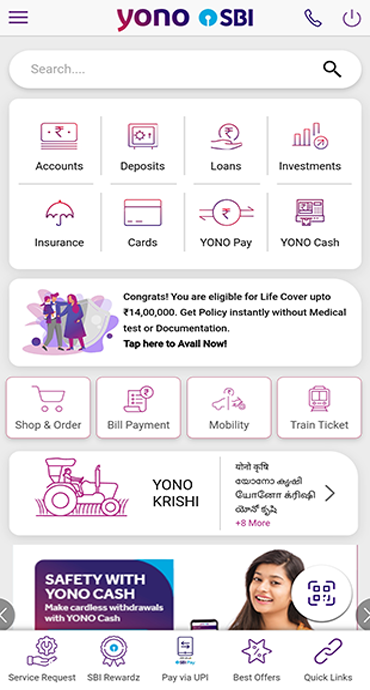

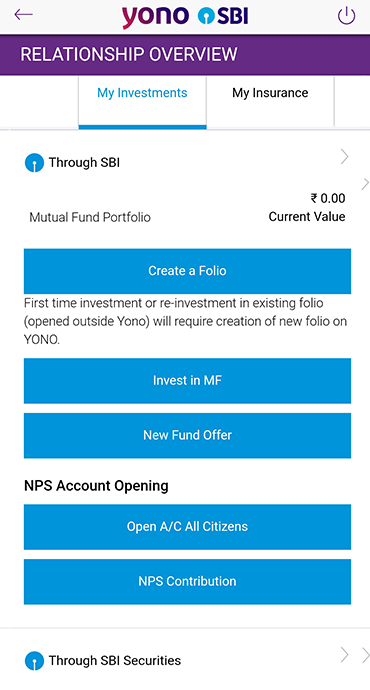

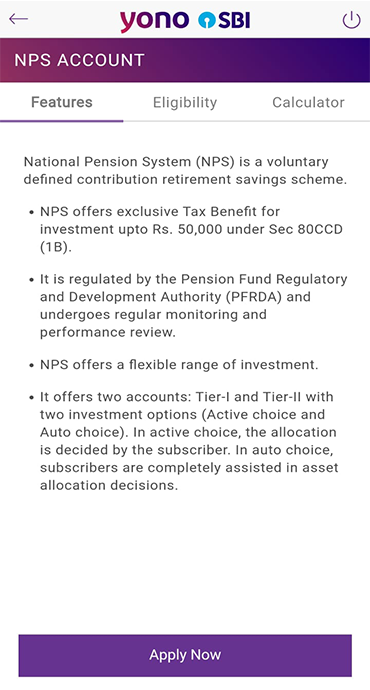

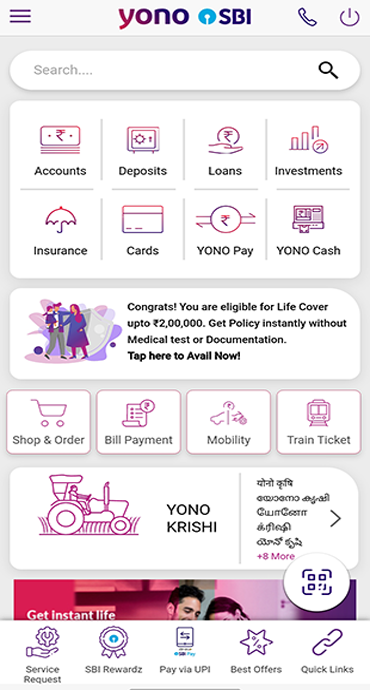

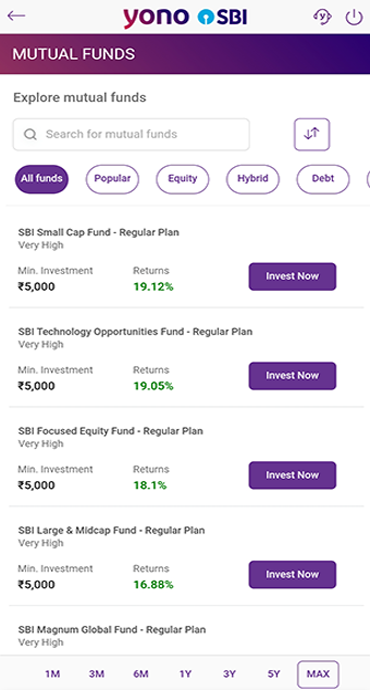

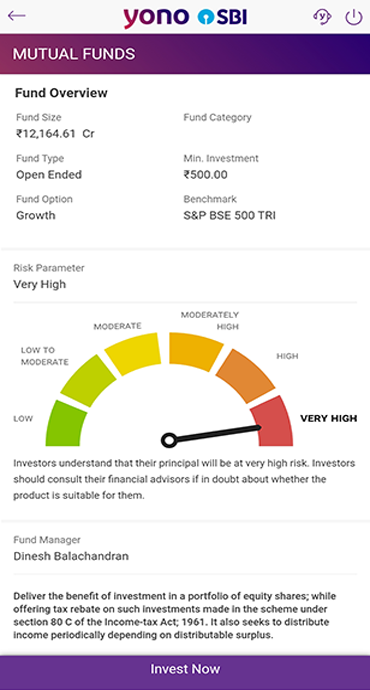

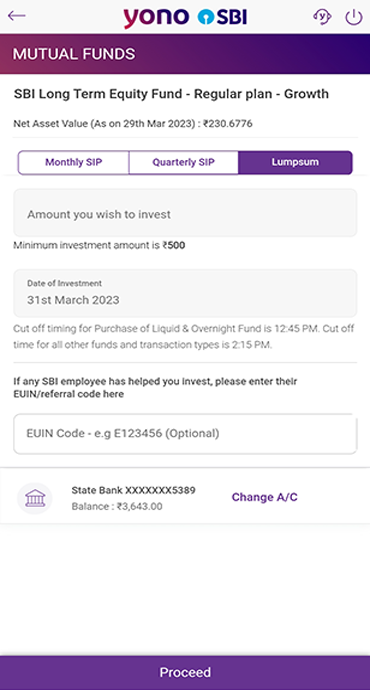

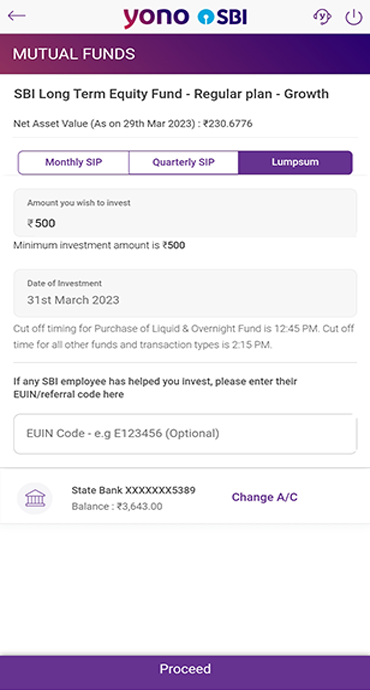

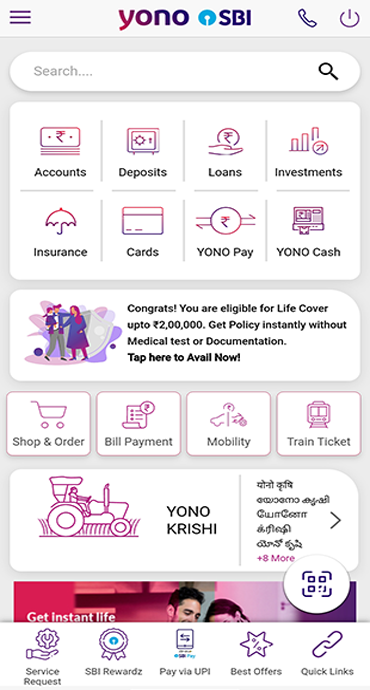

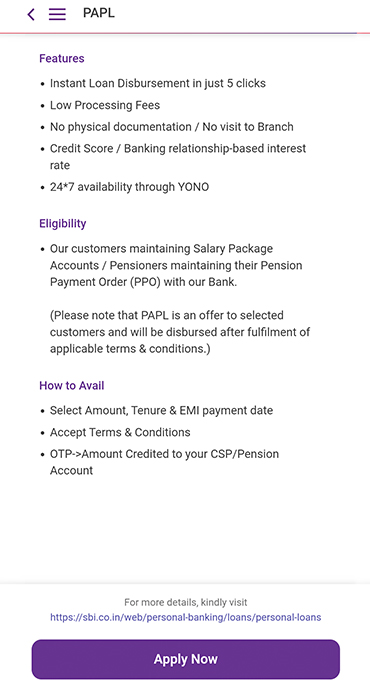

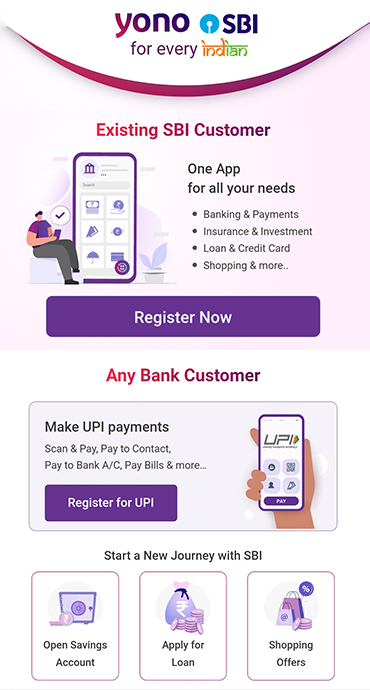

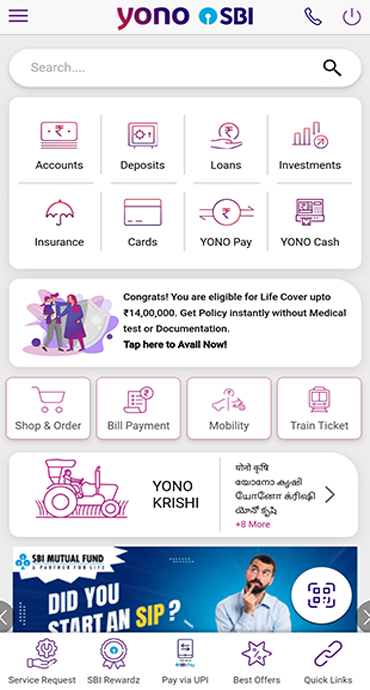

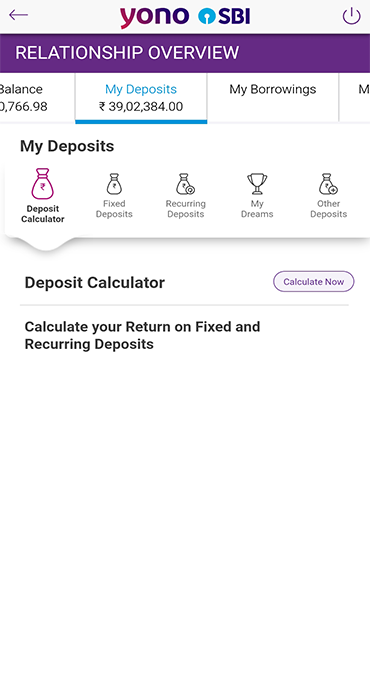

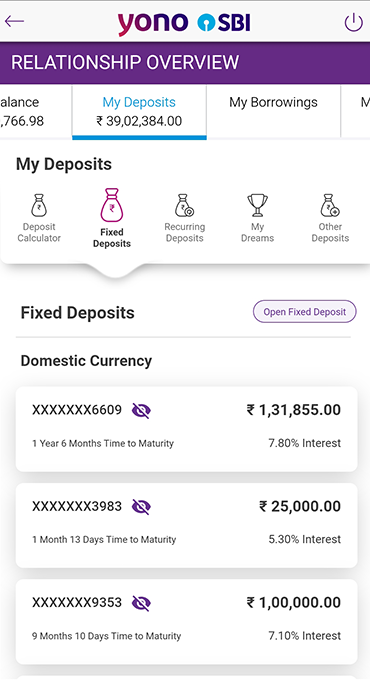

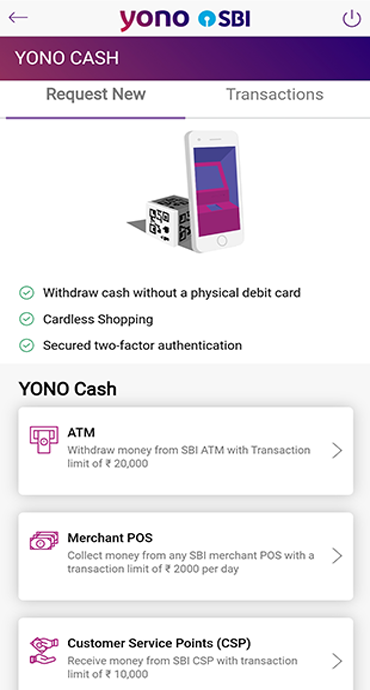

