How to Open a Bank Account Online with YONO SBI | Quick Video KYC - Yono

How to Open a Digital Savings Account through Video KYC on YONO SBI?

13 Nov, 2023

accounts saving bank account

Step Into the Future: Digital Savings Accounts Made Easy

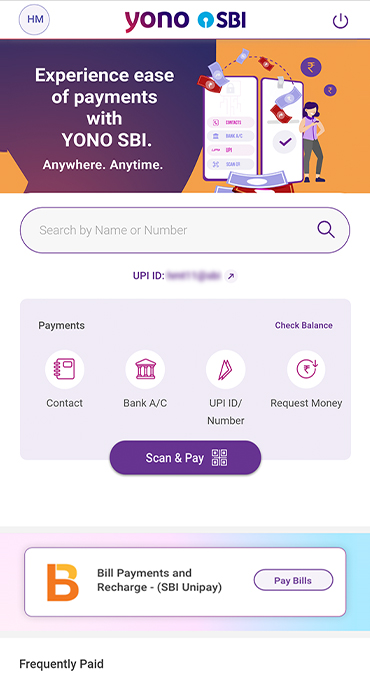

Welcome to the digital age, where the most popular catchphrases are convenience and speed. Gone are the days of waiting in long bank queues to open a savings account. Thanks to technology, you can now easily open a digital savings account from home. Here we will guide you through the simple process of opening an online savings account so that you can start managing your finances and saving with ease.

Understanding the Digital Savings Account: A Modern Approach

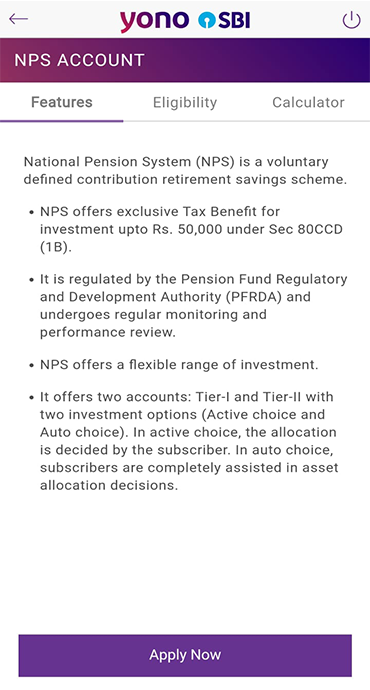

A Digital Savings Account is a type of bank account that allows individuals to manage their savings and conduct various banking transactions entirely online, without the need for physical visits to a bank branch. It is a modern and convenient approach to traditional savings accounts, leveraging the power of technology and the Internet to provide users with seamless and efficient banking services.

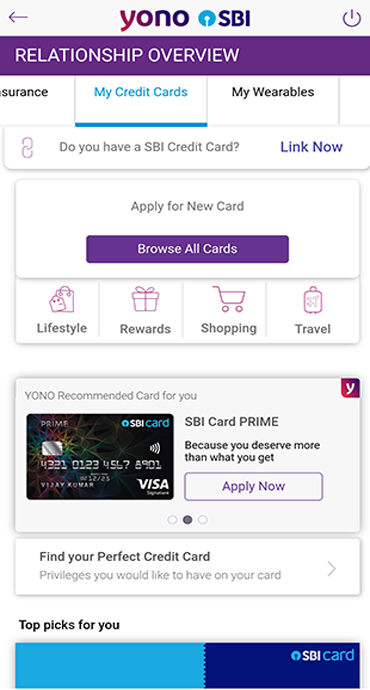

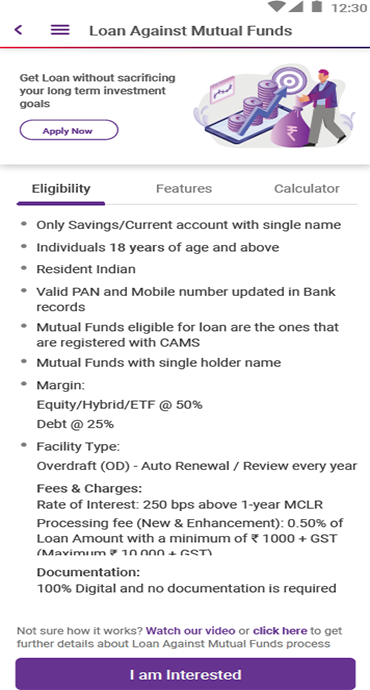

When choosing a savings account, it's essential to compare the different saving account interest rates offered by various banks to ensure you get the best returns on your savings.

Key Features of an Online Digital Savings Account

Here are the essential features you need to know before opening a digital savings account:

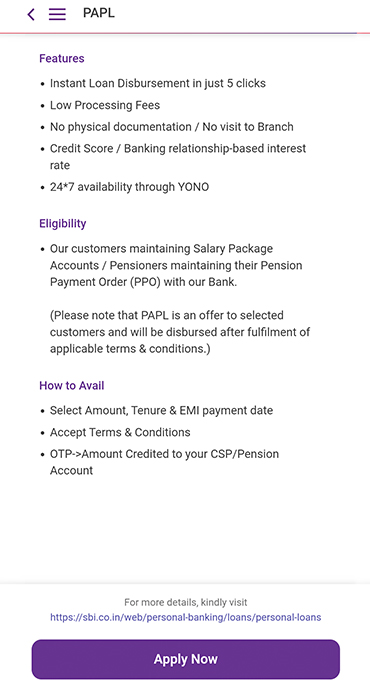

- Online Account Opening: Open your Digital Savings Account effortlessly from the comfort of your home with YONO SBI. To open YONO SBI Account online, no paperwork, physical documents, or in-person verification required.

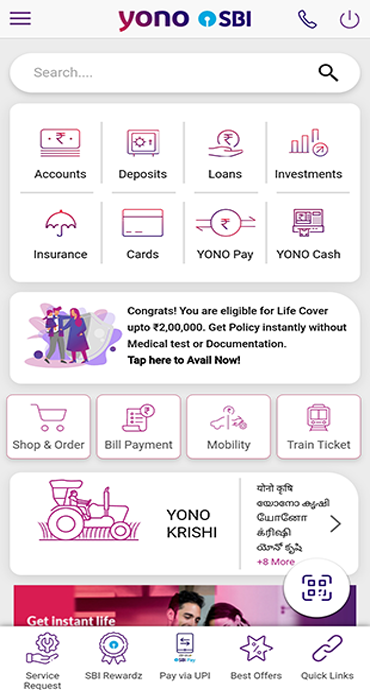

- 24/7 Accessibility: The Digital Account is always accessible to the account holder using any internet-enabled device, such as a computer, smartphone, or tablet.

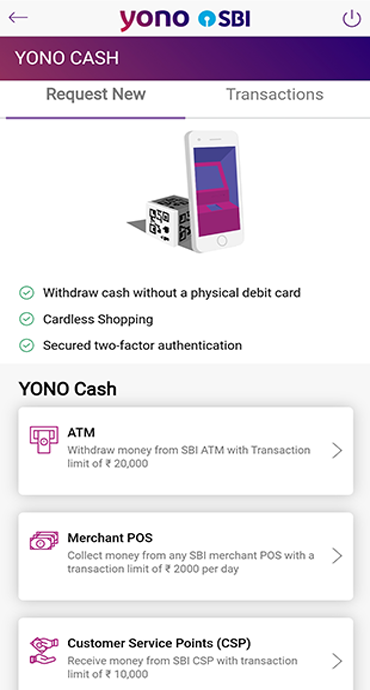

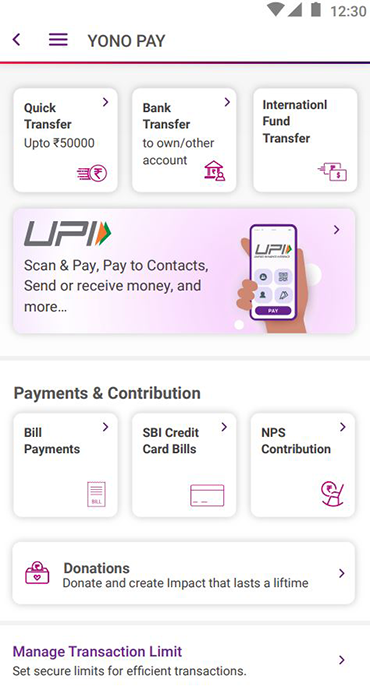

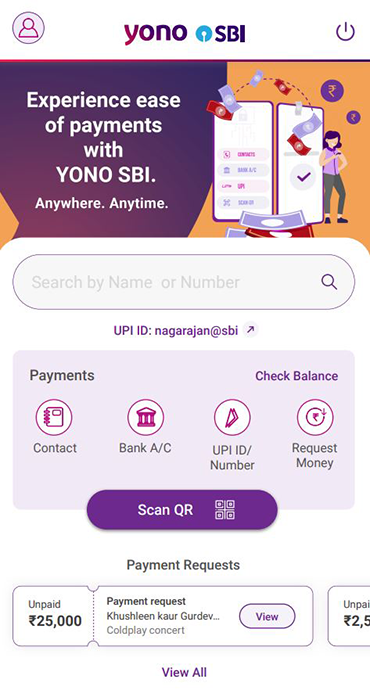

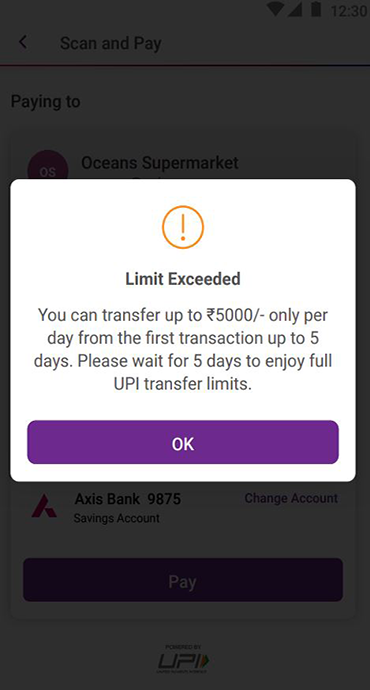

- Fund Transfers: It also allows them to transfer funds between accounts, pay bills, and perform other activities through electronic means.

