SBI Gold Loan: Interest Rates, Eligibility & Easy Digital Application - Yono

Maximise Your Gold's Value: SBI Gold Loan Schemes Demystified

21 Aug, 2025

gold loan

Gold Loans: A Smart and Reliable Financial Solution

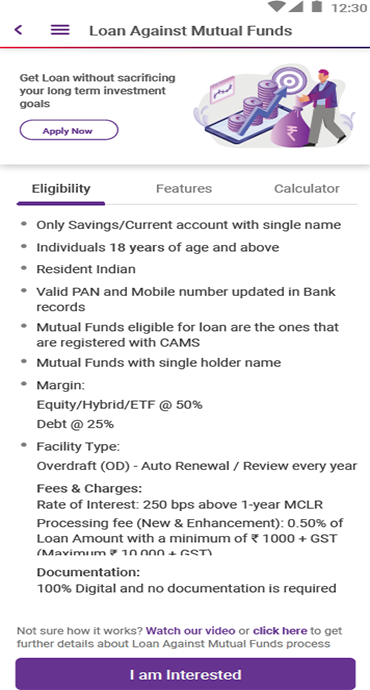

Gold has been a trusted asset in Indian households for generations. Today, your gold jewellery can do more than just adorn your collection - it can provide quick financial support when you need it most. What is gold loan? Simply put, it's a secured loan where you pledge your gold jewellery or ornaments as collateral to obtain funds from SBI.

Gold loans leverage your valuable gold assets and can be processed quickly. This makes them an excellent option for addressing immediate cash requirements while keeping your long-term financial planning intact. With competitive gold loan interest rates and flexible repayment options, SBI offers a convenient way to unlock the value of your gold when you need additional funds.

Busting Common Myths About Gold Loans

Despite the growing popularity of gold loans, several misconceptions prevent people from leveraging their gold assets effectively.

Myth 1: "I'll Lose My Gold If I Take a Gold Loan”

Reality: Utilizing Gold as an Asset

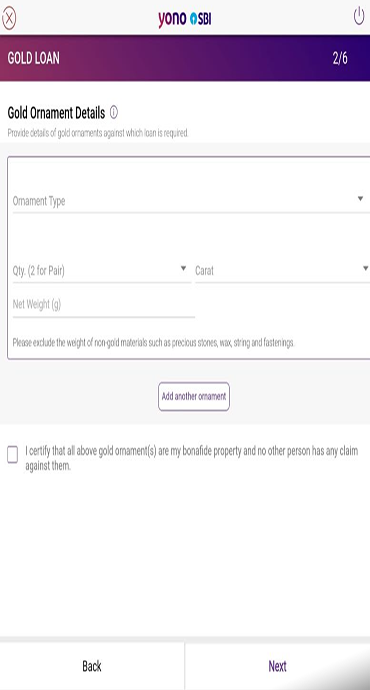

Your gold jewellery isn't just ornamental - it's a valuable financial asset. SBI Gold Loans allow you to unlock this value without selling your precious gold. The quality and purity of your gold (18-24 carats) directly determines its value and the loan amount you can receive. The best part? Once you repay the loan, your gold ornaments will be returned to you in the same condition.

Myth 2: "My Credit Score Will Be Affected"

Reality: Minimal Impact on Credit Score

SBI Gold Loans offer a unique advantage for those seeking funds without impacting their credit eligibility for other financial products. Since these loans are secured by your gold assets, they provide a separate borrowing avenue that complements your overall financial portfolio. This allows you to address immediate financial needs while preserving your eligibility for other important financial products like home loans or auto loans in the future.

Myth 3: "The Application Process Is Complicated"

Reality: Quick Approval & Minimal Documentation

When financial emergencies strike, such as unexpected medical expenses, urgent home repairs, or educational fee deadlines, waiting days for loan approval isn't practical. SBI Gold Loans offer swift processing with minimal documentation requirements. All you need is proof of identity and address making it an instant gold loan solution for urgent needs.

Myth 4: "Gold Loans Have High Interest Rates"

Reality: Competitive Gold Loan Interest Rates

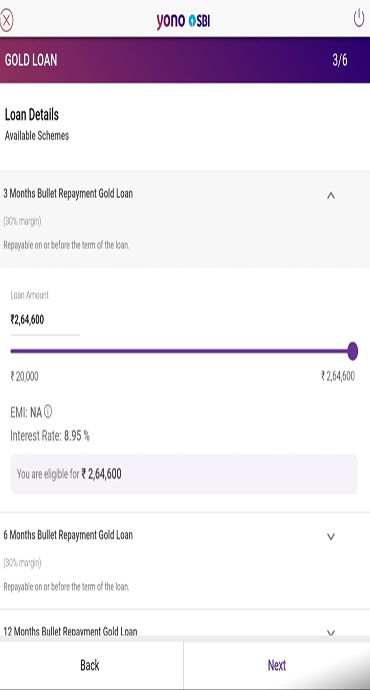

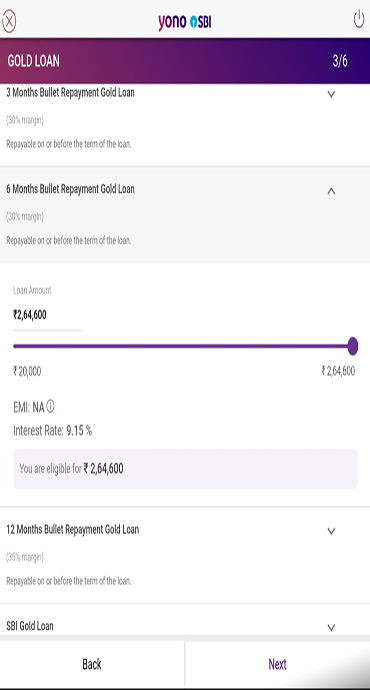

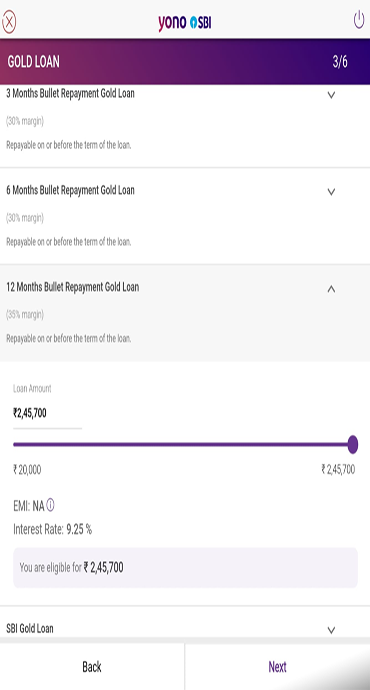

SBI offers some of the most competitive gold loan interest rates in the market. Loans is a cost-effective borrowing option compared to personal loans or credit cards.

Myth 5: "Gold Loans Have Rigid Repayment Terms"

Reality: Flexible Repayment Options

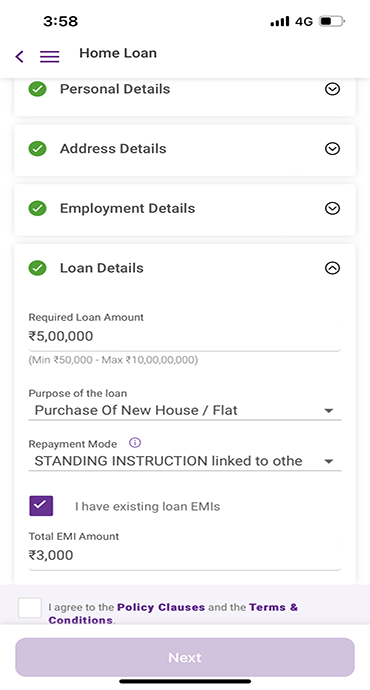

SBI understands that different customers have different financial situations. That is why their gold loan schemes offer multiple gold loan repayment options - from bullet payments at the end of the term 3 months, 6 months, or 12 months to regular EMI structures that fit your budget. Additionally, your pledged gold remains completely secure in SBI's state-of-the-art vaults with advanced security systems, comprehensive insurance coverage, and strict handling protocols, giving you complete peace of mind throughout the loan tenure.

Applying for an SBI Gold Loan: Easy & Convenient

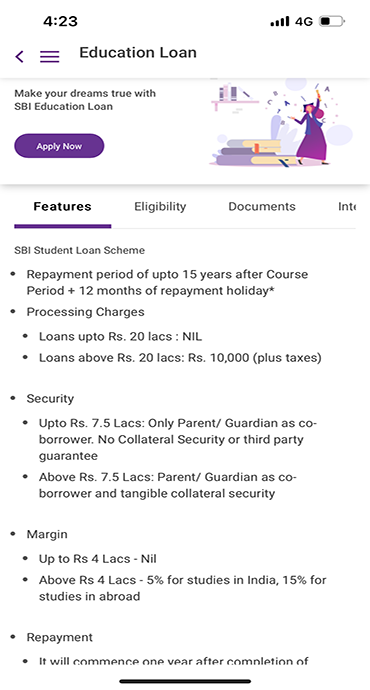

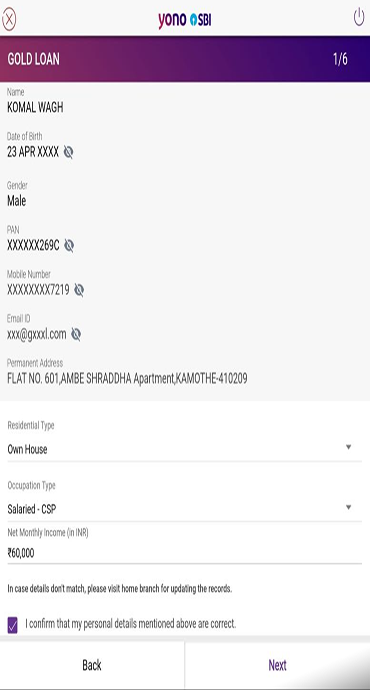

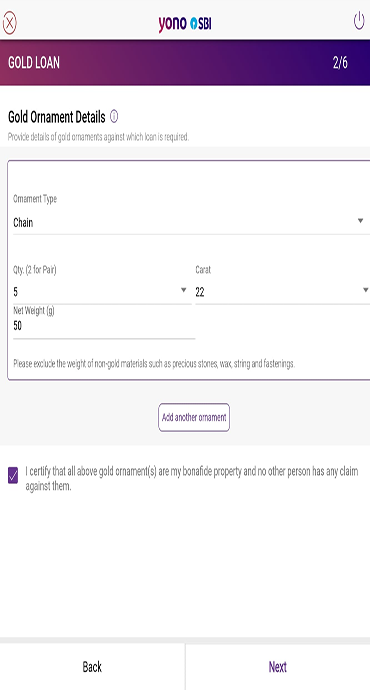

- Gold Purity Requirement – The gold should typically be between 18-24 carats to be accepted as collateral.