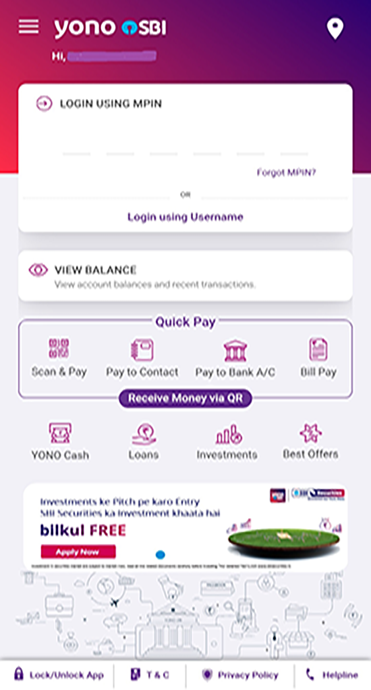

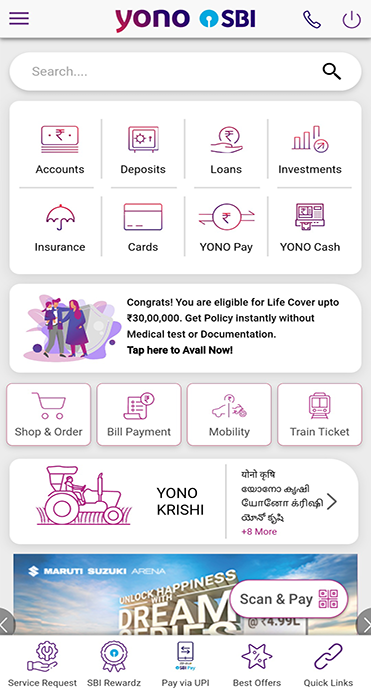

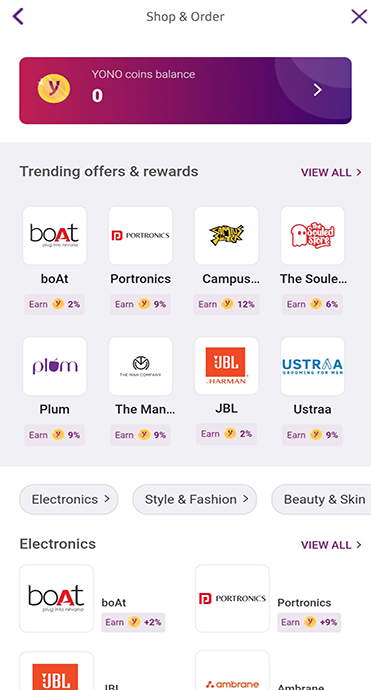

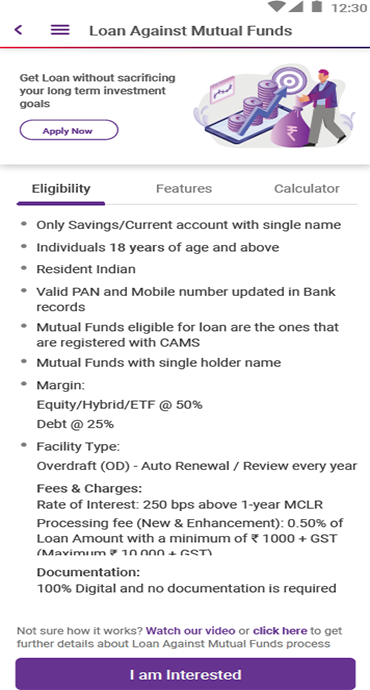

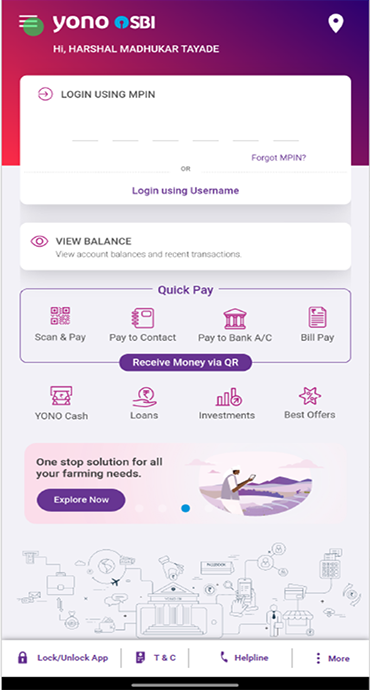

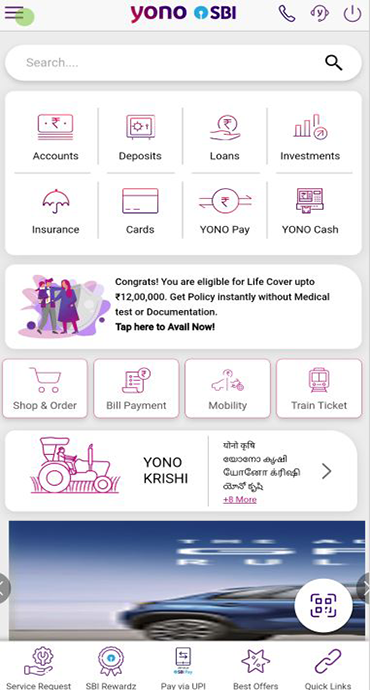

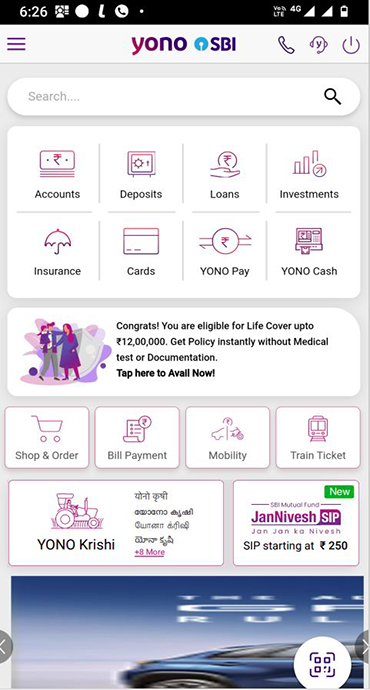

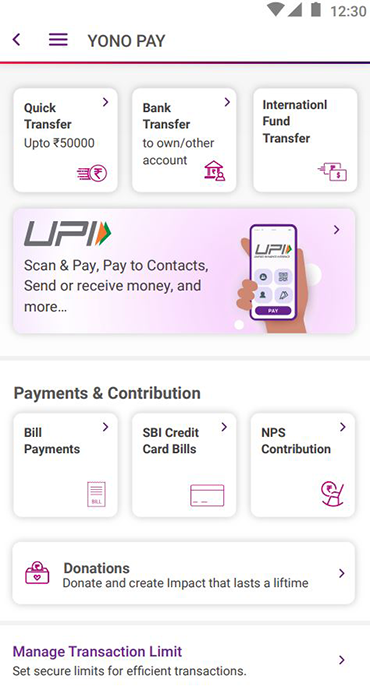

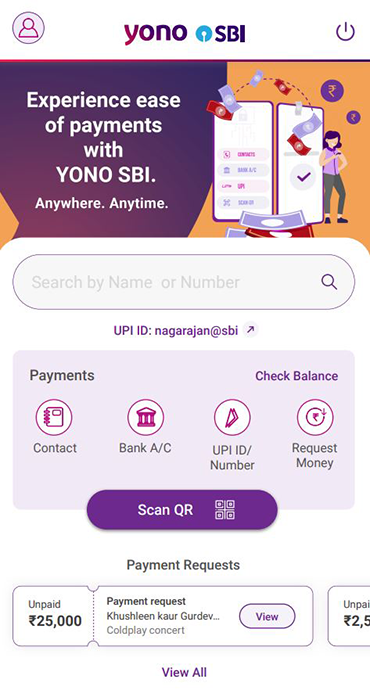

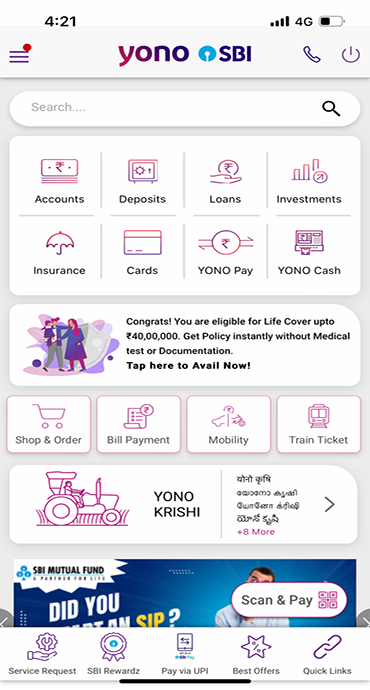

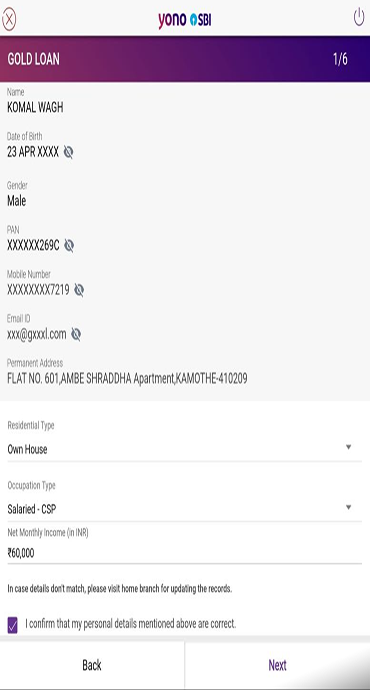

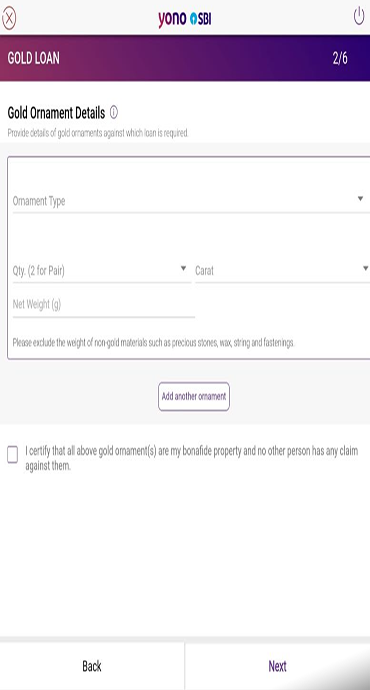

The convenience of digital banking has transformed how money is managed, making transactions faster and easier than ever. With