Grow Your Savings with PPF Account Through YONO SBI App | SBI - Yono

Grow Your Savings Securely with a PPF Account

27 Nov, 2024

accounts investments public provident fund

Public Provident Fund commonly referred to as PPF account is among the safest and most dependable investment available for the Indian investors. It holds tax advantages and offers PPF interest rate that is competitive compared to many other financial products. Whether it is a retirement plan that requires slow accumulation of wealth or one that seeks an investment that requires steady accumulation of wealth without much risk, PPF account offers a perfect opportunity.

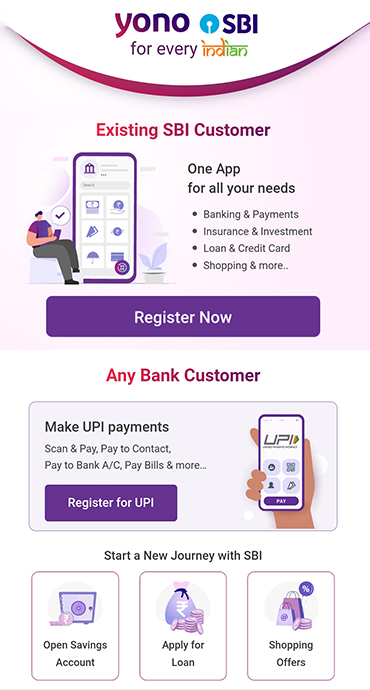

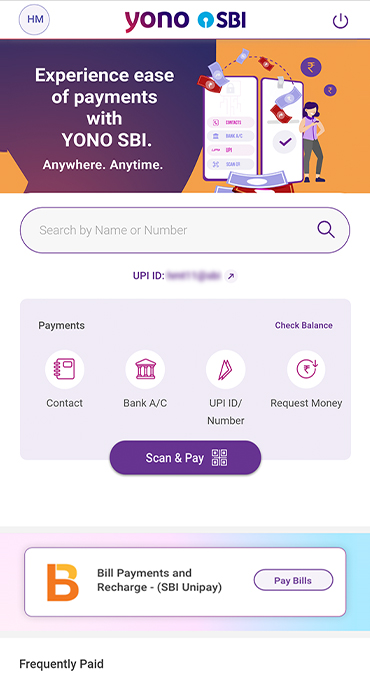

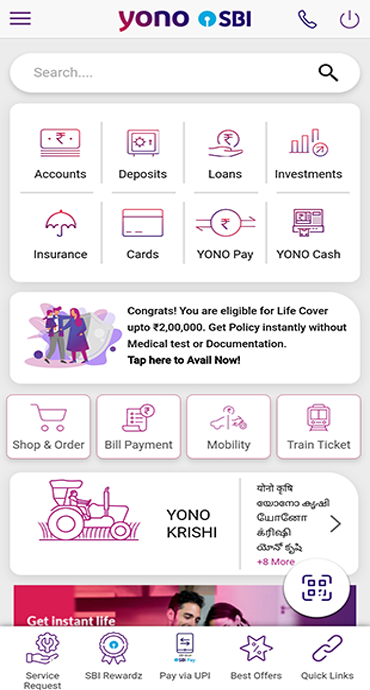

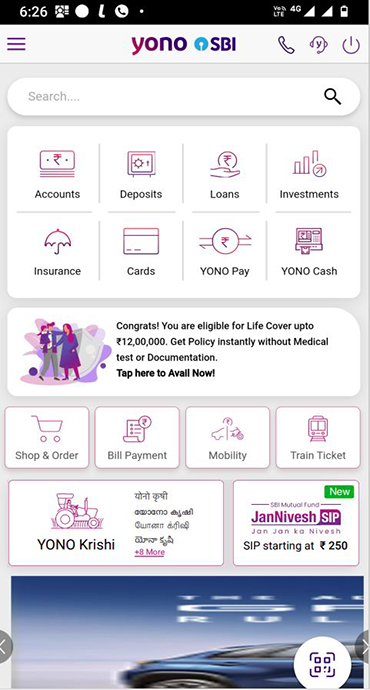

Now SBI has made it easier to open and operate a PPF account through its YONO SBI app.

What is Public Provident Fund (PPF) Account?

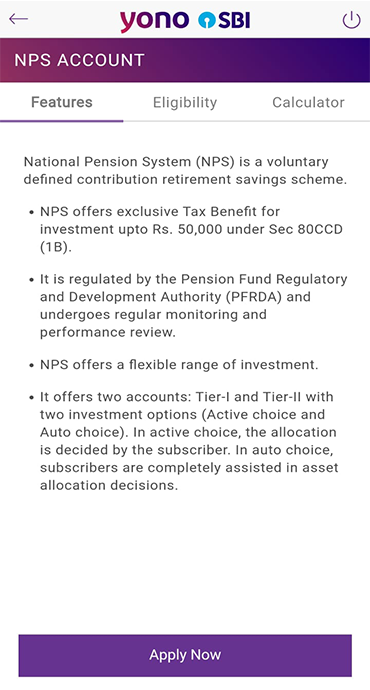

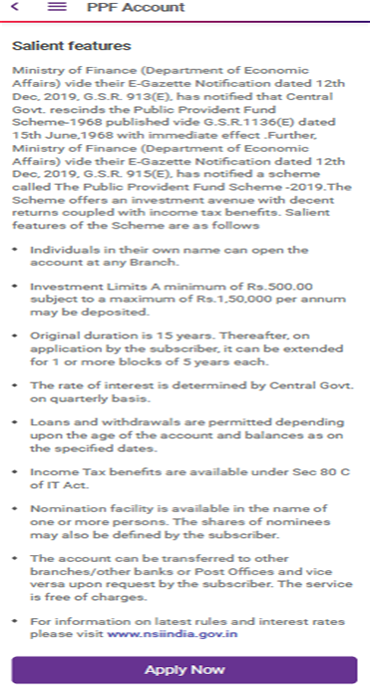

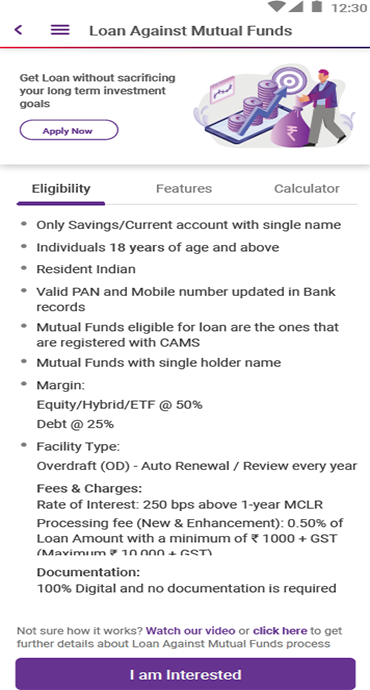

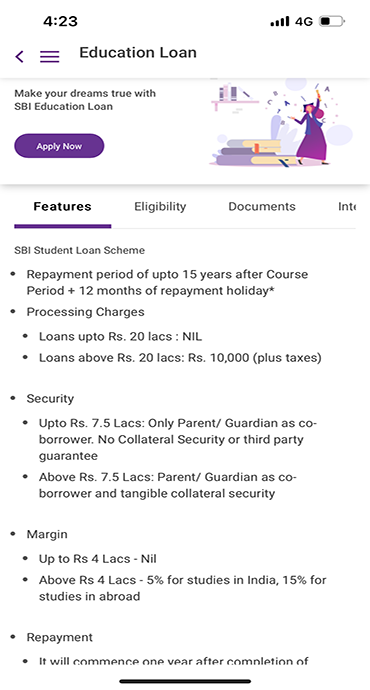

A Public Provident Fund (PPF) account is a government-backed long-term savings scheme in India that offers attractive interest rates with complete tax exemption benefits. Contributions to PPF qualify for tax deductions under Section 80C, while both the interest earned, and the maturity amount remain tax-free. With a lock-in period of 15 years, PPF provides a secure investment avenue with the flexibility to make partial withdrawals after the 7th year. SBI allows eligible customers to open and manage their PPF account seamlessly.

Understanding what is PPF account and its key features can help investors make informed decisions.

Features

- PPF account opening: Can be opened through YONO SBI app or at any SBI branch

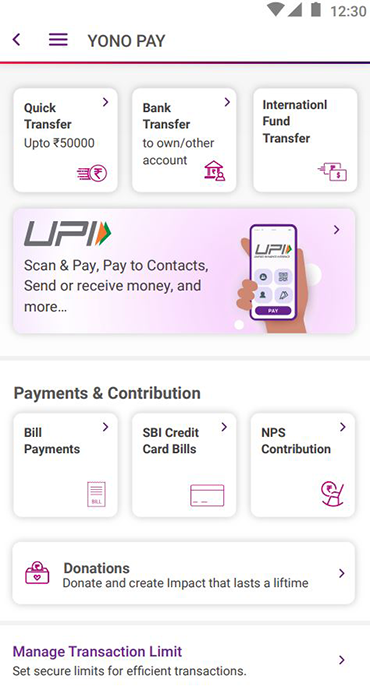

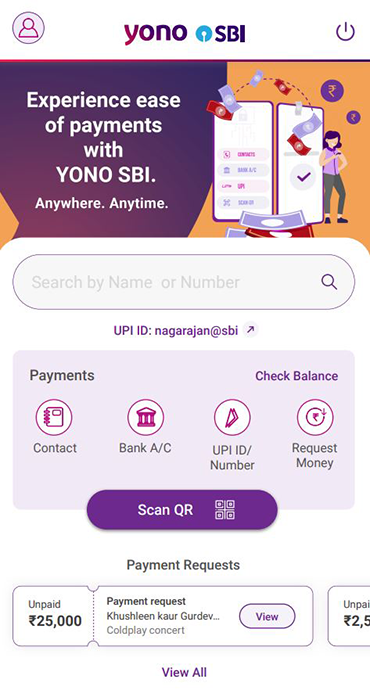

- Account operation: Available through YONO SBI, internet banking, or branch visits

- Interest calculation: Calculated on the lowest balance between the 5th and the last day of the month

- Statement access: Available through YONO SBI App and internet banking

- Nomination facility: Available during account opening

- Minimum deposit: ₹500 per financial year

- Maximum deposit: ₹1.5 lakh per financial year

- PPF Interest Rate: Currently at 7.10% (as of the latest update) and revised quarterly by the government, ensuring stable and transparent returns. For the latest PPF interest rates, visit the National Savings Institute (NSI) website.