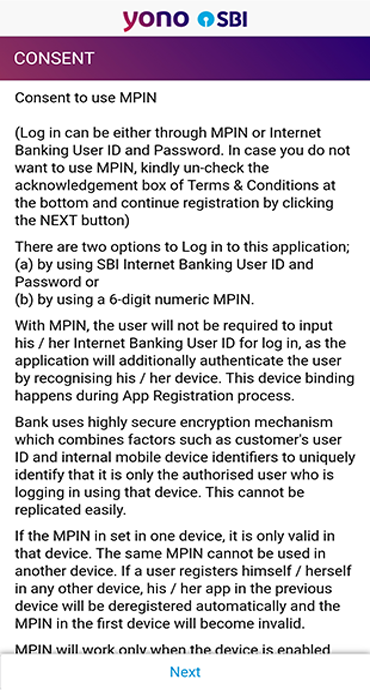

- Security Measures: The bank implements robust security measures, such as encryption and two-factor authentication, to protect users' financial information and transactions.

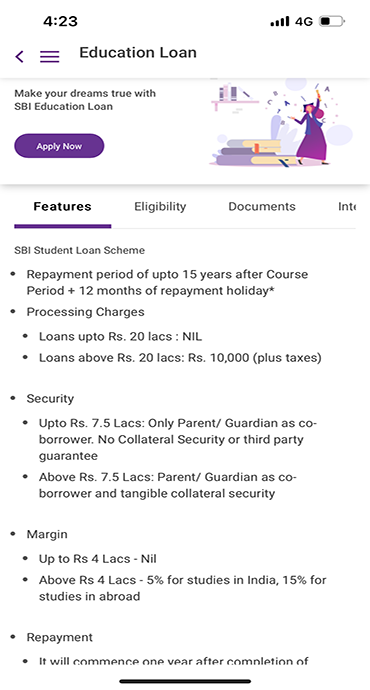

- KYC Verification: To comply with regulatory requirements, the bank conducts the Know Your Customer (KYC) verification process electronically for new account openings.

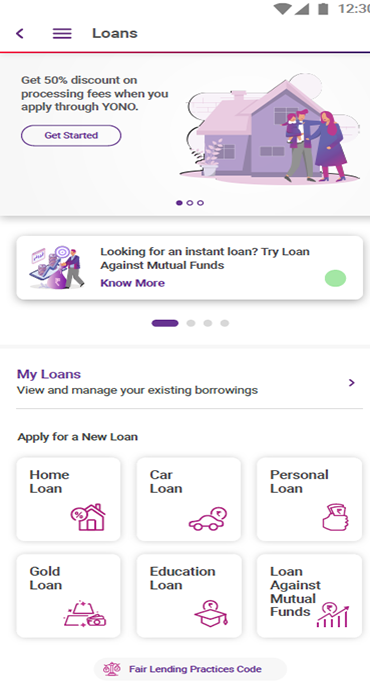

Step-by-Step Guide to Digital Account Opening through Video KYC

Here’s how to open a Digital Savings Account through YONO SBI app:

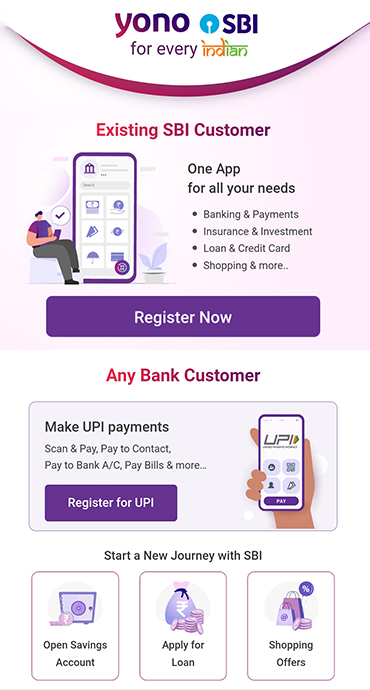

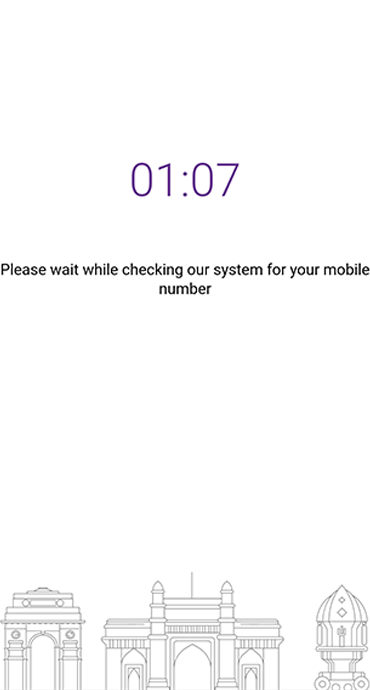

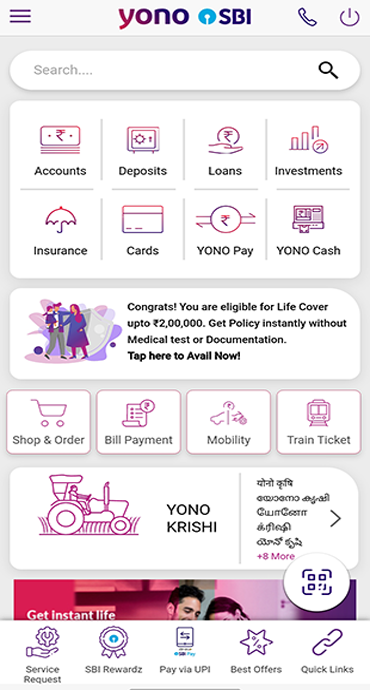

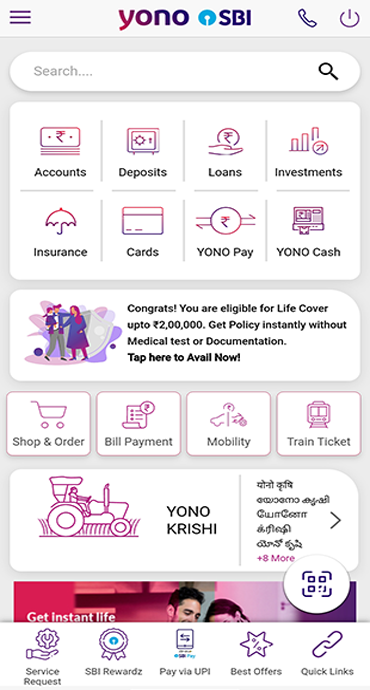

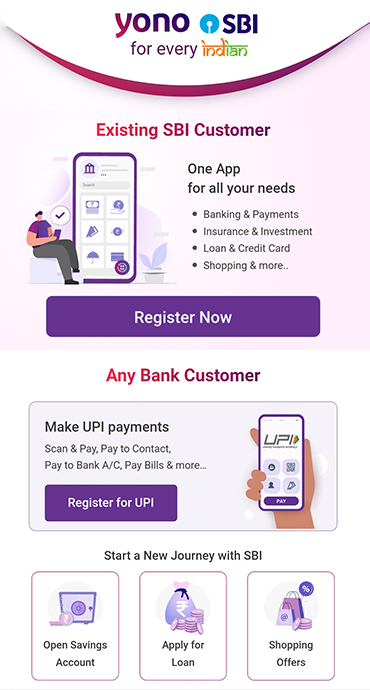

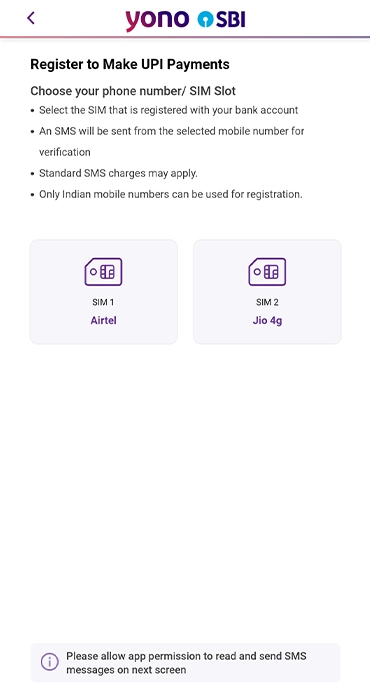

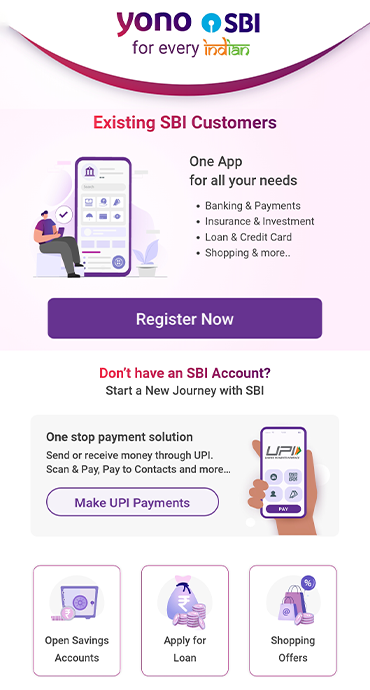

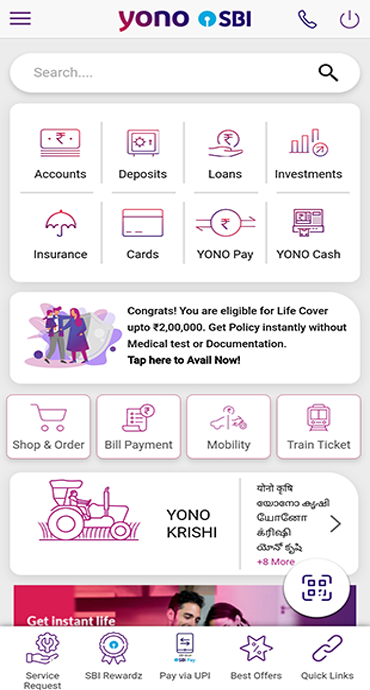

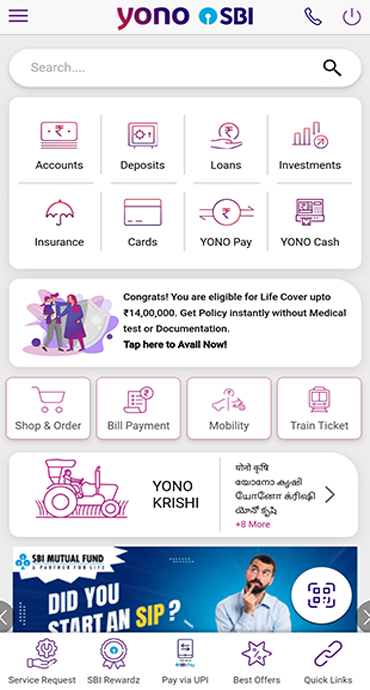

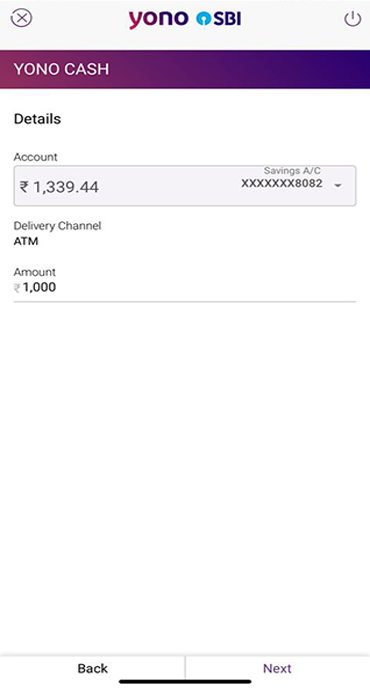

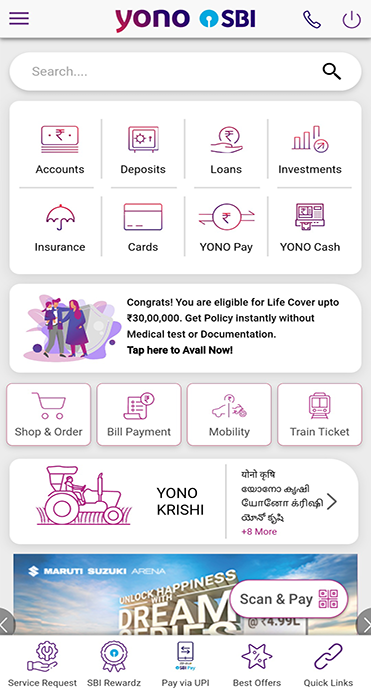

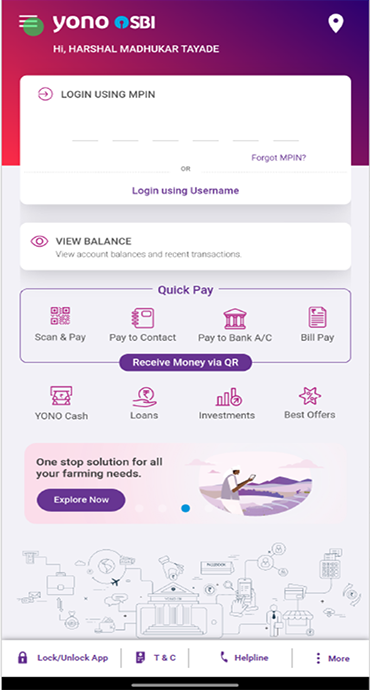

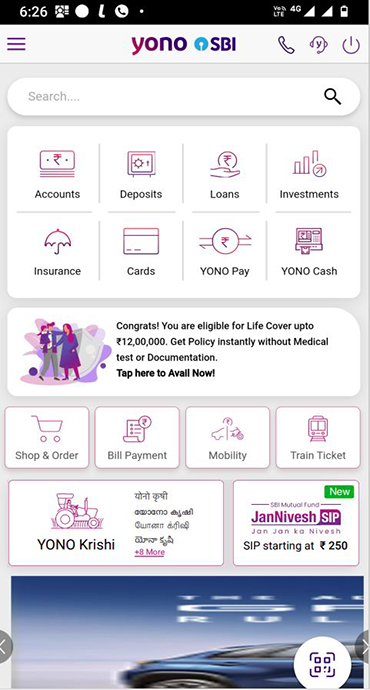

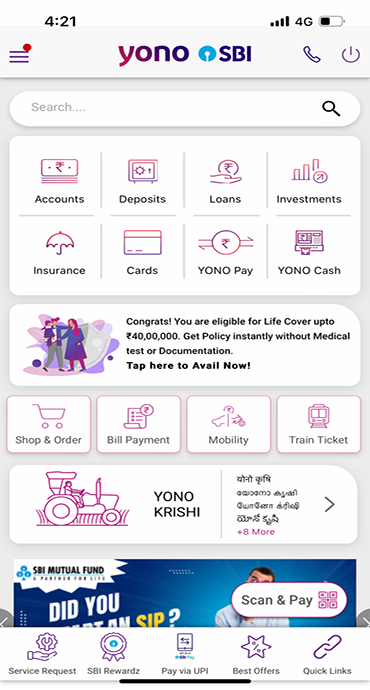

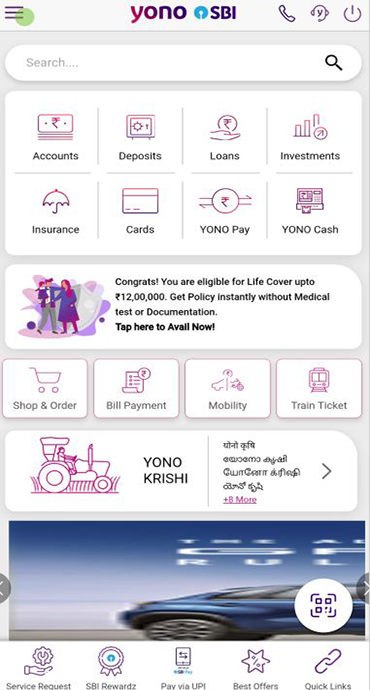

Step 1: Download YONO SBI App

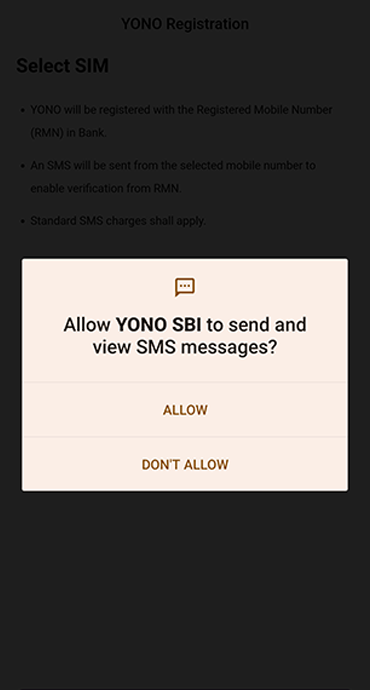

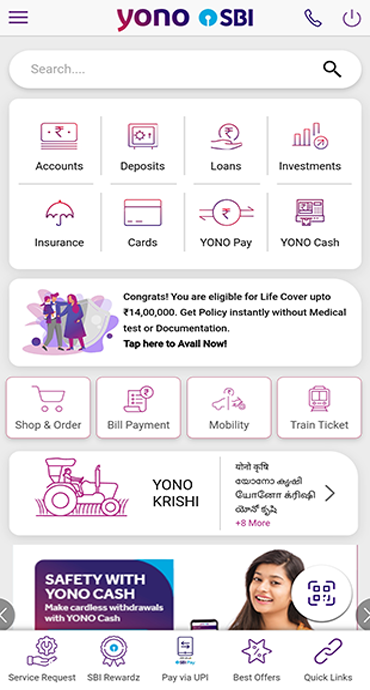

The first step is to download and install the YONO SBI App from the relevant app store. This app will be your platform for accessing SBI's digital services and managing your banking needs.

