Secure Every UPI Payment: Understand Your Limits, Cooling Periods & Safe Payment Tips - Yono

Secure Every UPI Payment: Understand Your Limits, Cooling Periods & Safe Payment Tips

27 Jun, 2025

cybersecurity

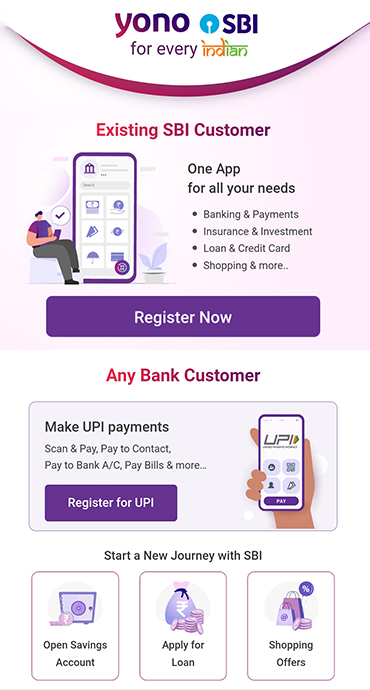

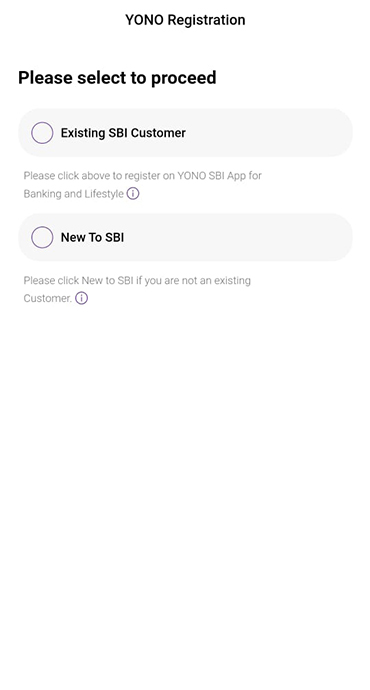

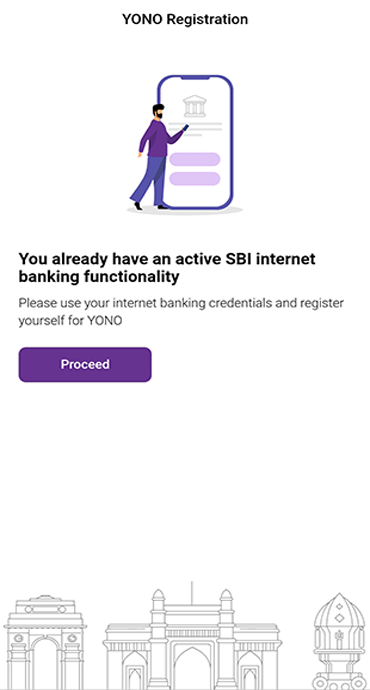

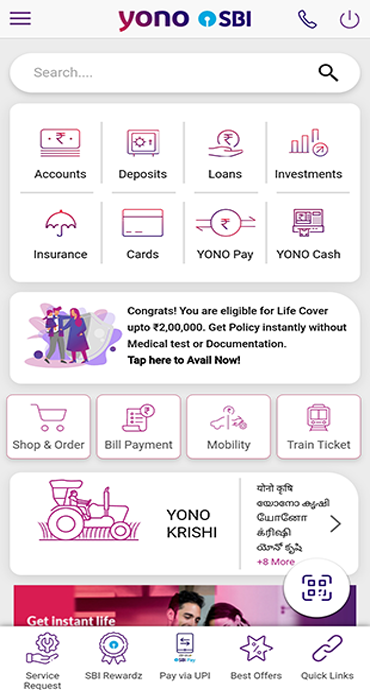

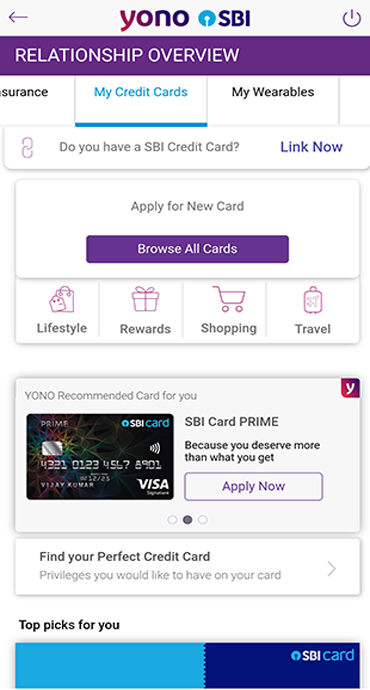

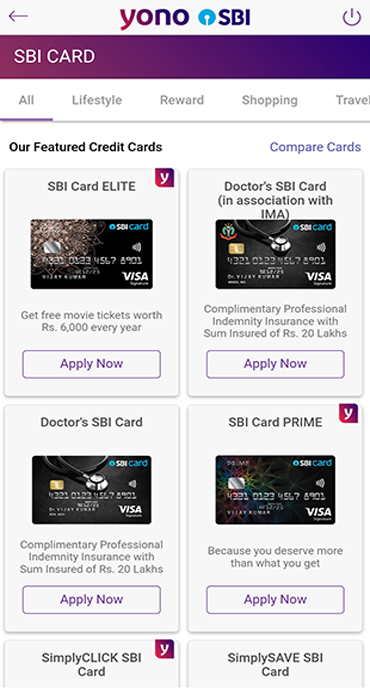

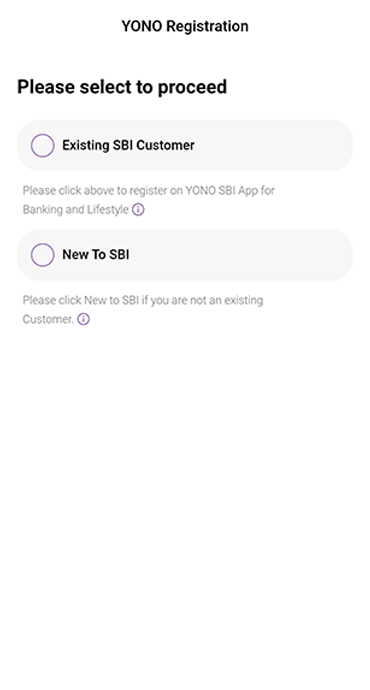