- Account activity: Seamlessly link your SBI savings account for hassle free transfers and easy account management

Benefits

Knowing what is PPF account helps investors appreciate these significant benefits:

- Tax advantages:

o Contributions qualify for deductions under Section 80C of the Income Tax Act

o The Interest earned on your investment is completely tax-free

o The maturity amount is fully exempted from taxes, ensuring maximum returns - Digital convenience: Easily manage your PPF account through YONO SBI app

- Auto-debit facility: Set up standing instructions from your SBI savings account during account opening process for hassle-free contributions

- Flexible contributions: Choose to invest lump sums or make regular deposits as per your preference

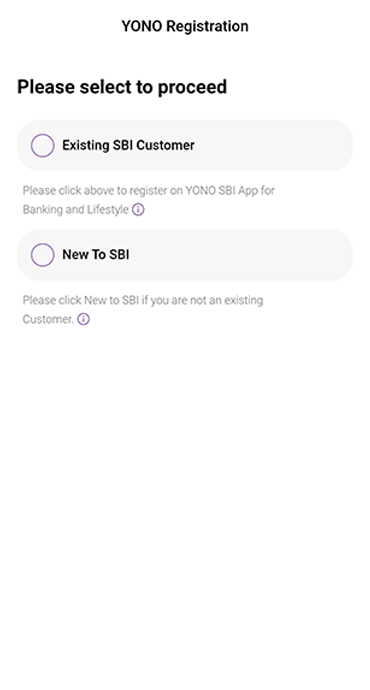

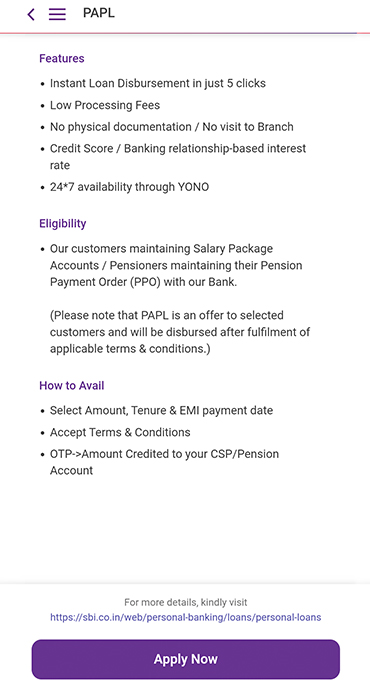

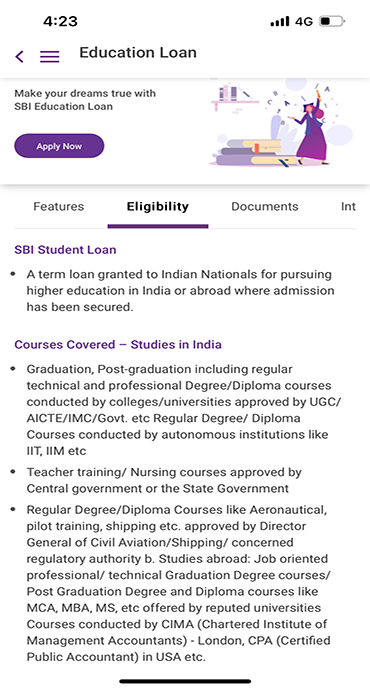

Eligibility for SBI PPF Account

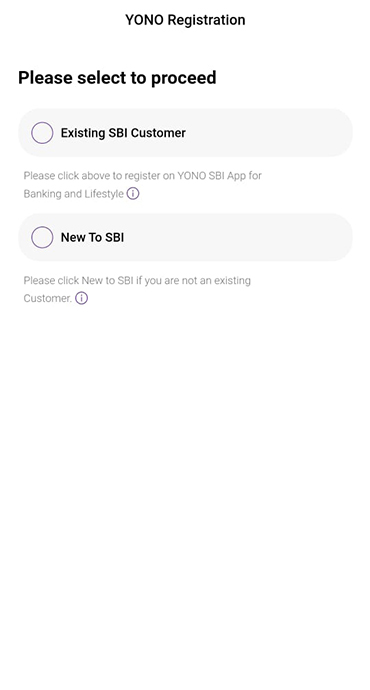

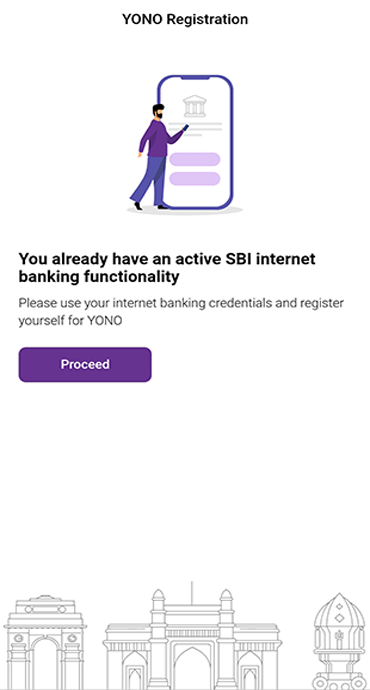

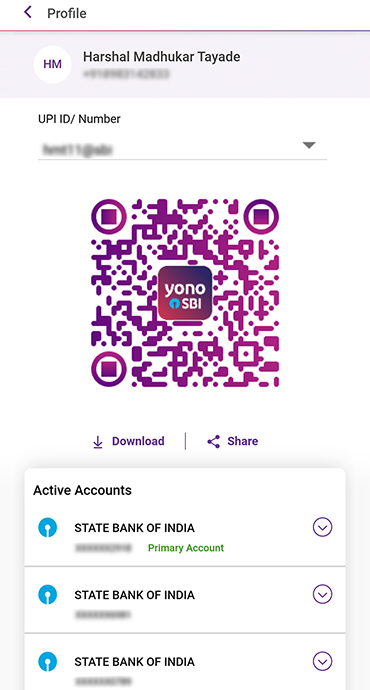

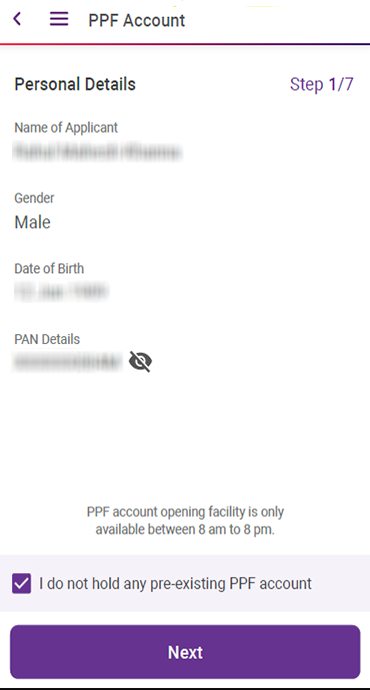

Any Indian resident above 18 years of age who are existing Bank (ETB) customers (registered on YONO SBI), having Aadhaar and PAN updated, can open a PPF account through YONO SBI app