platforms like YONO SBI, YONO Lite, UPI, and Internet Banking, banking is now at your fingertips. However, ensuring the security of each transaction is equally important. SBI prioritises your financial safety and has robust security measures in place to protect you from unauthorised transactions.

As a customer of the Bank, being aware of these security measures and knowing how to respond can help you bank with confidence. But first, let us start with understanding what are unauthorised transactions and how they can happen.

What are Unauthorised Transactions?

An unauthorised transaction occurs when money is withdrawn from your account without your knowledge or approval. This can happen through fraudulent activities, including:

- Phishing Emails & Fake Calls – Giving away your credentials to scammers posing as bank representatives.

- Fraudulent Links – Clicking on suspicious links that capture your banking details.

- Lost or Stolen Cards – Unauthorised usage of your debit or credit card for transactions without your permission.

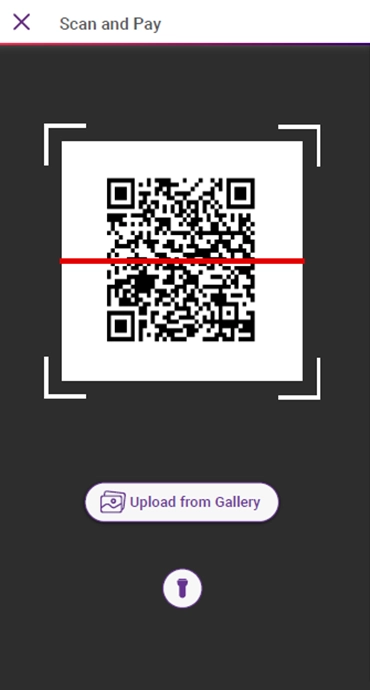

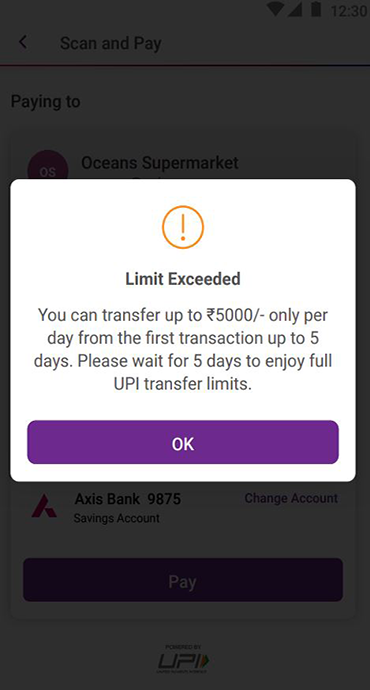

- Fraudulent UPI Requests – Unknowingly sending money instead of receiving it, by approving UPI payment request made by fraudsters.