The YONO SBI account opening online process makes it seamless to start managing your finances without visiting a branch.

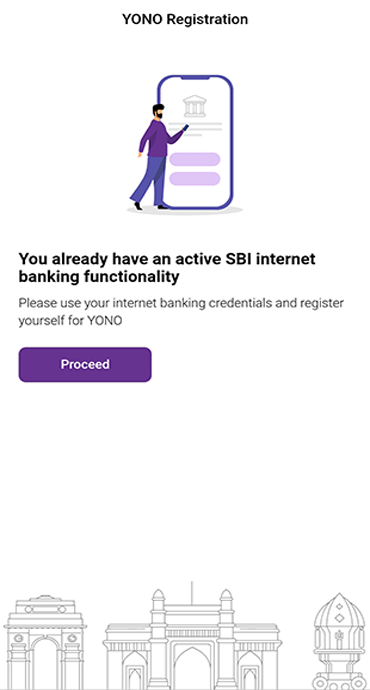

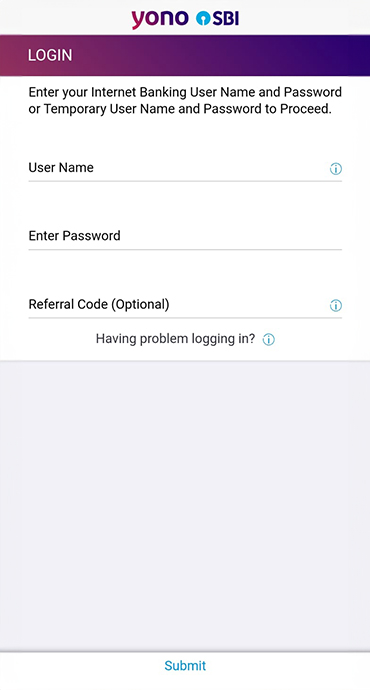

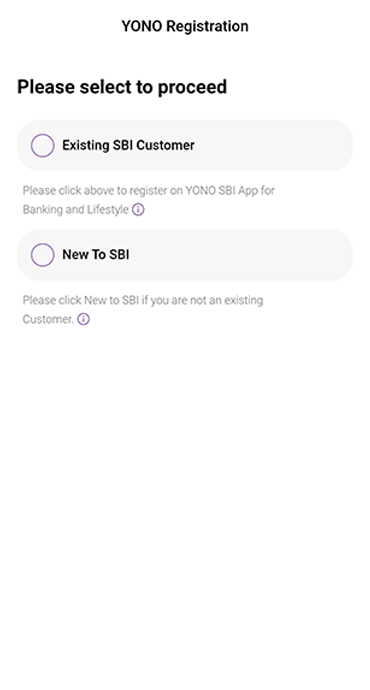

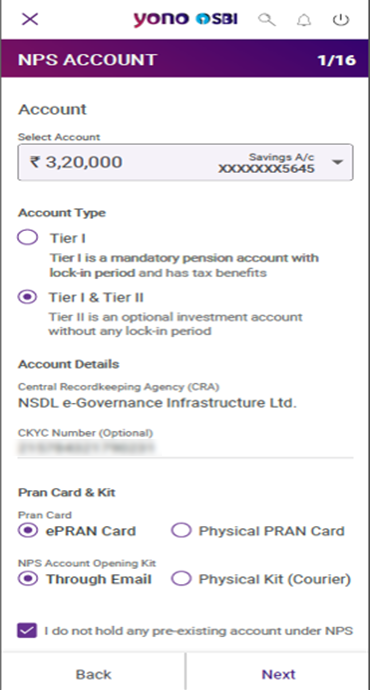

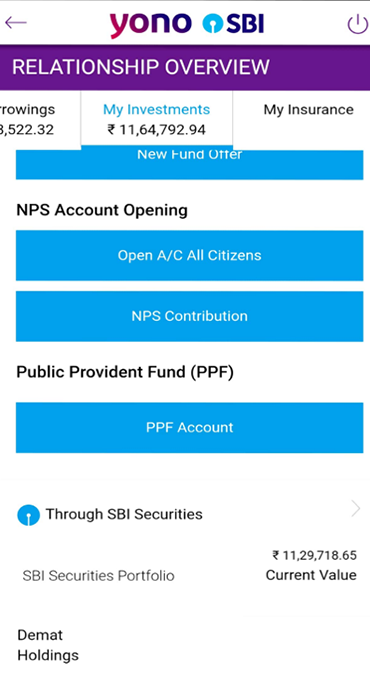

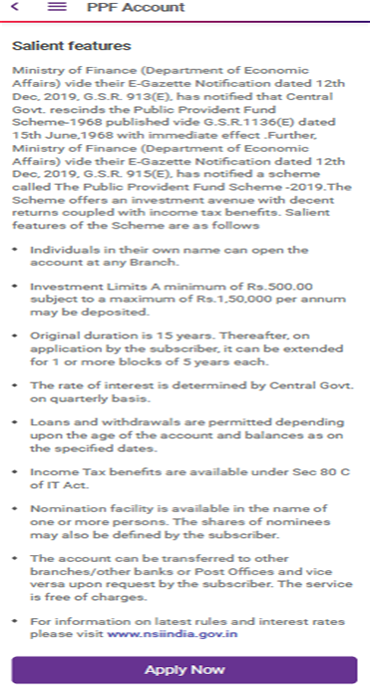

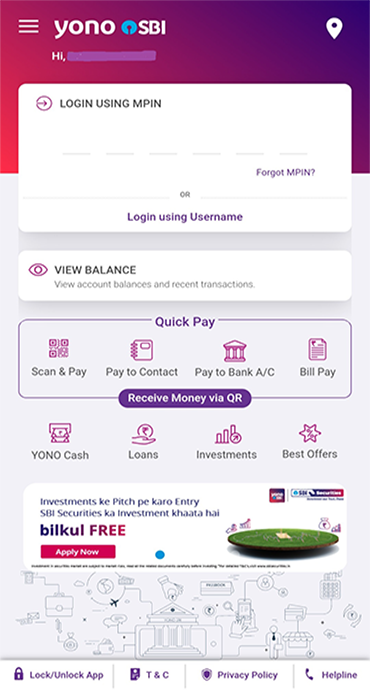

Step 2: Initiate Account Opening

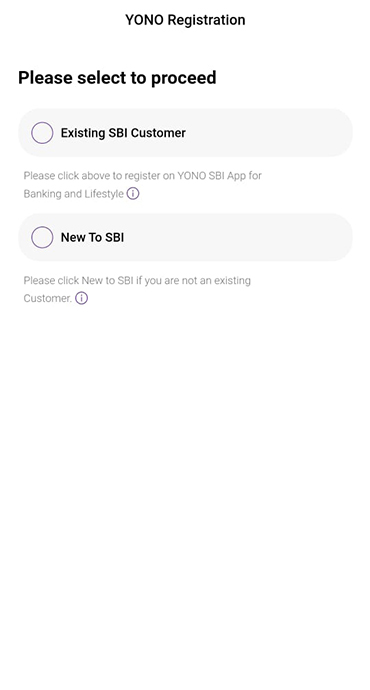

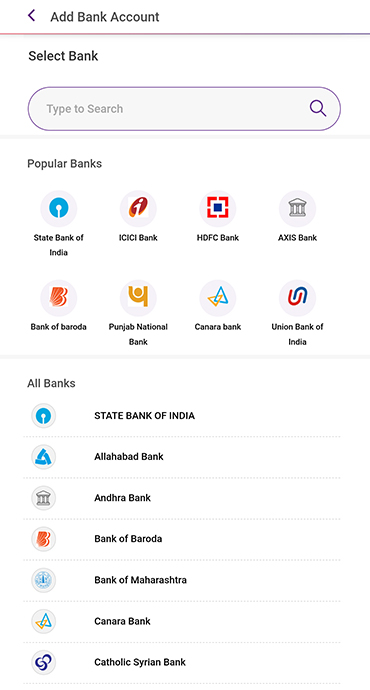

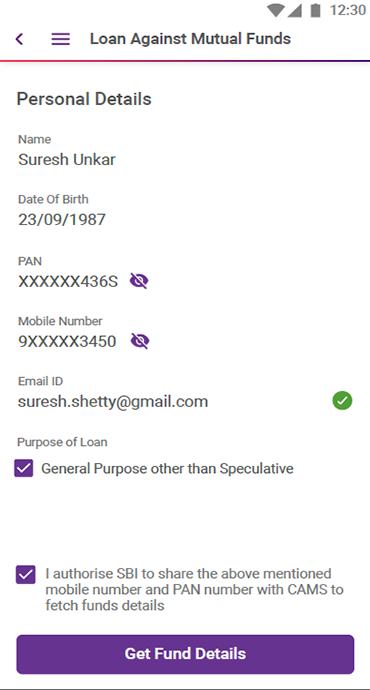

After successfully downloading the YONO SBI app, open the app and locate the “New to SBI” button. This is where the process of account opening starts. Select ‘without branch visit’