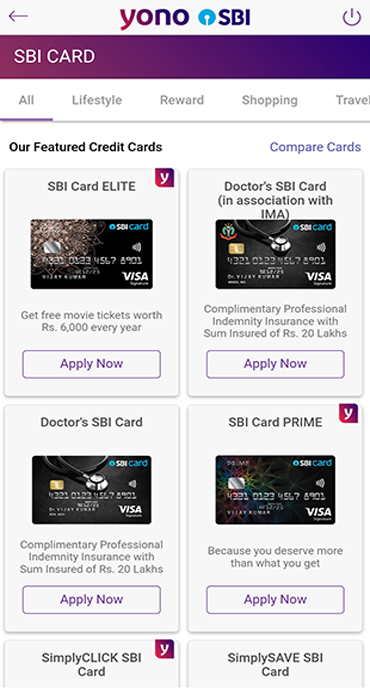

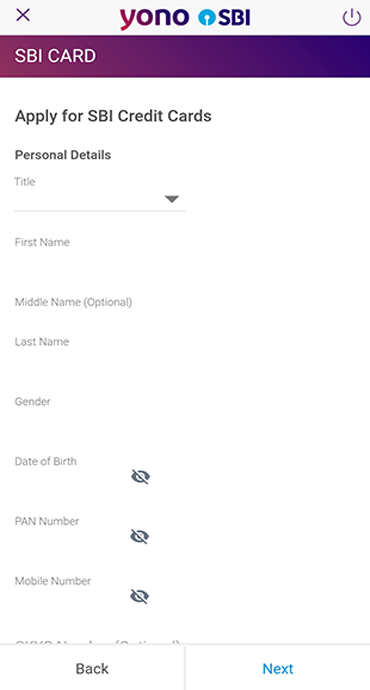

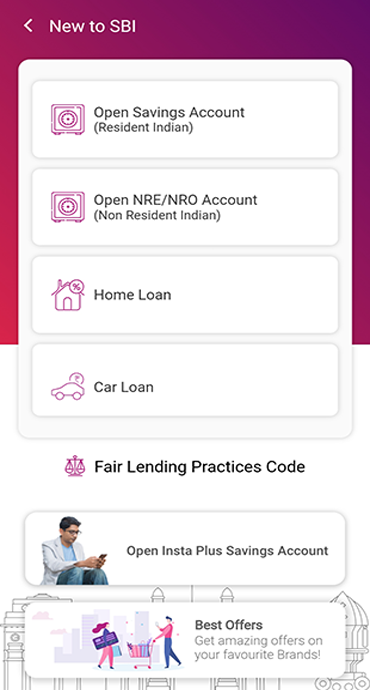

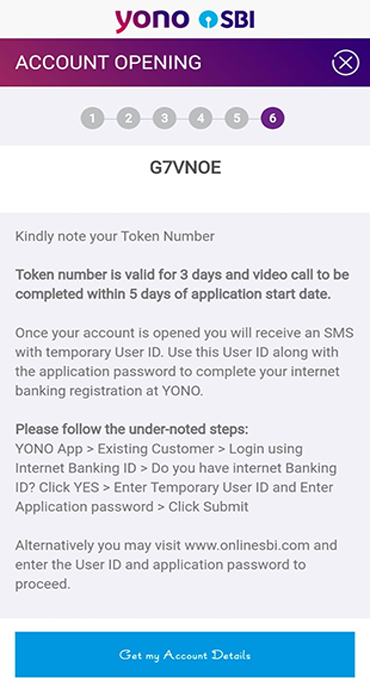

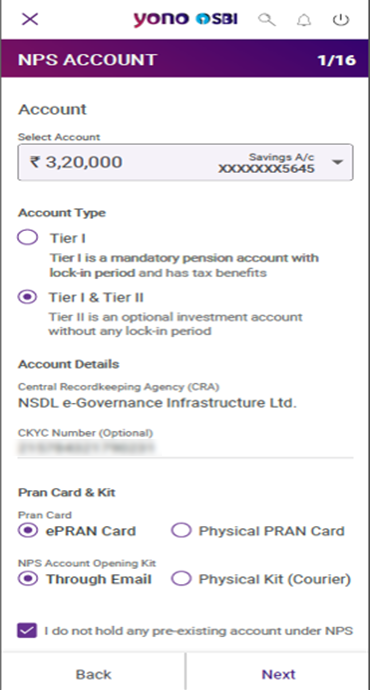

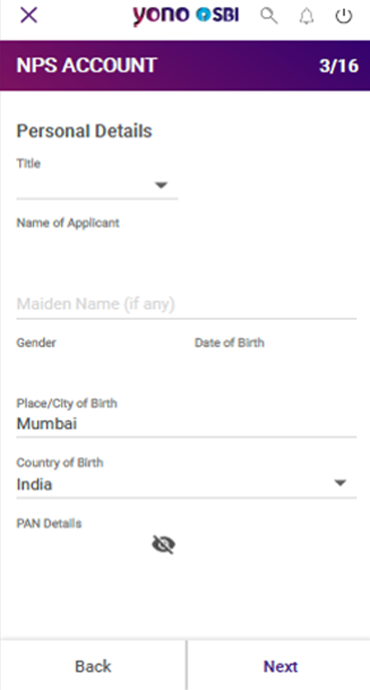

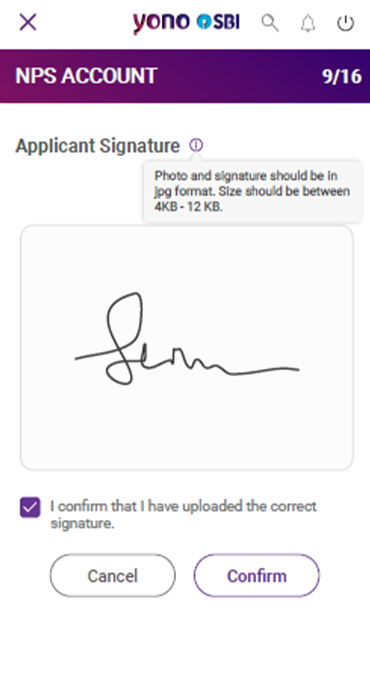

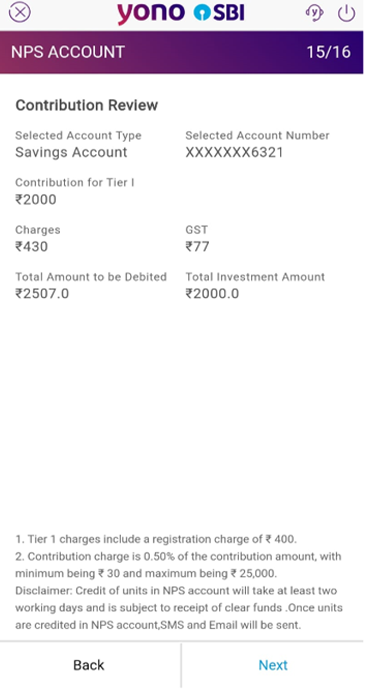

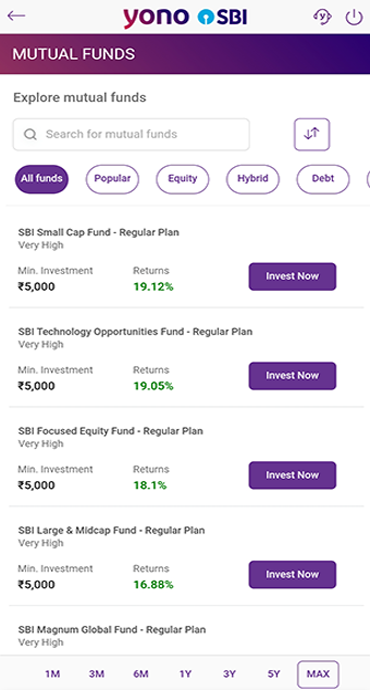

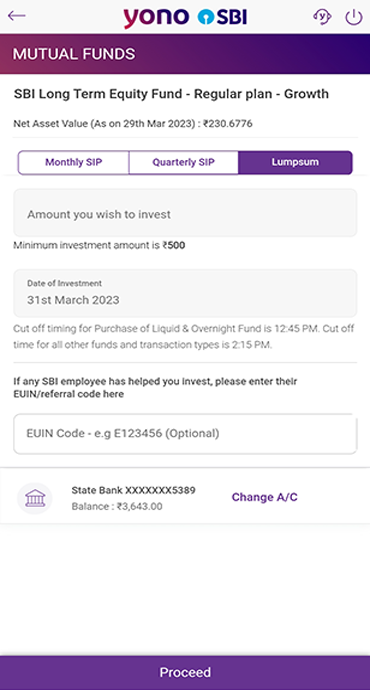

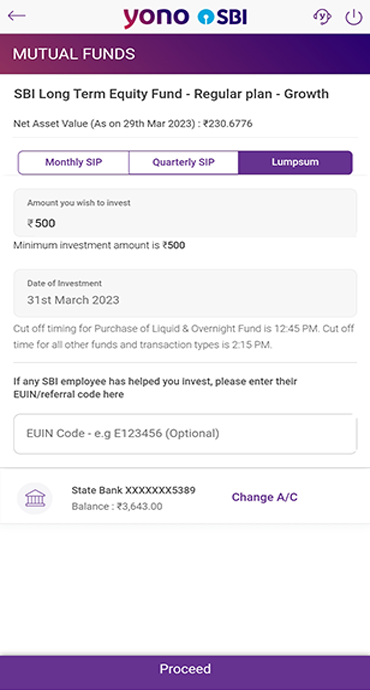

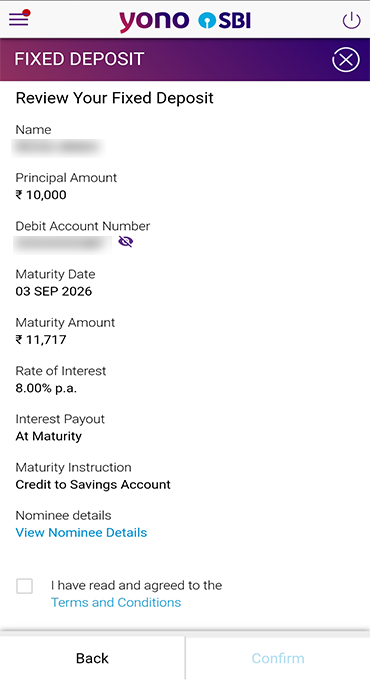

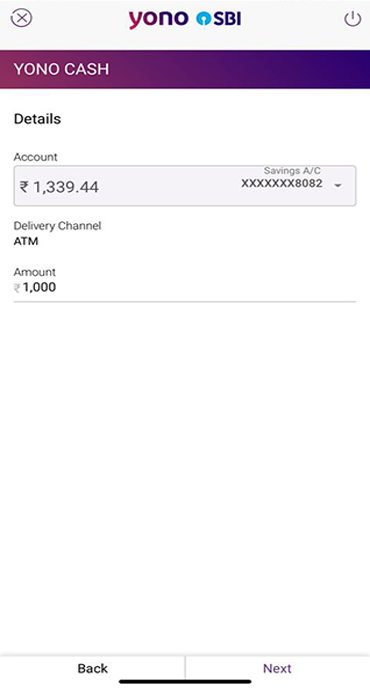

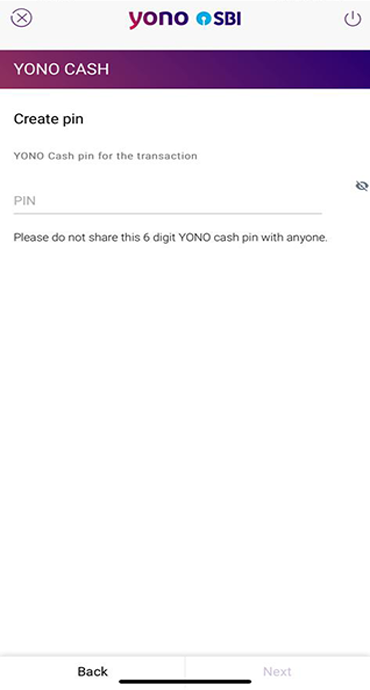

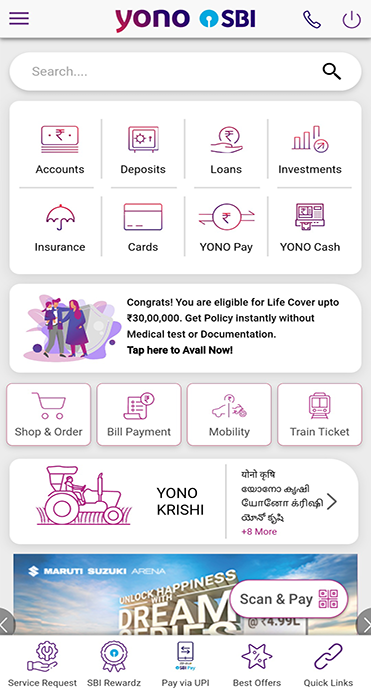

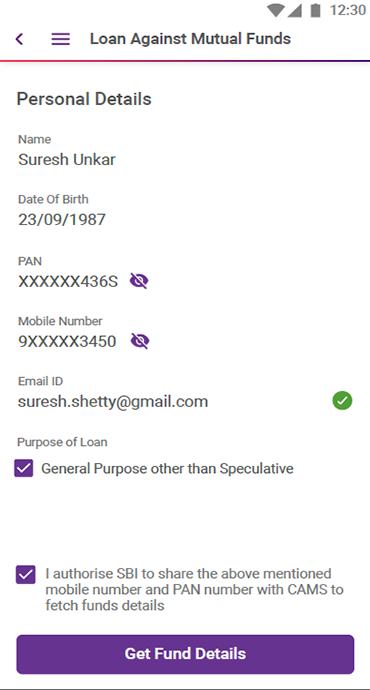

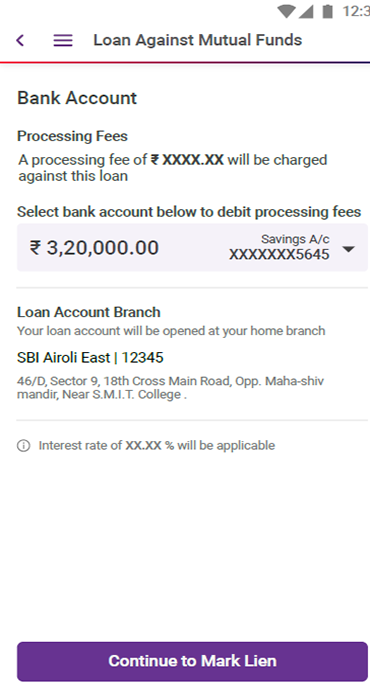

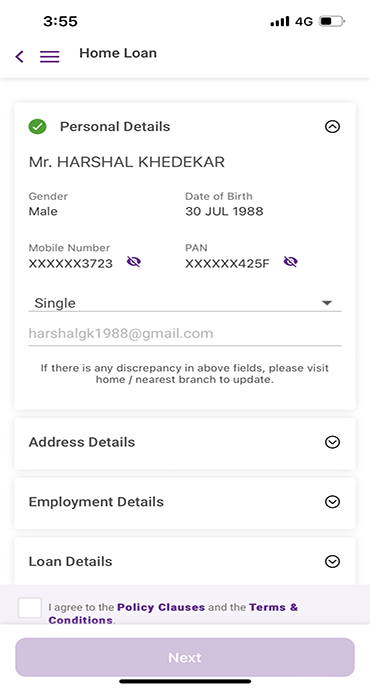

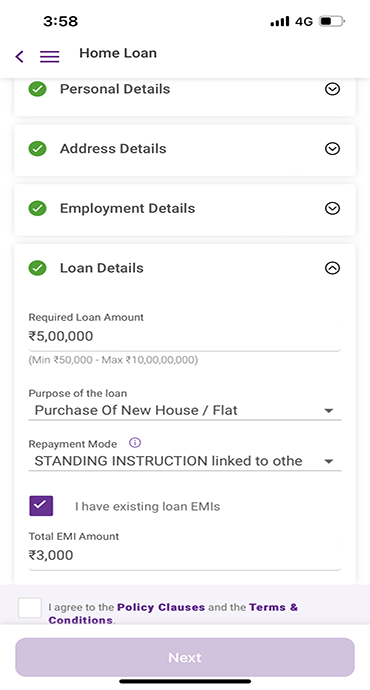

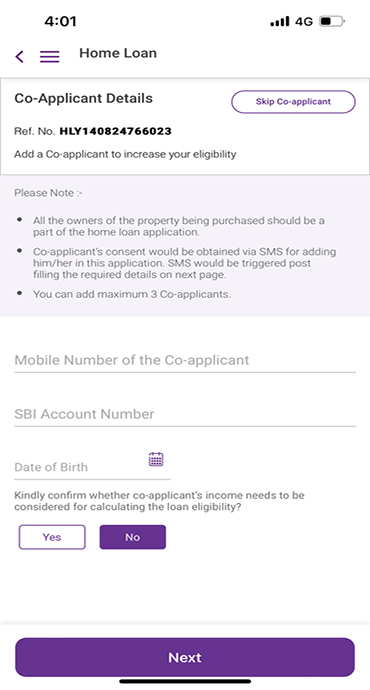