Things To Do In Case of Frauds

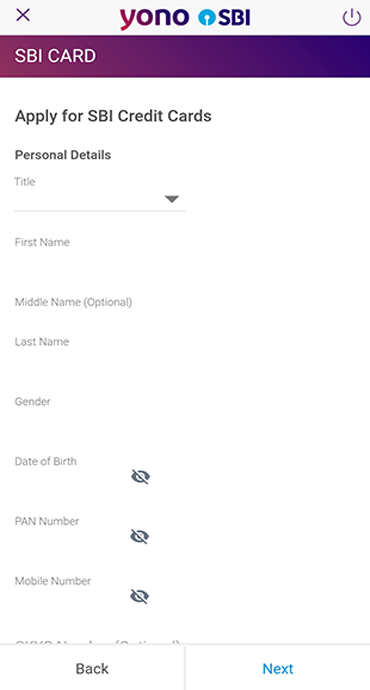

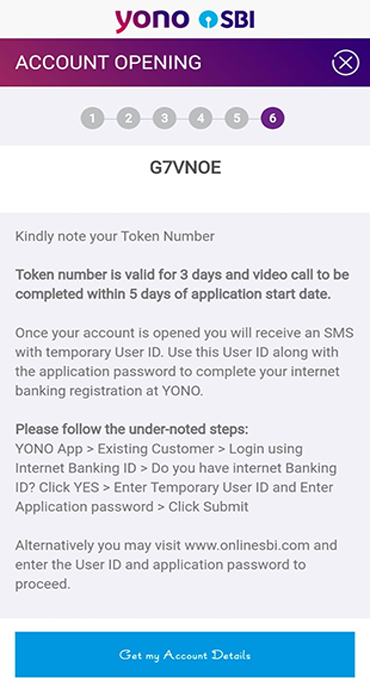

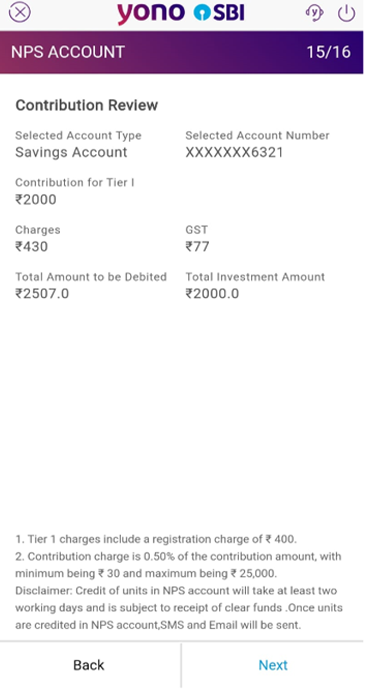

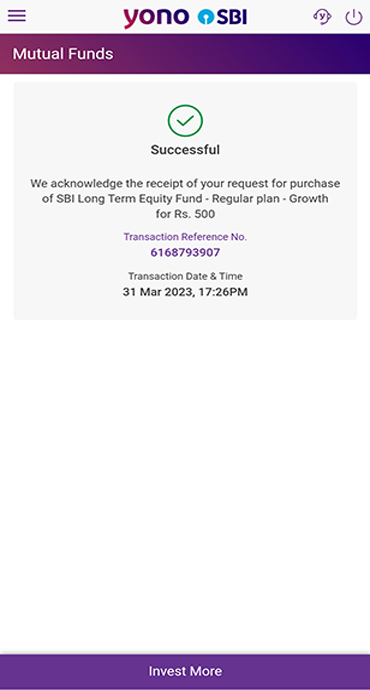

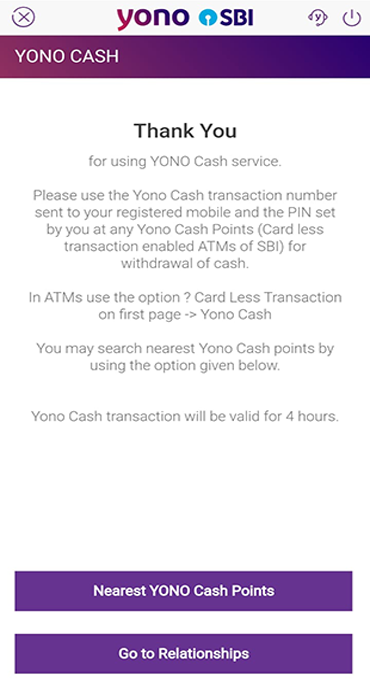

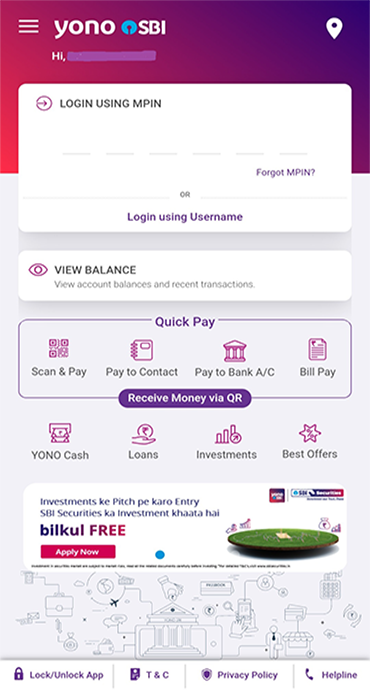

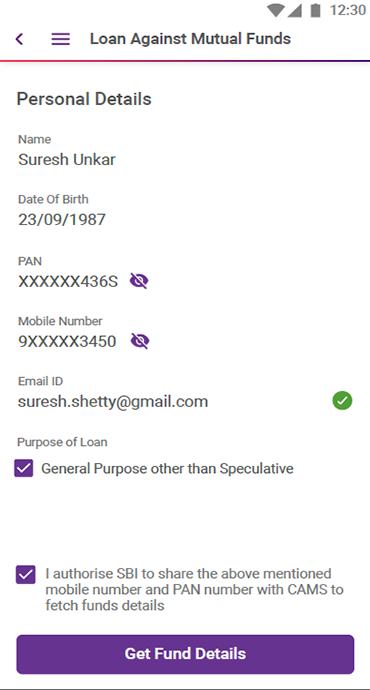

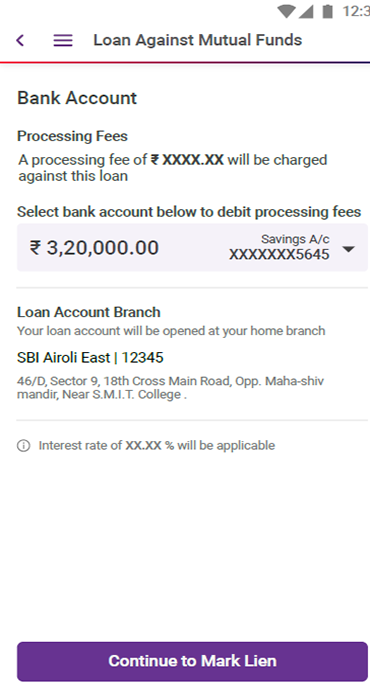

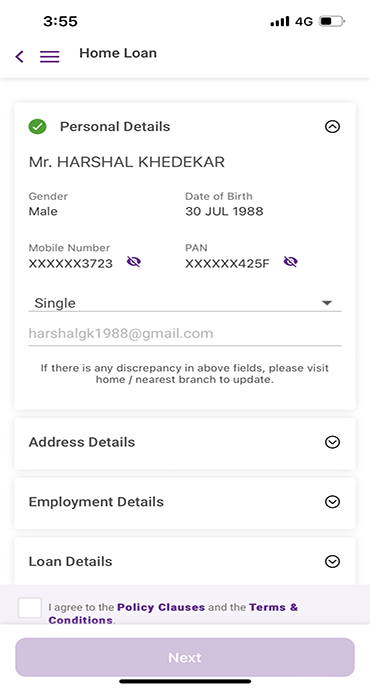

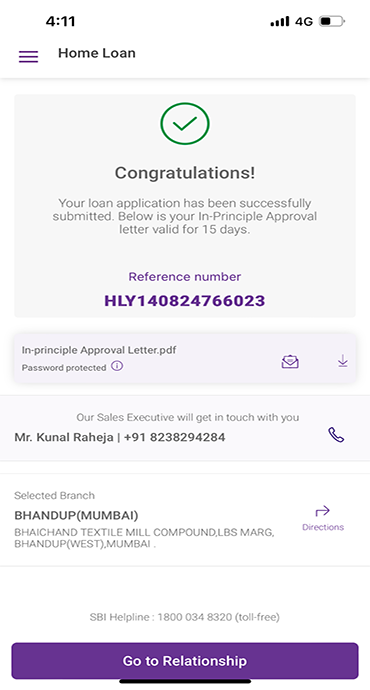

- Step 1: Immediately, contact SBI’s Customer Care at 1800111109 or visit your nearest SBI branch to block your card or restrict account access via YONO SBI App or Internet Banking.

- Step 2: You may also report the incident to cybercrime helpline number 1930 or at the cybercrime portal www.cybercrime.gov.in

- Step 3: Report the transaction through SBI’s online grievance portal (https://crcf.sbi.co.in/ccf/) or file a complaint at your nearest SBI branch.

- Step 4: SBI Bank will assess your complaint internally and update you on the resolution accordingly

Tips For Safeguarding Against Scams

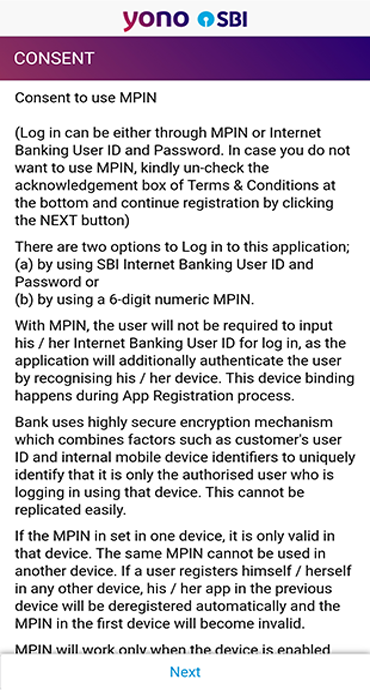

- Enable Multi-Factor Authentication (MFA): Adds an extra layer of security to your banking login.

- Set Up Alerts & Notifications: Receive instant SMS/email alerts for every transaction.