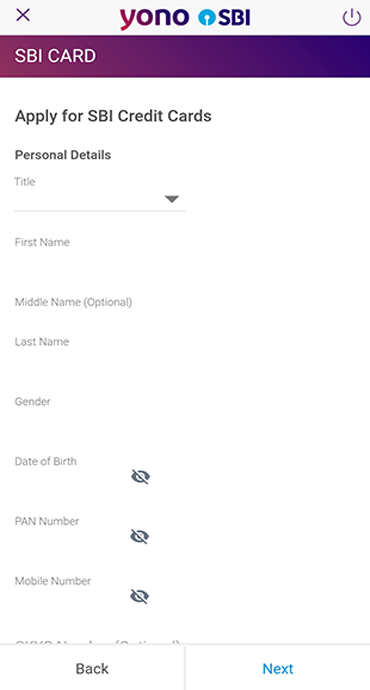

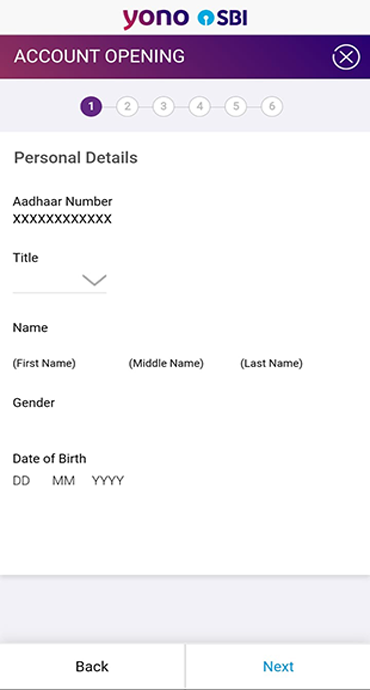

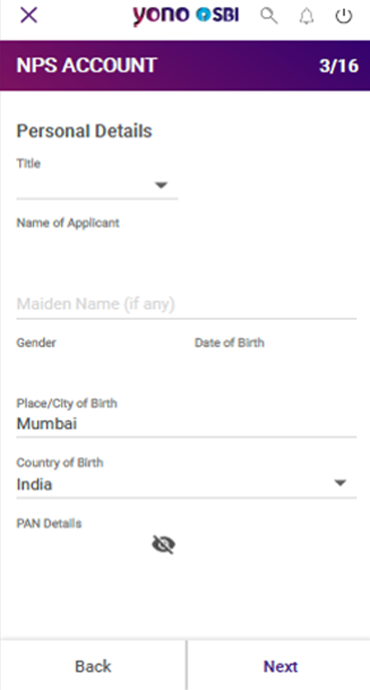

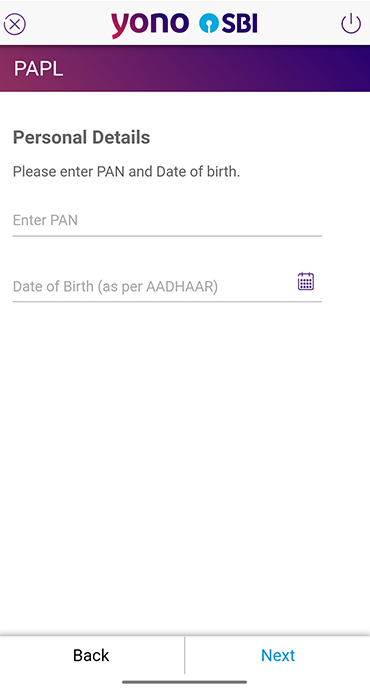

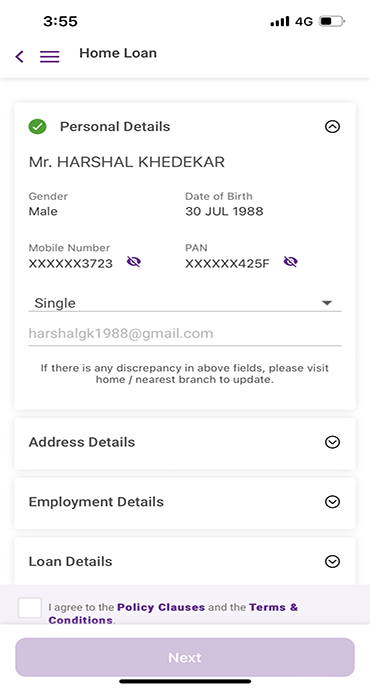

- Basic Documentation – Applicants need to provide essential documents such as identity proof, address proof, and passport size photographs.

- Age Criteria – Resident Indian of 18 years and above to meet the gold loan eligibility requirements.