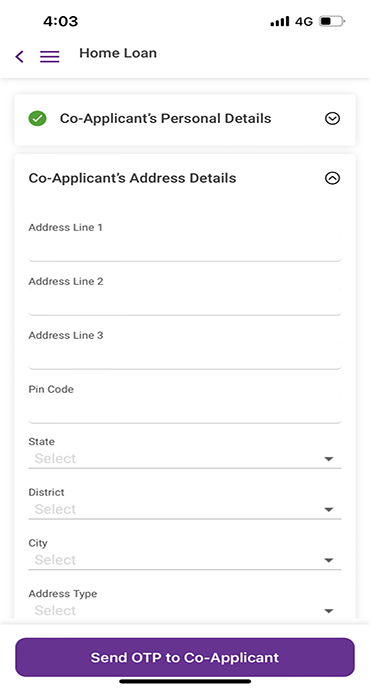

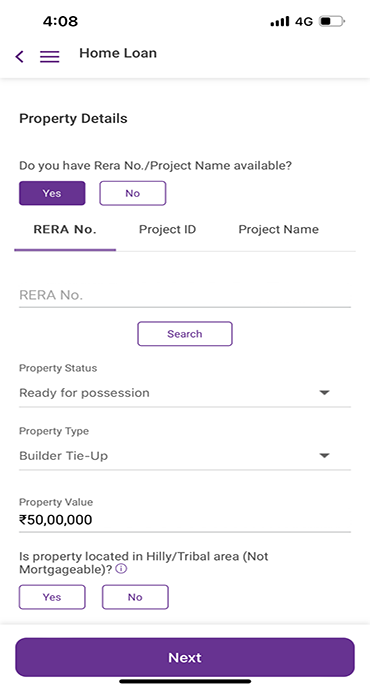

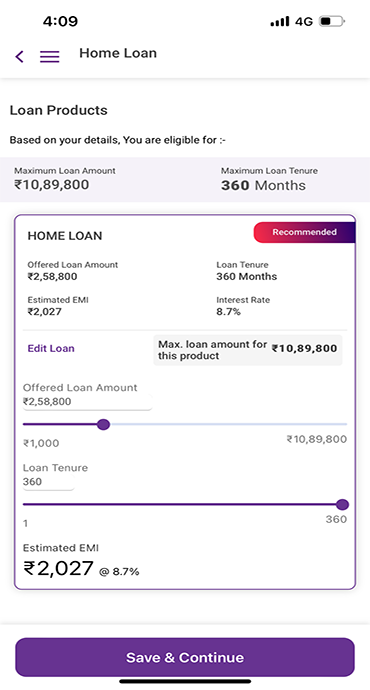

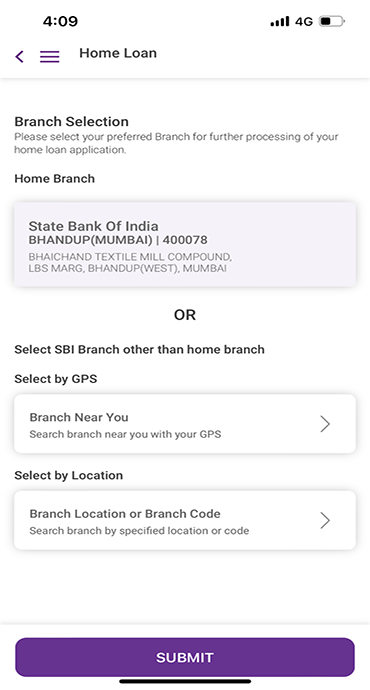

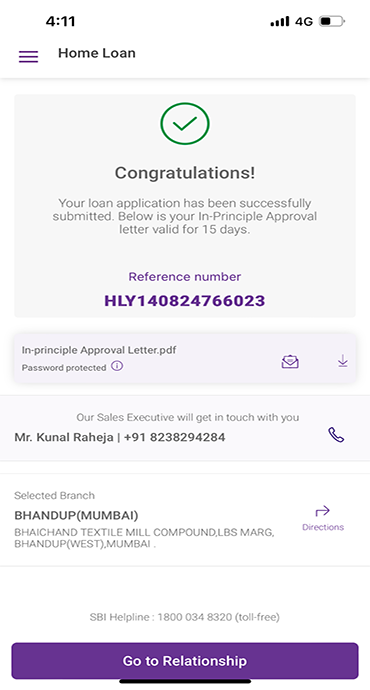

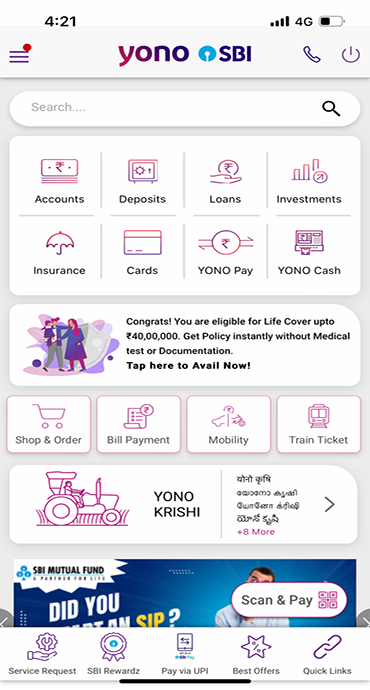

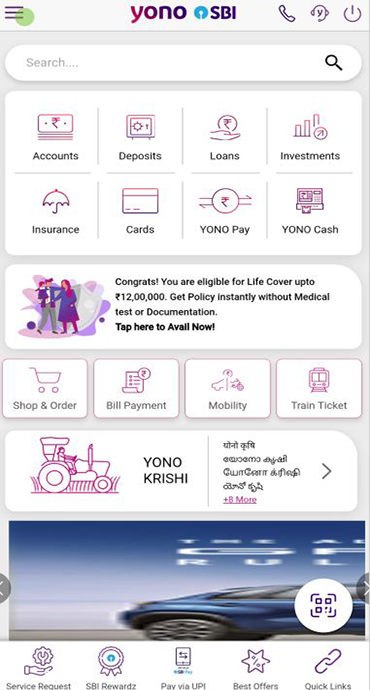

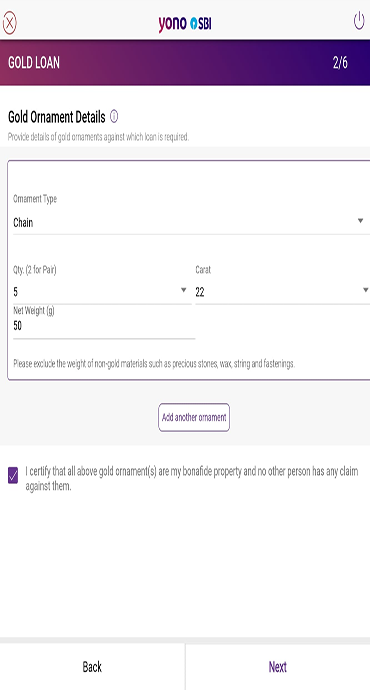

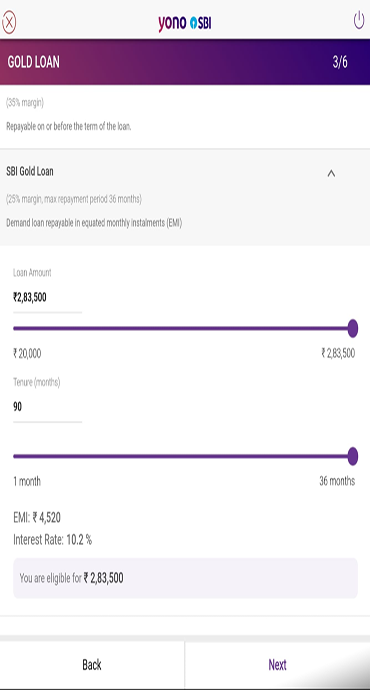

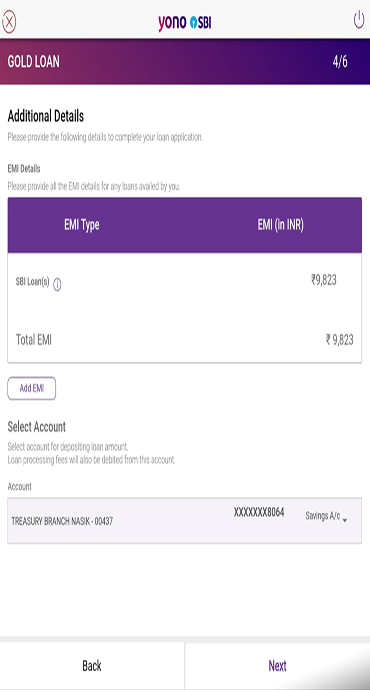

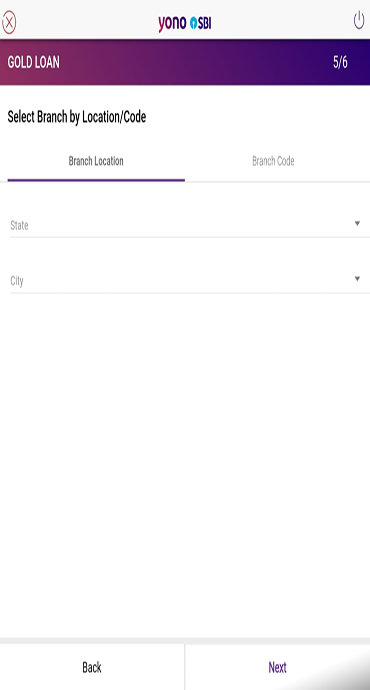

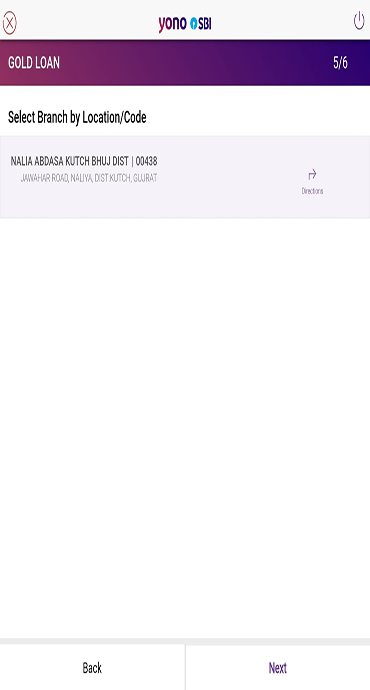

Step-by-Step Guide to Opening a PPF Account Online through the YONO SBI App

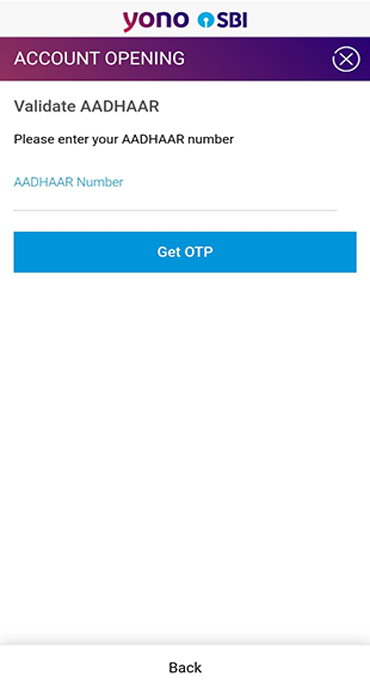

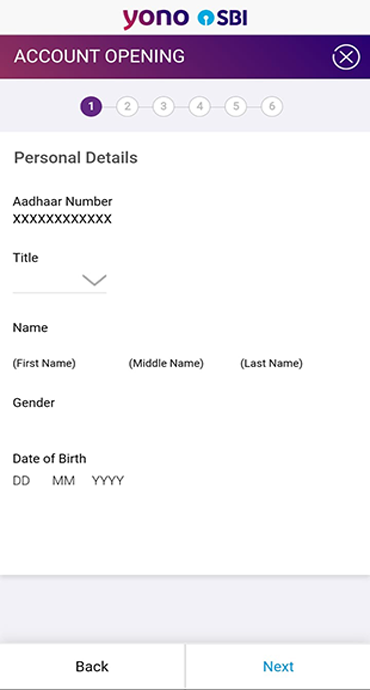

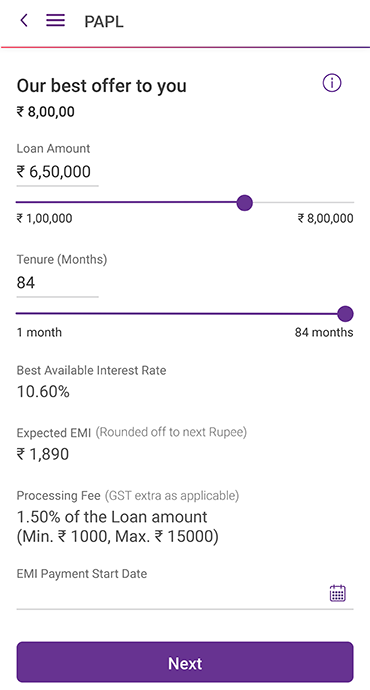

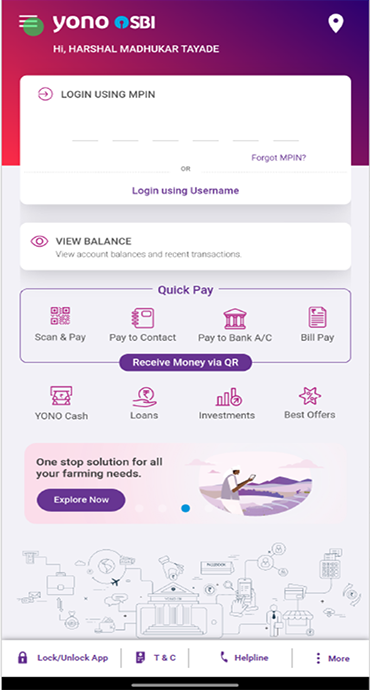

Wondering how to open PPF Account using the YONO SBI app. Here is quick and straightforward process.