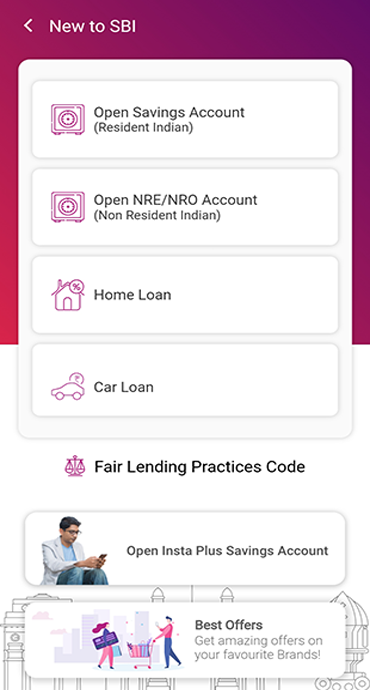

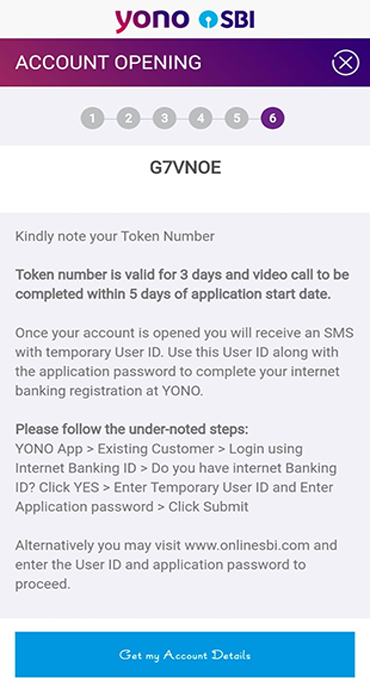

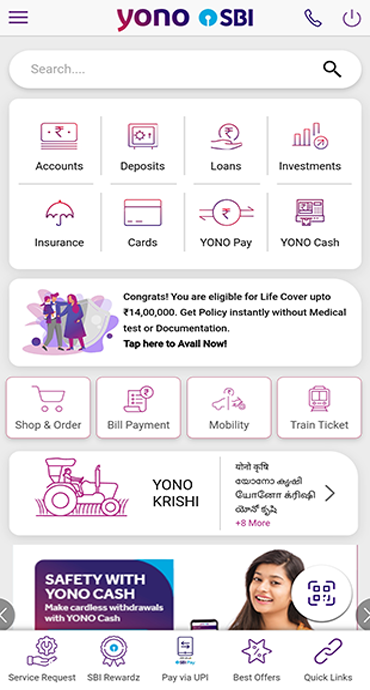

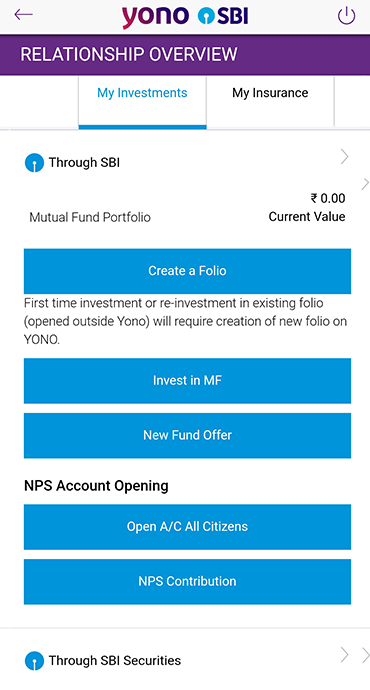

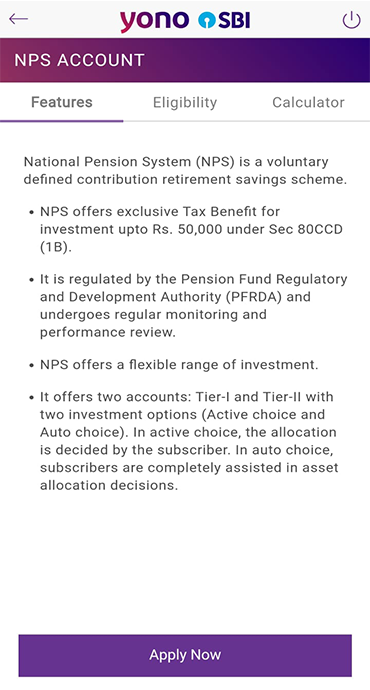

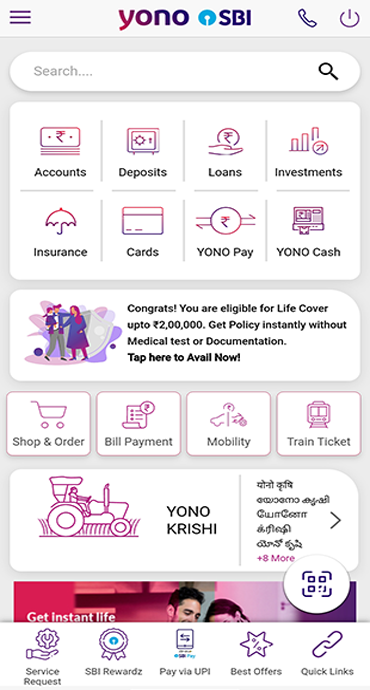

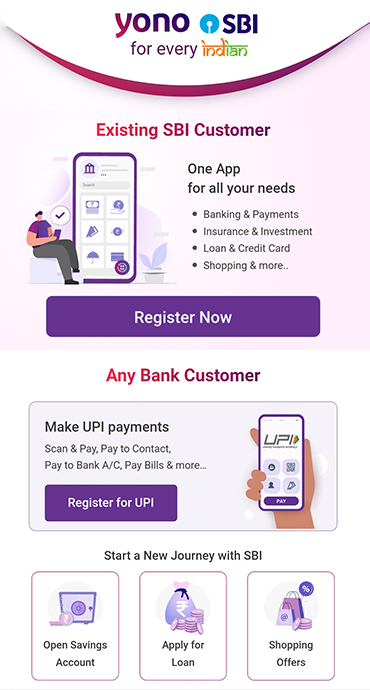

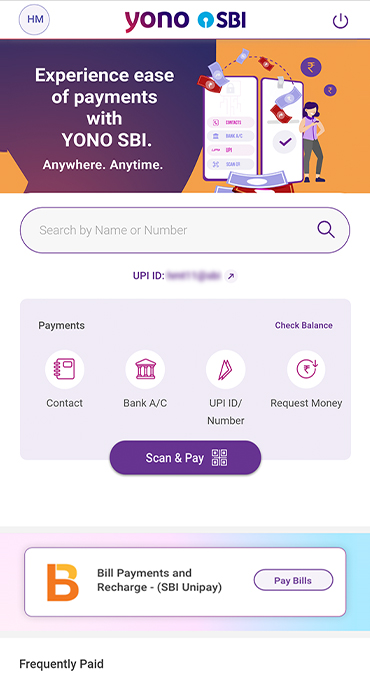

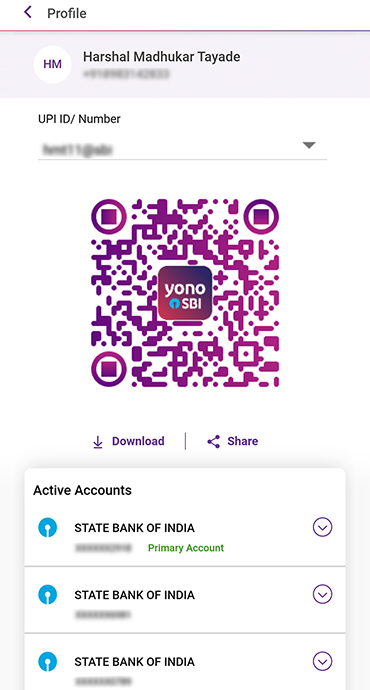

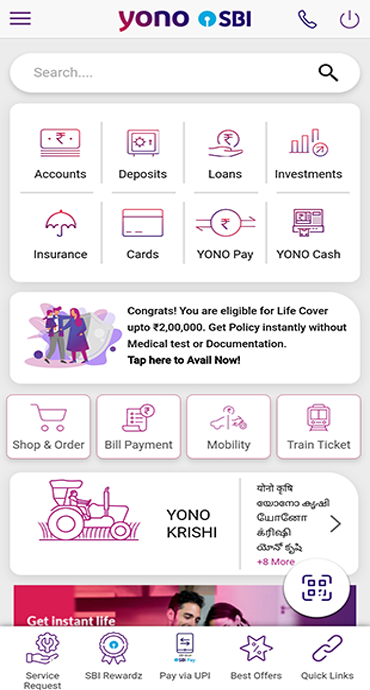

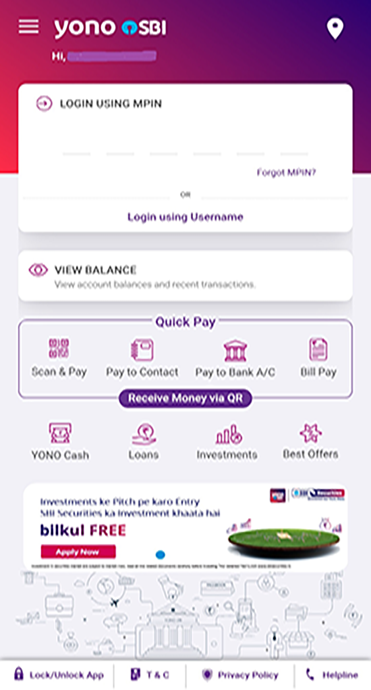

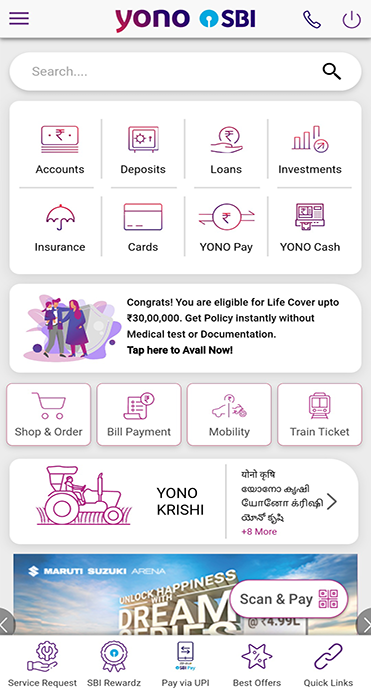

