Education Loan in India: Eligibility, Interest Rates & Benefits | SBI - Yono

Guide to Education Loans in India: Types, Eligibility, and Benefits

25 Jul, 2025

education loan

Education Loans in Empowering Students' Dreams

Quality education opens doors to countless opportunities, but the rising costs can be a barrier for many aspiring students. Education loans in India have become a crucial stepping stone for students pursuing their academic dreams. In 2025, with education costs continuing to rise, understanding your loan options and education loan eligibility criteria is more important than ever.

With Indian higher education costs increasing annually, pursuing an MBA at a top institute or an engineering degree abroad can be financially challenging. SBI's education loans offer tailored financial solutions to support your academic aspirations, ensuring that financial constraints don't hinder your educational and career advancement.

SBI leads the education loan market in India with tailored solutions that put students first. Our commitment to education has helped thousands of students access quality learning opportunities both in India and abroad. With over 25 years of experience in education financing, SBI understands the unique challenges students face and offers customized solutions to meet their needs.

SBI Education Loans: Understanding the Right Fit for You

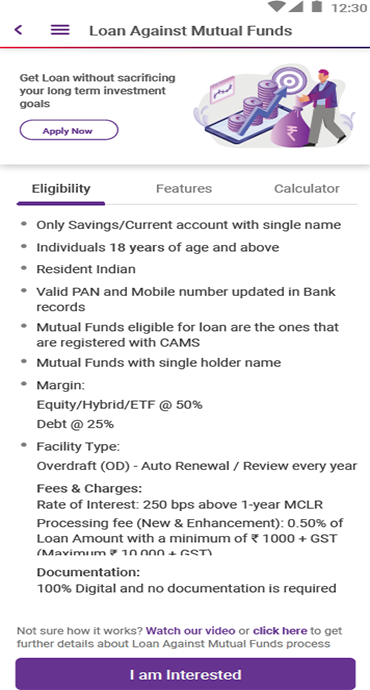

SBI primarily offers three main loan categories for different educational needs:

I. Higher Education in India:

- Supports UG & PG studies in IITs, IIMs, NITs & premier institutes under “Scholar Loan”

- Special benefits for top performers & female students

- Lowest interest rates with flexible repayment options

- Designed to ensure access to quality education

- Tailored education loan for students in India pursuing premier education

II. Higher Education in Abroad:

- For studying abroad with loan amounts above ₹7.5 lakh & up to ₹3 crore under “Global Ed-Vantage”

- Education loan for abroad studies covers various expenses including tuition fees, accommodation and living costs

- Unsecured loans up to ₹50 lakh available for select courses/institutes

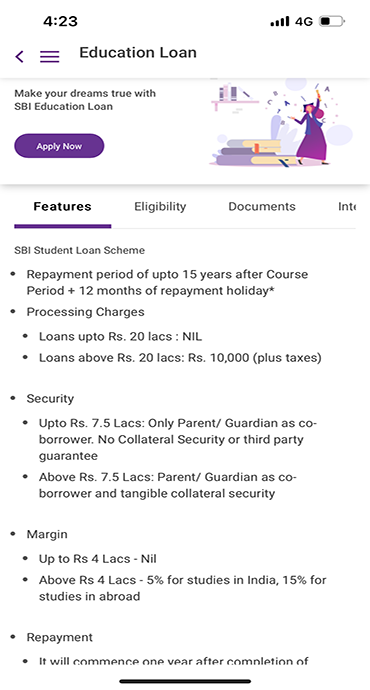

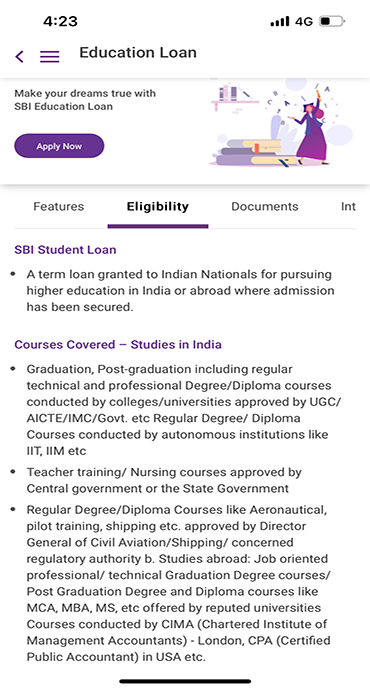

III. SBI Student Loan Scheme:

- Supports students pursuing various academic programs

- Offers flexible financing options for diverse educational needs

- Covers tuition fees, living expenses & other education-related costs

- Designed to make higher education more accessible

Applying for an education loan with SBI is simple. To be eligible, you must be:

- A Resident Indian or OCI who are resident in India

- Admitted to a recognized institution

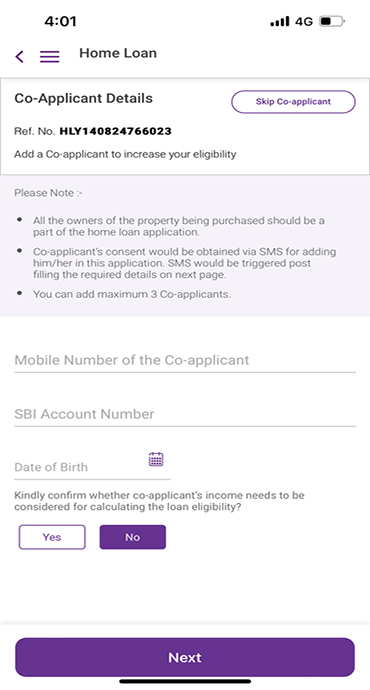

A co-applicant may be required in certain cases, usually a parent or guardian.

Comprehensive Coverage for Your Educational Journey

SBI’s education loan coverage extends beyond just tuition fees, covering a range of expenses to support a seamless learning experience. We understand that quality education involves various expenses, here’s what our loans cover:

- ✅ Accommodation costs

- ✅ Study materials

- ✅ Travel expenses

- ✅ Laboratory fees

- ✅ Living expenses for international students

- ✅ Insurance premiums

- ✅ Caution deposits and refundable fees

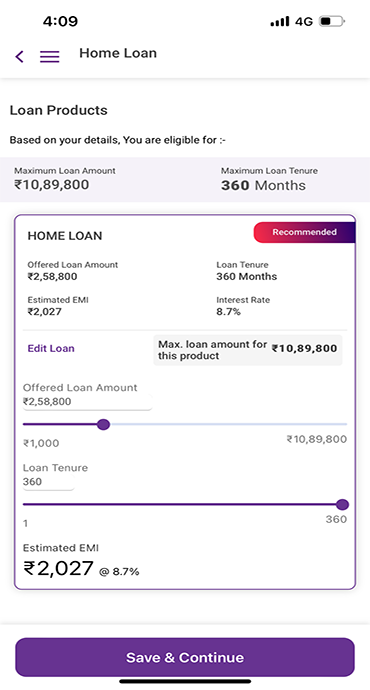

Benefits of Choosing SBI for Your Education Loan

Choosing SBI for your education loan means selecting a trusted financial partner committed to your academic success. SBI offers:

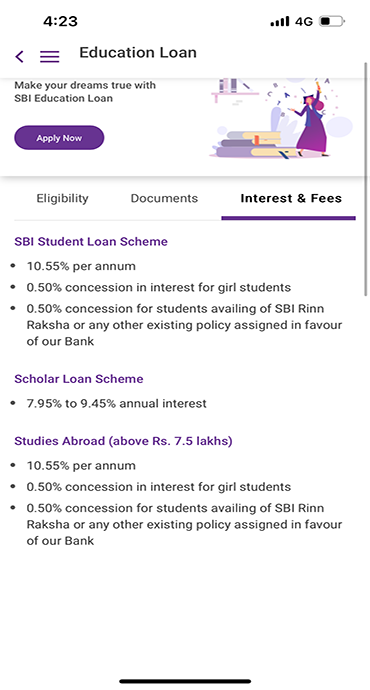

- ✅ Competitive Interest Rates – Transparent terms with some of the lowest education loan interest rates in the market.

- ✅ Up to 100% Financing– Covers course fee up to 100%, based on your needs ensuring financial ease.

- ✅ Flexible Repayment Terms – Loan tenure of up to 15 years, with a moratorium period covering the course duration plus six months after completion.

- ✅ No Prepayment Penalty – Repay early without any additional charges.

- ✅ Tax Benefits – Enjoy tax deductions on interest paid under Section 80E of the Income Tax Act.

- ✅ No Collateral for Loans up to ₹7.5 Lakh – Making education loans more accessible.

- ✅ Interest Concessions – Special discounts for meritorious students and female students under the SBI Scholar Loan Scheme.