- Avoid Public Wi-Fi: Never access your banking apps on unsecured networks to prevent hacking risks.

- Restricted Remote Access Apps: Avoid using remote access tools like Anydesk etc. to prevent unauthorized control over your device.

How SBI Protects Your Account: Advanced Security Measures

To safeguard your funds, SBI has implemented multiple layers of security and fraud prevention tools, including:

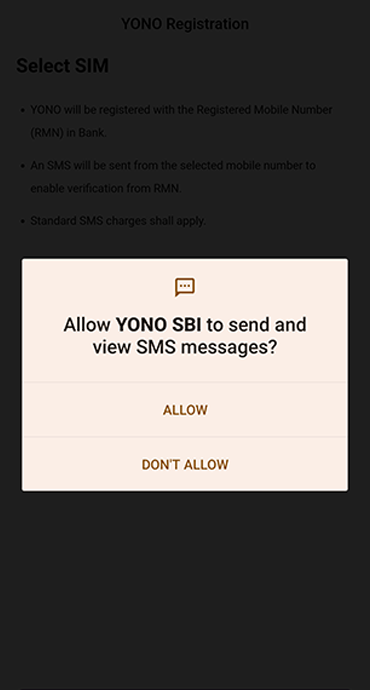

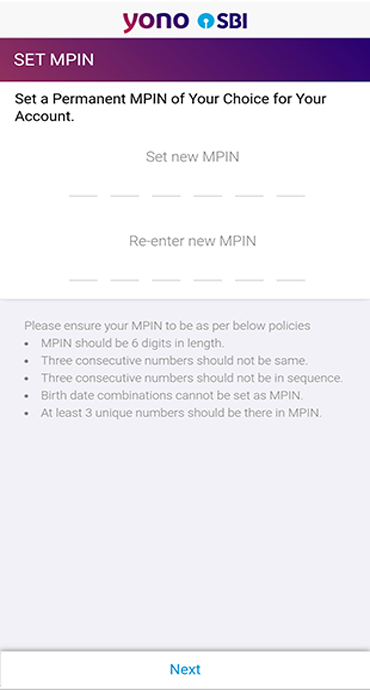

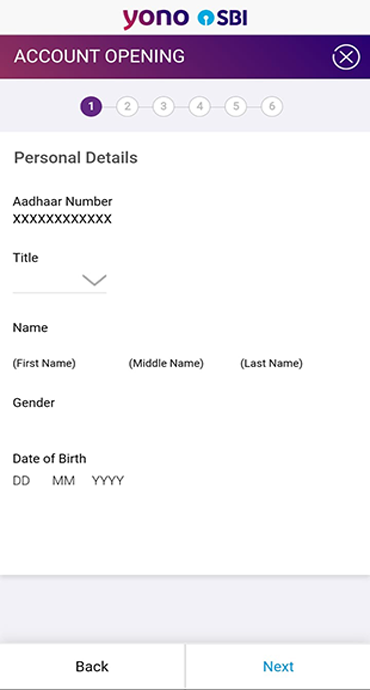

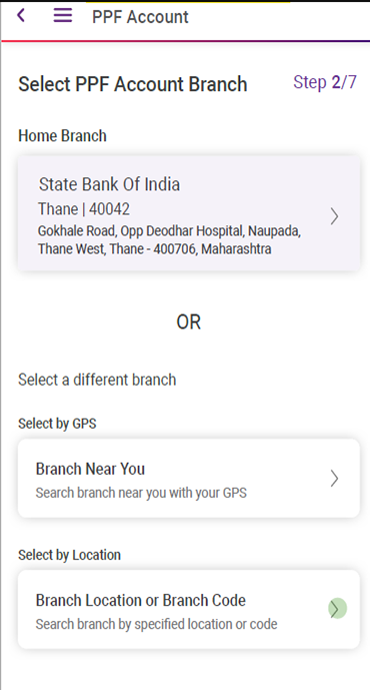

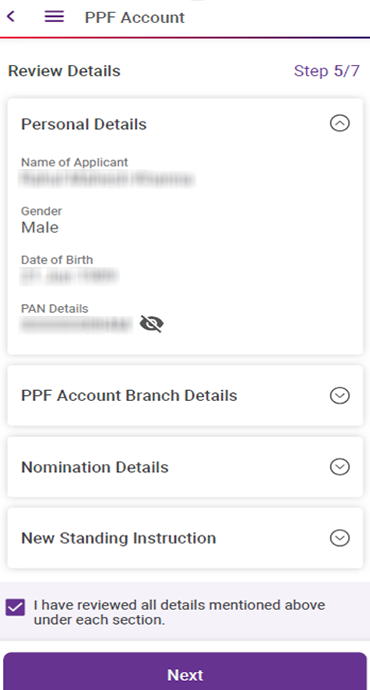

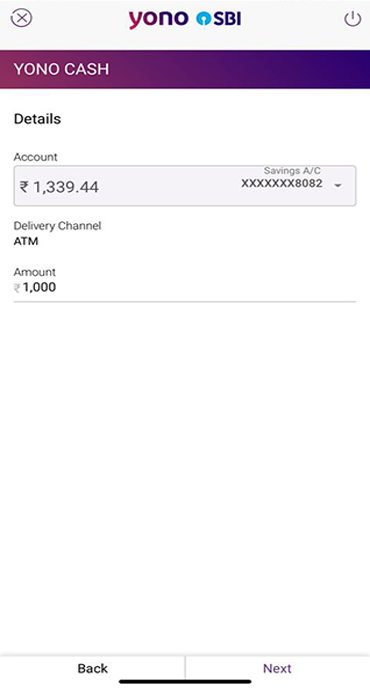

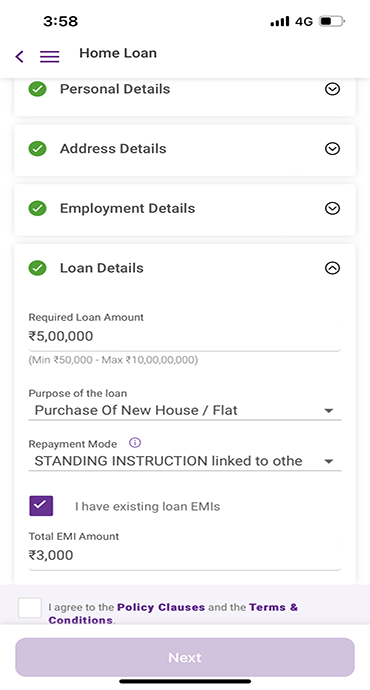

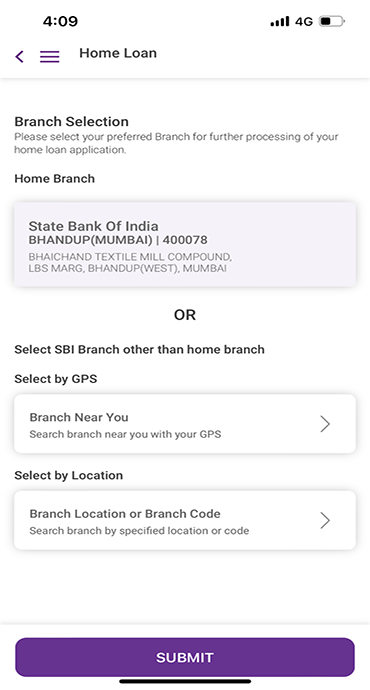

- Device Binding: The YONO SBI, YONO Lite app are securely linked to your registered device, preventing unauthorised access from unknown devices.