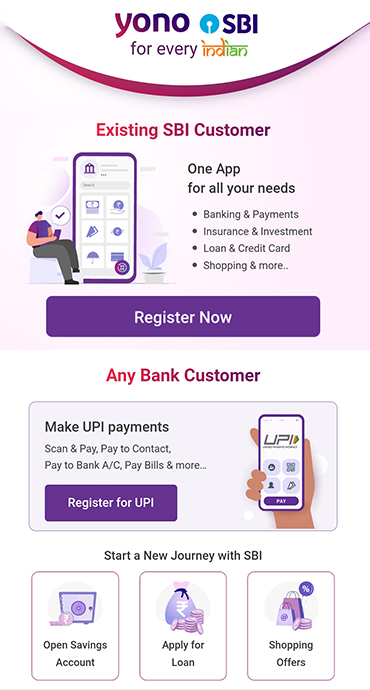

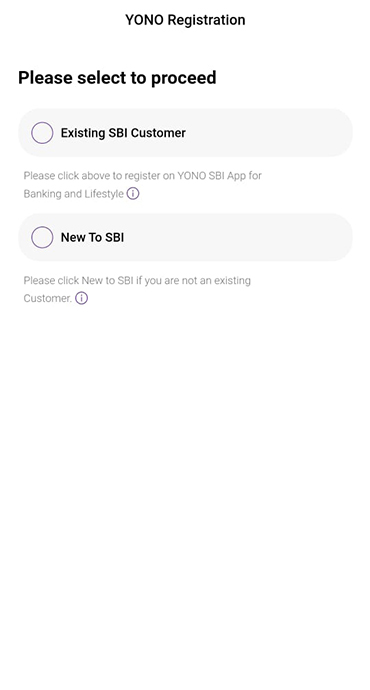

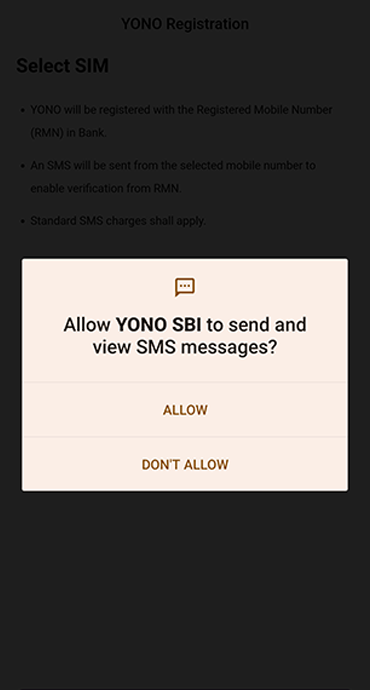

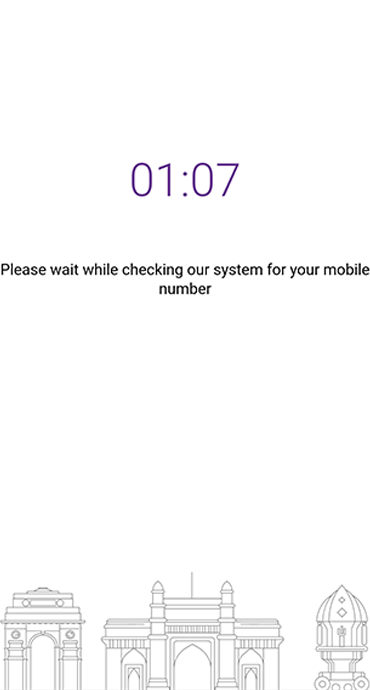

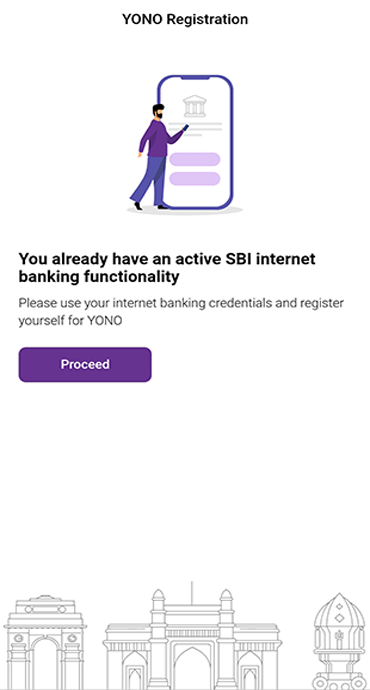

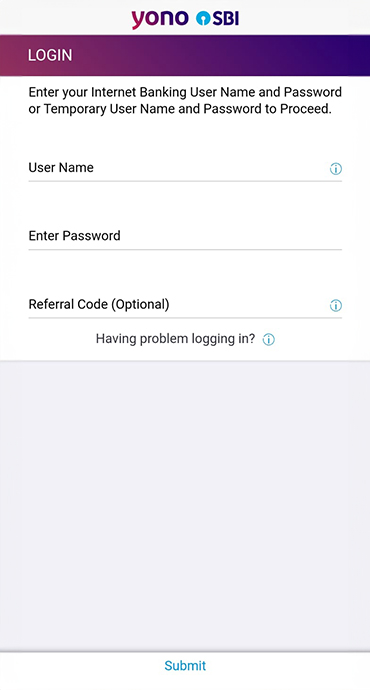

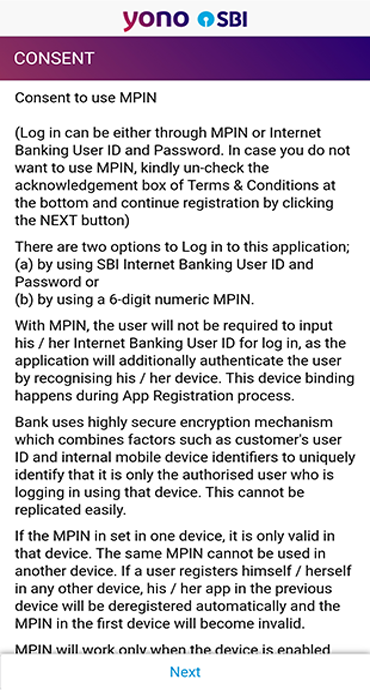

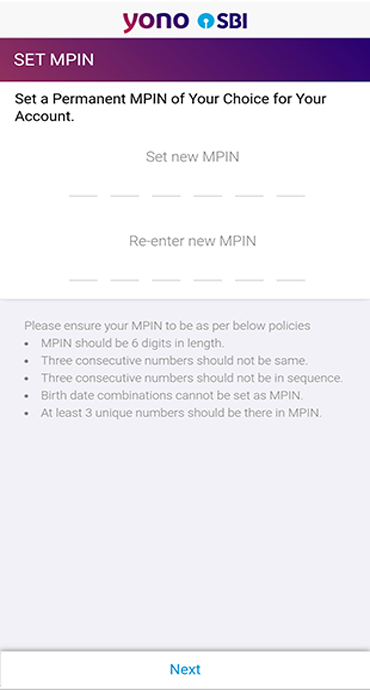

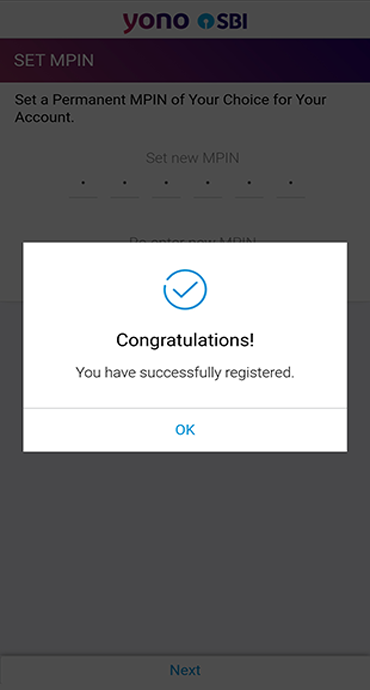

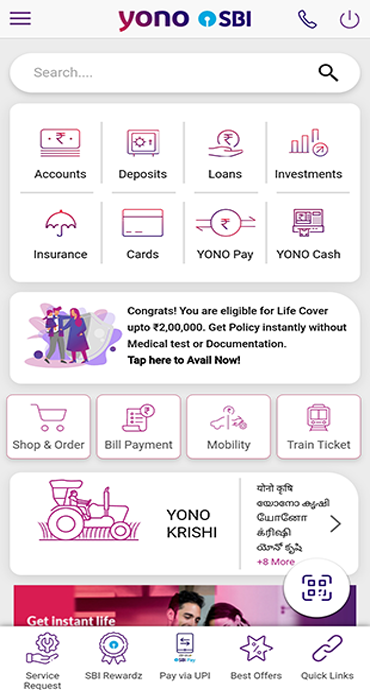

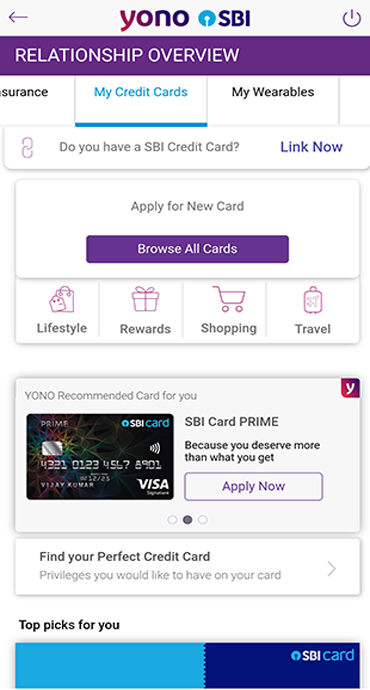

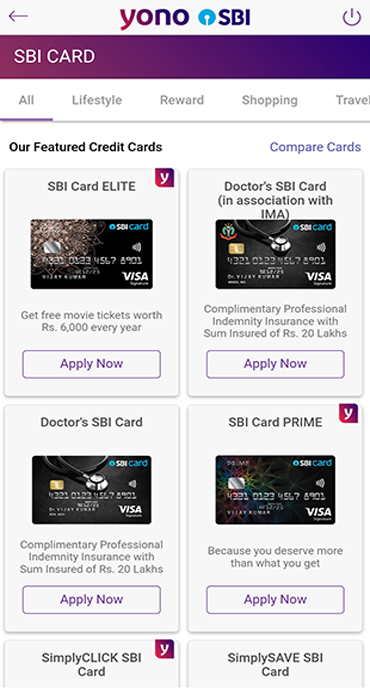

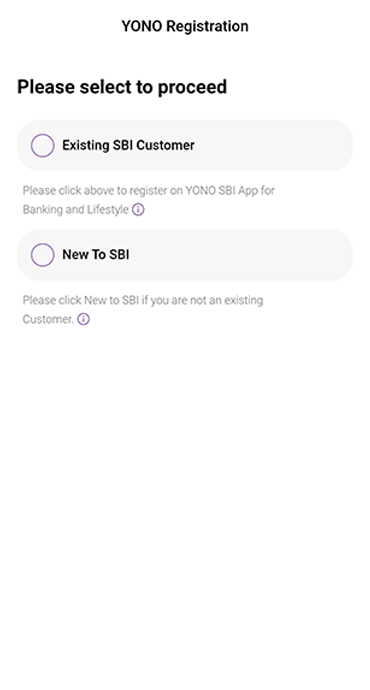

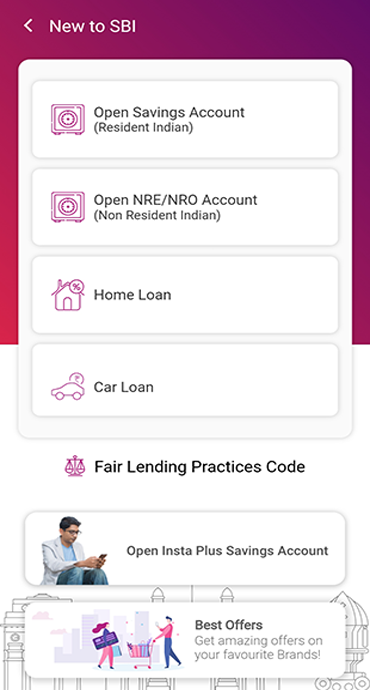

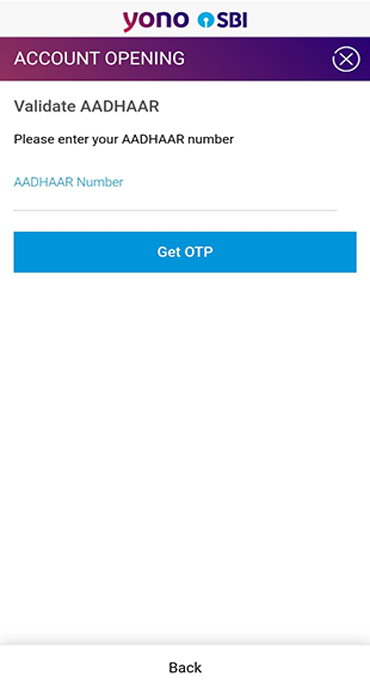

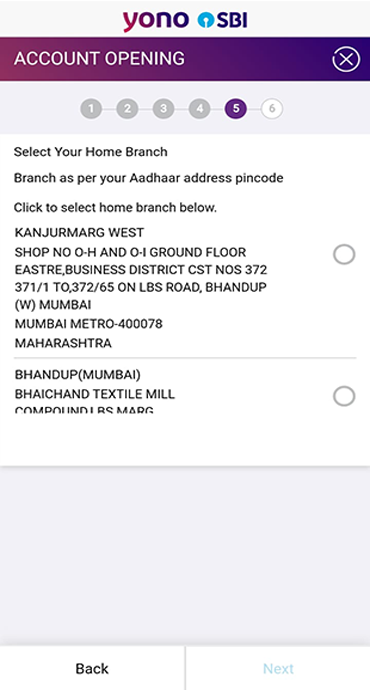

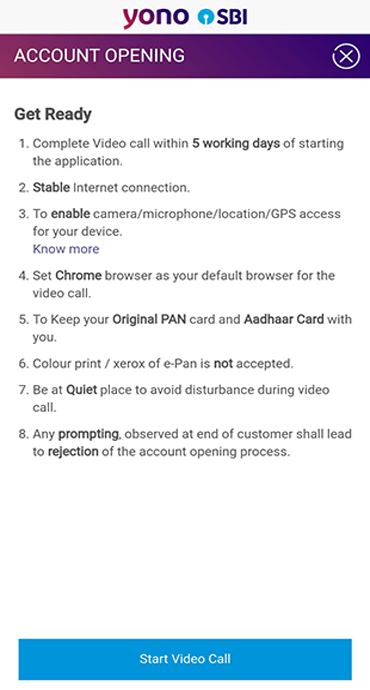

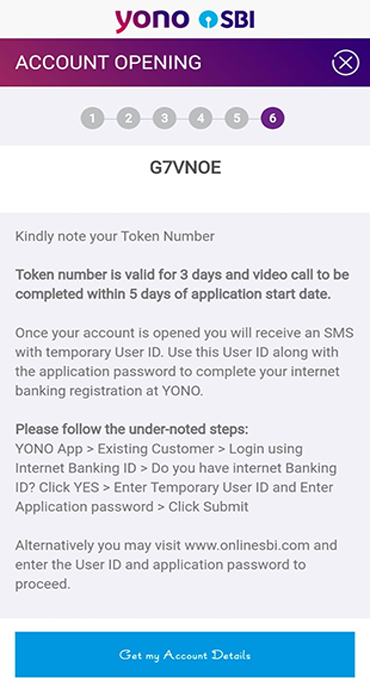