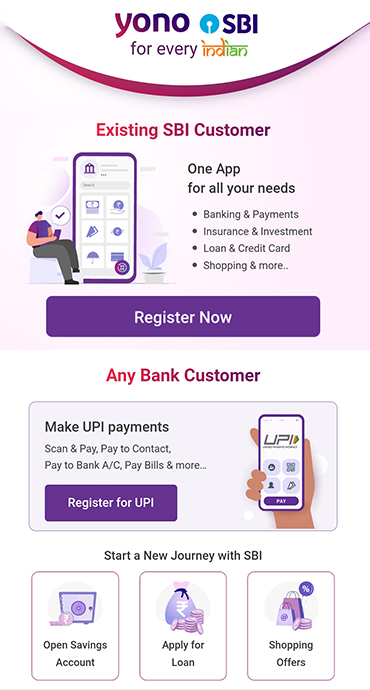

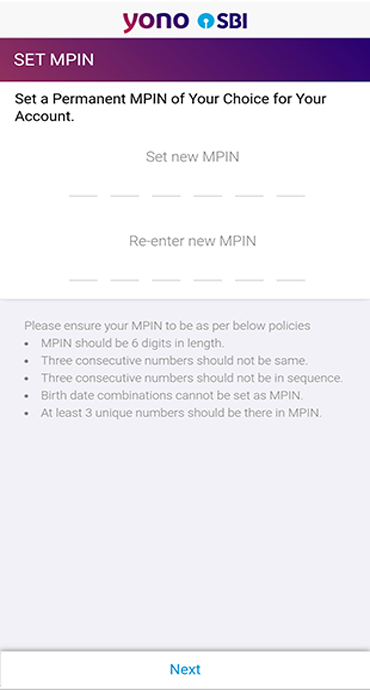

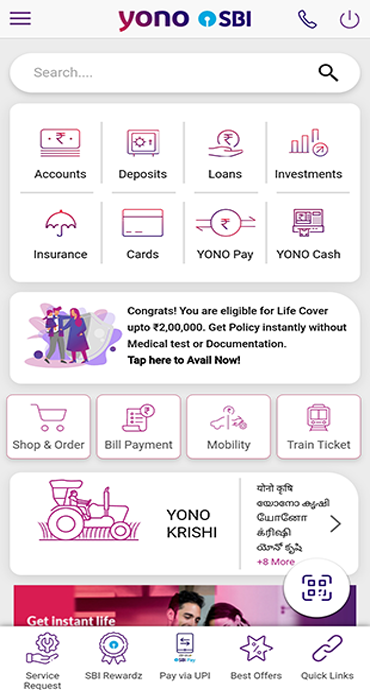

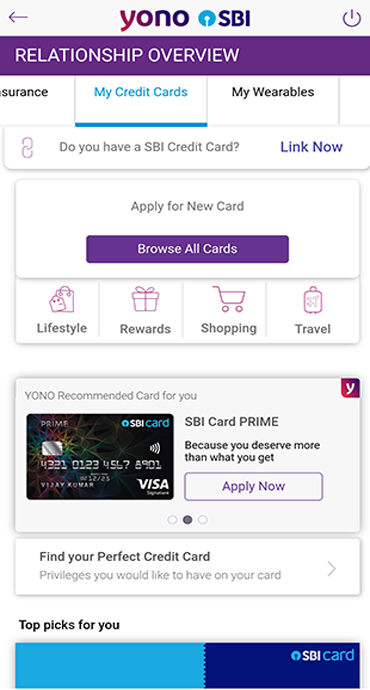

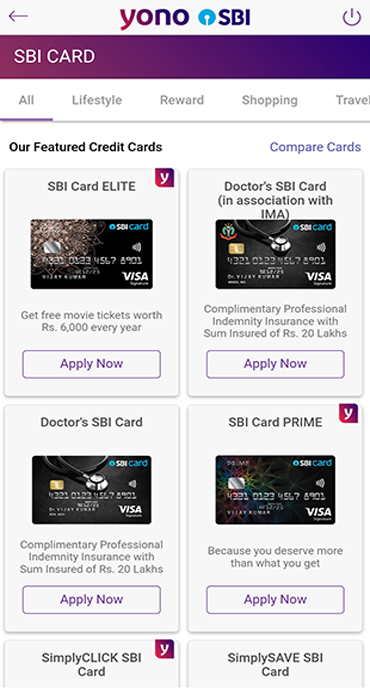

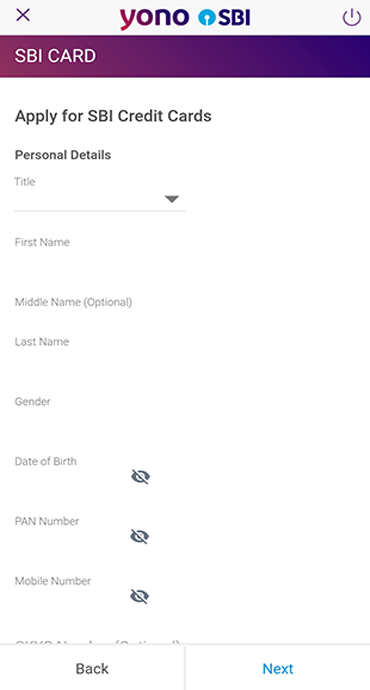

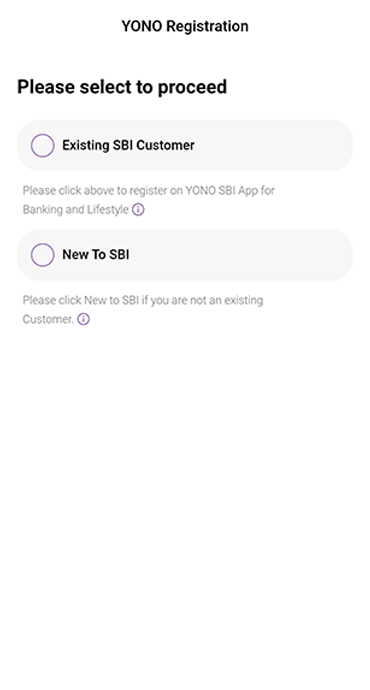

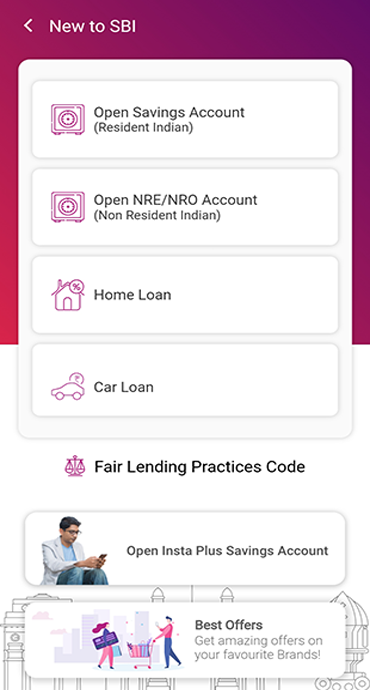

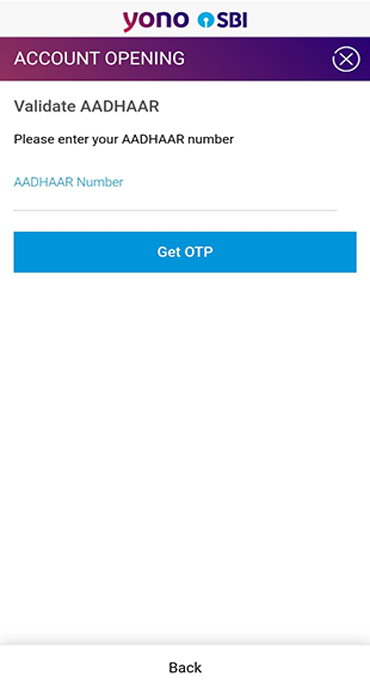

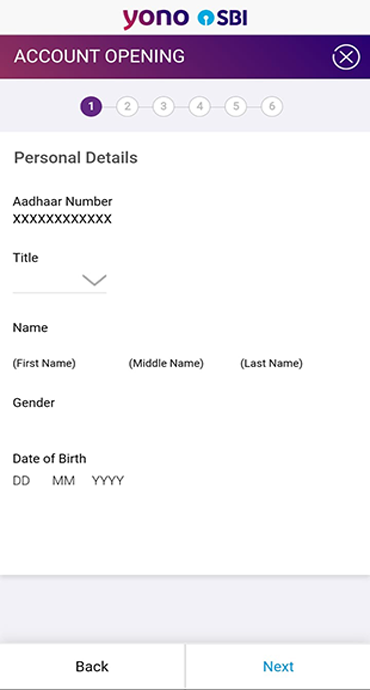

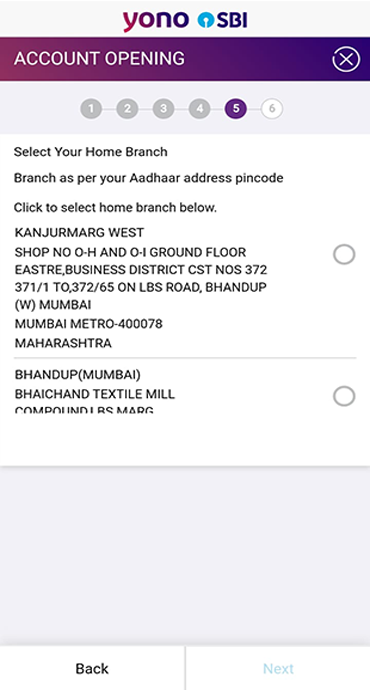

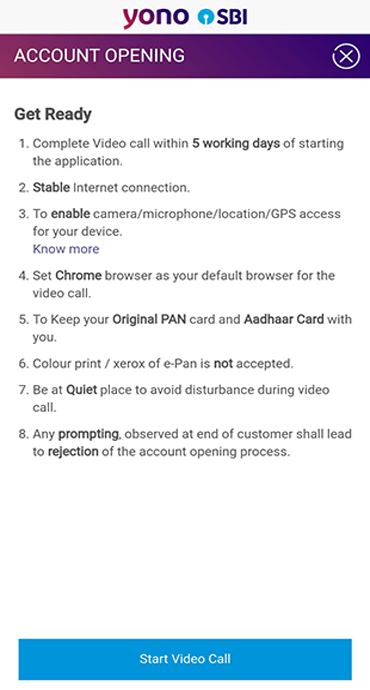

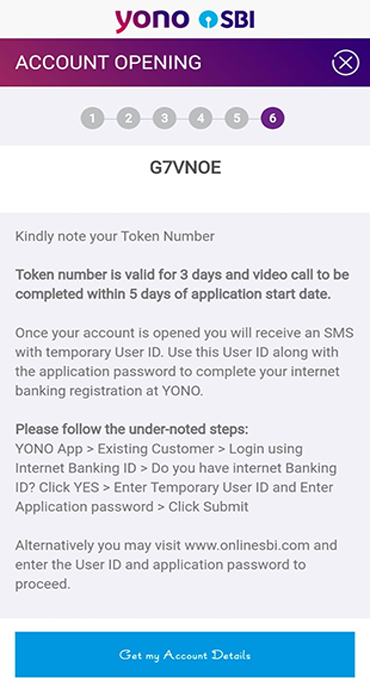

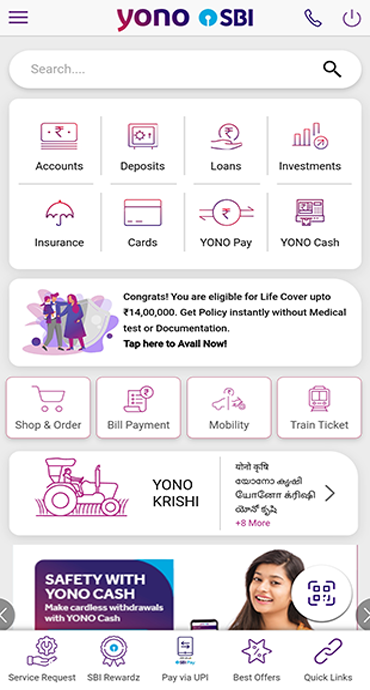

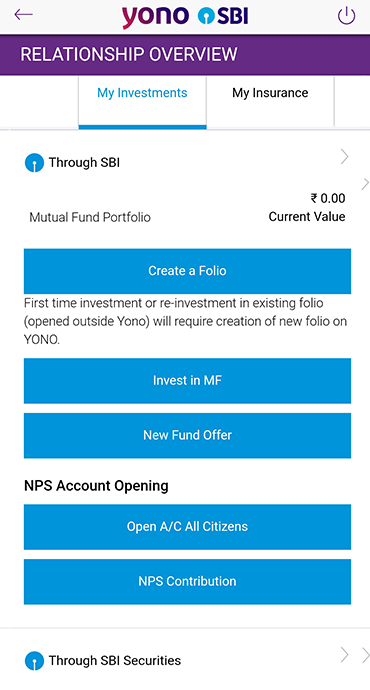

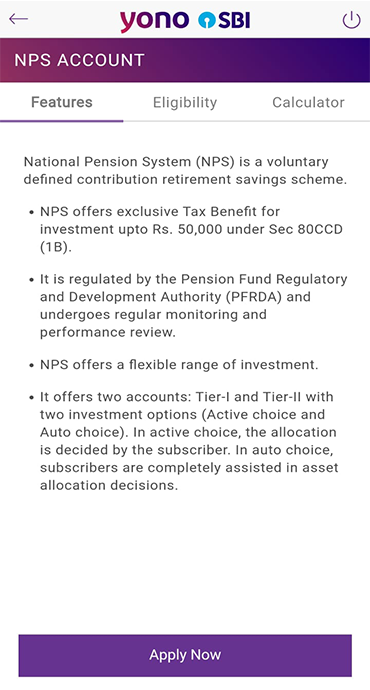