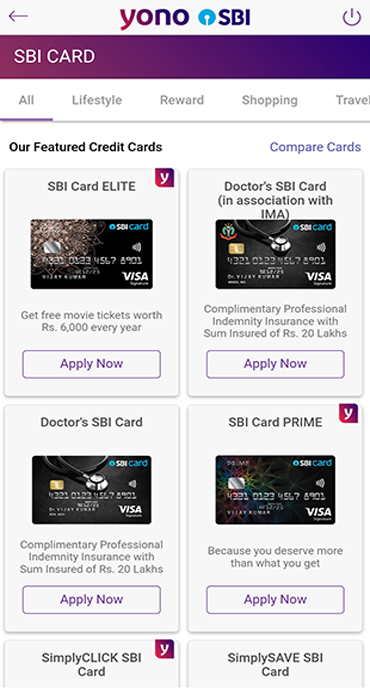

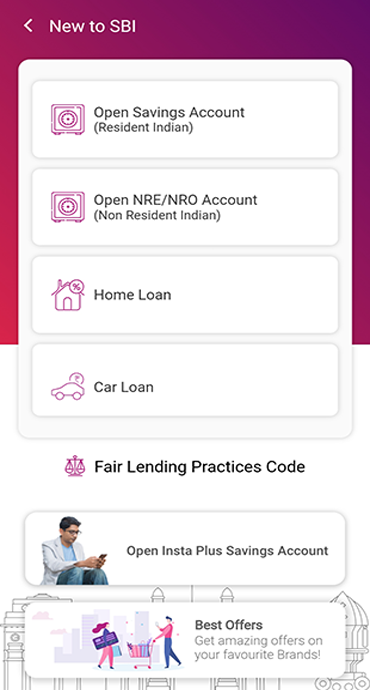

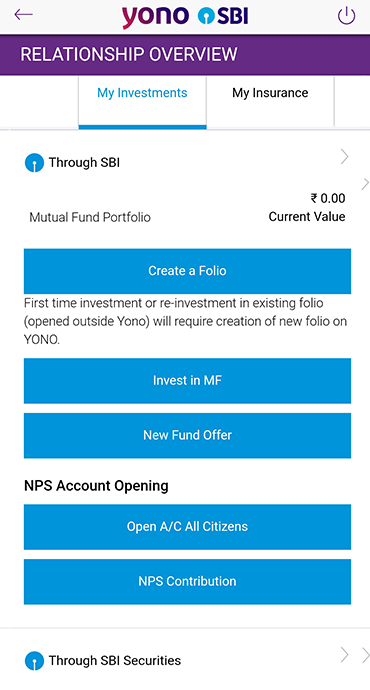

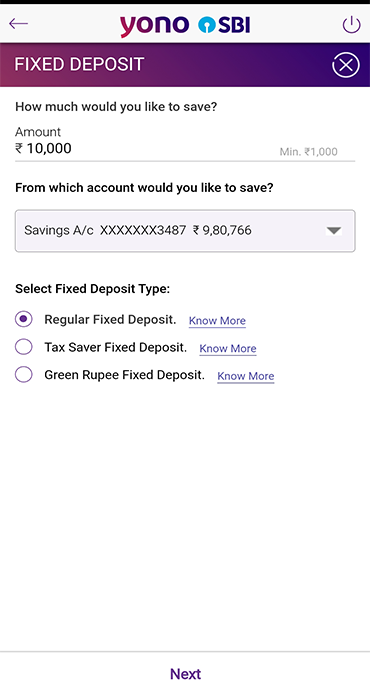

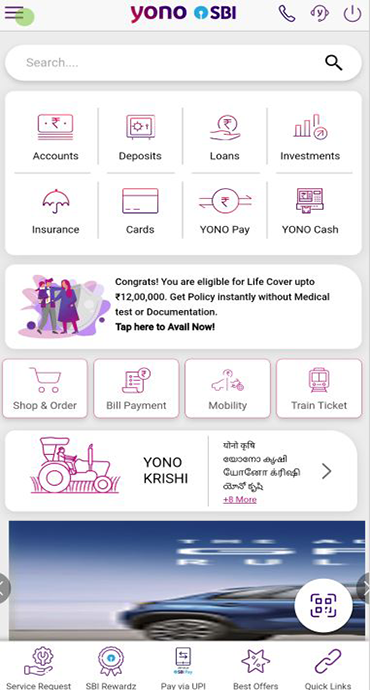

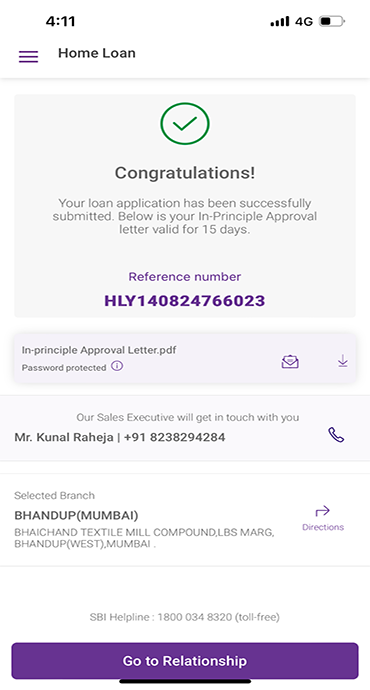

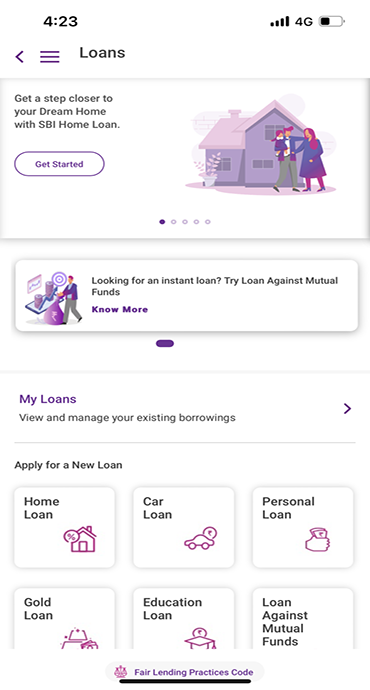

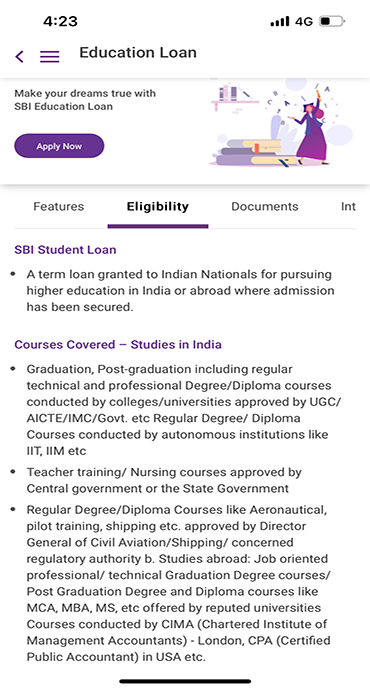

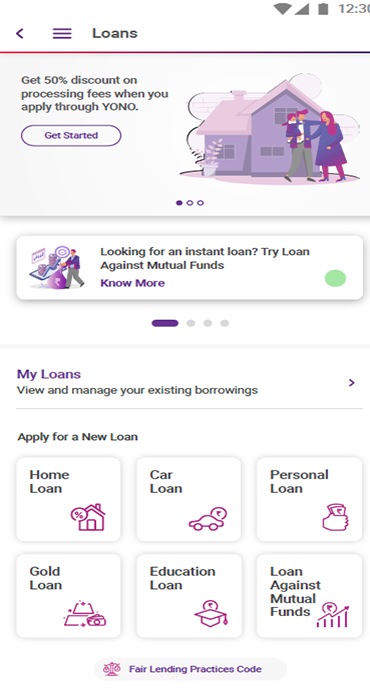

Step 3: Select Insta Plus Savings Account

Choose "Open Savings Account." From the various savings accounts available, select the "Insta Plus Savings Account" to proceed with the account opening journey.