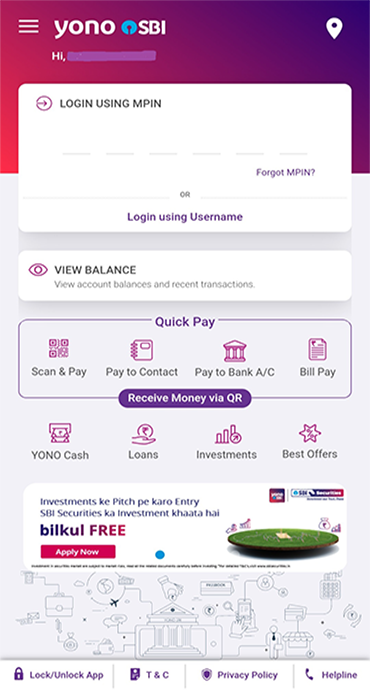

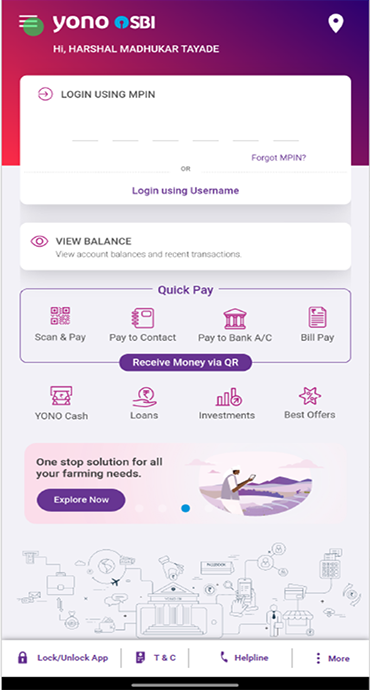

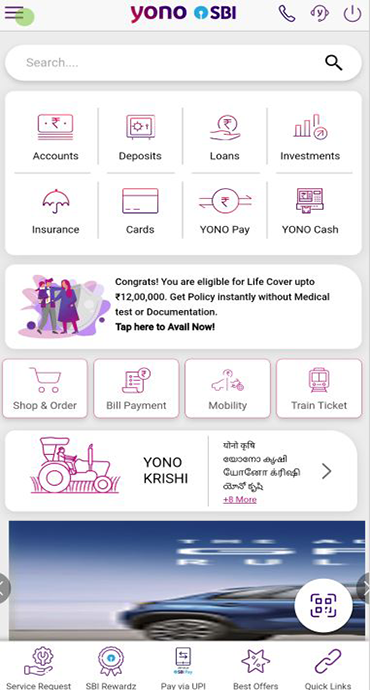

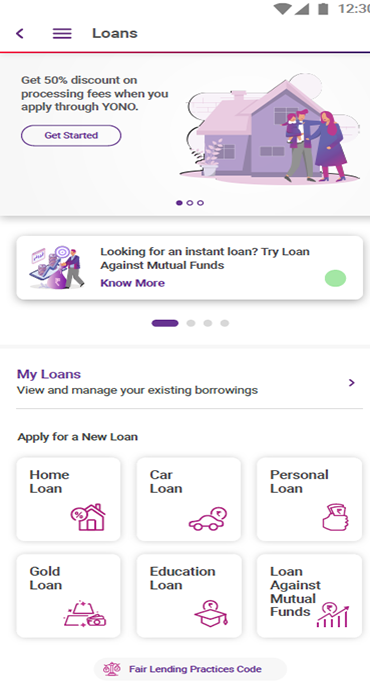

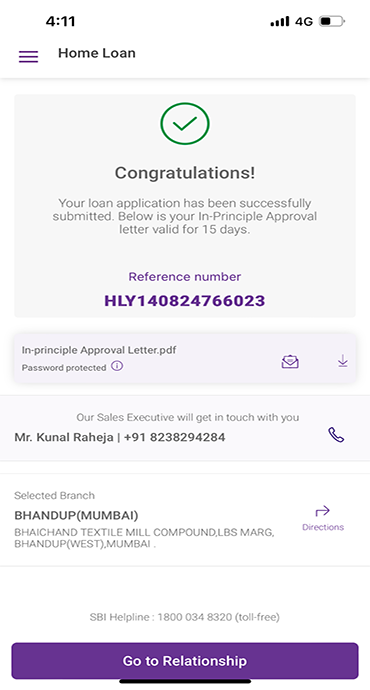

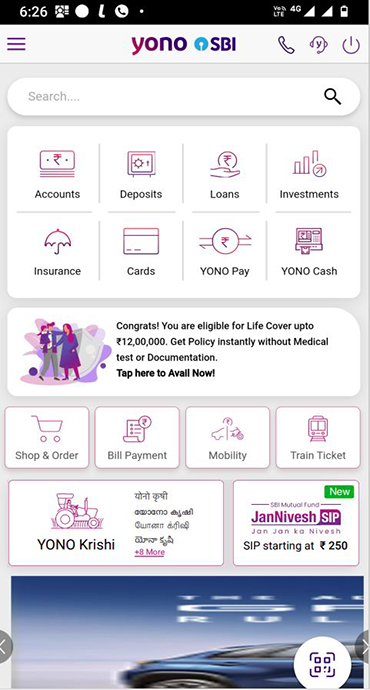

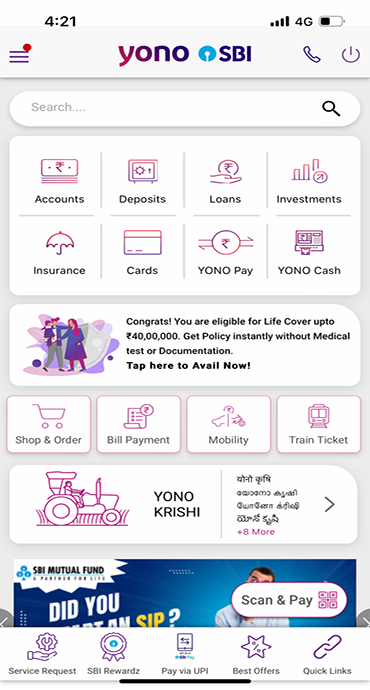

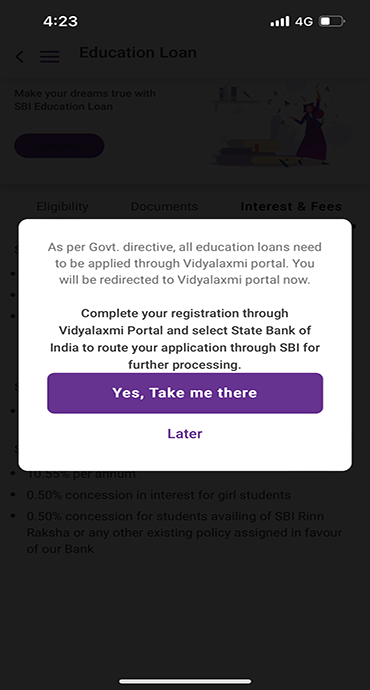

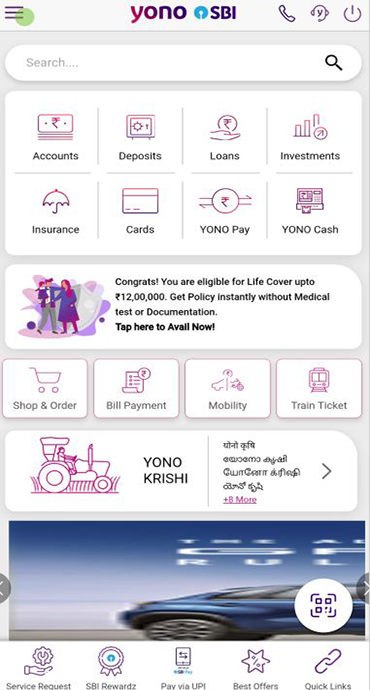

Digital transactions in India have witnessed exponential growth, driven largely by the Unified Payments Interface (UPI). It's accessible 24/7, quick, and