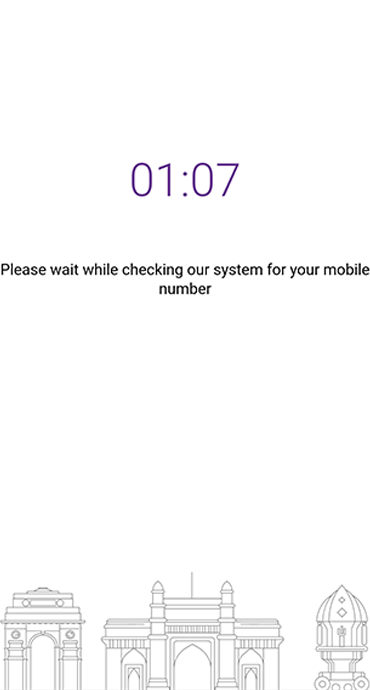

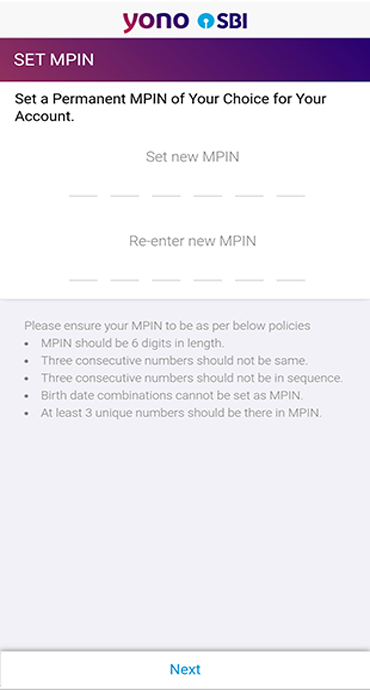

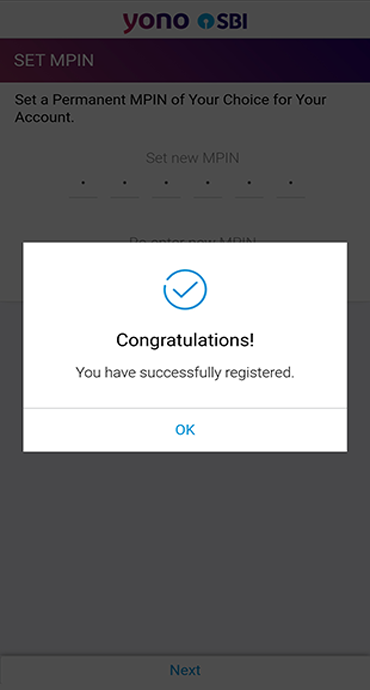

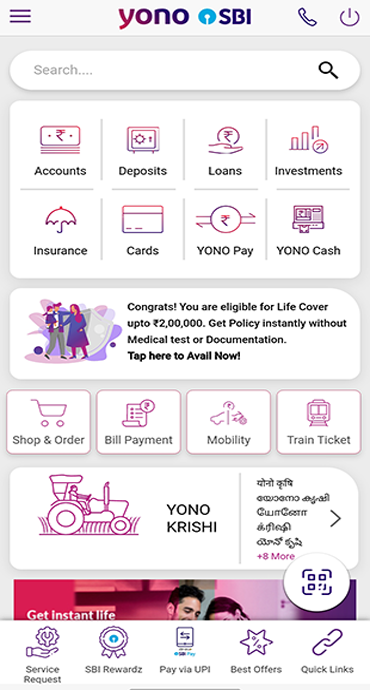

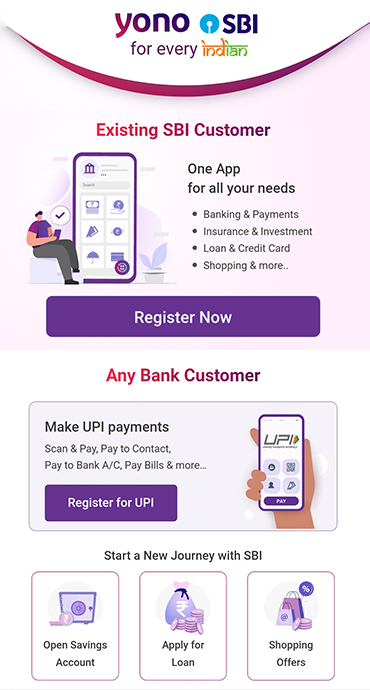

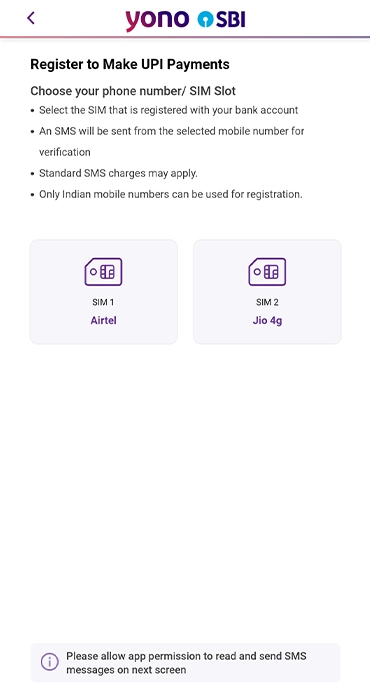

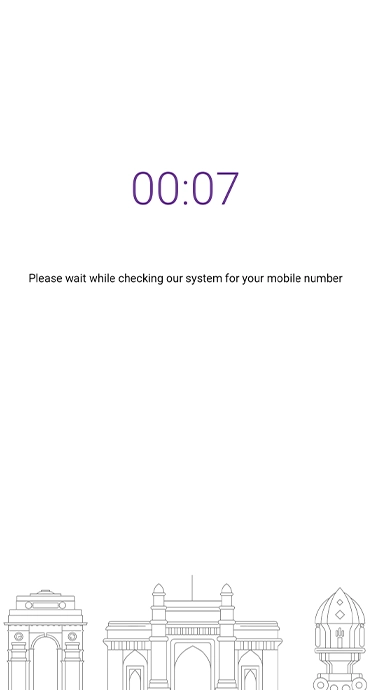

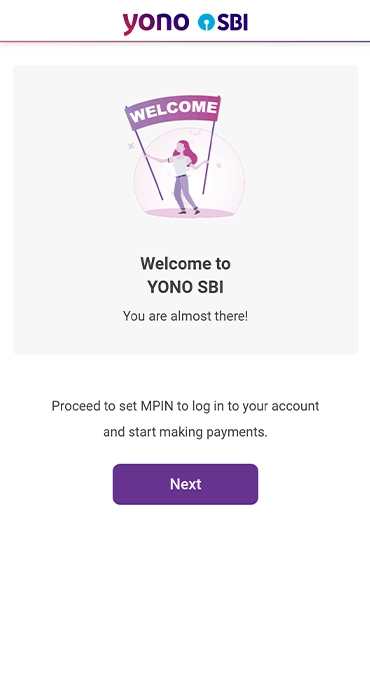

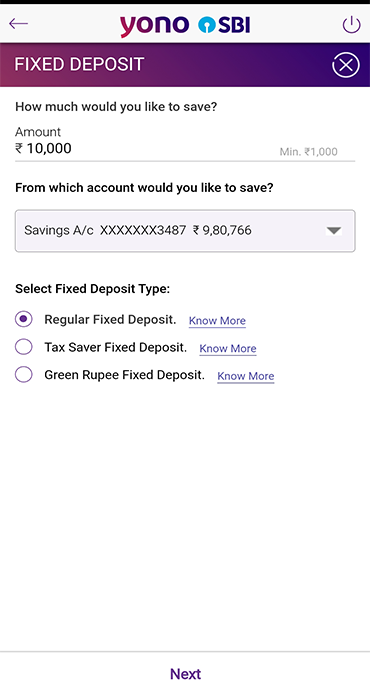

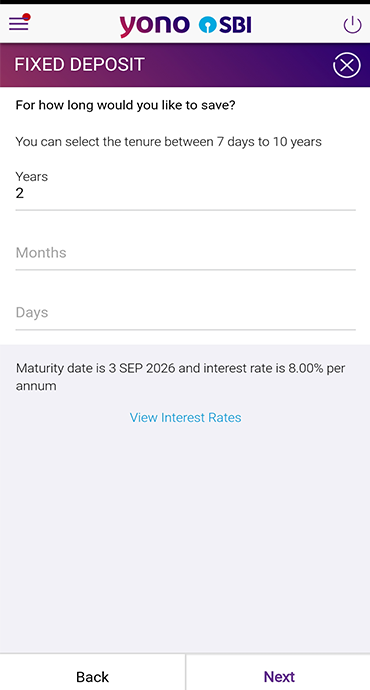

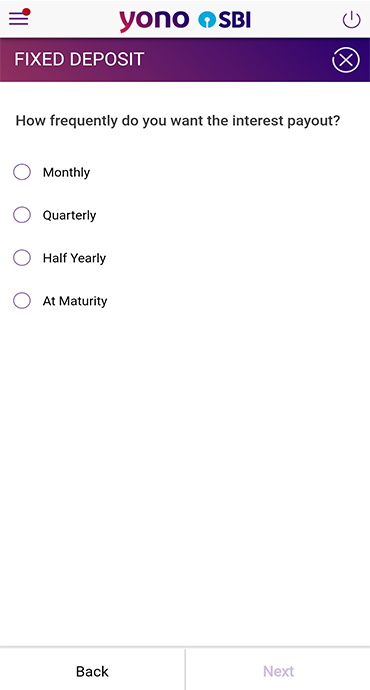

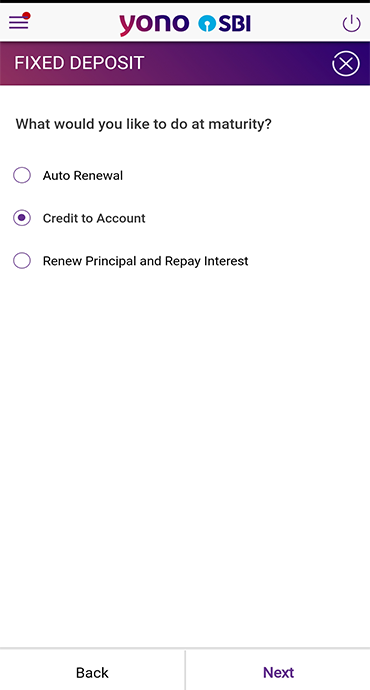

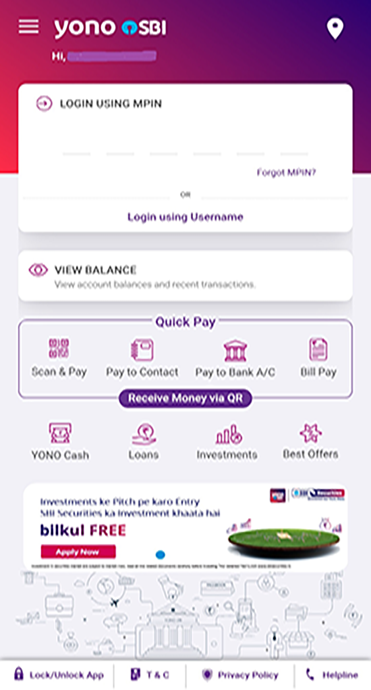

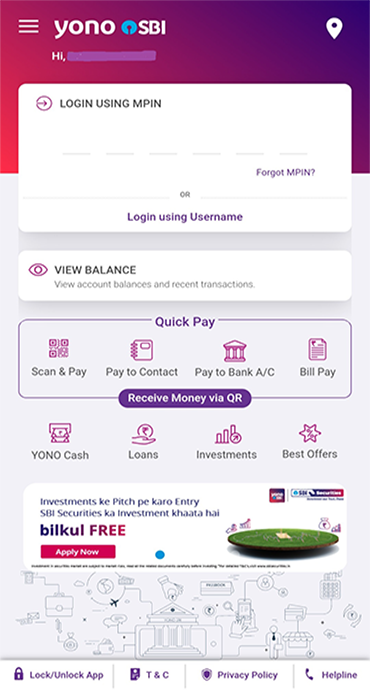

- Download the YONO SBI App from the Google Play Sore / App Store.