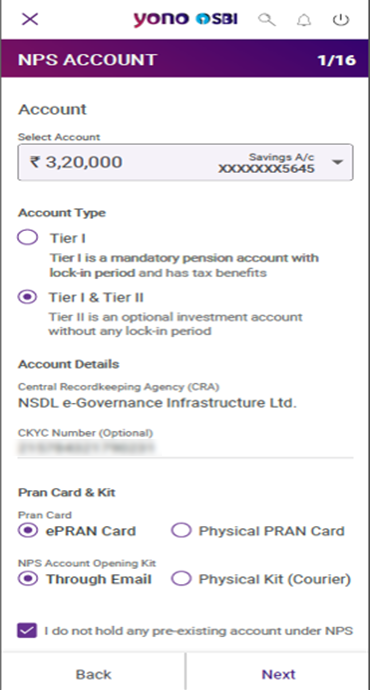

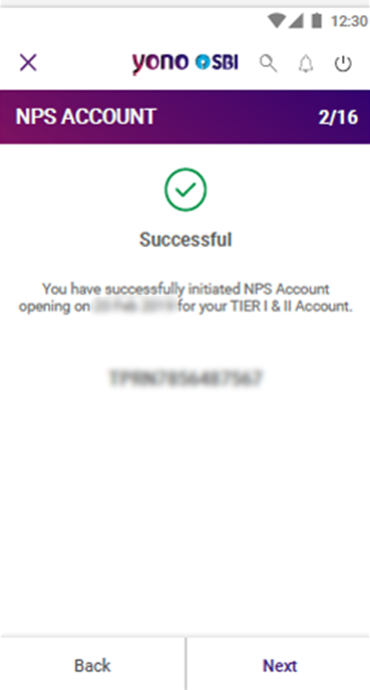

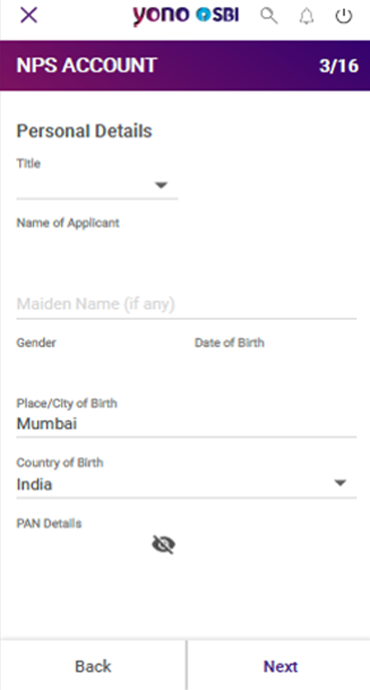

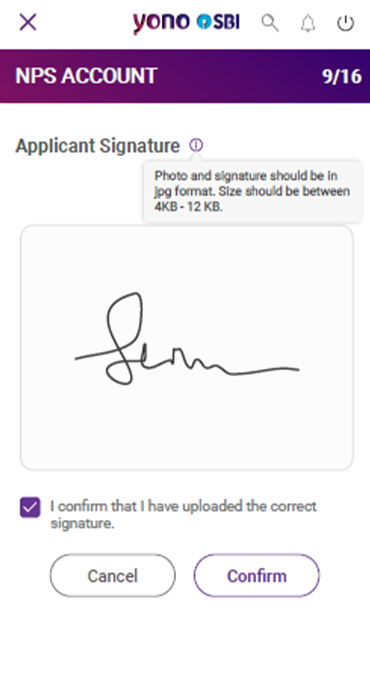

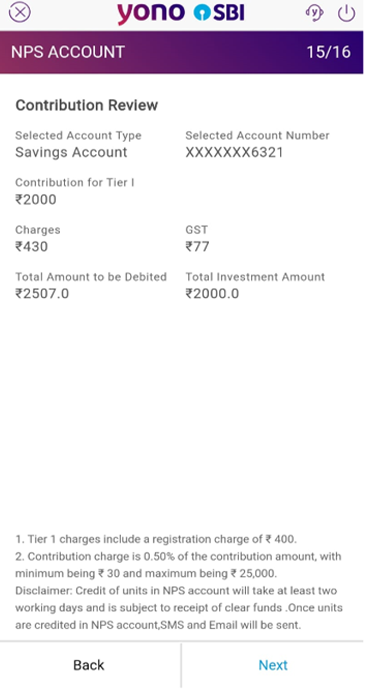

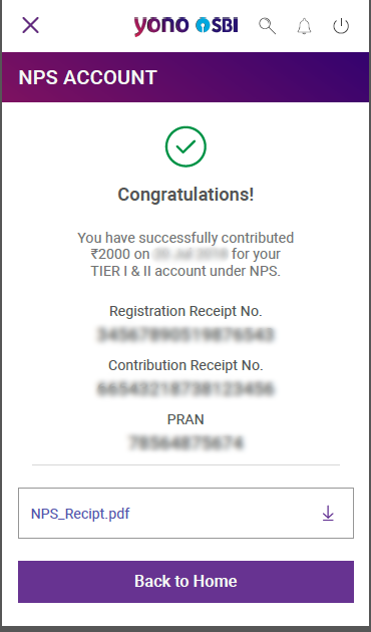

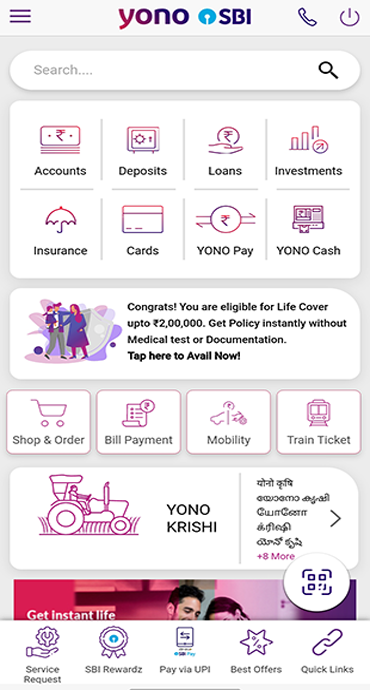

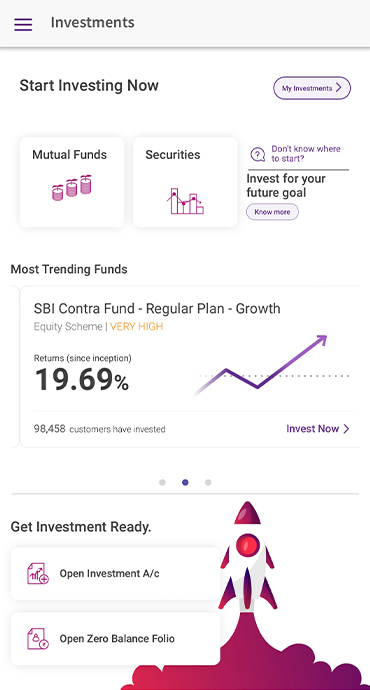

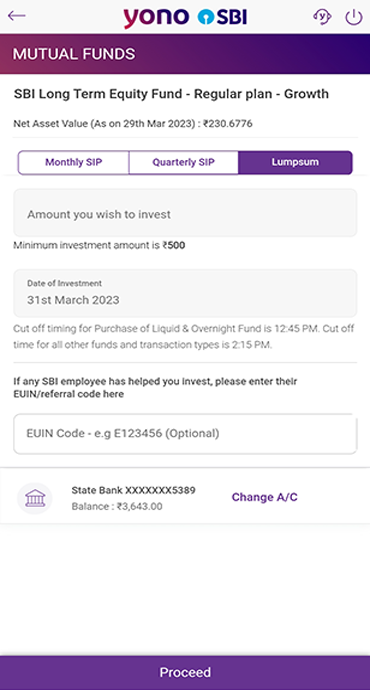

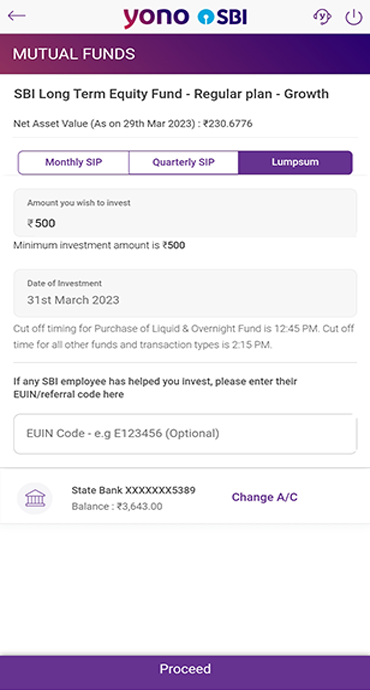

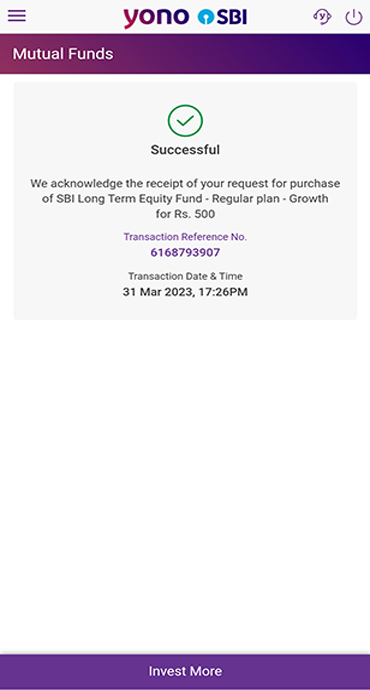

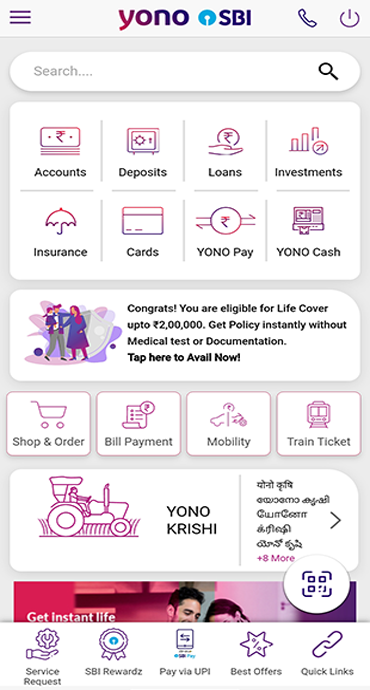

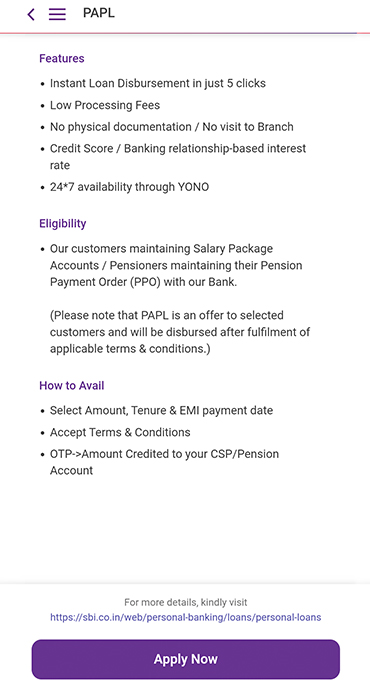

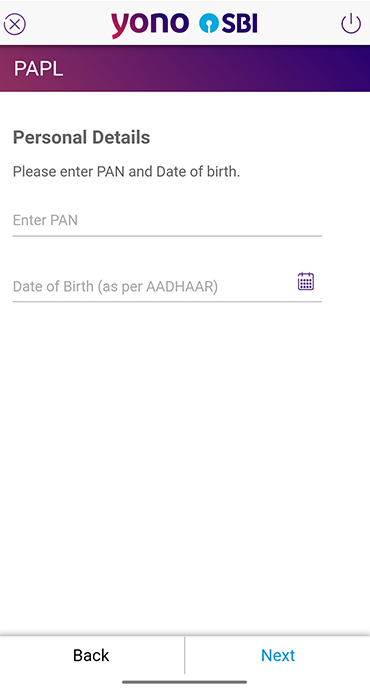

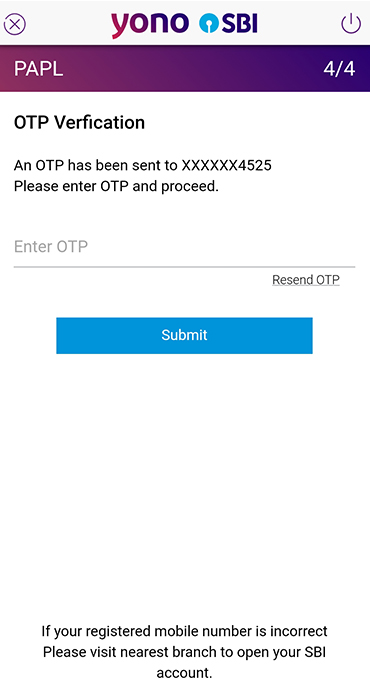

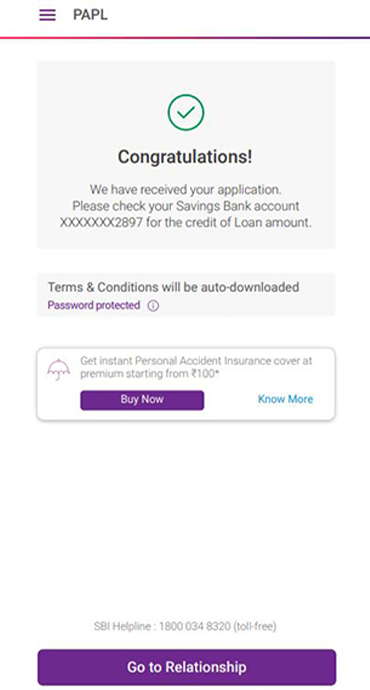

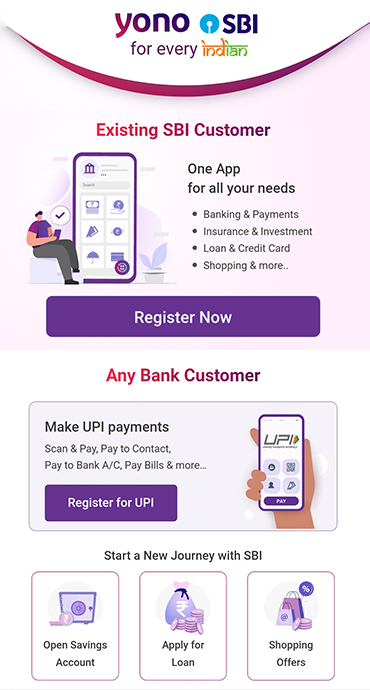