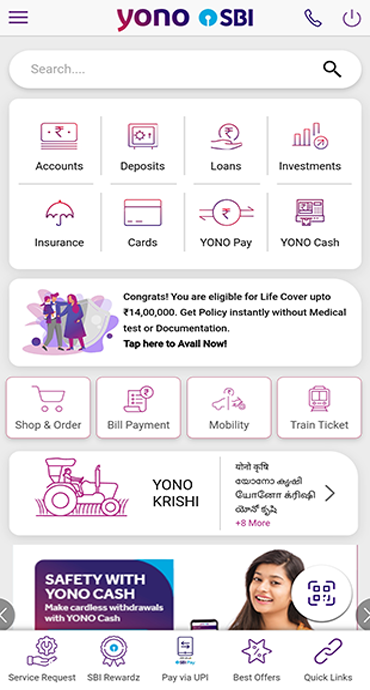

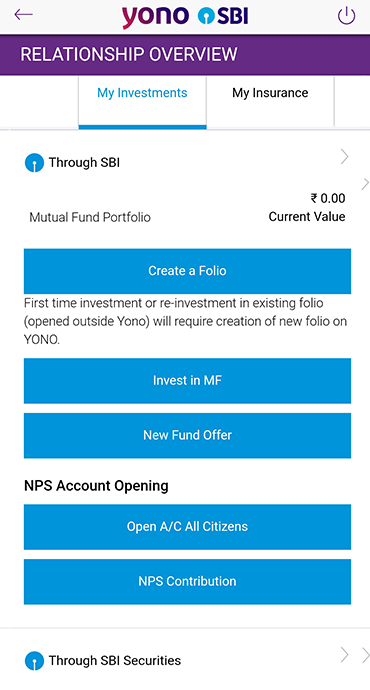

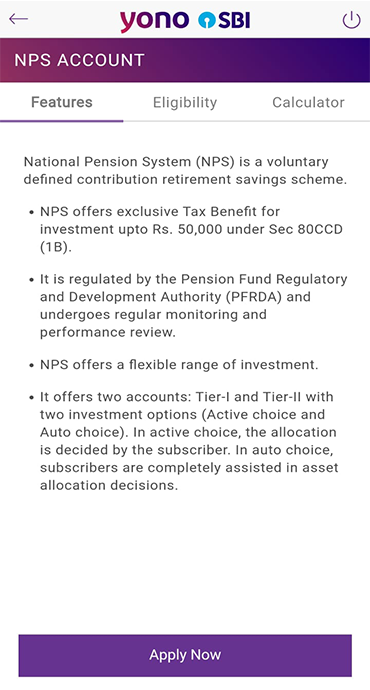

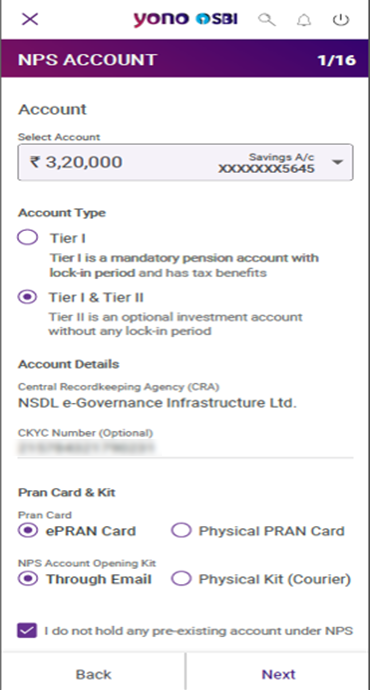

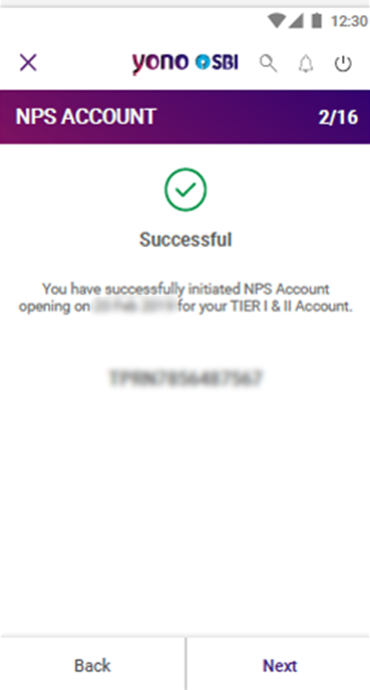

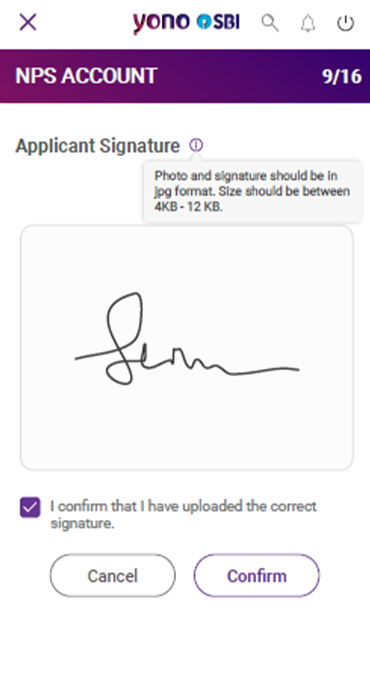

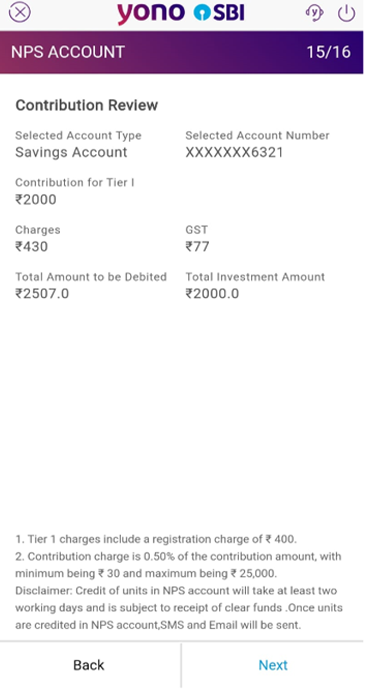

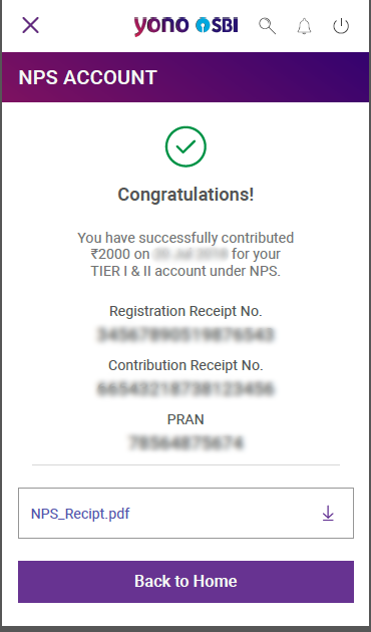

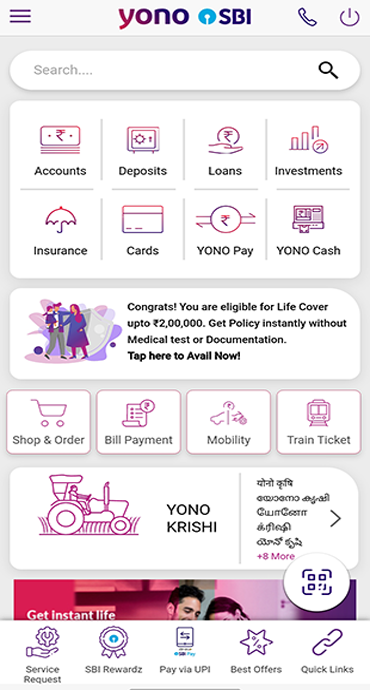

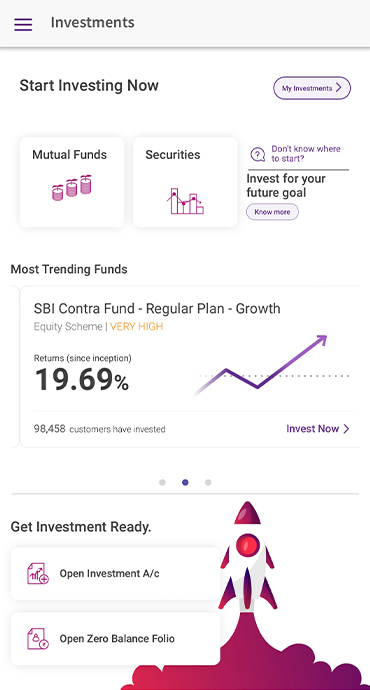

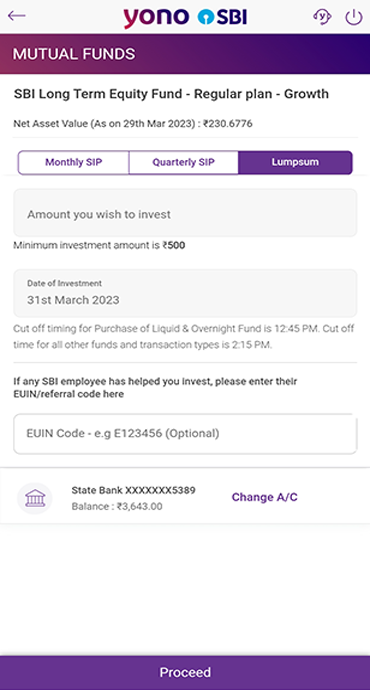

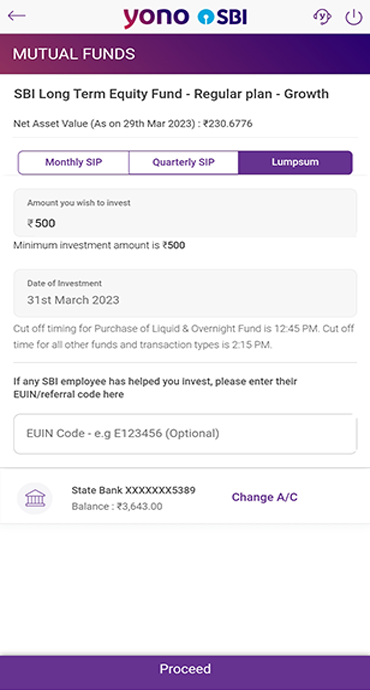

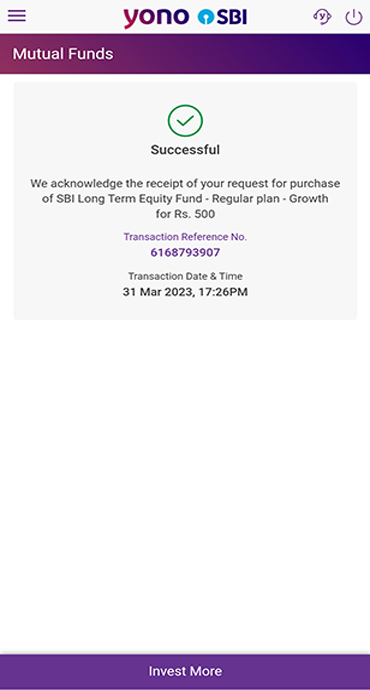

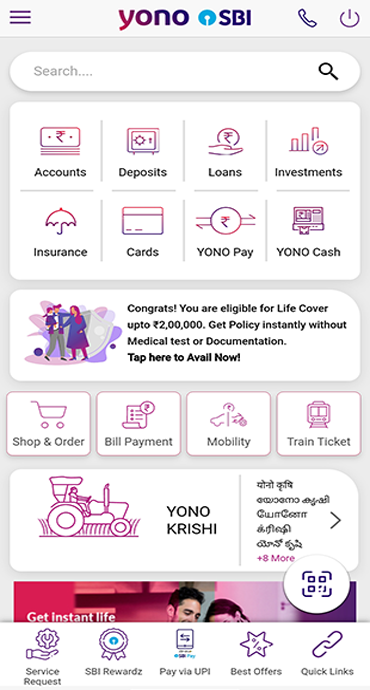

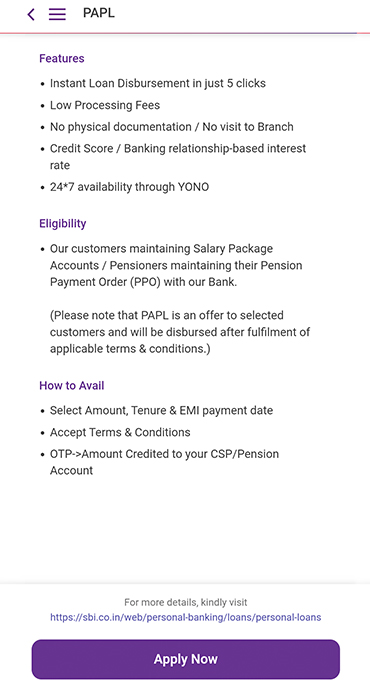

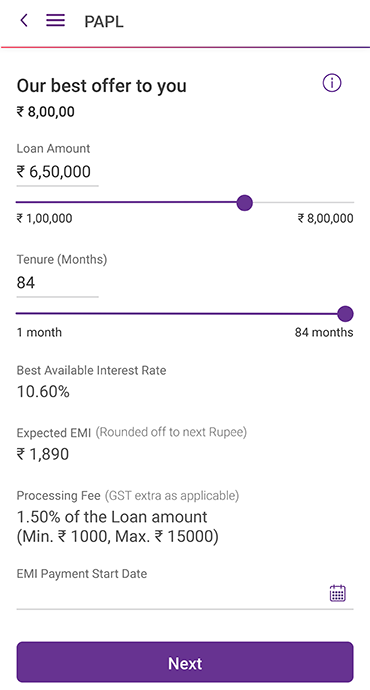

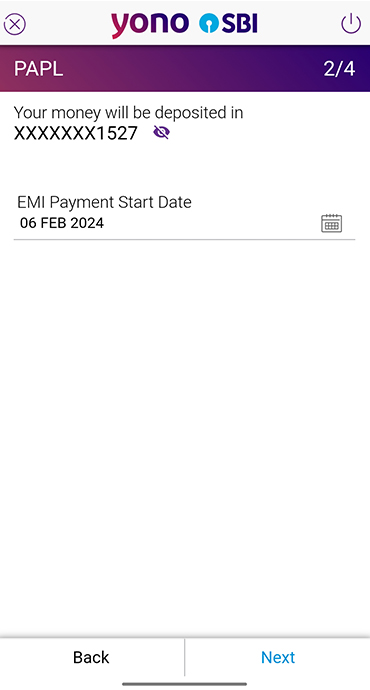

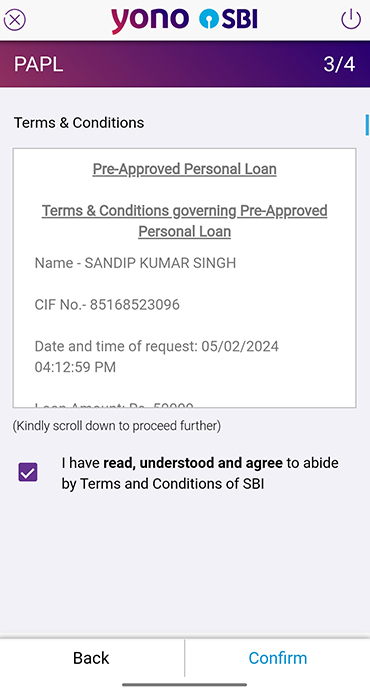