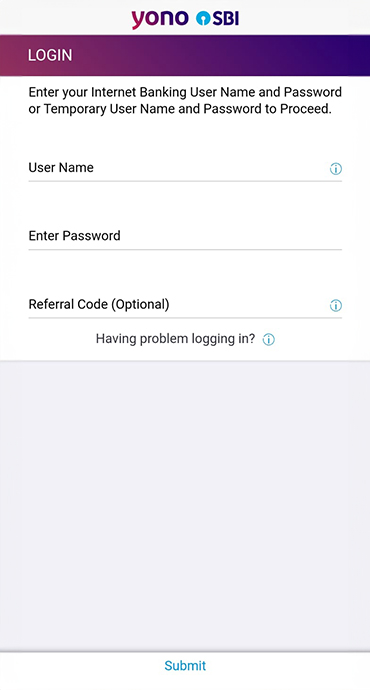

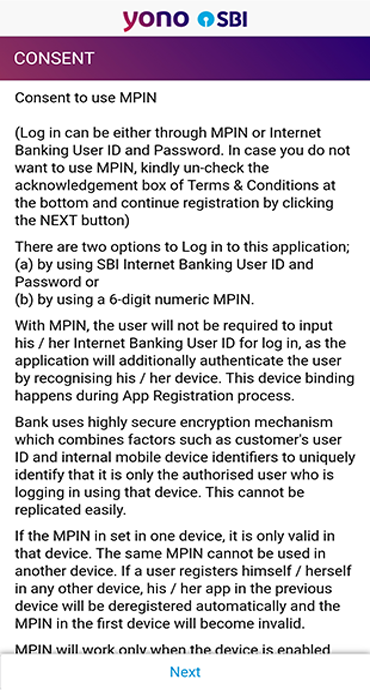

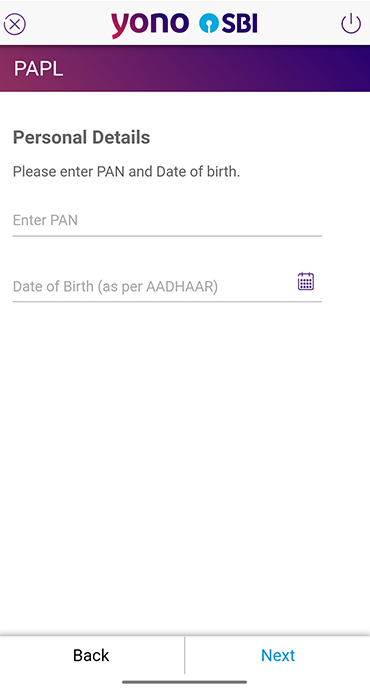

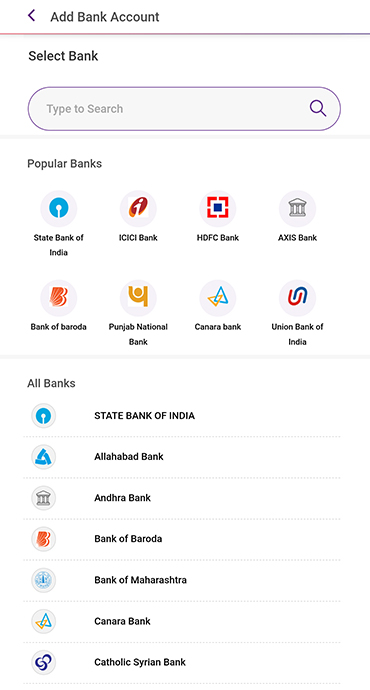

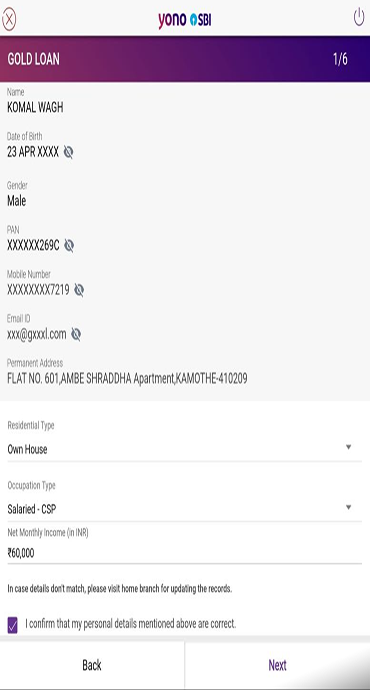

- Log in to your account using your credentials and ensure that your KYC details are up to date.