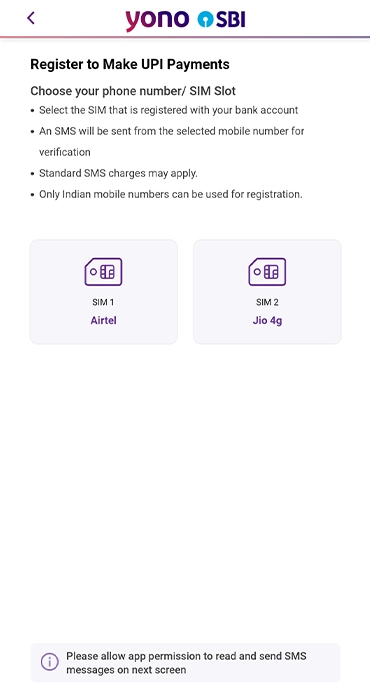

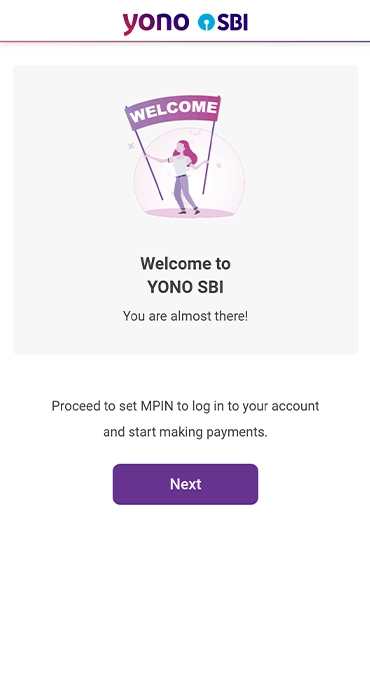

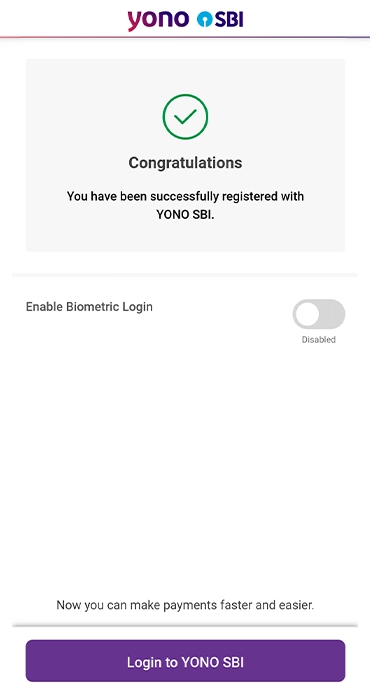

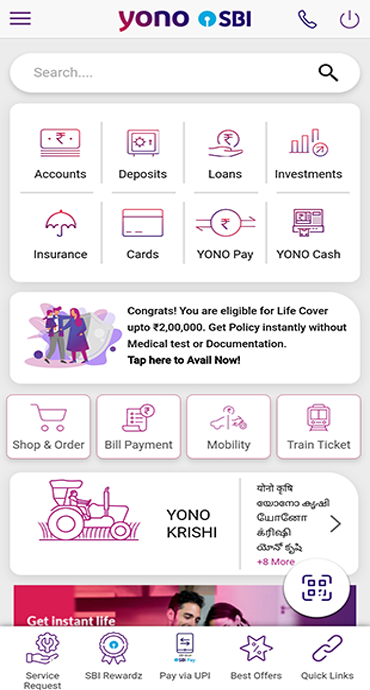

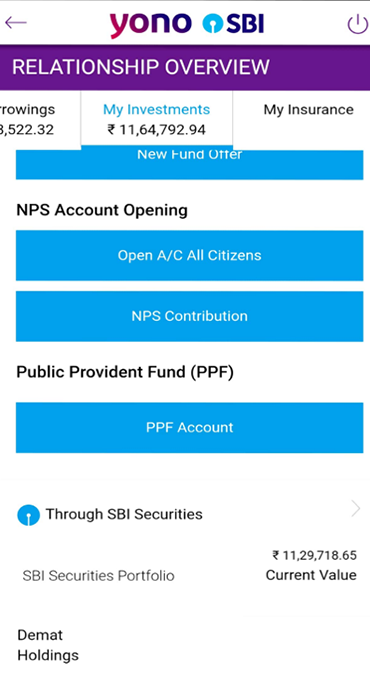

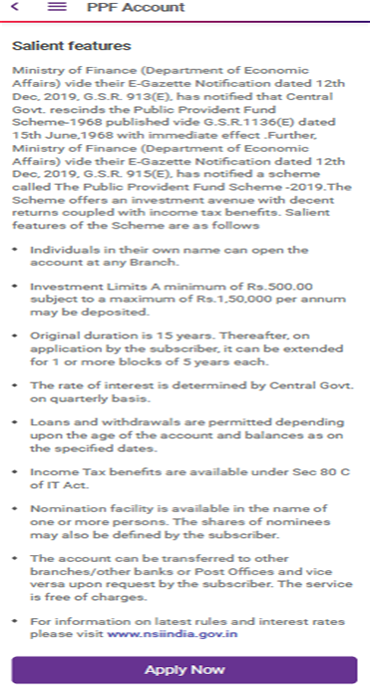

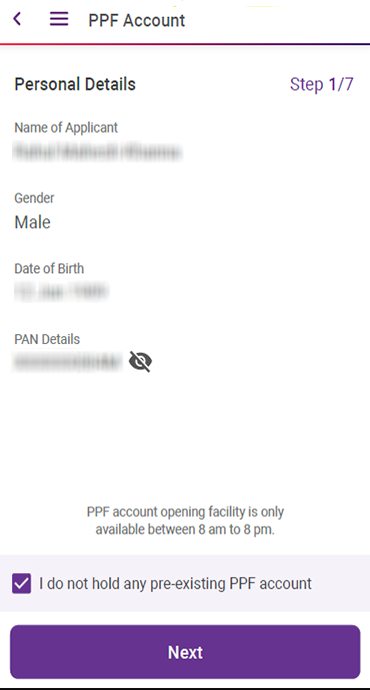

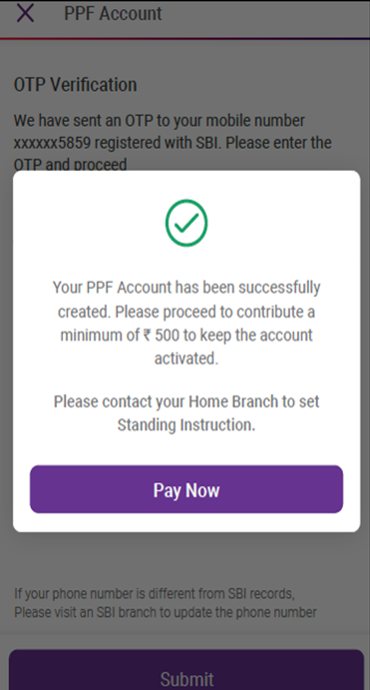

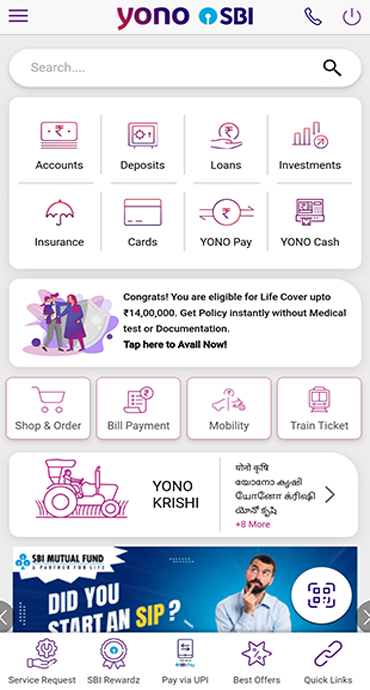

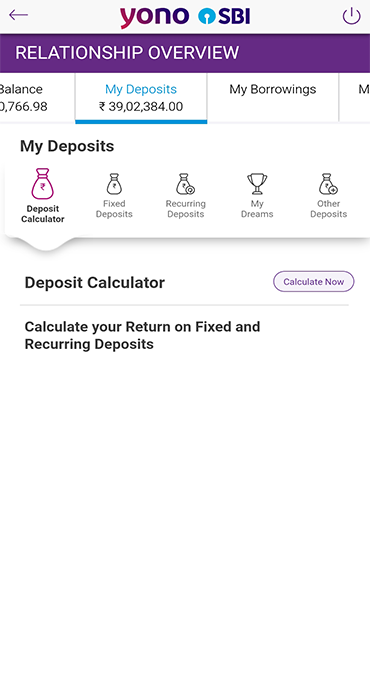

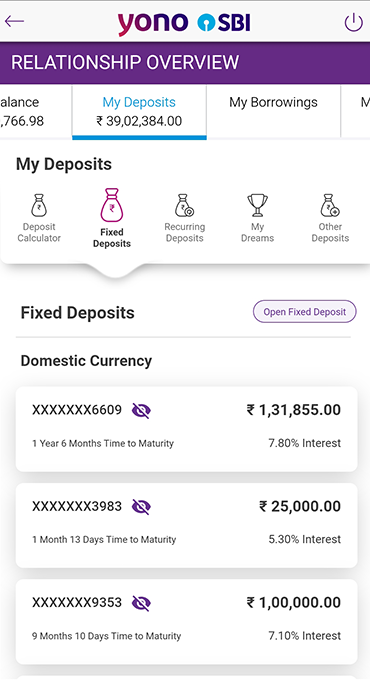

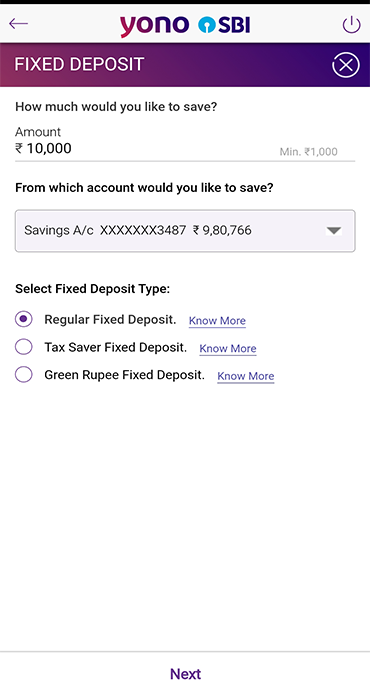

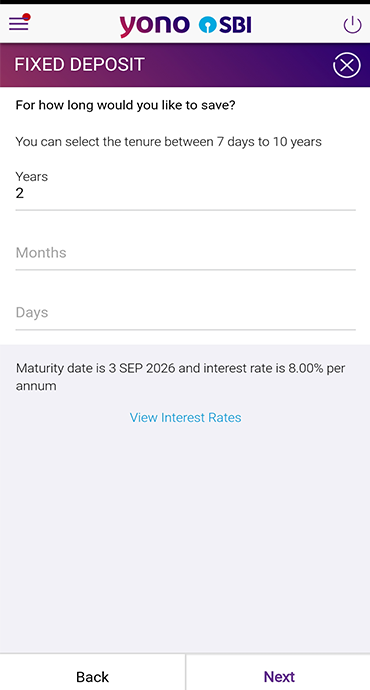

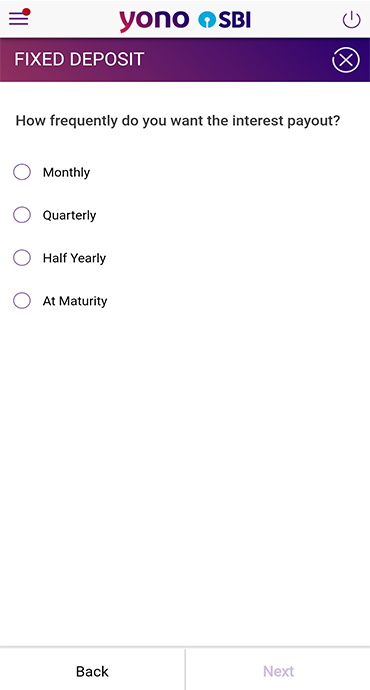

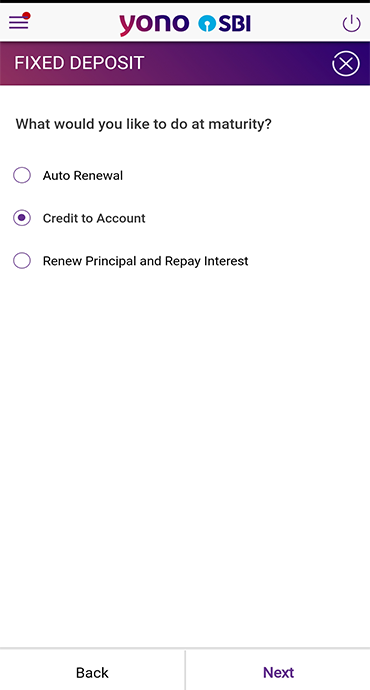

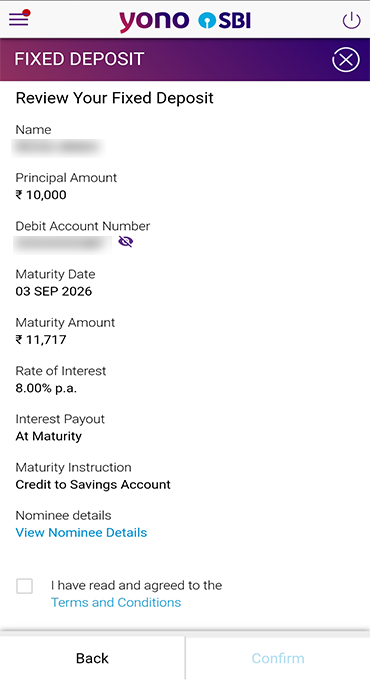