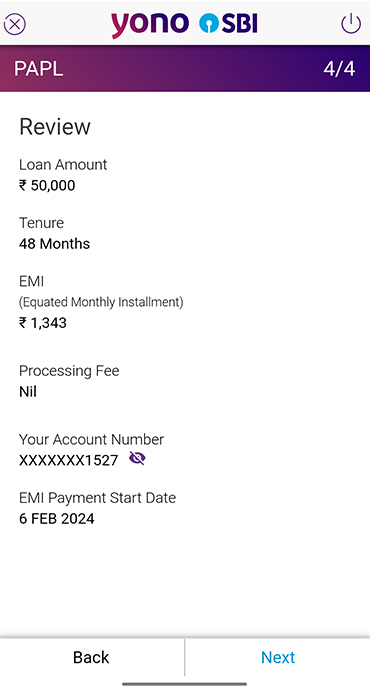

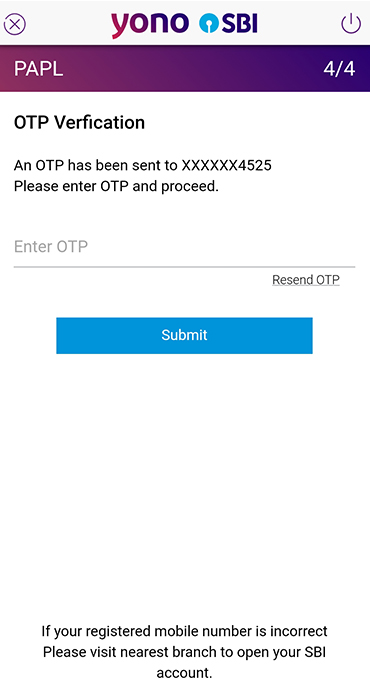

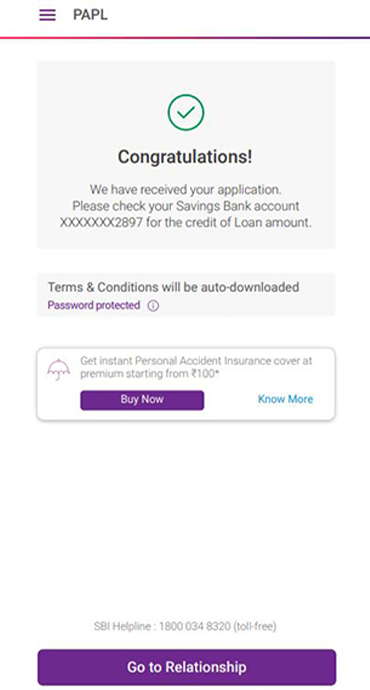

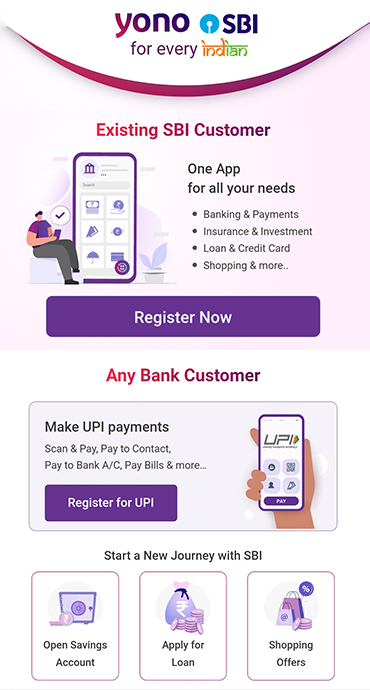

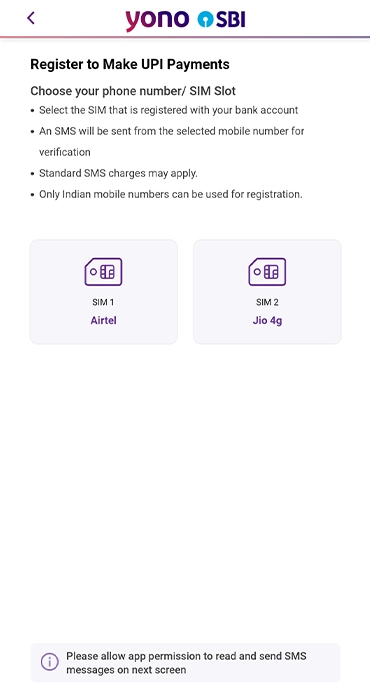

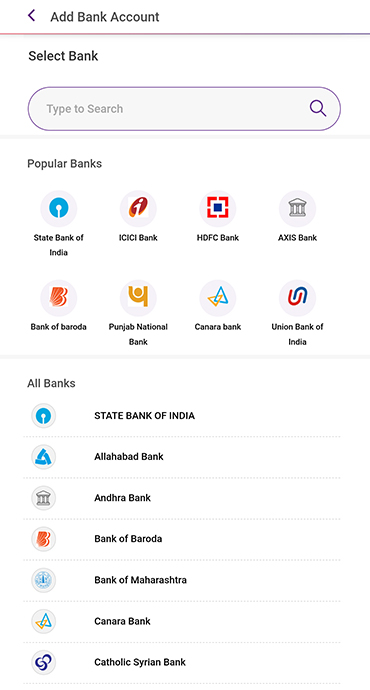

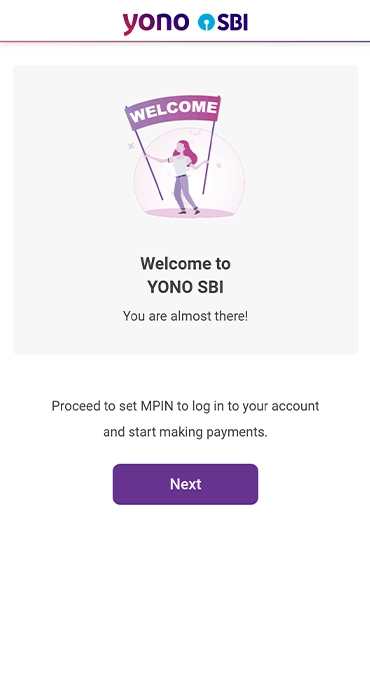

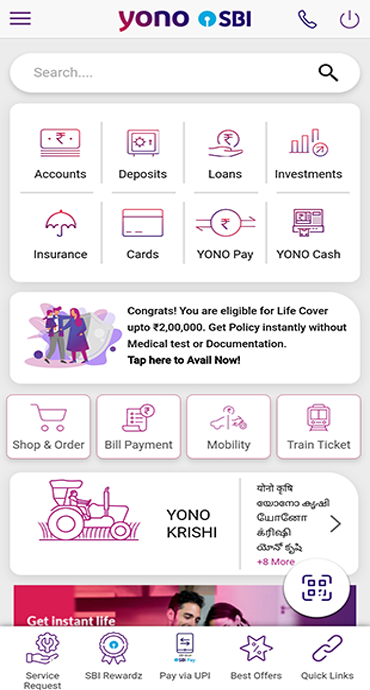

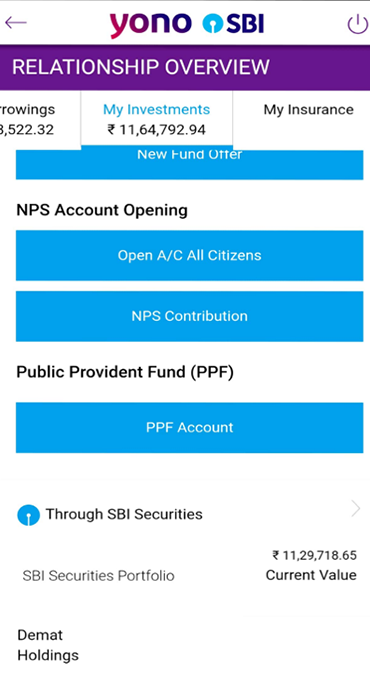

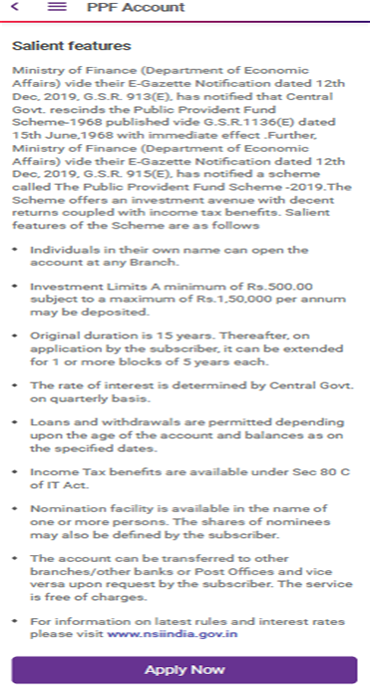

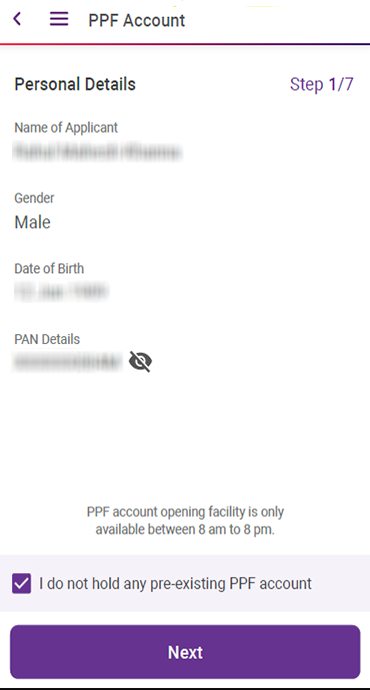

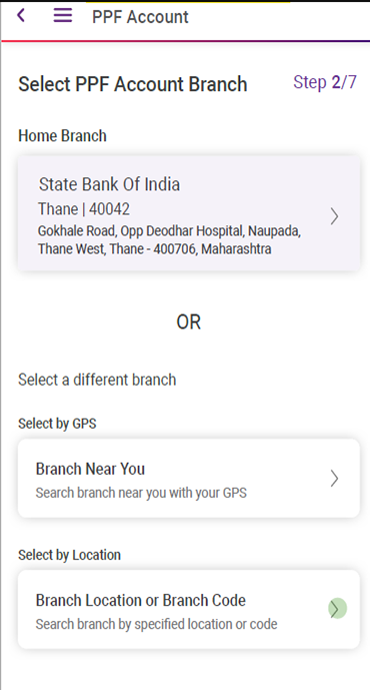

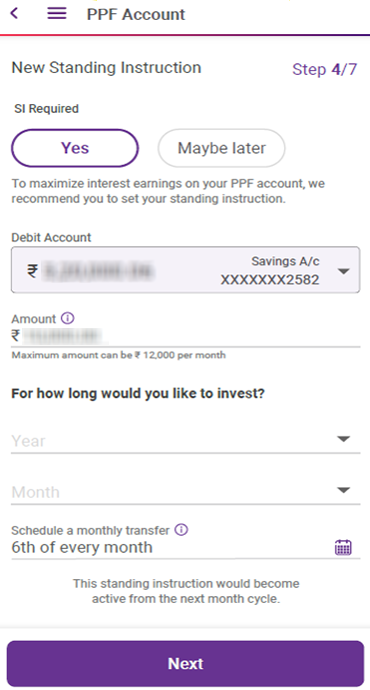

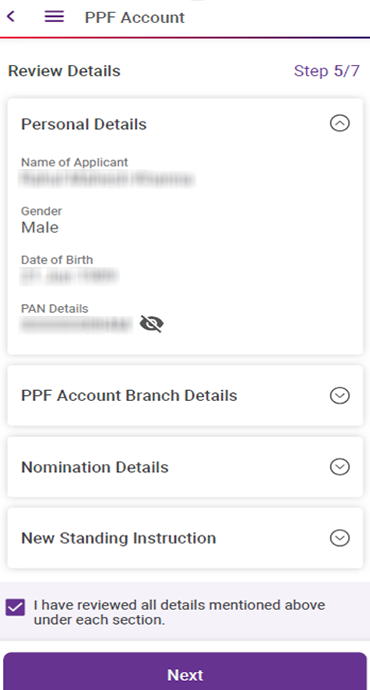

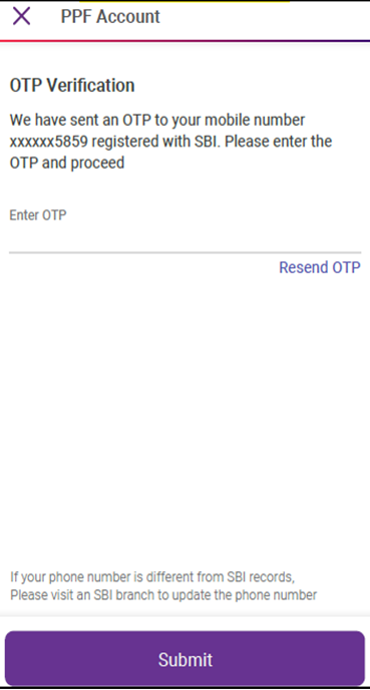

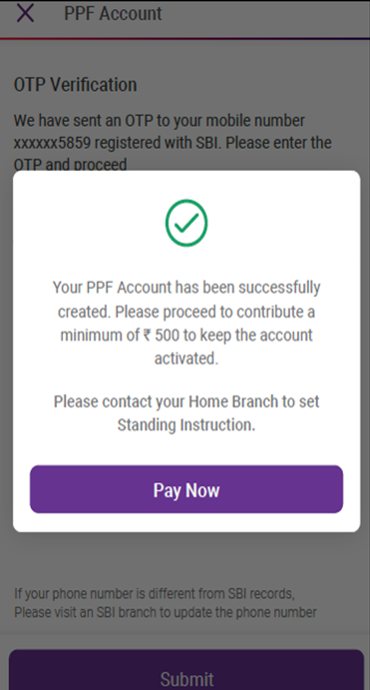

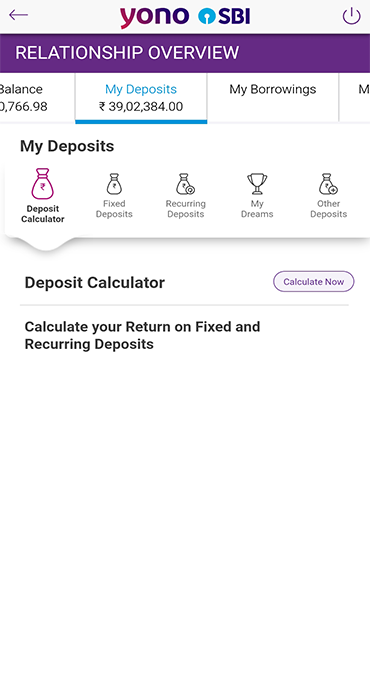

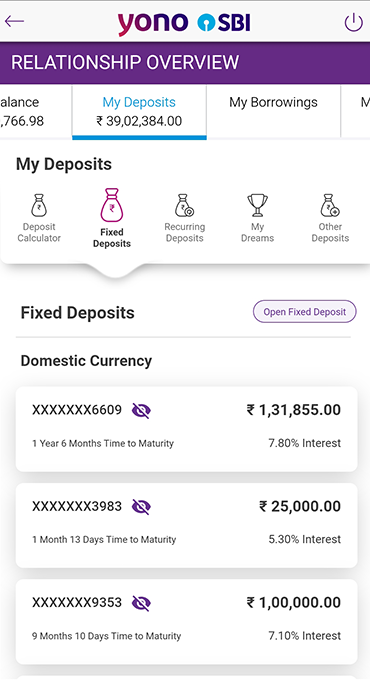