safe. Among the biggest banks in India, State Bank of India (SBI) provides comprehensive UPI services through its flagship YONO SBI app, offering customers seamless digital banking with integrated UPI functionality for secure and convenient transactions.

Setting transaction limits is very important for your security, especially as more and more transactions happen online. These limits help reduce potential cyber risks by making payment experiences more controlled and secure. By adhering to these guidelines, banks like SBI ensure that your transactions remain protected while offering you convenient digital banking. Let's look into these limits and see how they help keep your daily transactions safe.

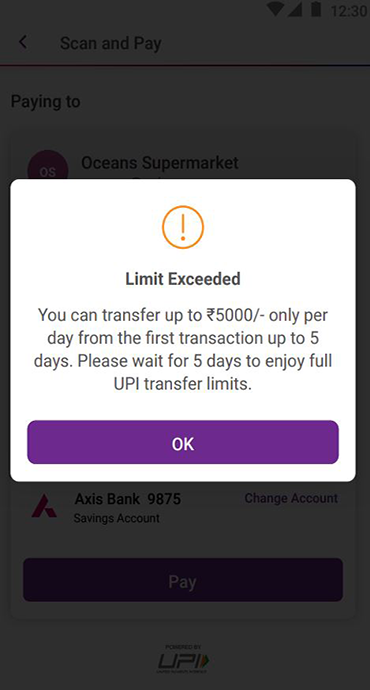

Safeguard Your Payments with UPI Cooling Period Guidelines

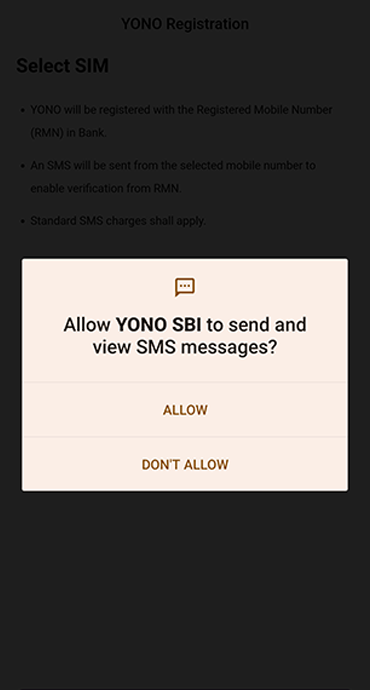

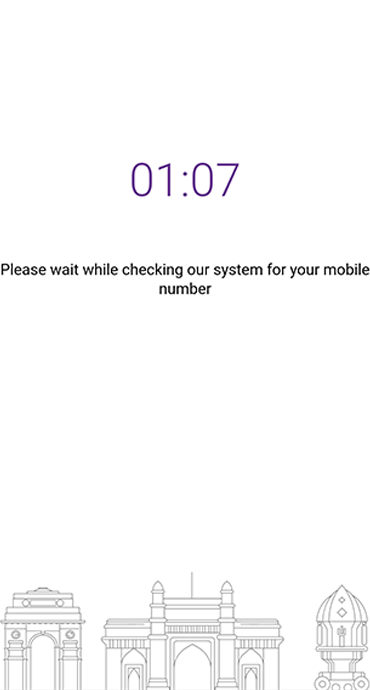

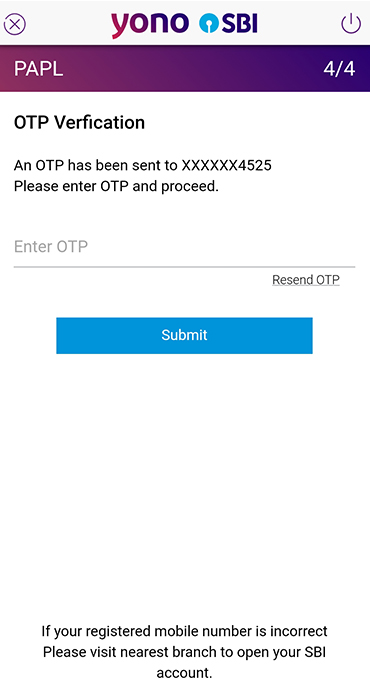

To enhance security, a cooling period is implemented in certain scenarios:

- First transaction after setting/resetting UPI PIN maximum amount will be ₹5,000 and cumulative amount in a day will be ₹5,000 for the first 24 hours for Android users and ₹5,000 per day for first 5 days for iOS users.

- Post completion of above limit, per transaction and per day limit is

₹1, 00,000 in BHIM SBI Pay, UPI on YONO SBI or YFEI, at present.

- You can do a maximum number of 20 transactions in 24 hours per account within the ₹1,00,000 limit for P2P transactions and there is no limit in terms of transactions in 24 hours per account within the ₹1,00,000 limit for P2M transaction.

Note: These are subject to change from time to time as per the NPCI guidelines or Bank’s discretion.

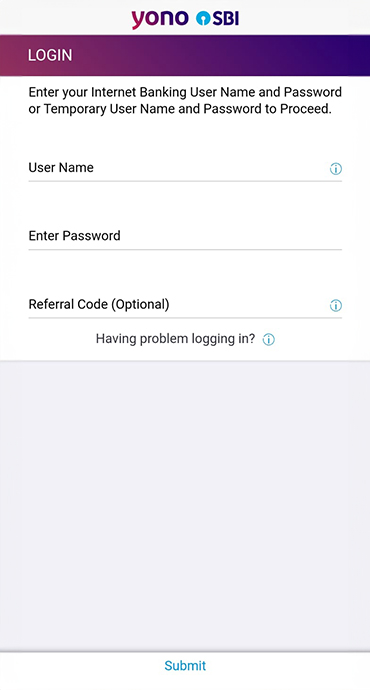

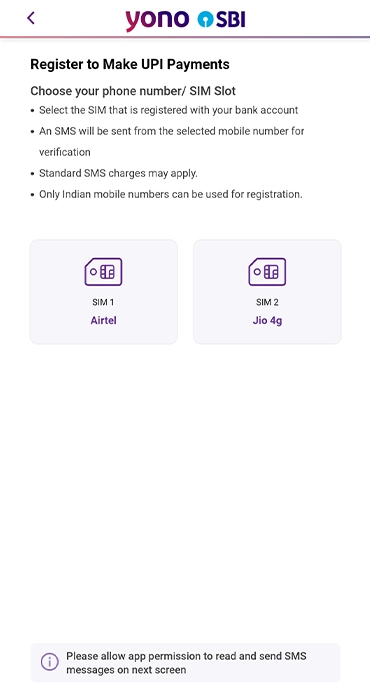

Standard UPI Transaction Limits (Android & iOS)

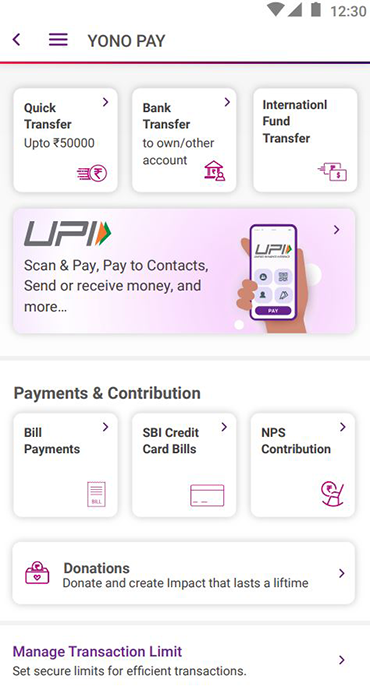

SBI has implemented the following UPI transaction limits:

- Number of Person to Person (P2P) Transactions per day: 20 transactions

- Number of Person to Merchant (P2M) transactions per day: This will be subject to the per day limit on the UPI transaction value.

- UPI Transaction value limit: ₹1,00,000

- UPI Transaction value limit per day (Person to Person and P2M): ₹1,00,000

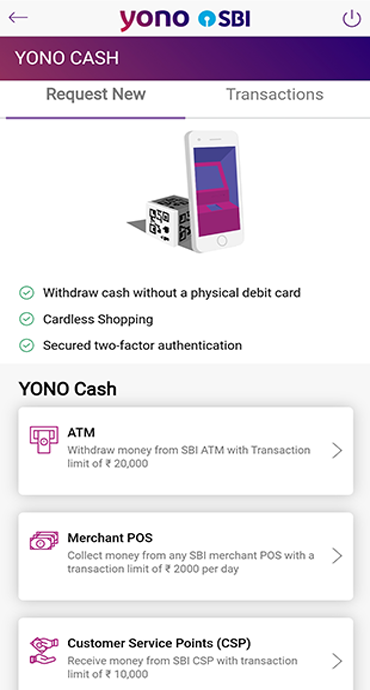

- Small Value Transactions via UPI Lite: Up to ₹1000 (No UPI PIN required)