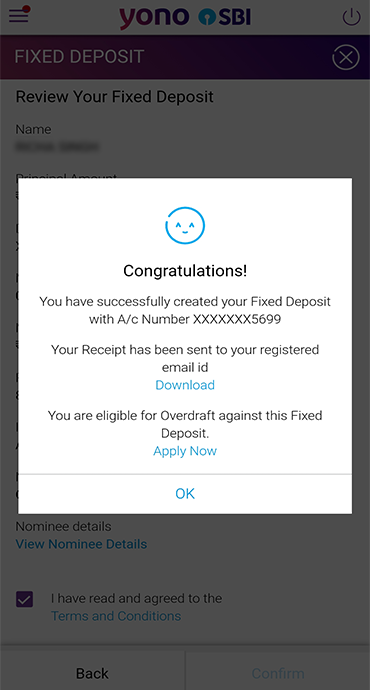

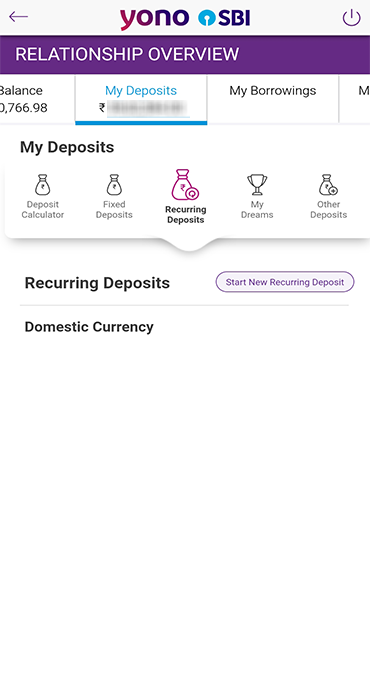

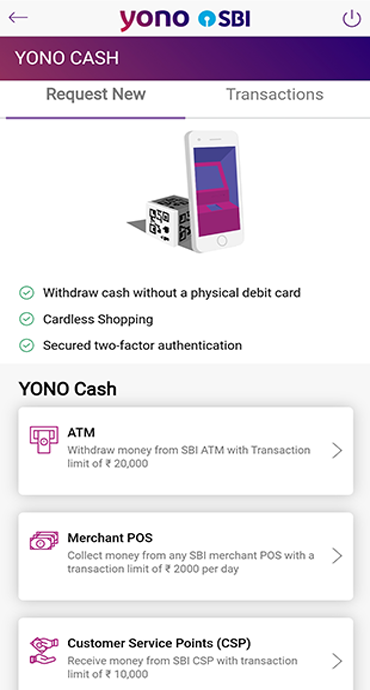

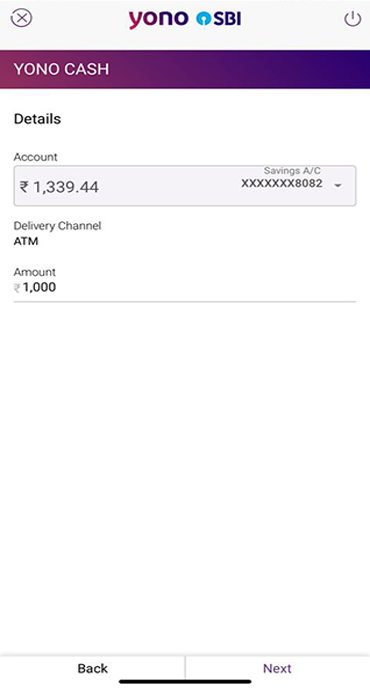

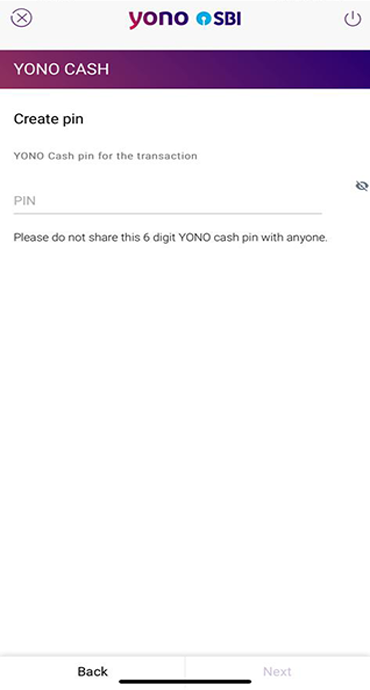

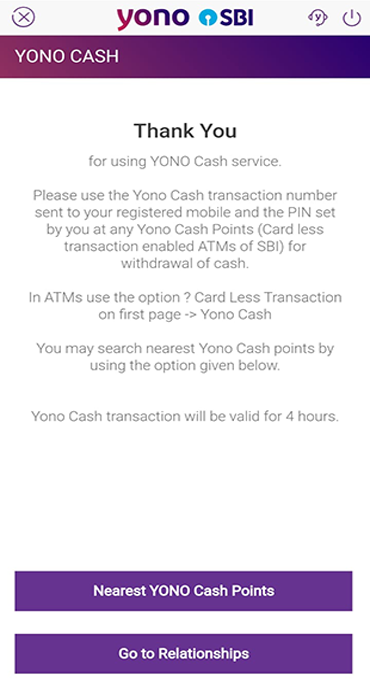

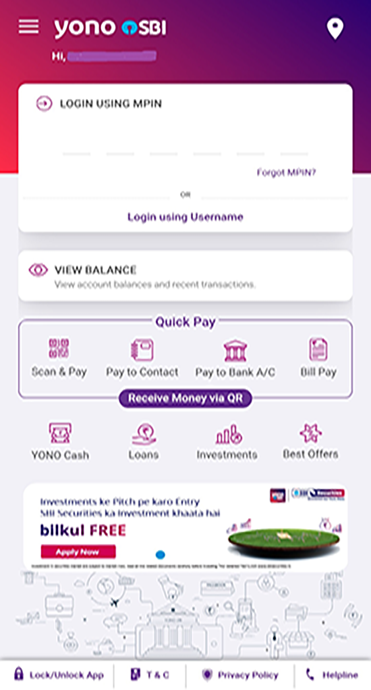

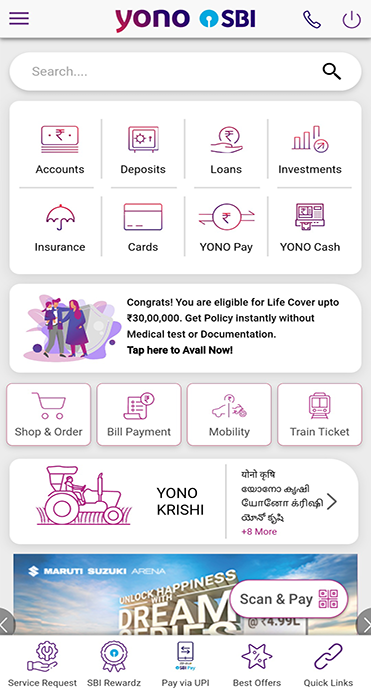

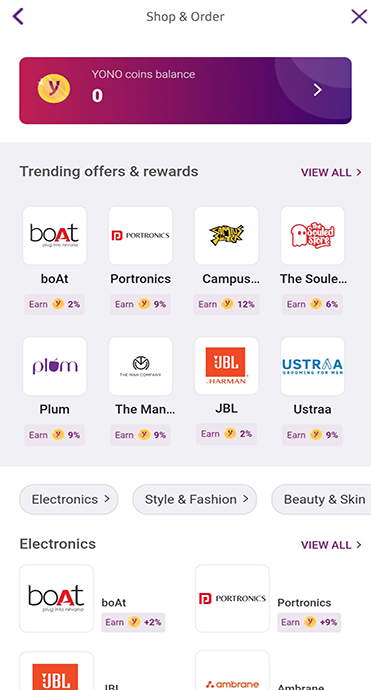

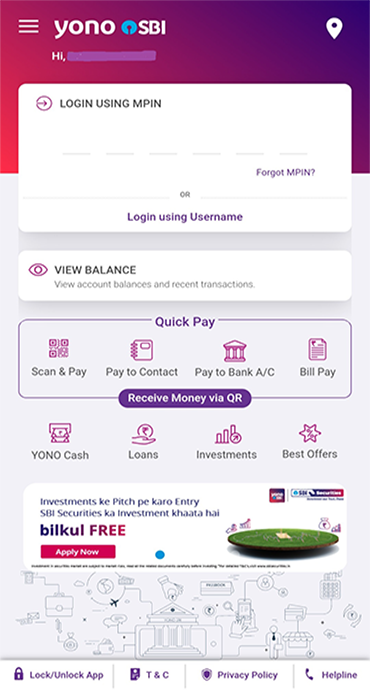

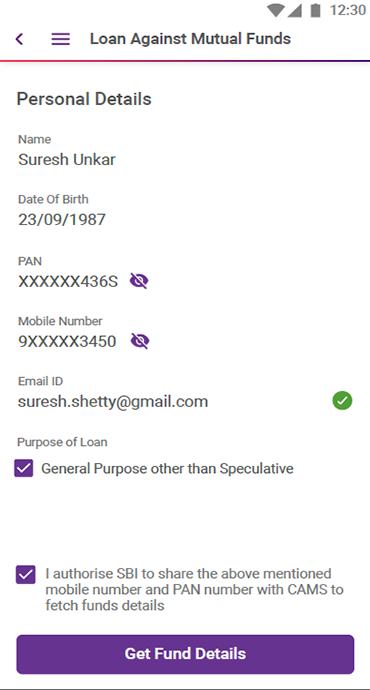

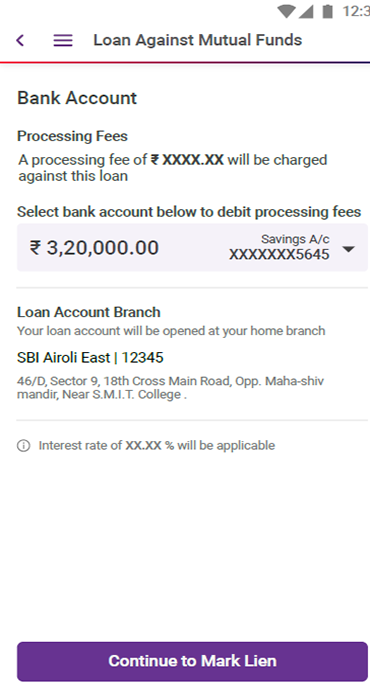

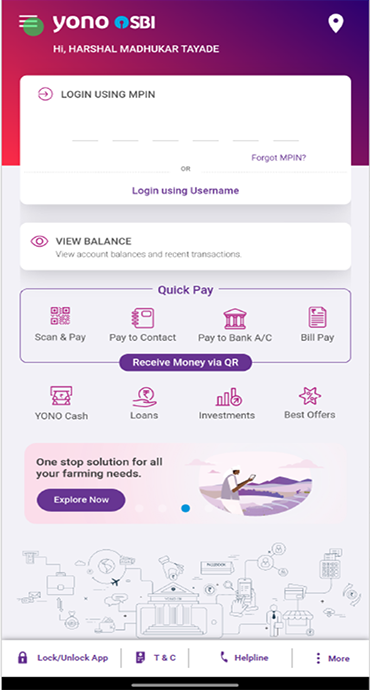

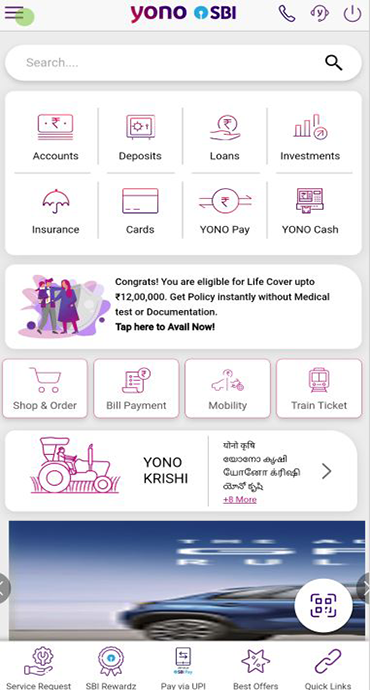

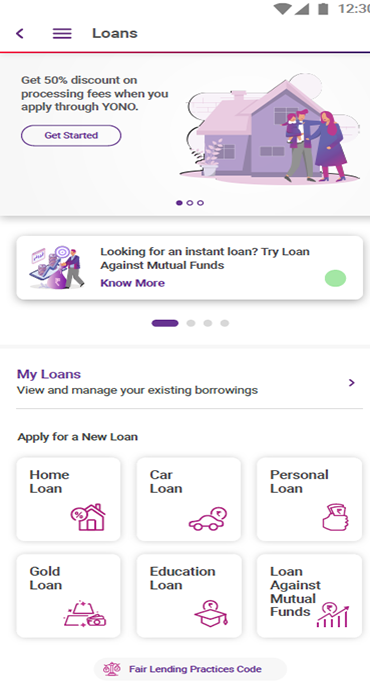

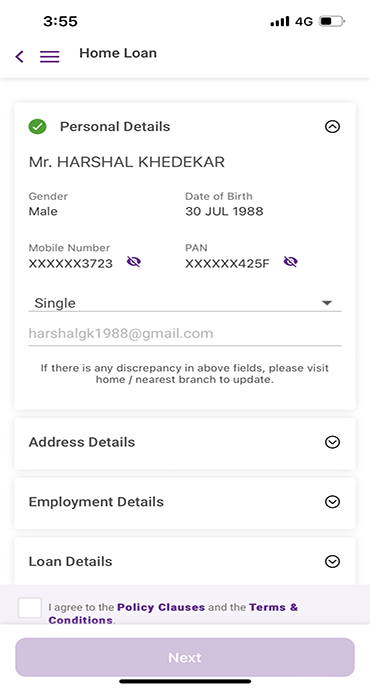

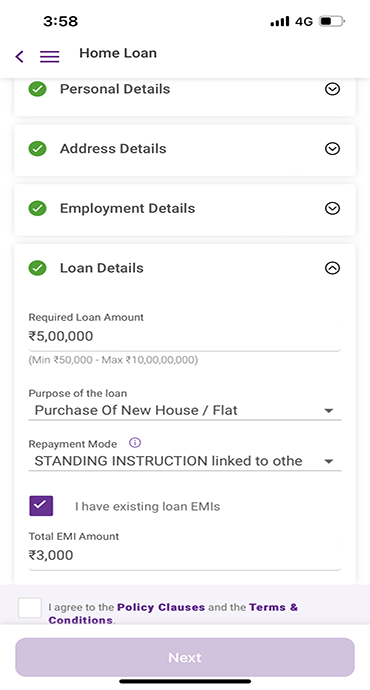