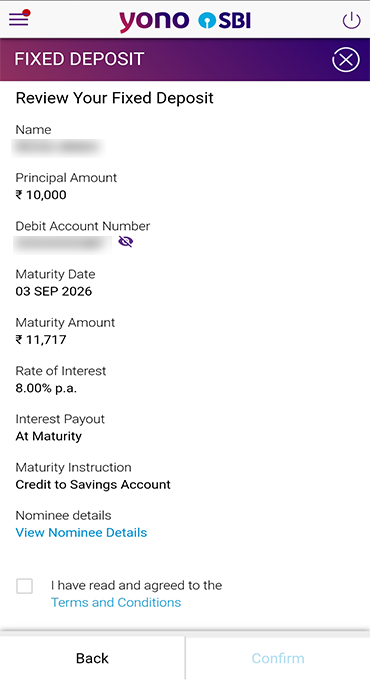

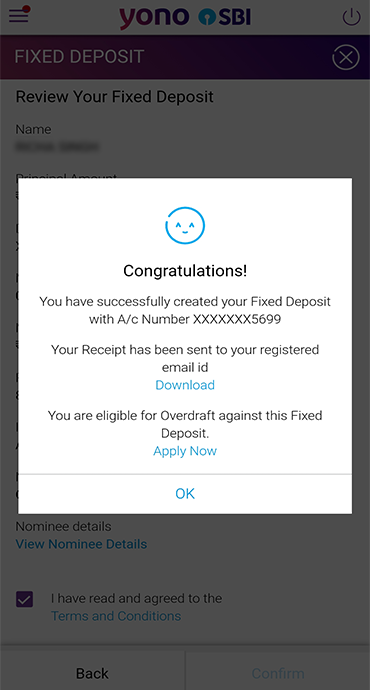

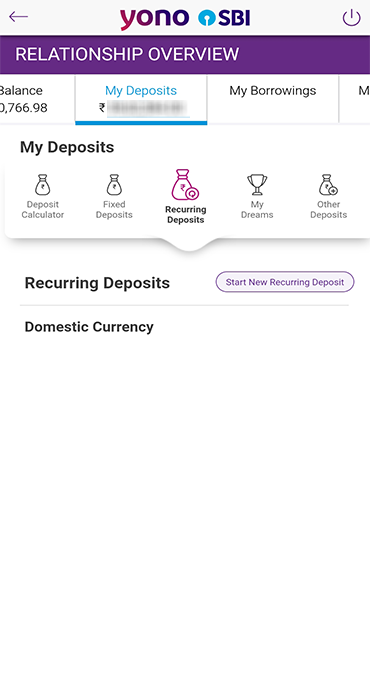

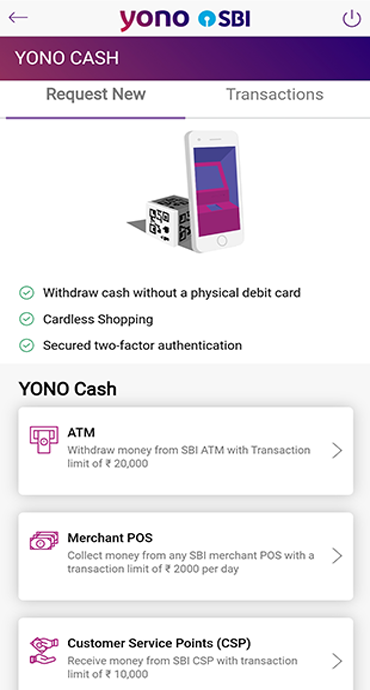

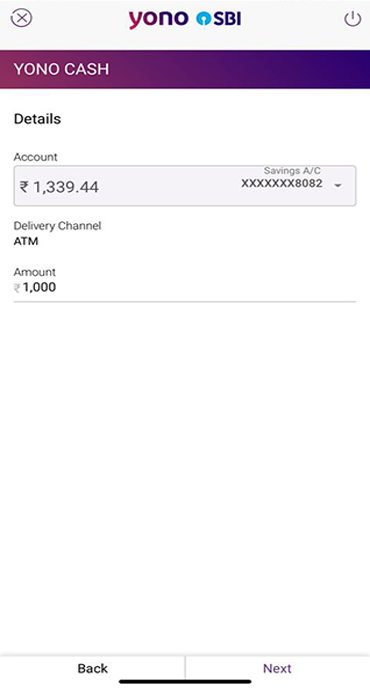

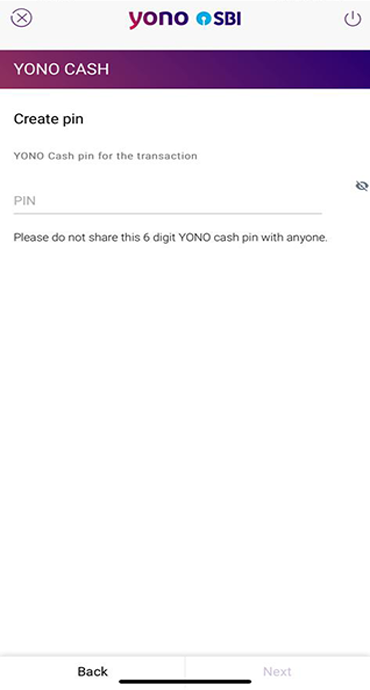

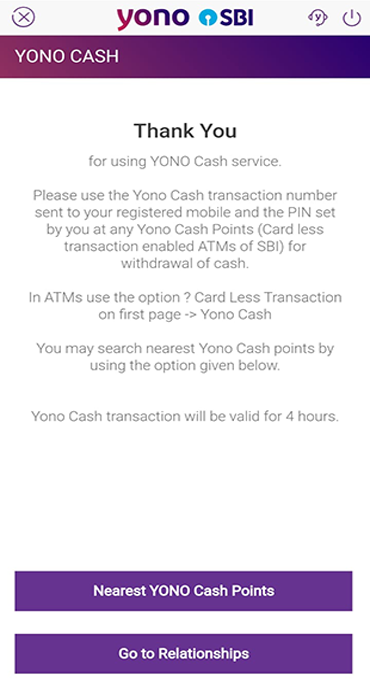

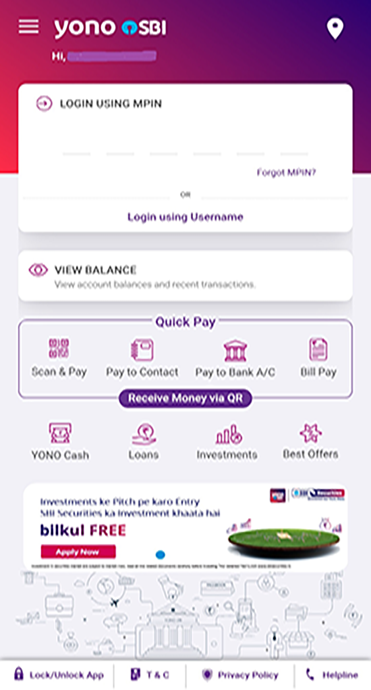

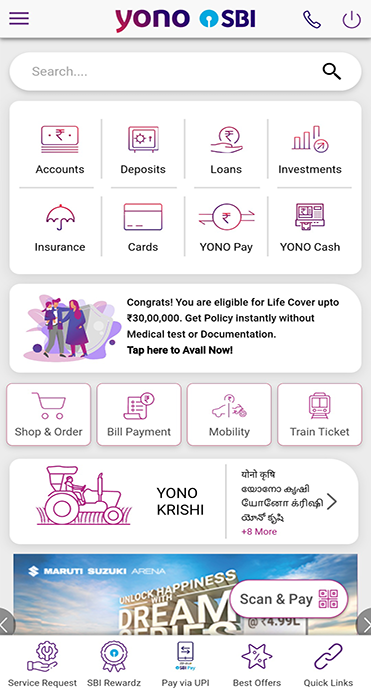

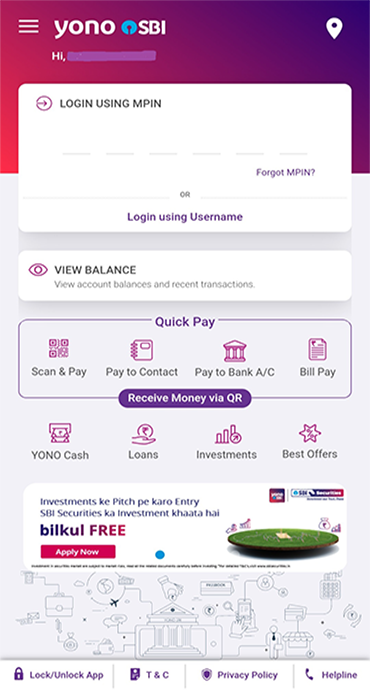

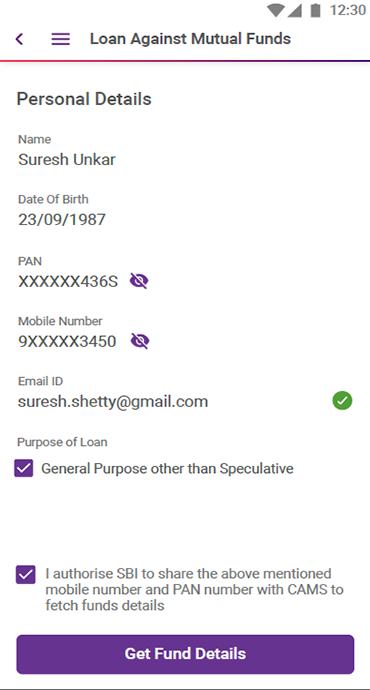

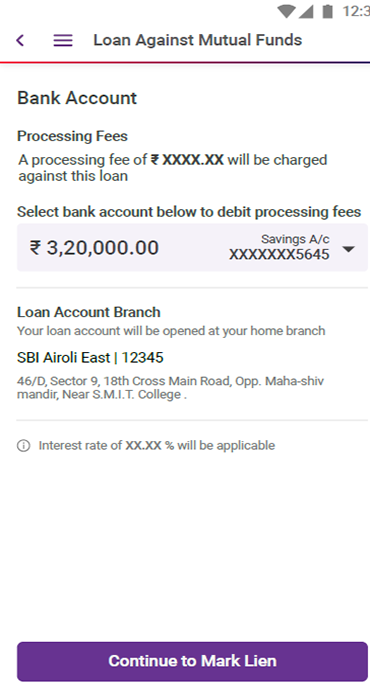

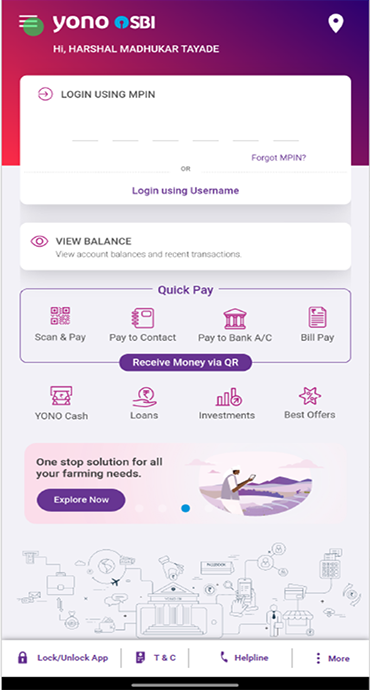

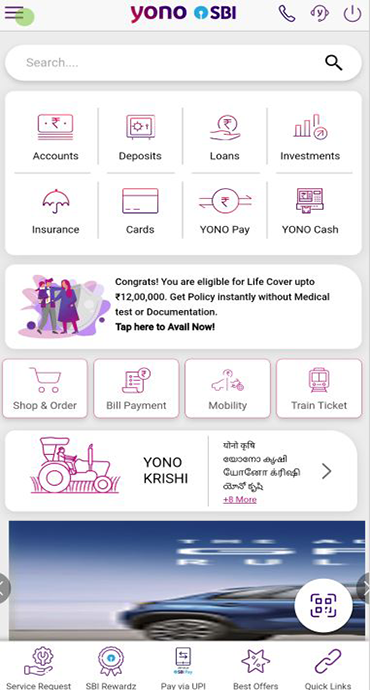

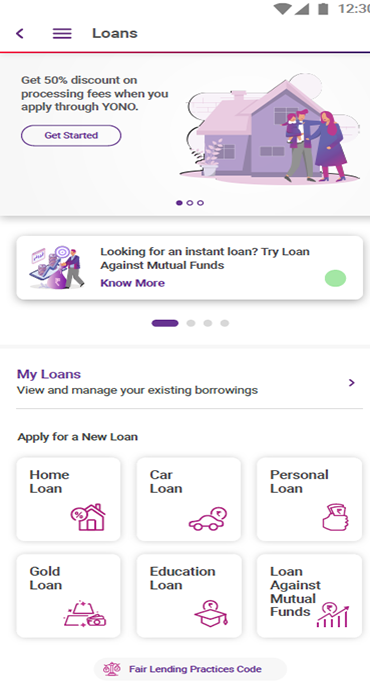

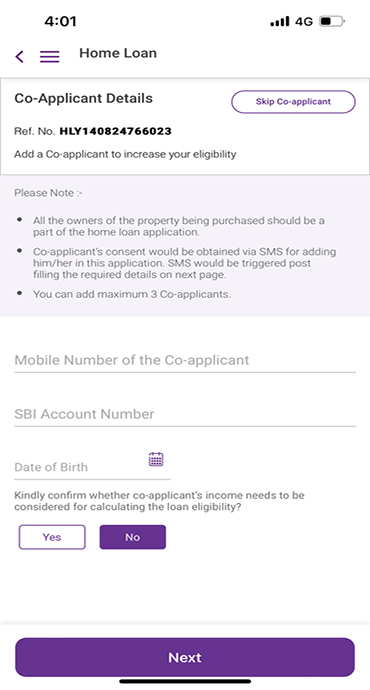

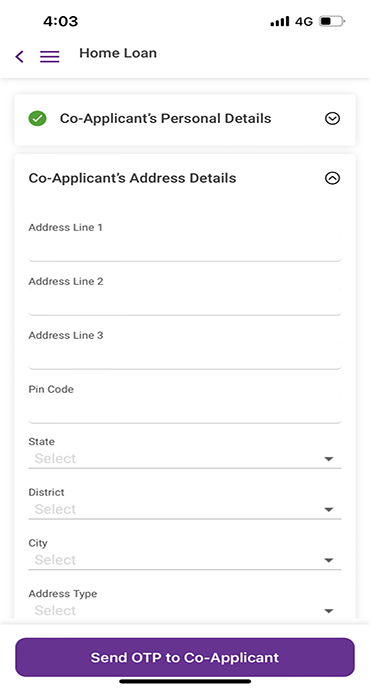

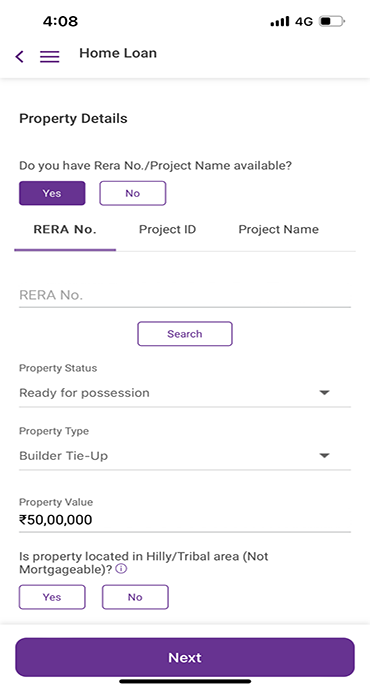

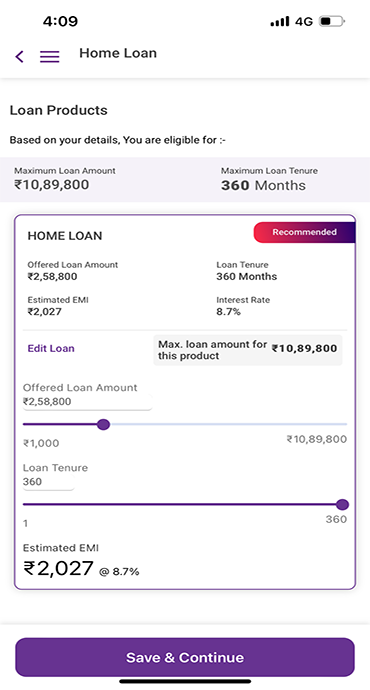