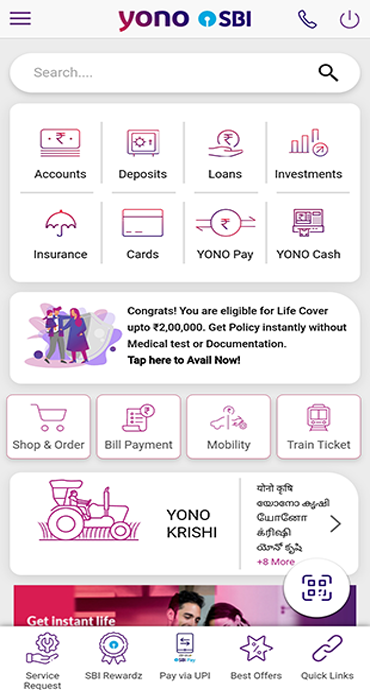

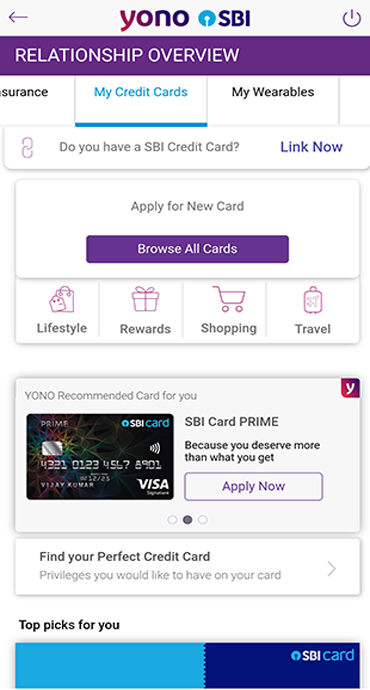

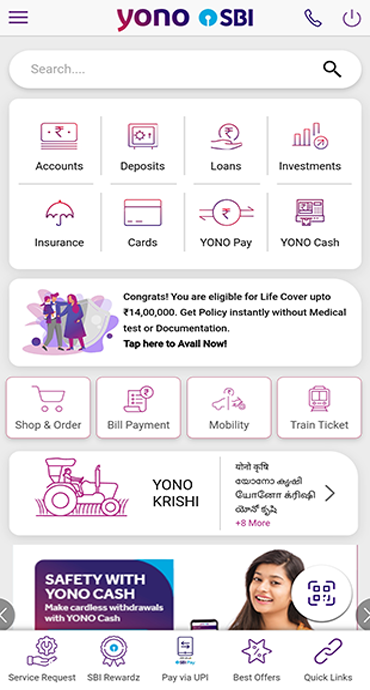

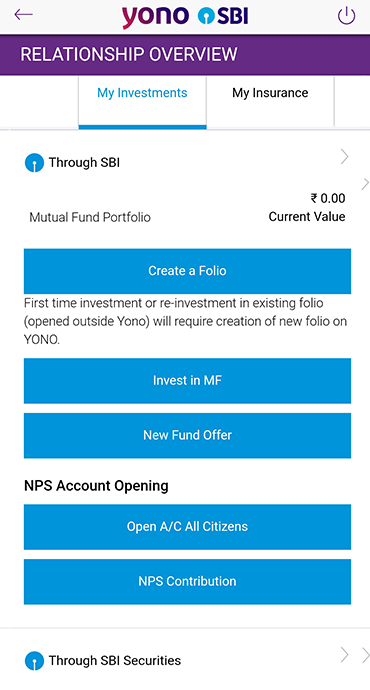

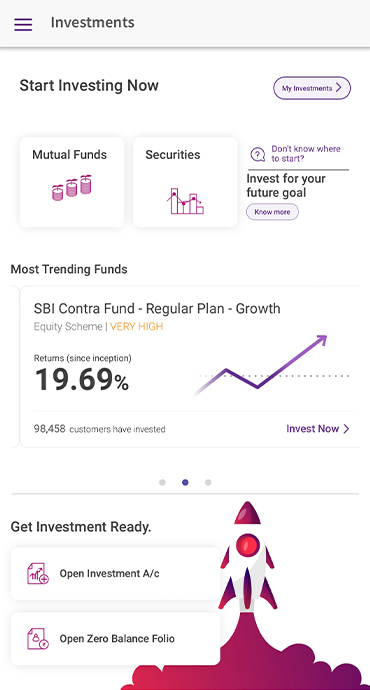

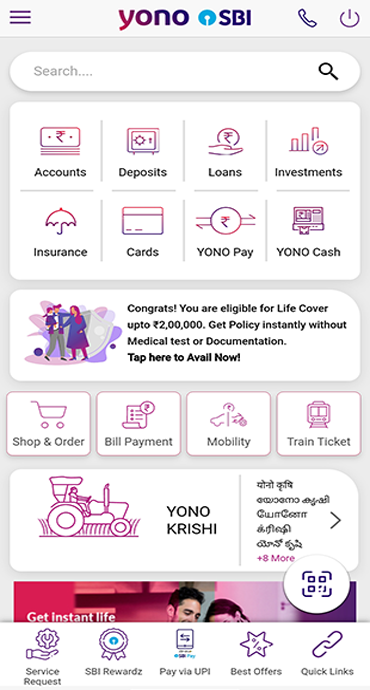

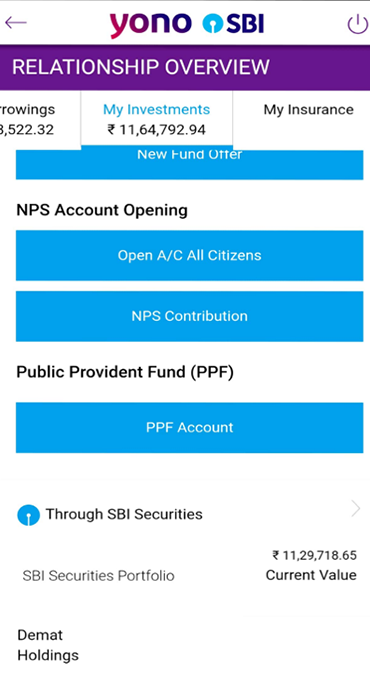

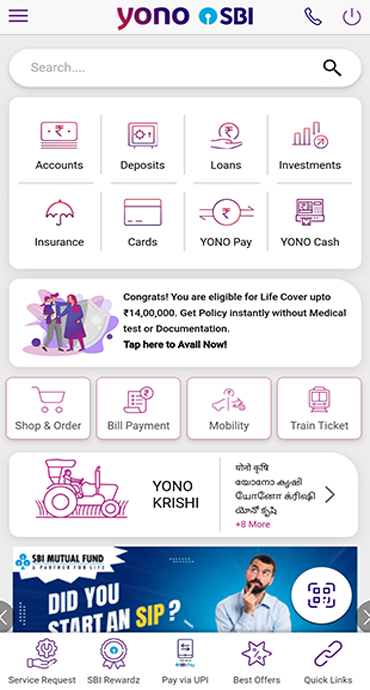

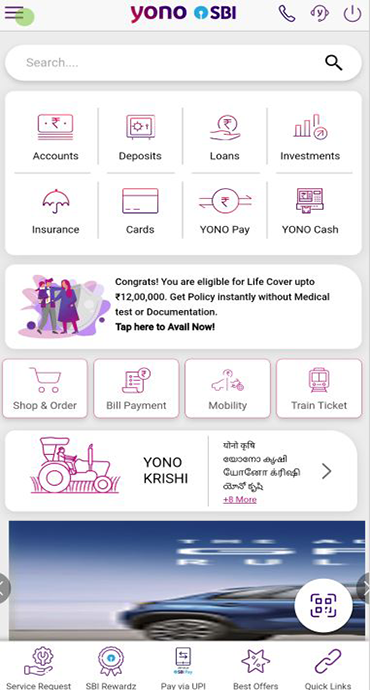

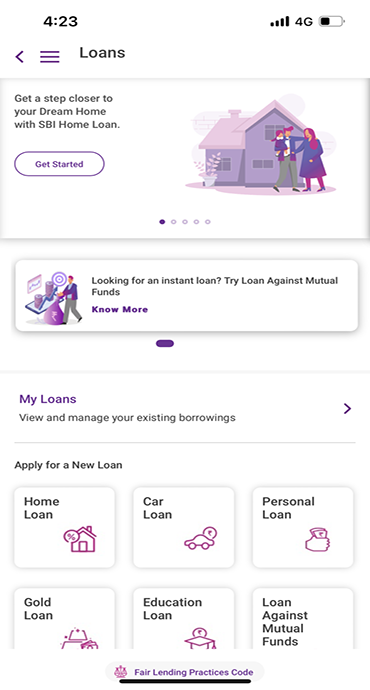

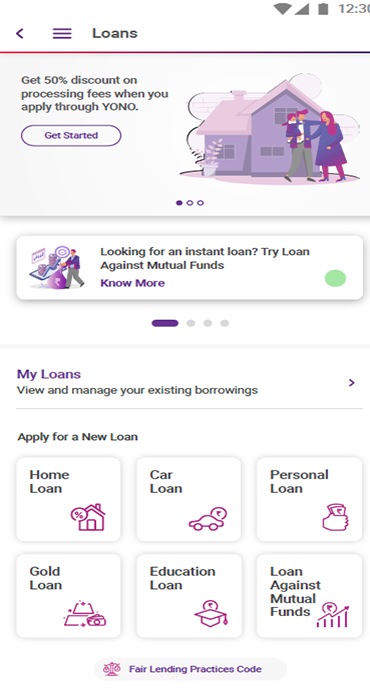

- Navigate to the 'Investments' section in the main menu of the app.

- Select ‘PPF Account' to initiate the process.

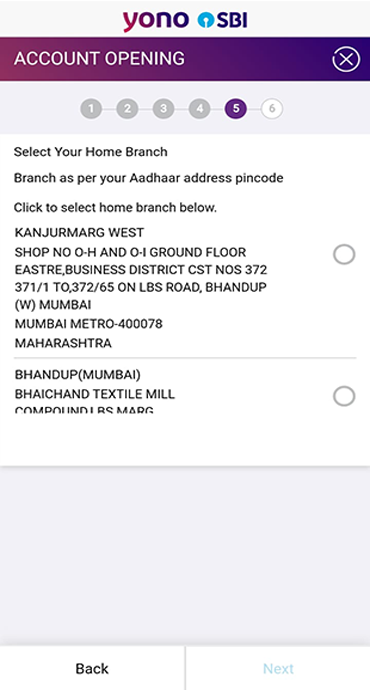

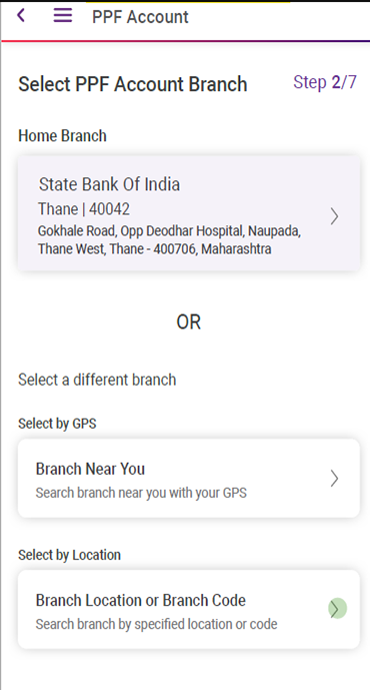

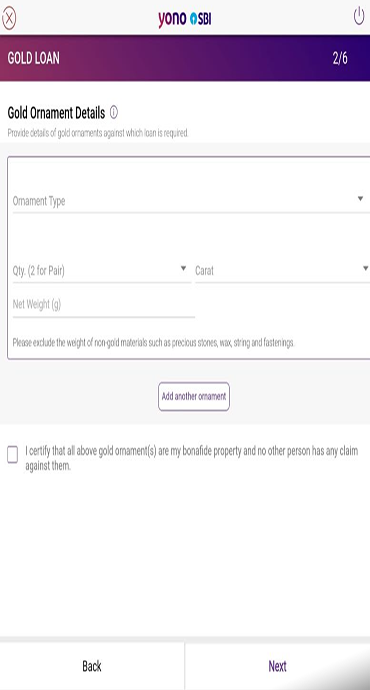

- Choose your preferred branch and add nominee details (up to four nominees).

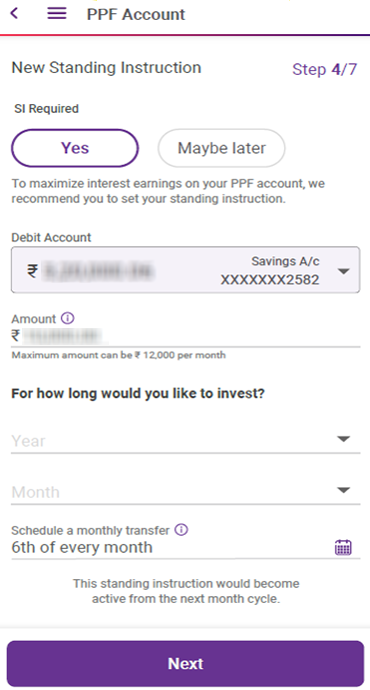

- Set up monthly standing instructions for contributions (optional)

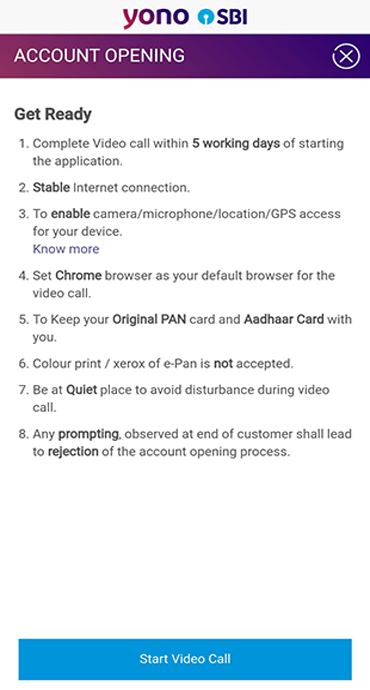

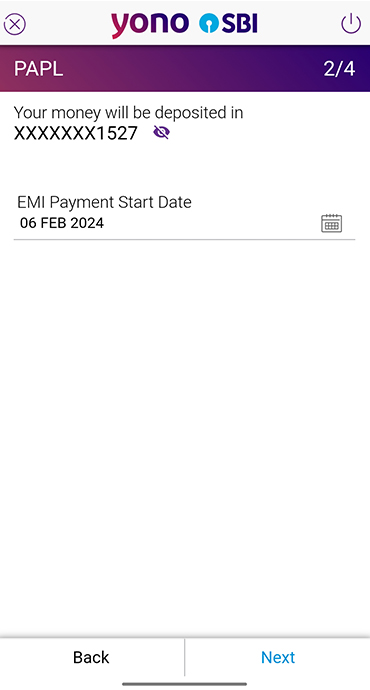

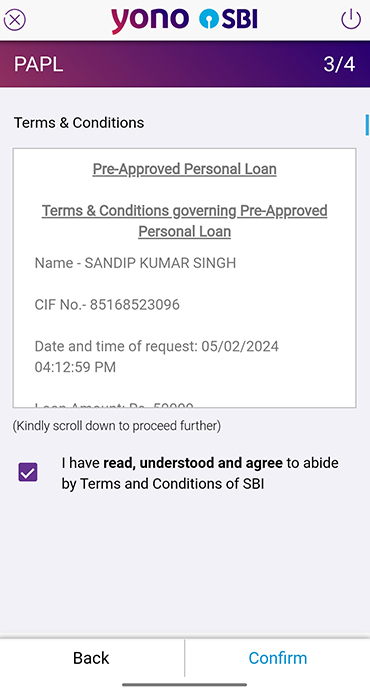

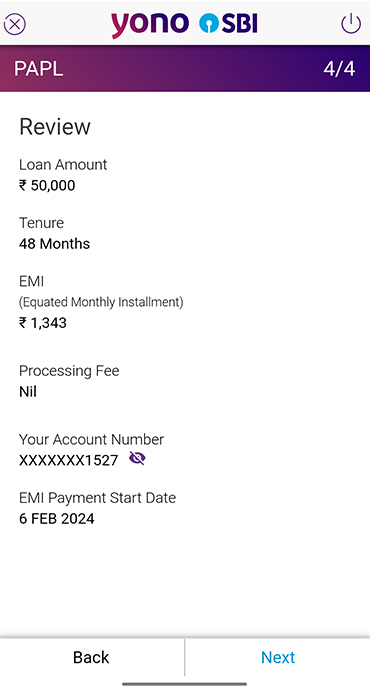

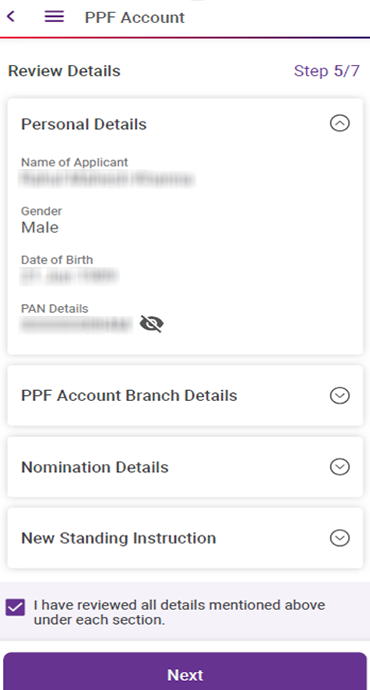

- Review the details, then acknowledge and accept the Terms and Conditions.

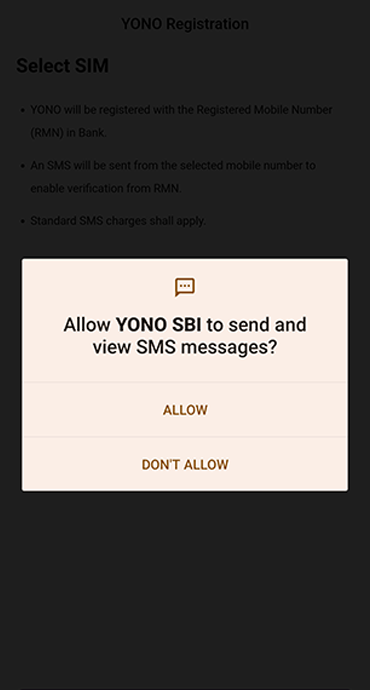

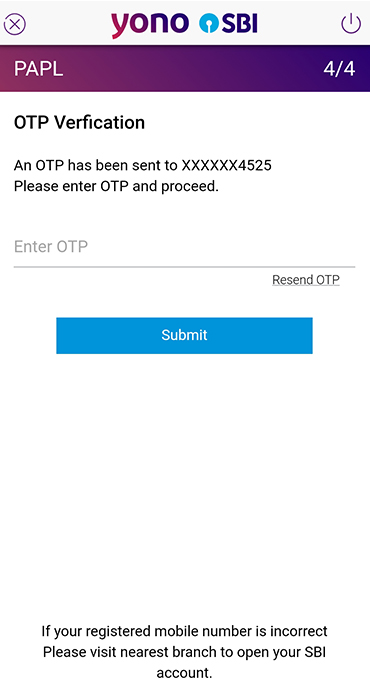

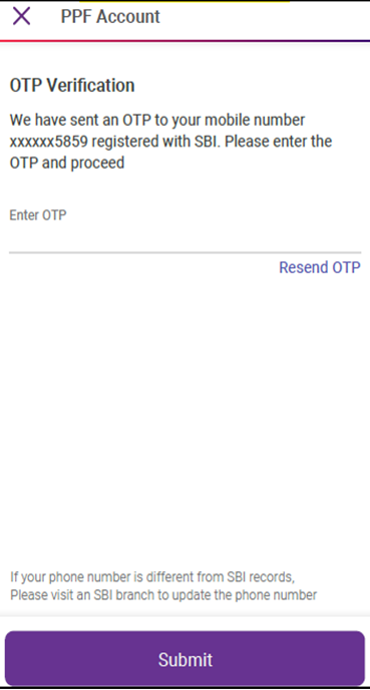

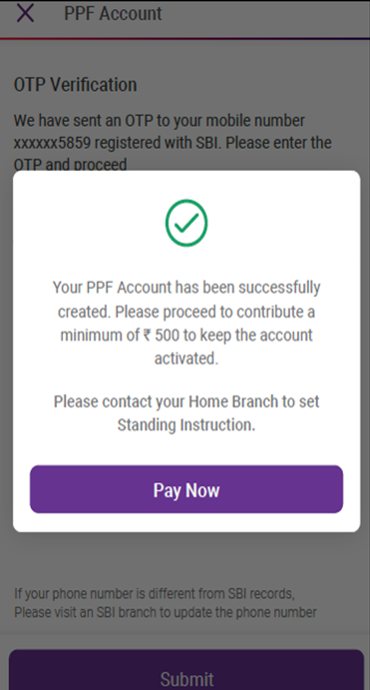

- Enter the OTP sent to your registered mobile number to proceed.