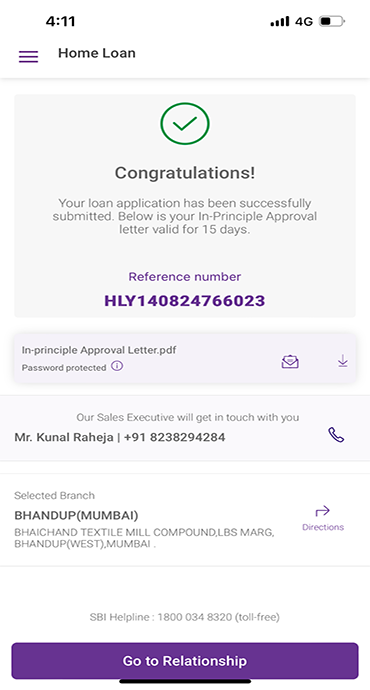

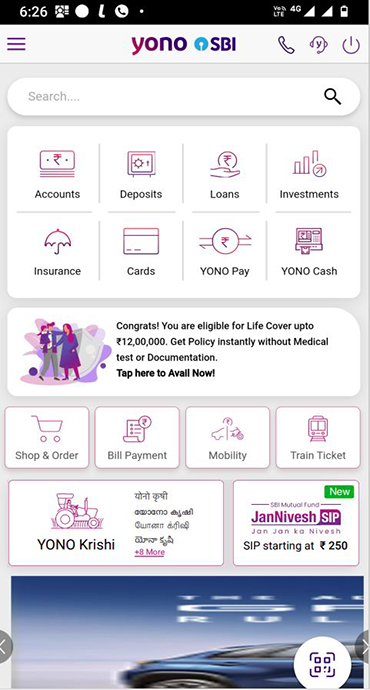

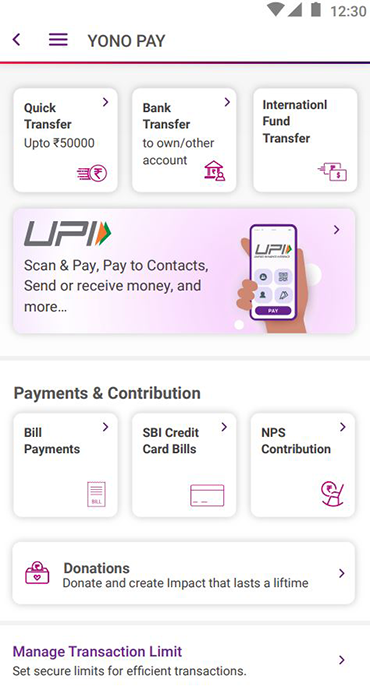

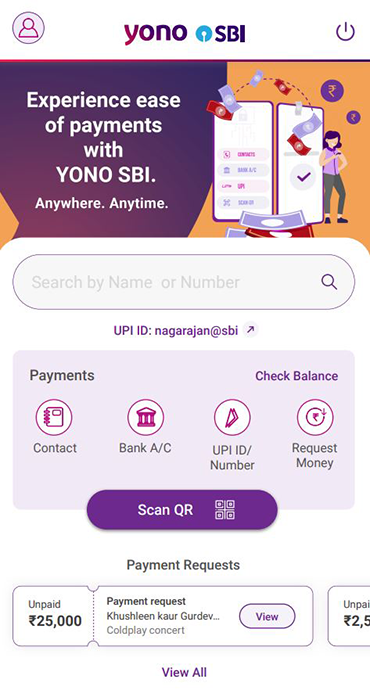

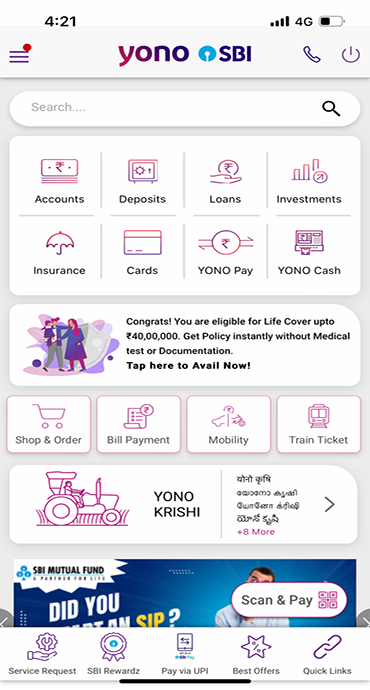

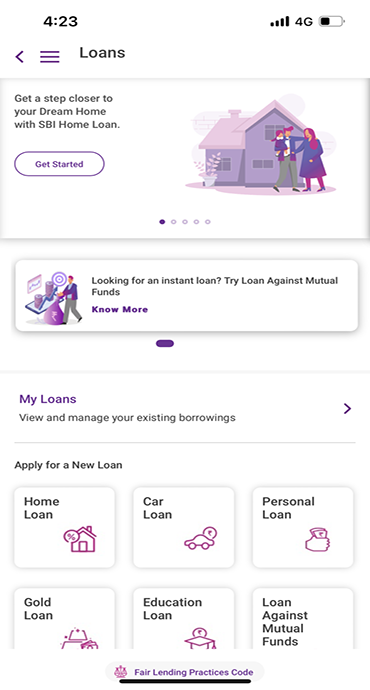

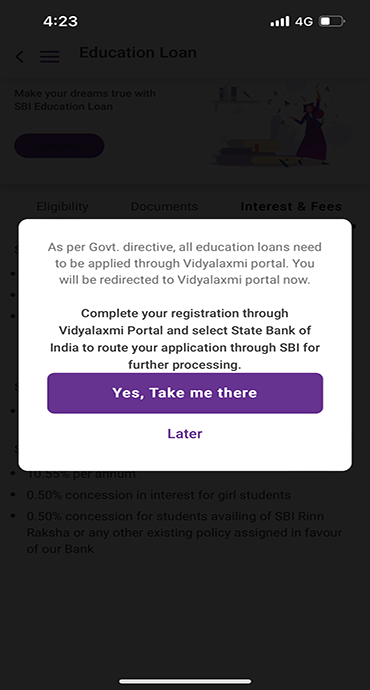

Digital Experience: YONO Journey

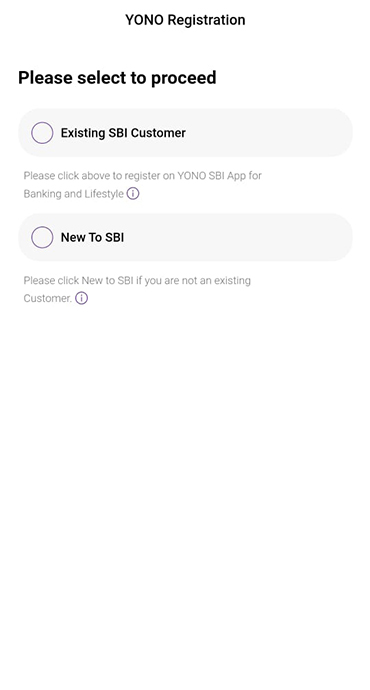

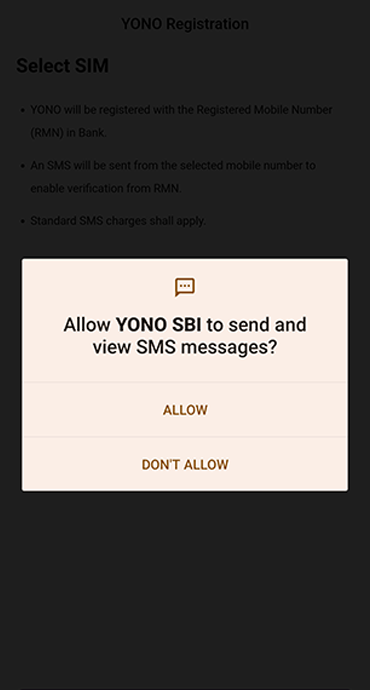

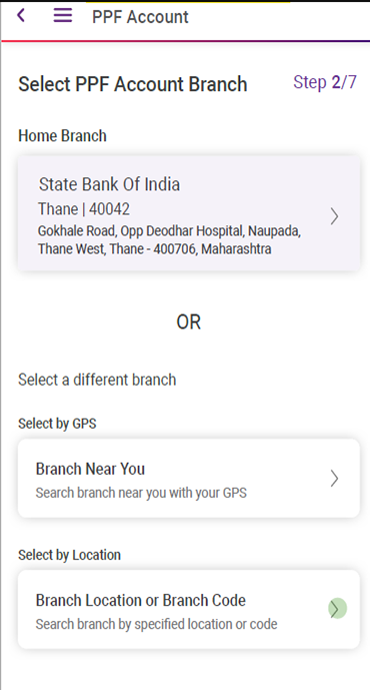

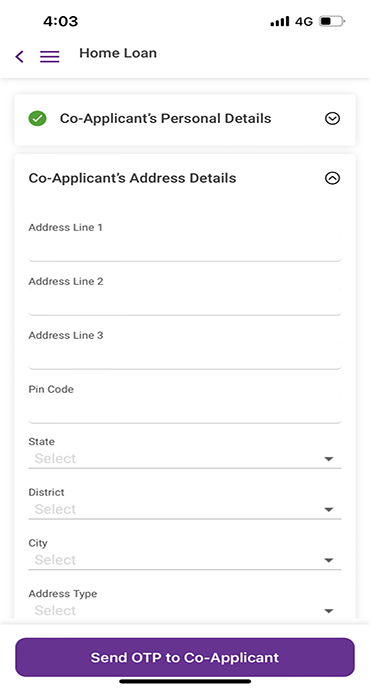

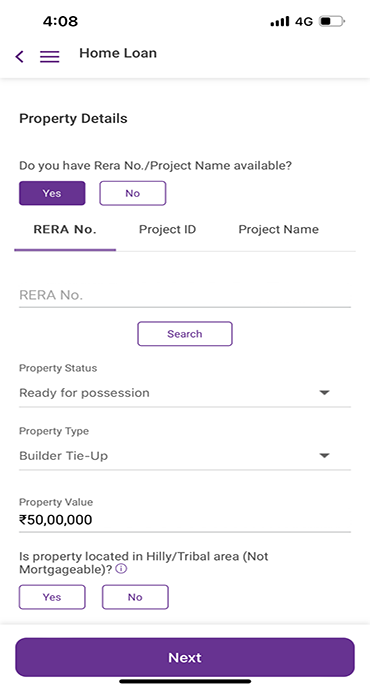

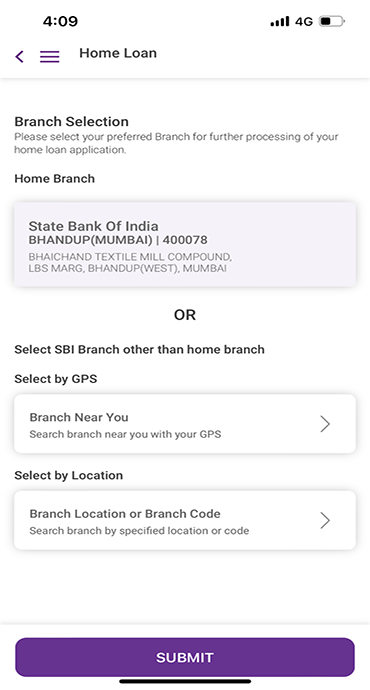

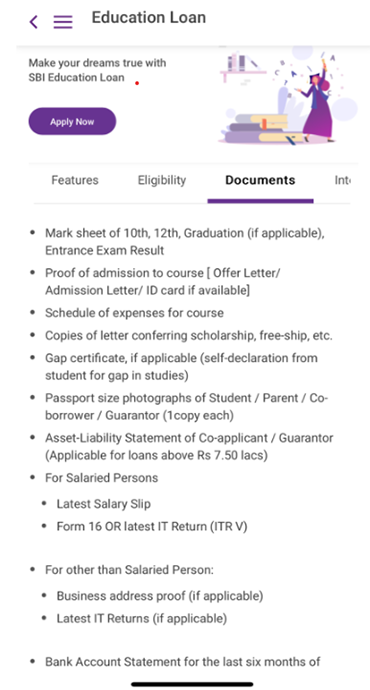