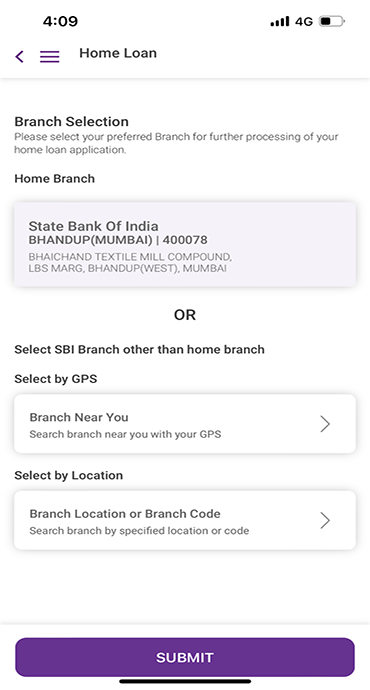

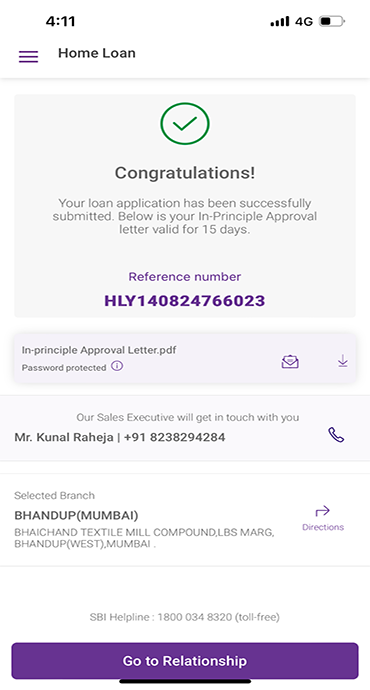

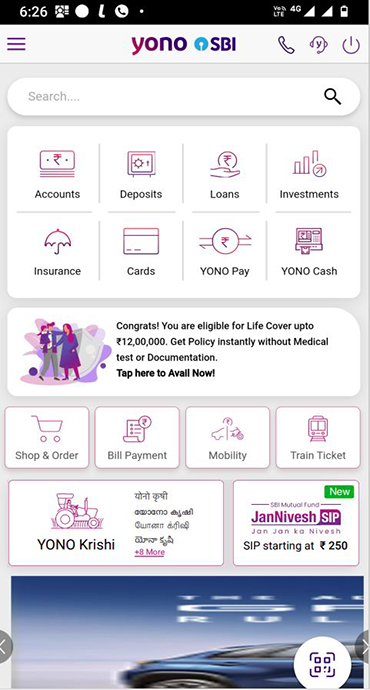

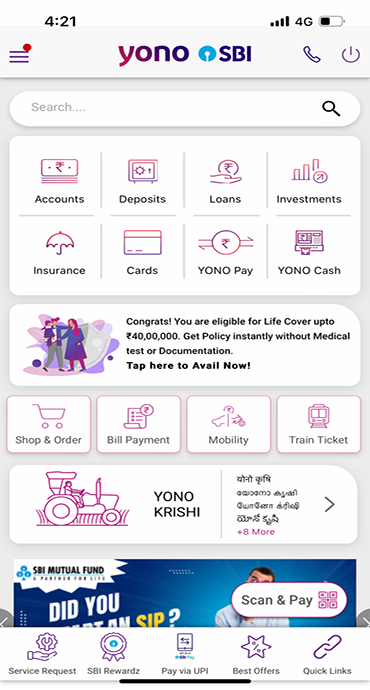

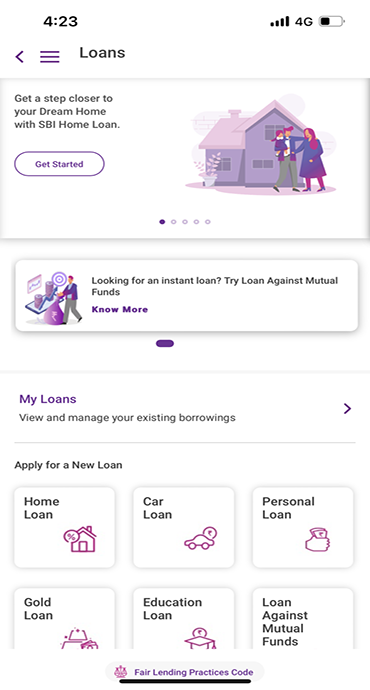

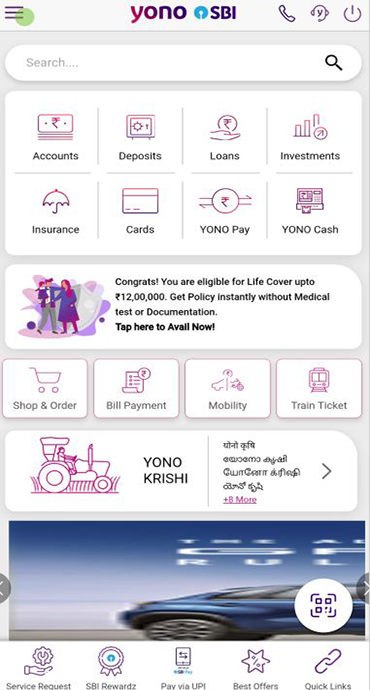

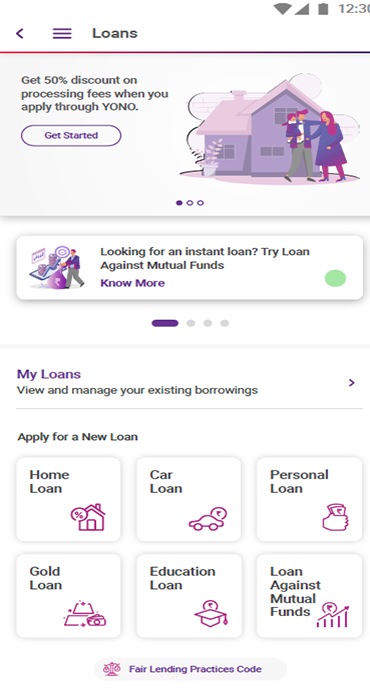

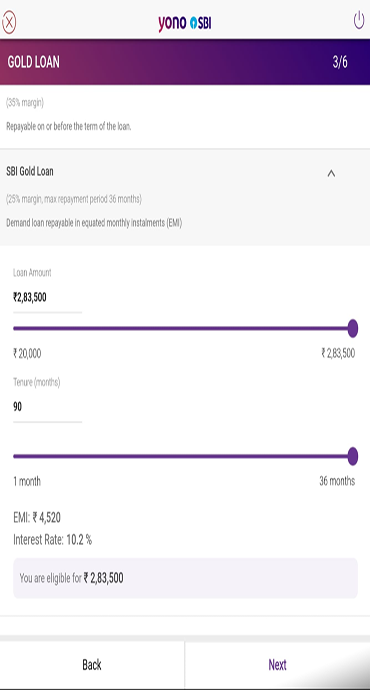

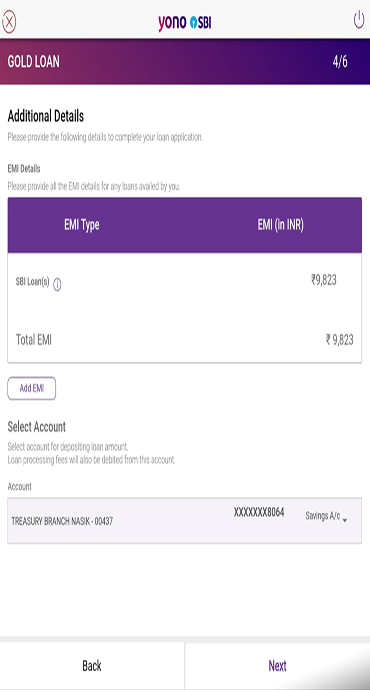

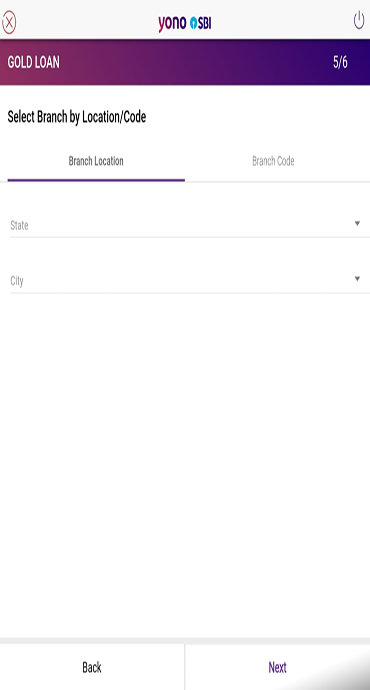

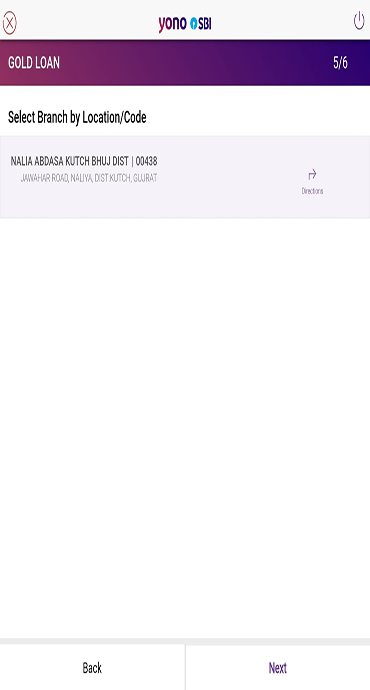

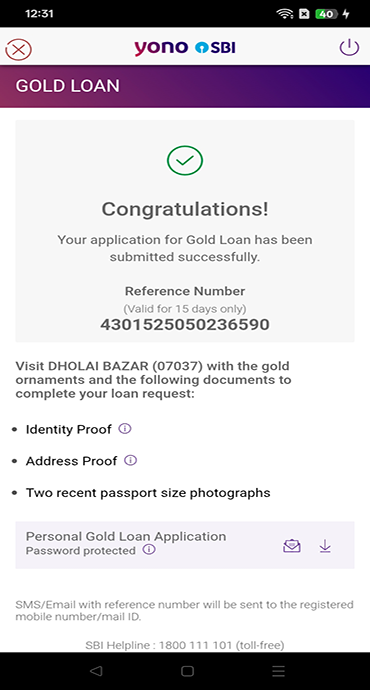

- Simple Application Process – For added convenience, you can apply for an online gold loan through YONO SBI App- SBI's digital banking platform, in 4 easy steps:

- Apply for Gold Loan

- Visit branch with gold

- Sign Documents