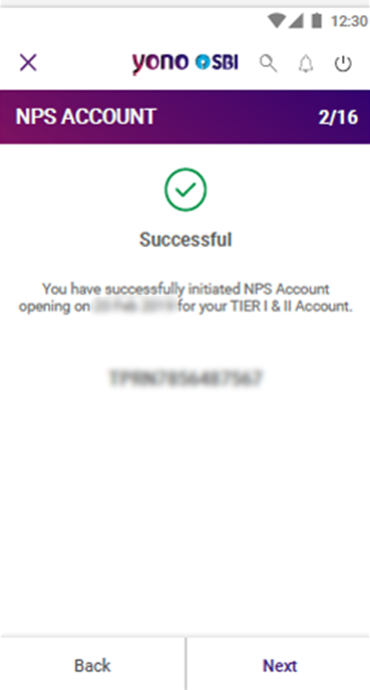

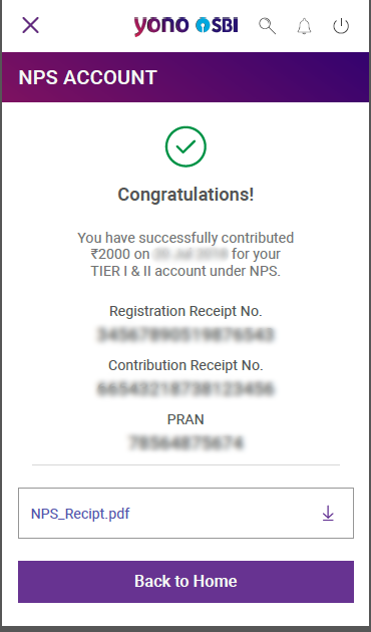

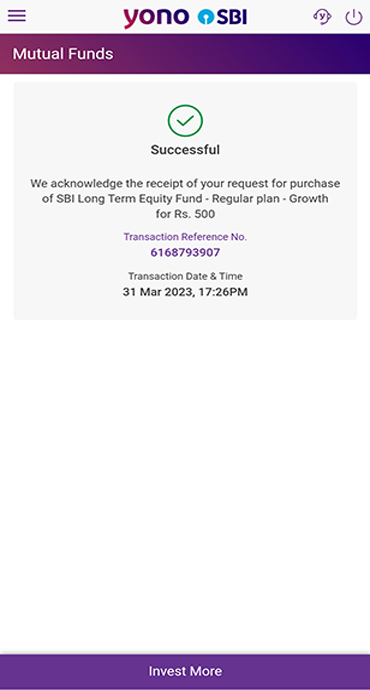

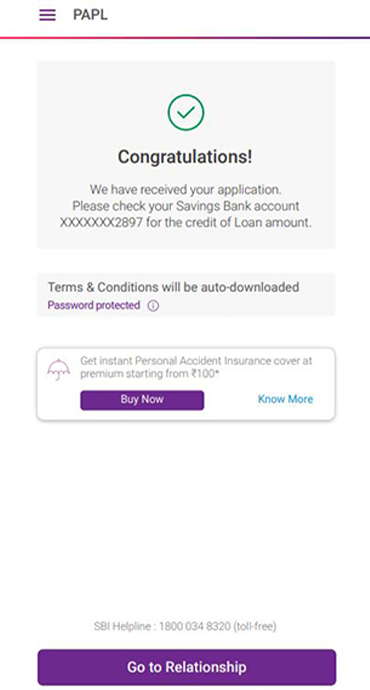

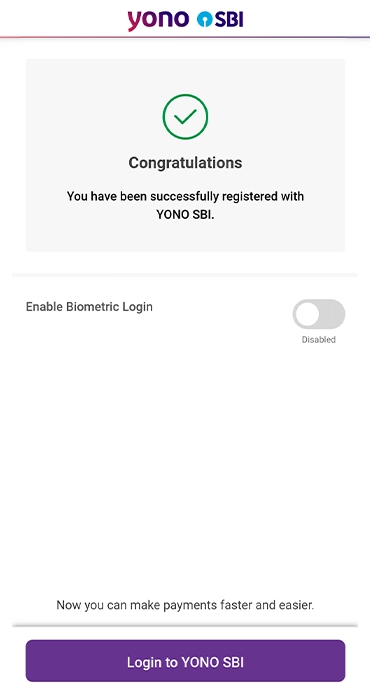

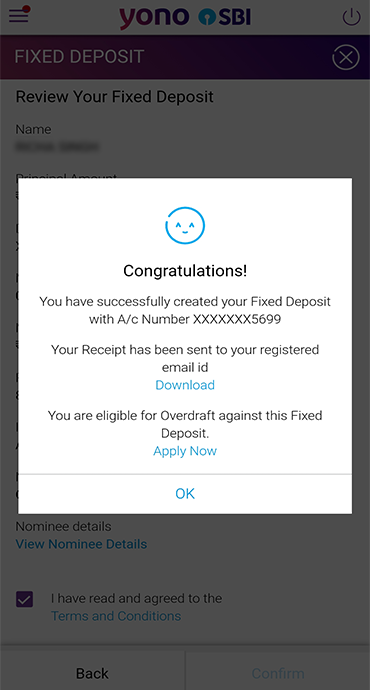

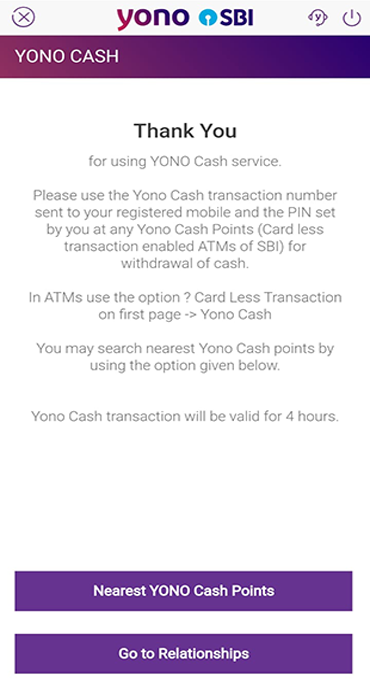

- Your PPF account is successfully created. Fund it immediately to activate.

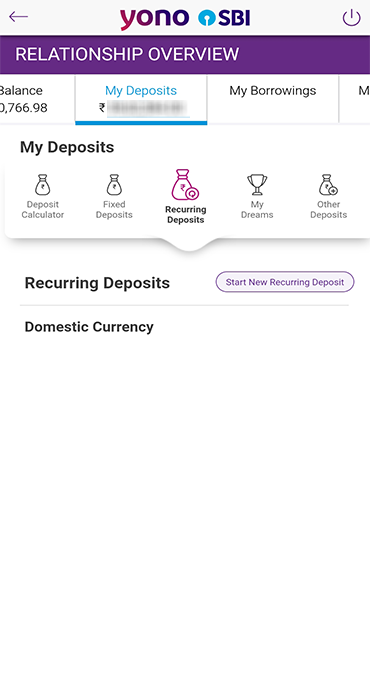

Managing Your PPF Account Online

The YONO SBI app makes it easy to manage your PPF account. Here's how:

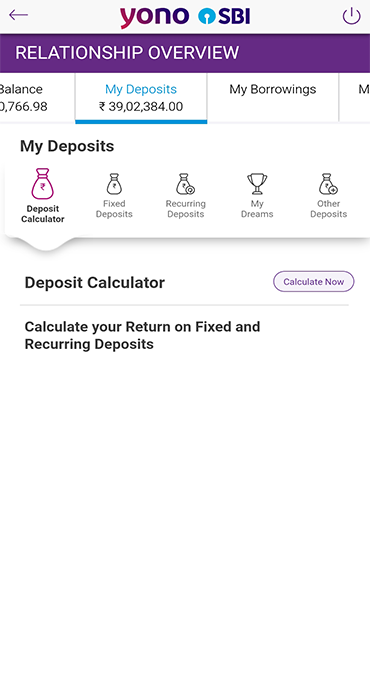

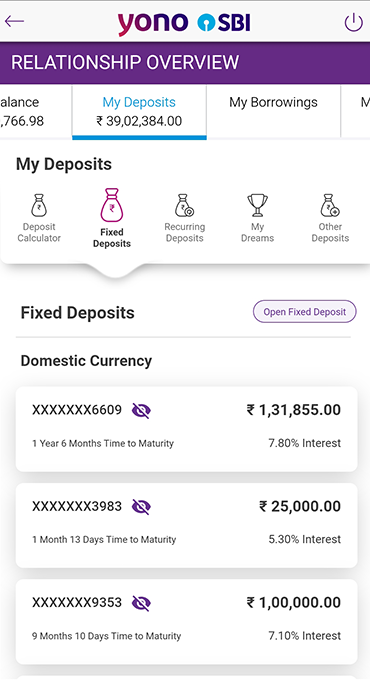

- Check your PPF Balance: Go to the Deposits > Other Deposits to view existing PF balance.

- Update Nominee Details: To update your nominee for the PPF account, you may navigate to Service Request > Account > Manage PPF Nominee wherein you can add, remove, or edit nominee details.

Grow Your Wealth with a PPF Account

To get the most out of your PPF account opening, follow these tips:

Understanding the power of Compound Interest

- PPF earns compound interest, with returns automatically reinvested.

- Longer investment durations leads to significantly higher returns.

- The PPF interest rate is compounded annually, enabling exponential growth over the 15-year maturity period.

- The quarterly revision of PPF interest rate by the government ensures that your returns remain aligned with the economic environment while providing stability.

Strategies for Optimal Contributions

- Contribute at the beginning of the financial year rather than the end.

- Early investments accumulate interest for the full year.

- Set up automatic transfers for consistent contributions.

Leveraging Tax Benefits

- Invest up to ₹1.5 lakh annually to maximize Section 80C tax benefits.

- Reduce your tax liability while securing long-term financial growth.

- Enjoy tax-free returns on both contributions and earned interest.

Secure Your Future with a PPF Account

A PPF account offers a secure and tax-free way to grow your wealth over the long term. With a competitive PPF interest rate of 7.10% that is revised quarterly, your savings grow steadily in a tax-efficient manner. Whether you're saving for retirement or simply looking for a reliable investment option, the PPF account is a great choice. With the YONO SBI app, managing your PPF account is easy and convenient.

YONO SBI enables you to begin your PPF journey today. Take charge of your secure financial future by downloading the app and opening a PPF account.

आपकी रुचि से संबंधित ब्लॉग