- Maximum UPI Lite balance: ₹5,000

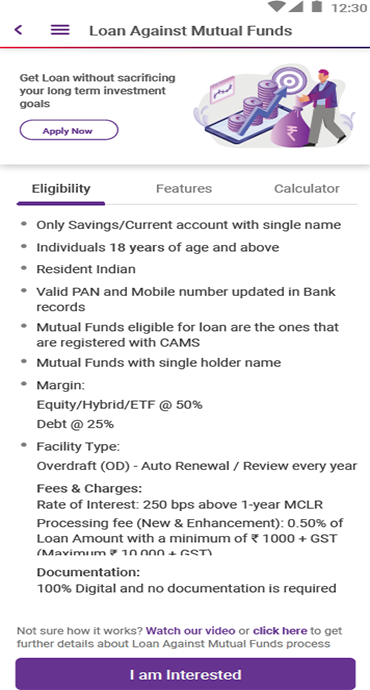

- Enhanced transaction limits for Select Verified Merchants:

- Insurance, Capital Markets: ₹2,00,000

- IPO (ASBA), Retail Direct scheme (RDS), Tax Payments, Hospitals, Educational Institutions: ₹5,00,000

- Inward and Outward Remittances through UPI (India -Singapore corridor) – Up to 1000 SGD equivalent

- Platforms Supported: All UPI-compatible platforms including Android, iOS, and feature phones.

Strengthening Digital Payment Safety Through Updated UPI Limits

UPI transaction limit alters depending on certain criteria:

- User Behaviour: New users may have lower initial limits, which, depending on transaction history and usage habits, can be increased over time.

- Regulatory Guidelines: Periodically, the RBI and NPCI revise rules to accommodate new use cases and improve security.

- Security Concerns: Banks could change limitations as a preventive effort to stop fraud and illegal transactions.

It is imperative for you to be aware of these limits and changes to ensure the correct usage of UPI transactions.

Tips for Safe UPI Transactions

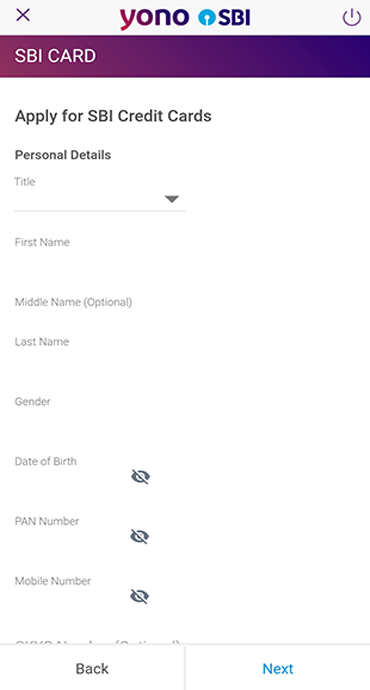

Your first priority should be the security of your UPI transactions. Below are a few tips to prevent any unauthorised online transaction:

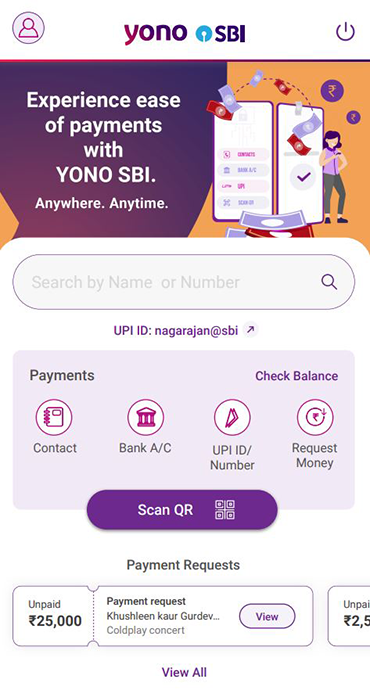

- Never share your UPI PIN: It is important to keep your UPI PIN confidential; do not share it with anyone.

- Verify Recipient Details: For money transfer using a mobile number, always confirm the Name, UPI ID or mobile number.

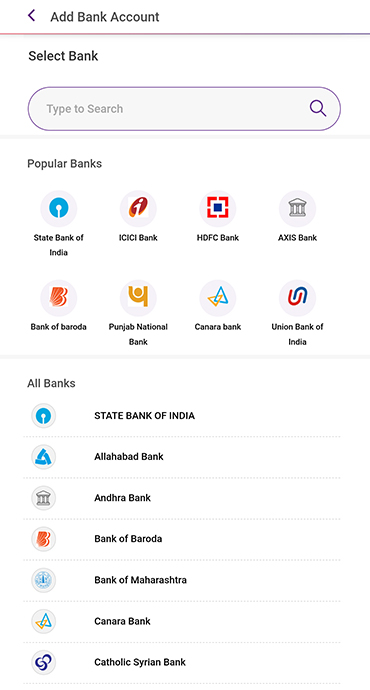

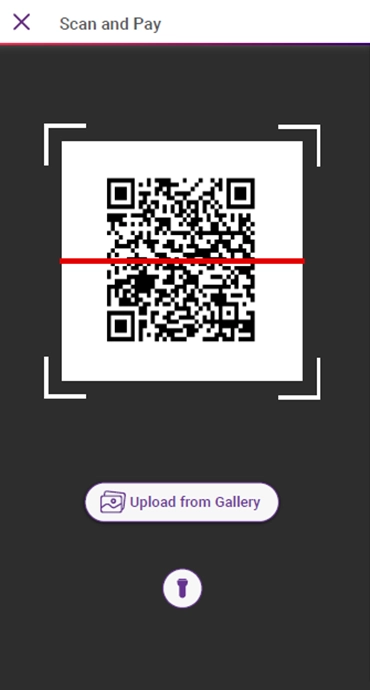

- Use Trusted Apps: Download UPI apps only from official app stores to avoid malicious software.

- Monitor Your Account: Look for any unusual/unauthorized transactions regularly in your account statements.