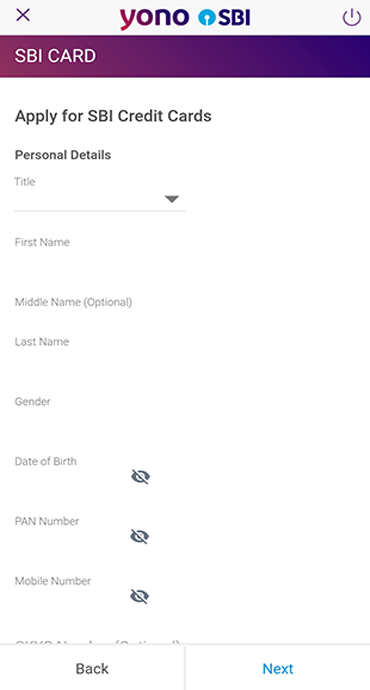

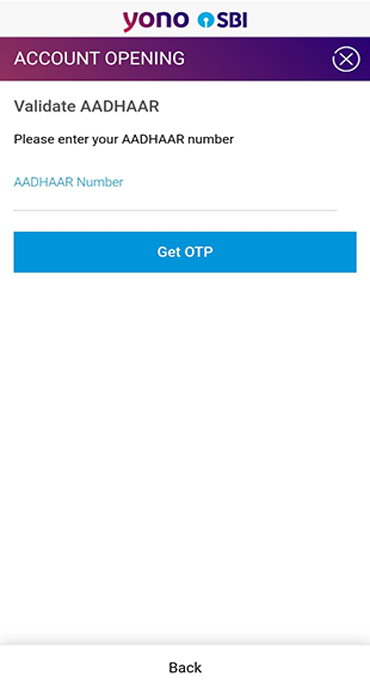

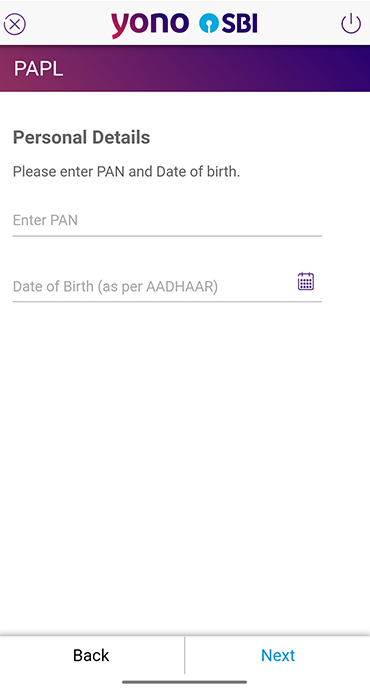

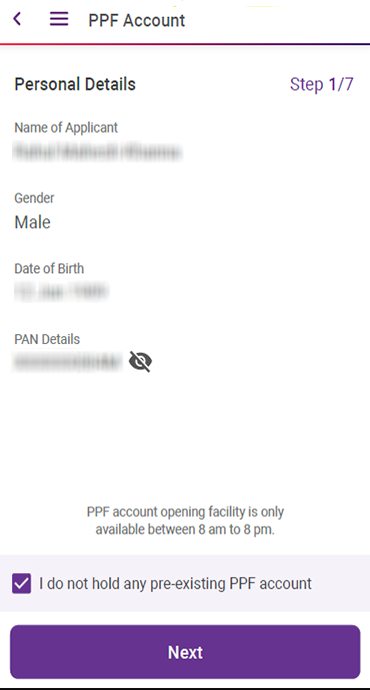

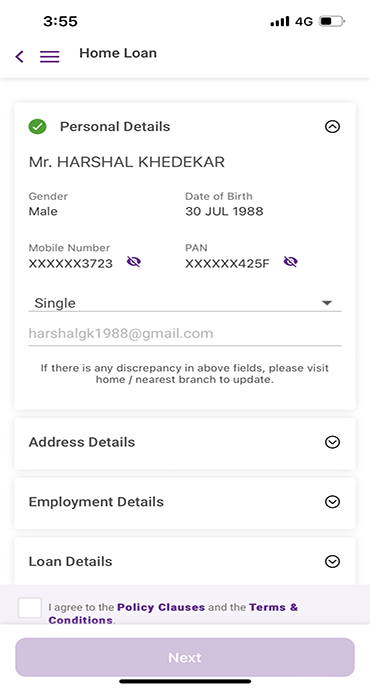

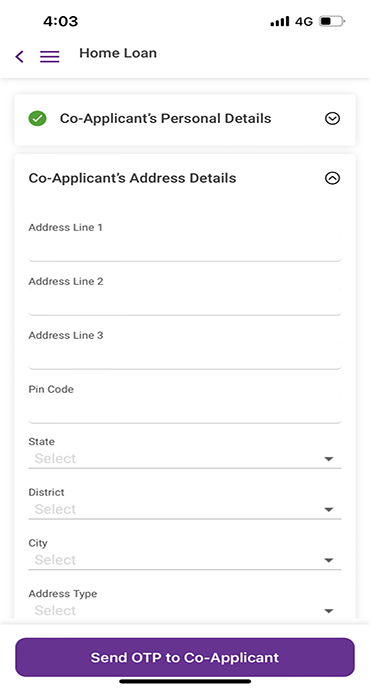

Step 4: Provide Aadhaar or Virtual Identity Number Details

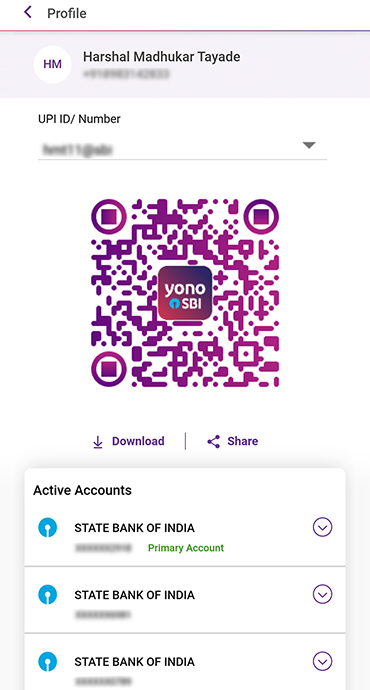

As part of the application process, you'll be asked to enter your Aadhaar or Virtual Identity Number details.

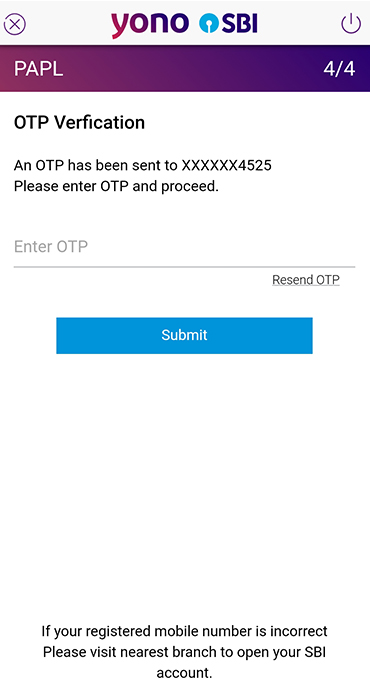

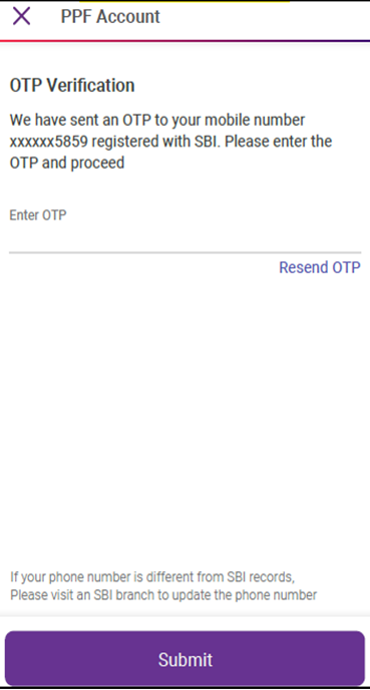

Step 5: Verify Aadhaar OTP

Upon entering your Aadhaar details, a One-Time Password (OTP) will be sent to the mobile number linked to your Aadhaar.