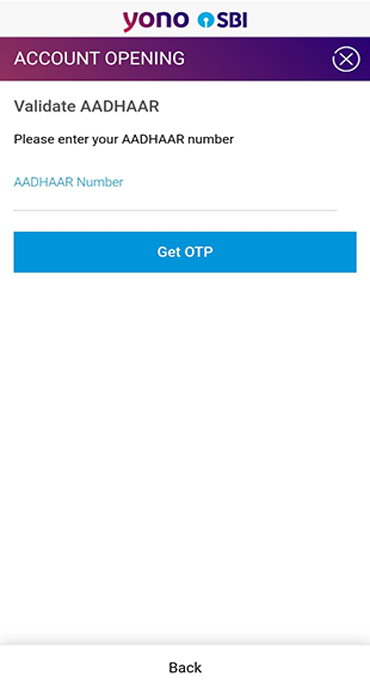

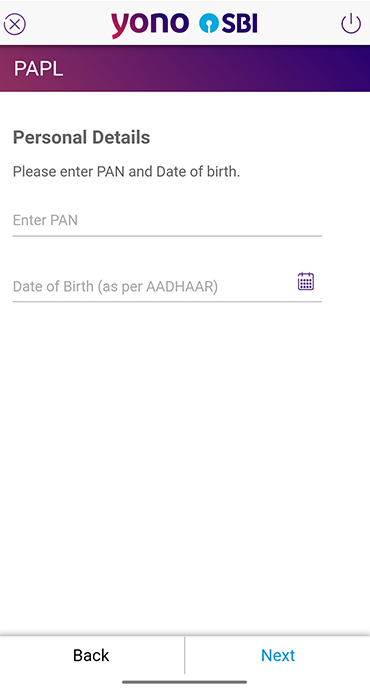

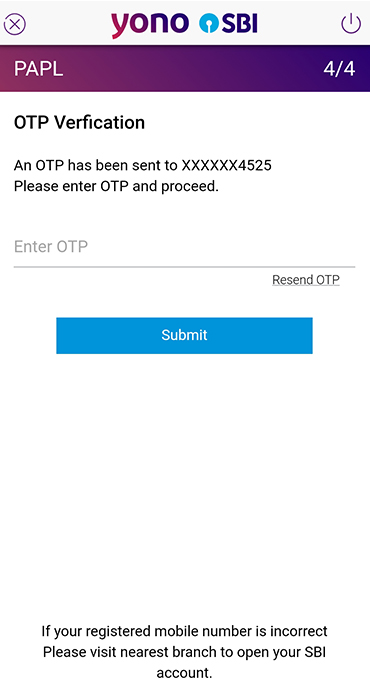

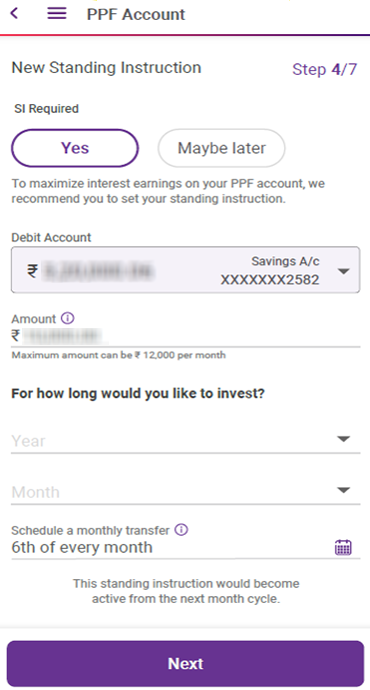

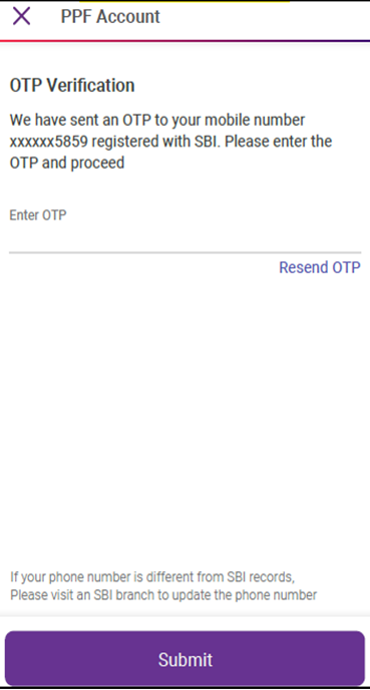

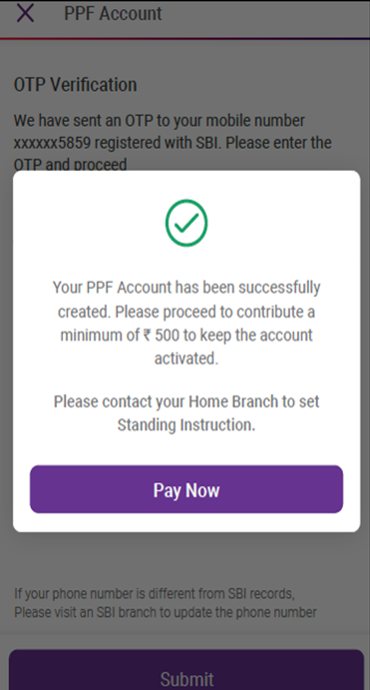

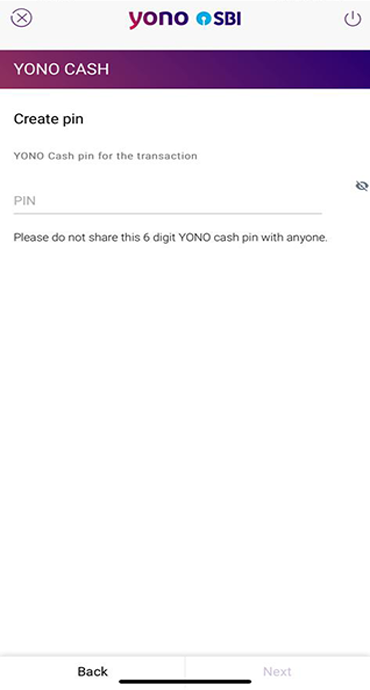

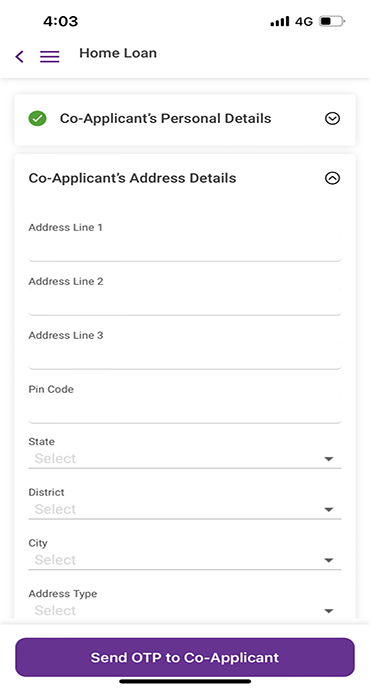

- OTP Validation: Every transaction requires you to validate via OTP authentication thereby enhancing security.