The YONO SBI app provides easy access to education loans by redirecting applicants to the Vidyalakshmi Portal, as per government regulations. Check your education loan eligibility and apply for education loan for abroad studies or education loan for students in India directly through the YONO SBI app. Through this app, you can:

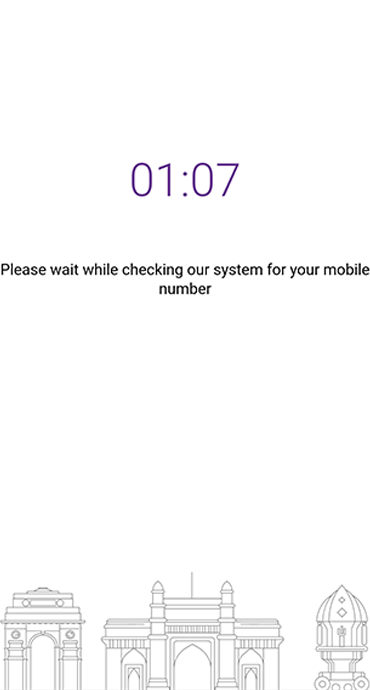

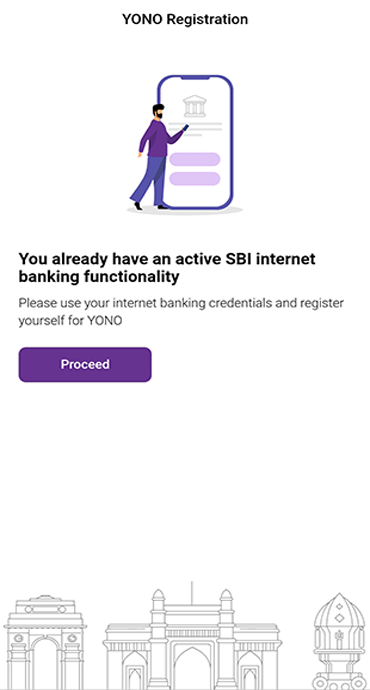

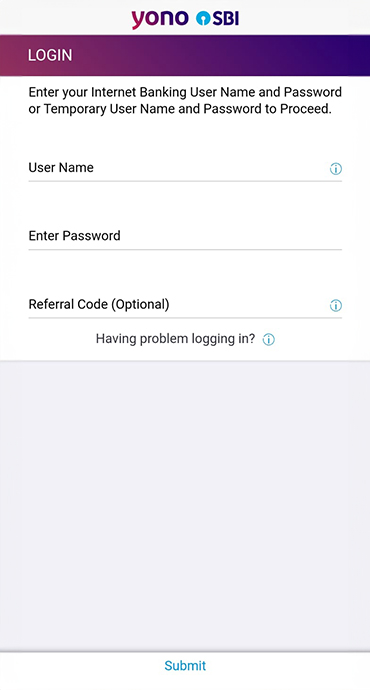

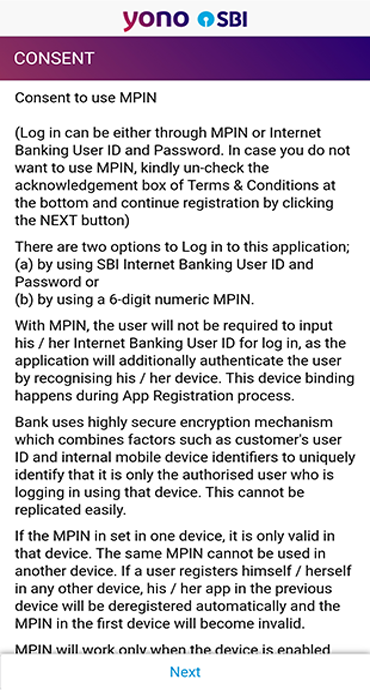

- Log in to the YONO SBI App

- Navigate to the Loans section and tap on Education Loans

- You will be redirected to the Vidyalakshmi Portal to apply

- Complete your loan application on the portal

- Upload the required documents

- Visit the nearest branch with the documents

- Track your application status

Take the Next Step Towards Your Higher Education Goals

Education loans empower students to pursue their higher education goals without financial constraints. Choosing SBI education loans enables you to access the services of India's most trusted financial institution that specializes in education funding. Transparent loan procedures and multiple competitive interest rates are available at our specialized education loan cells throughout India.

Start your educational journey confidently by accessing the Vidya Lakshmi Portal through YONO SBI or by visiting their nearest branch today.

Related Blogs That May Interest You