- Be Cautious of Phishing Scams. Avoid sharing personal details with anyone. Also, never click on dubious links for instant online money transfer.

- Enable UPI Lite: UPI Lite is a handy choice for small transactions up to ₹1,000 without the need for a UPI PIN.

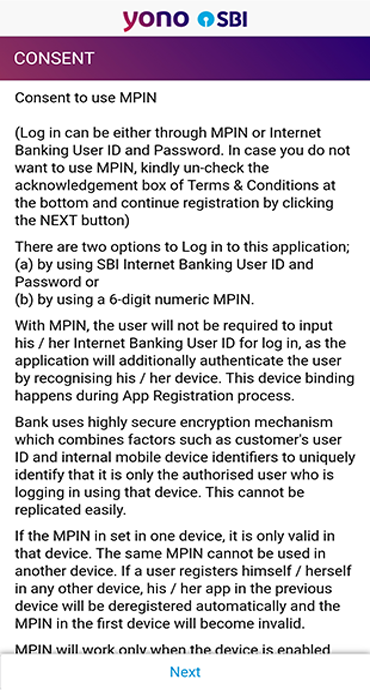

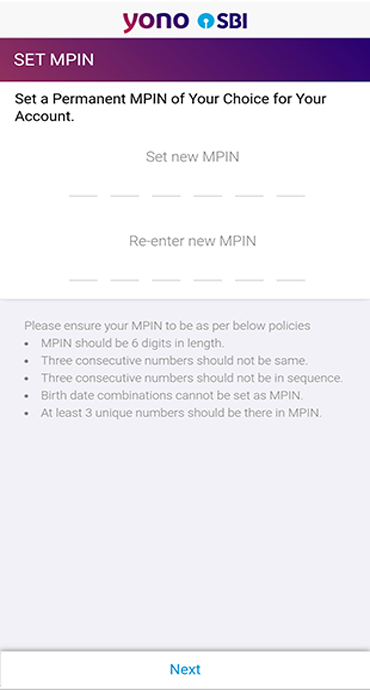

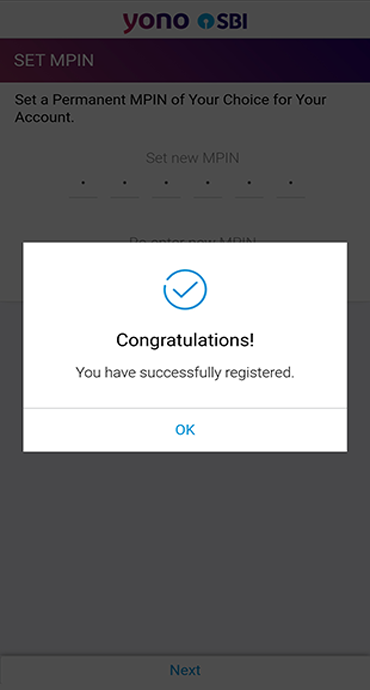

- UPI Safety videos on YONO app can be viewed during the UPI registration journey and are also accessible in the profile section.

SBI's Commitment to Safe Banking

SBI is committed to providing a safe banking environment with the following practices:

- Regular Updates: The Bank regularly updates security details on its Apps and adds fresh capabilities.

- Customer Support: Any UPI-related search queries can be answered on 24/7 helplines.

- Educational Initiatives: SBI runs awareness campaigns to inform consumers on digital banking safety.

Following best standards and staying updated will help you maximise UPI services while maintaining safe transactions.

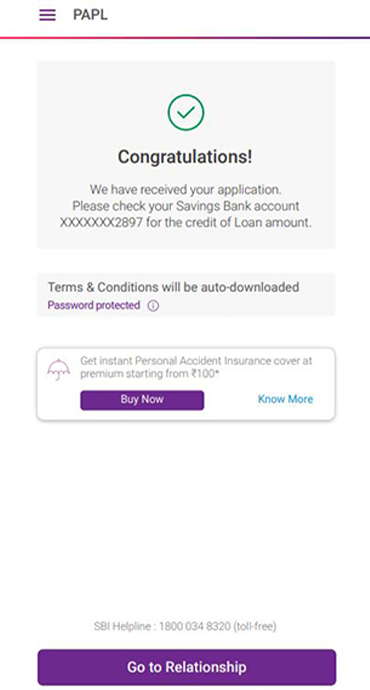

Make Every UPI Transaction Count

Knowing SBI's UPI transaction limits enables you to confidently and safely use digital payments. Understanding the daily limit, per-transaction limit, and cooling time helps you avoid surprises and guarantees seamless transactions.

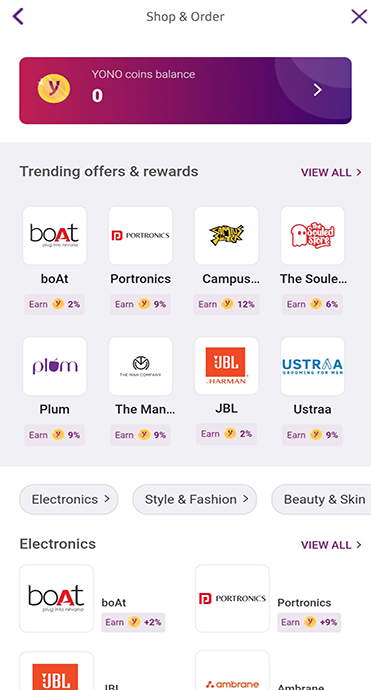

SBI is simplifying digital banking for everyone, by providing new features like UPI Lite, linking Rupay Credit cards to UPI, Tap and Pay, to name a few. Always follow simple security advice and stay updated with official bank releases. After all, smart banking isn’t just about convenience, it’s also about being informed and cautious with every tap.

आपकी रुचि से संबंधित ब्लॉग