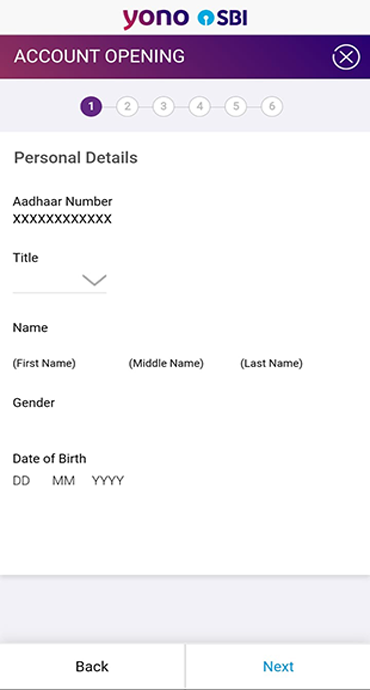

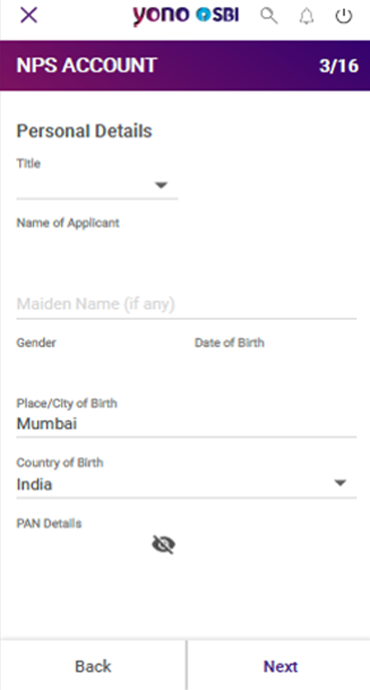

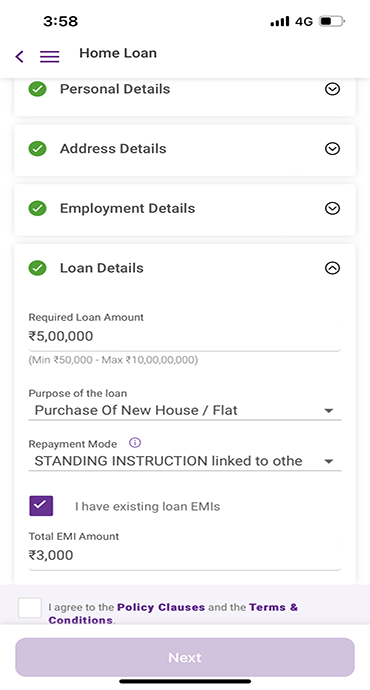

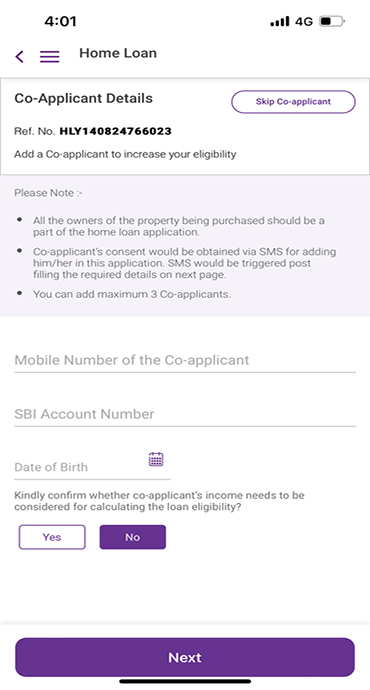

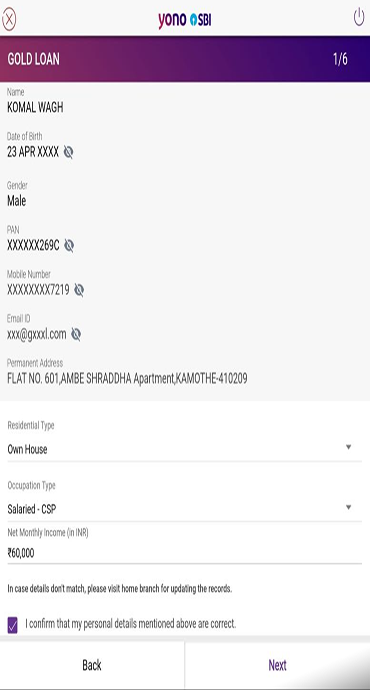

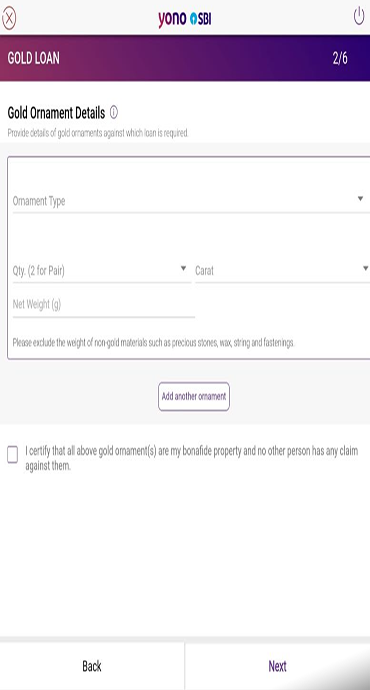

Step 6: Enter Relevant Details

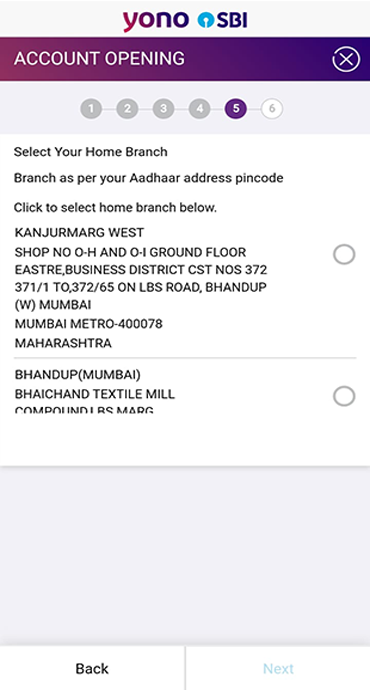

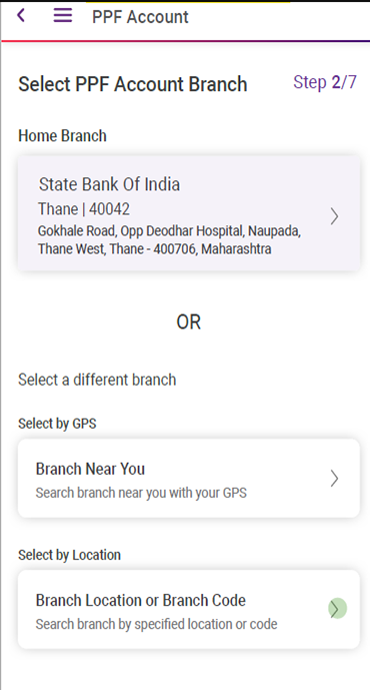

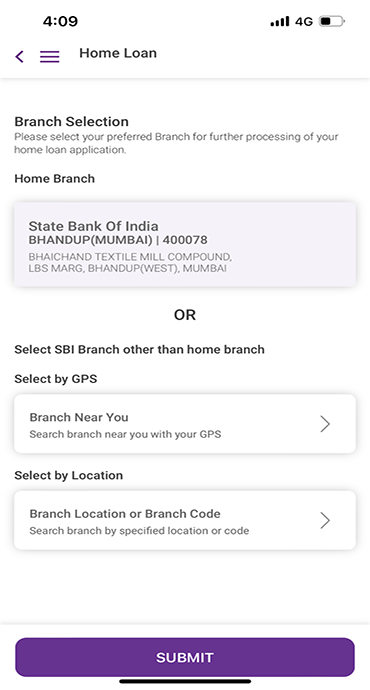

In this step, you'll need to provide additional information such as your details, contact information, and any other necessary details required for the account opening procedure. Select your Home Branch.

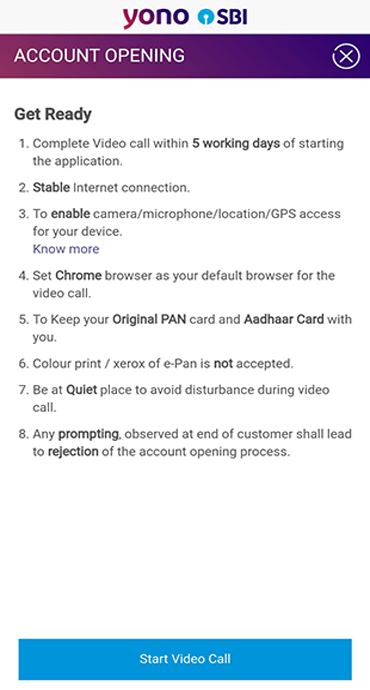

Step 7: Schedule Video Call

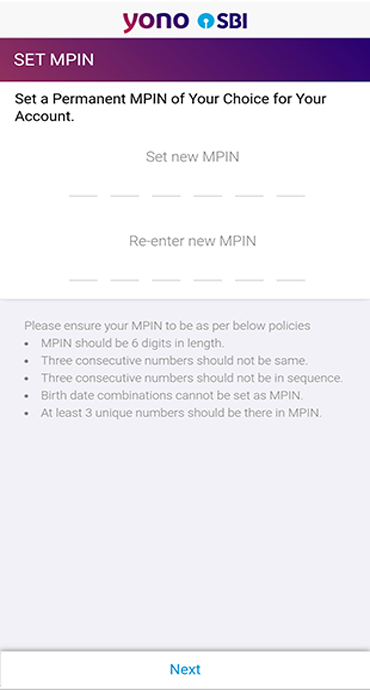

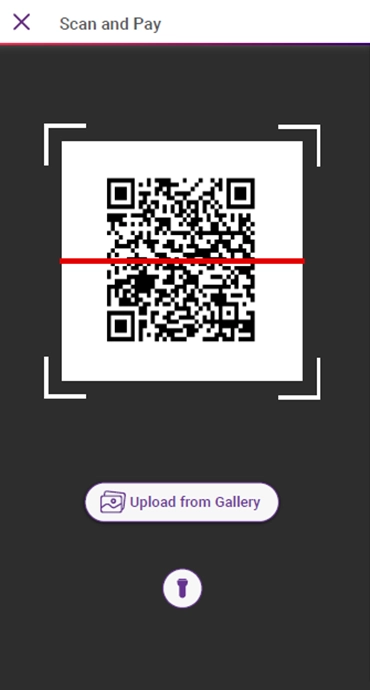

To proceed with the Video KYC process, you must schedule a slot for a video call to confirm your identity and visual documentation.