- Get Loan amount disbursed in your account

Leverage Your Gold's Potential with SBI

SBI provides a simple straightforward method of obtaining immediate financial assistance which operates transparently and efficiently. Through SBI's competitive Gold Loan interest rates and versatile loan conditions you can freely utilise your gold assets securely under India's biggest state-run bank.

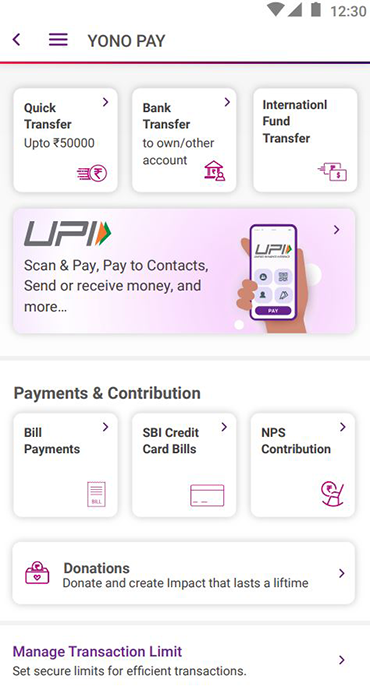

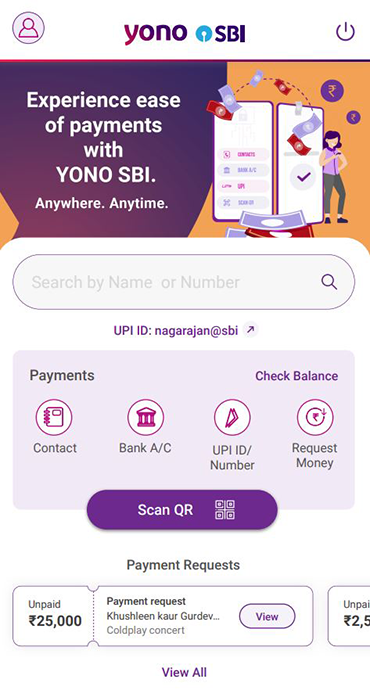

Explore SBI's gold loan options today through the YONO SBI App or visit your nearest branch. Turn your idle gold assets into productive financial tools with instant gold loan solutions that cater to both your immediate needs and long-term financial health.

Related Blogs That May Interest You