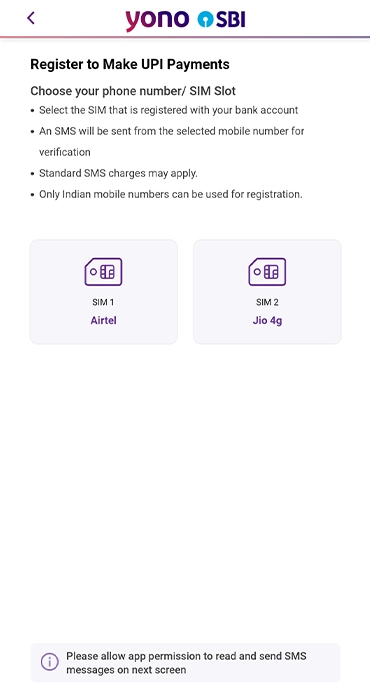

- UPI PIN Protection: Your UPI transactions can only be authorised using your secure PIN.

- 24/7 Fraud Monitoring: SBI continuously monitors transactions for suspicious activity and takes action when needed.

- Security Alerts & Notifications: SBI keeps customers informed through email/SMS updates about financial transactions. Additionally, it shares security tips from time to time to ensure a seamless banking experience.

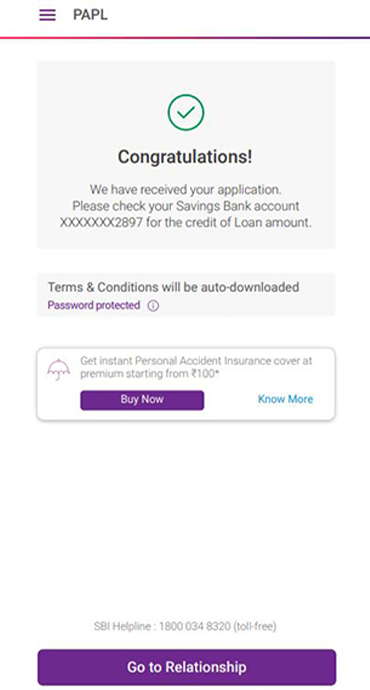

Zero Liability Protection: Your Money is Safe

If you become a victim of an unauthorised transaction, you can still exercise your Zero Liability protection during certain situations. With this protection, rest assured that your money will remain safe, and you won’t suffer any financial loss in such situations, as long as you report the issue within the required timeframe.

- Bank’s Responsibility: If a fraudulent transaction occurs due to a bank's security lapse or system error, you will not be held responsible, regardless of when it is reported.

- Third-Party Breach: If your data is compromised due to a third-party breach, and there is no negligence on your part, you are fully protected—provided you report the issue within three working days of receiving the bank’s notification about the unauthorised transaction.

Limited Liability Protection: Safeguarding You from Financial Loss

While banks strive to safeguard your funds, certain situations may involve partial responsibility, depending on how promptly the transaction is reported. For example, if there is a delay in reporting an unauthorised transaction beyond the stipulated time, you may be responsible for a portion of the loss. Here is an explanation of a few scenarios under the Limited Liability Protection.

- In a situation where the loss is due to your negligence such as where you have shared the login credentials, you are liable to bear the entire loss until you report the unauthorised transaction to the Bank. Any loss occurring after the reporting of the unauthorised transaction shall be borne by the Bank.

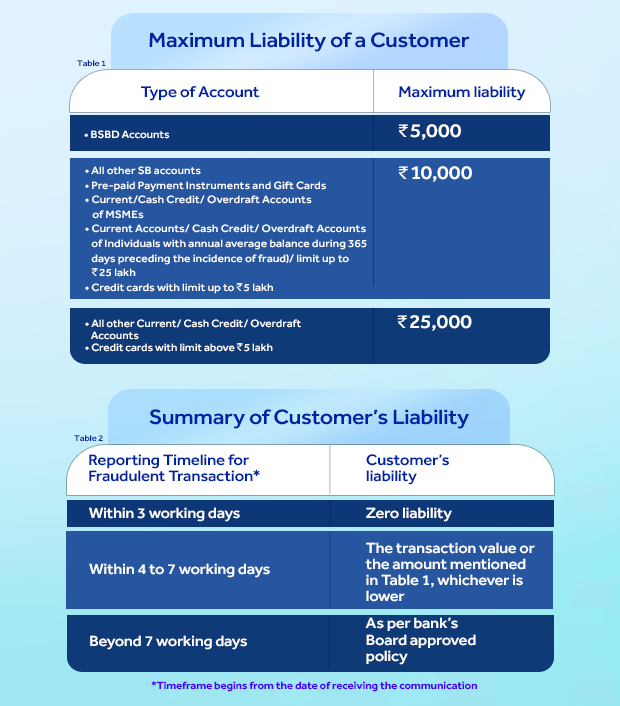

- In a situation, where the responsibility for the unauthorised electronic banking transaction lies neither with the Bank nor with you but lies elsewhere in the system and when there is a delay (of four to seven working days after receiving the communication from the Bank) on your part in notifying the bank of such a transaction then your per transaction liability shall be limited to the transaction value or the amount mentioned in Table given below, whichever is lower

Your Safety is SBI’s Priority

At SBI, your financial security is our topmost priority. We are committed to protecting your hard-earned money by implementing advanced security measures and ensuring a secure banking environment. With the rise in digital transactions, it is essential to stay vigilant and proactive against potential fraud.

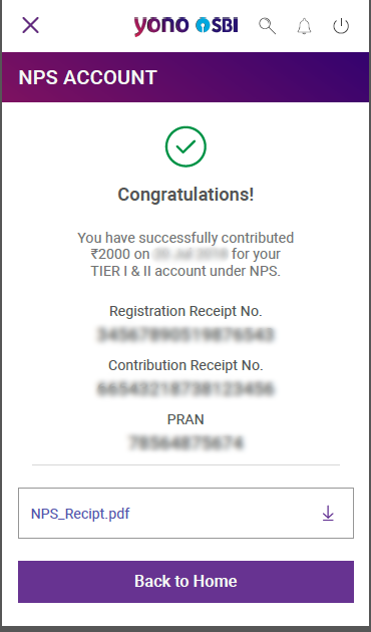

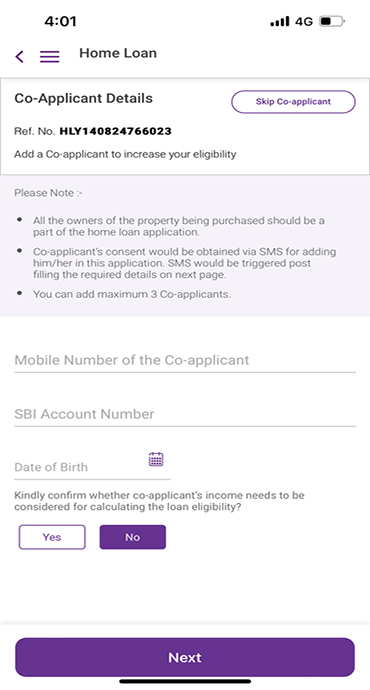

If you ever suspect an unauthorised transaction in your account, take immediate action by reporting it through the SBI helpline, Internet Banking, YONO SBI App, YONO Lite app or by visiting your nearest branch. Our dedicated team is available to assist you and always ensure your financial safety. By taking simple precautions and promptly reporting any suspicious activity, you can protect your account and ensure a secure banking experience.

Bank safely online! Send money only to trusted individuals, and beware of money transfers for any suspicious offers. Your financial security is our priority!

Related Blogs That May Interest You