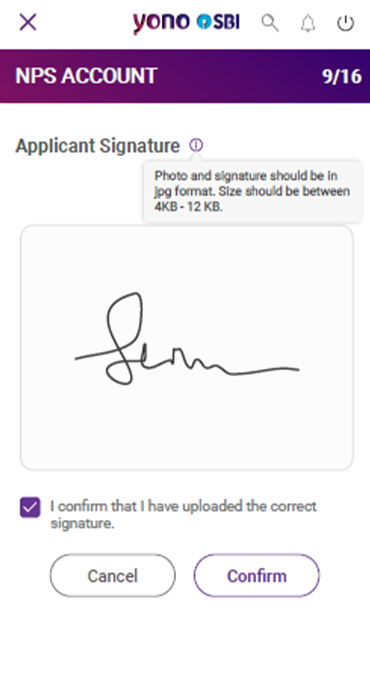

Step 8: Complete Video KYC

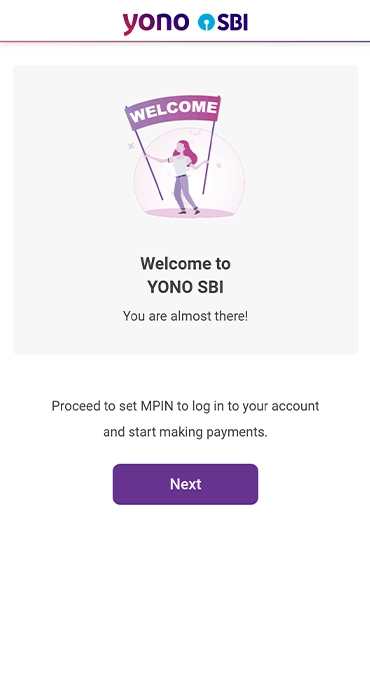

At the appointed time, log in to the YONO SBI App and use the "Resume" feature to continue the account opening process. During the video call, you'll interact with an SBI representative who will guide you through the Video KYC process and capture your photograph. They will ask you to show your identification documents, such as your PAN Card, ensuring these matches the provided details for verification purposes.

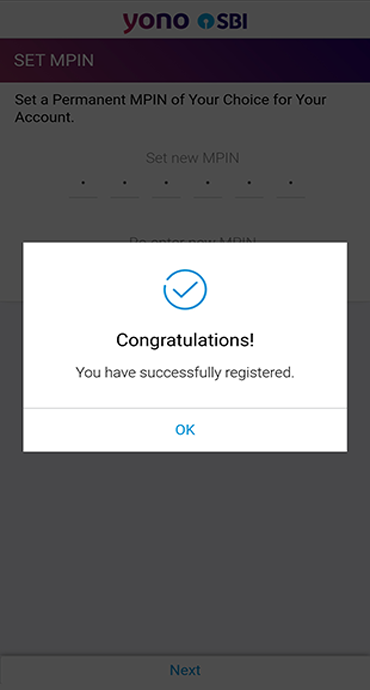

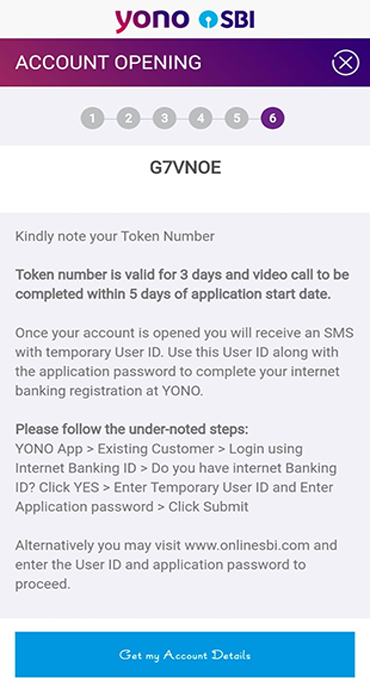

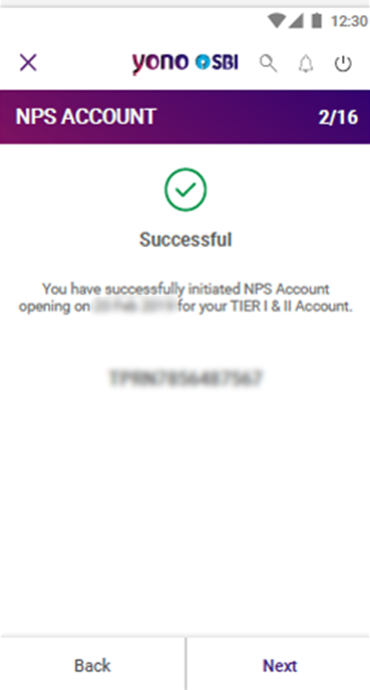

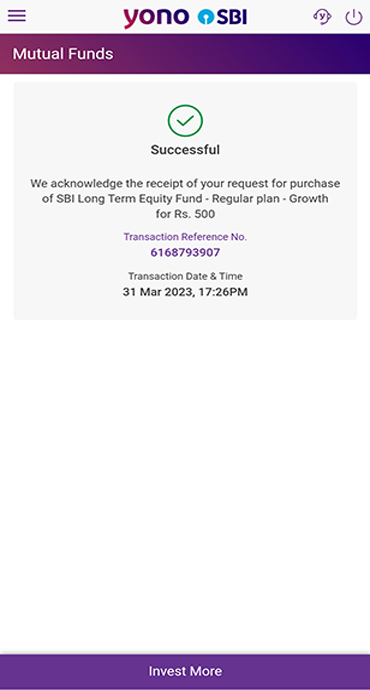

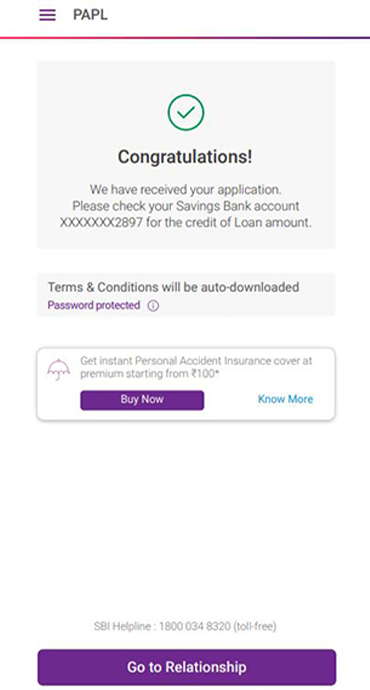

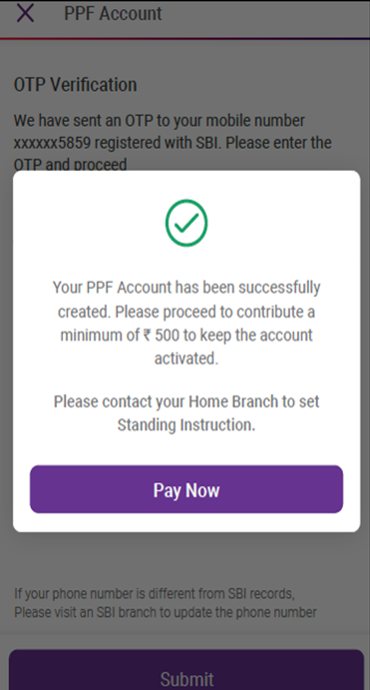

Step 9: Account Activation

Once the Video KYC process is completed, and your identity is verified, your Insta Plus Savings Account will be opened. However, please note that this account will be activated for debit transactions only after SBI Officials have verified it. This verification step ensures the security and legitimacy of the report.

Tips for a Smooth Digital Account Opening Experience

To open a digital savings account through Video KYC, follow the tips mentioned below:

- Use a reliable internet connection to avoid disruptions during the process.

- Keep your documents handy for verification and quick upload during video call.

- If you encounter any issues, don't hesitate to contact customer support for assistance.

Your Digital Saving Journey Starts Now

It has never been so easier to open a digital savings account! Understand the ease of online banking and manage your money with a few clicks. Remember to select the YONO SBI app that suits your needs, provides correct information throughout the application process, and protects your login credentials. What are you waiting for, then? Take advantage of modern banking by opening a digital savings account right now!

आपकी रुचि से संबंधित ब्लॉग