SBI Home Loan Process: Home loan Interest Rates, eligibility and loan application Guide - Yono

Step-by-Step Home Loan Process: Plan Your Dream Home with SBI

19 Jun, 2025

home loan

Importance of Home Loans for Fulfilling Housing Dreams

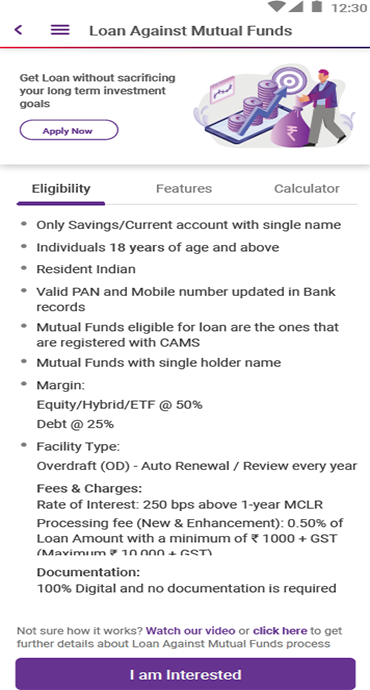

State Bank of India (SBI) Home Loans have been instrumental in assisting numerous families in achieving their dream of homeownership. With highly competitive home loan interest rates in the market, SBI offers flexible loan tenures of up to 30 years, making repayments more manageable. The bank provides financing options covering up to 90% of the property's cost, ensuring accessibility for a wide range of customers. Additionally, SBI's home loan products include benefits such as low processing fees, no hidden charges, further enhancing affordability and transparency for borrowers.

Whether you are a salaried employee, self-employed professional, or an NRI looking to invest in Indian real estate, SBI Home Loans provide customized financial solutions to suit your needs.

SBI Home Loans: Comprehensive Solutions for Every Homebuyer

SBI understands that every homebuyer has unique requirements, and thus, offers a variety of home loan products to cater to different needs:

- Regular Home Loans – For buying a new or resale property.

- Home Construction Loans – For constructing a house on an owned plot.

- Home Renovation & Extension Loans – For upgrading or expanding an existing property.

- Balance Transfer Home Loans – Transfer your existing loan from another bank to SBI at lower home loan interest rates.

- NRI Home Loans – Tailored for Non-Resident Indians (NRIs) looking to purchase a property in India.

Why Choose SBI Home Loans?

- Competitive Home Loan Interest Rates – Lower EMIs and cost-effective repayment.

- Minimal Processing Fees – Reduces the upfront financial burden.

- Flexible Repayment Tenures – Choose up to 30 years for easy repayment.

- High Loan Amounts – Finance up to 90% of the property value.

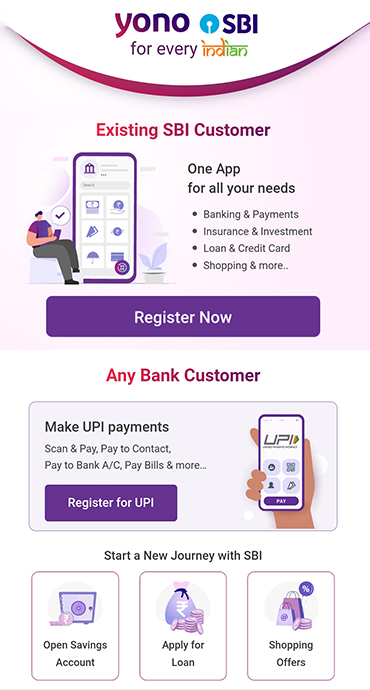

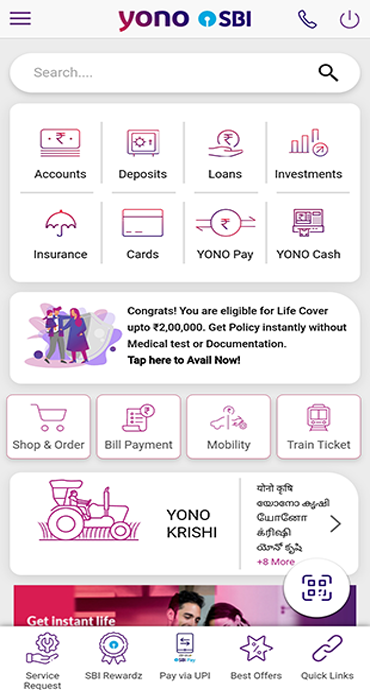

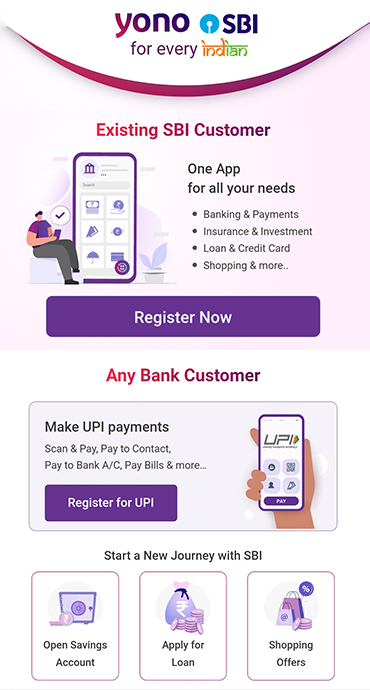

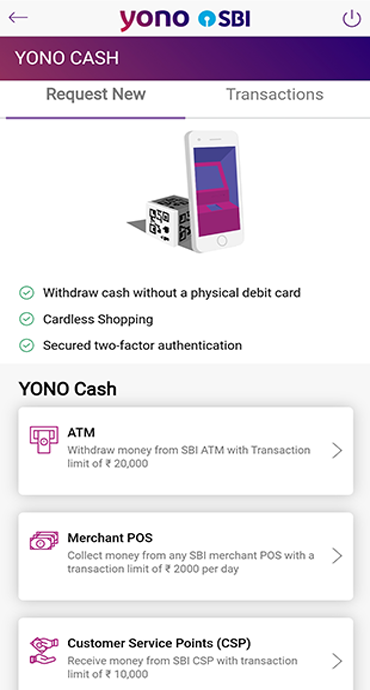

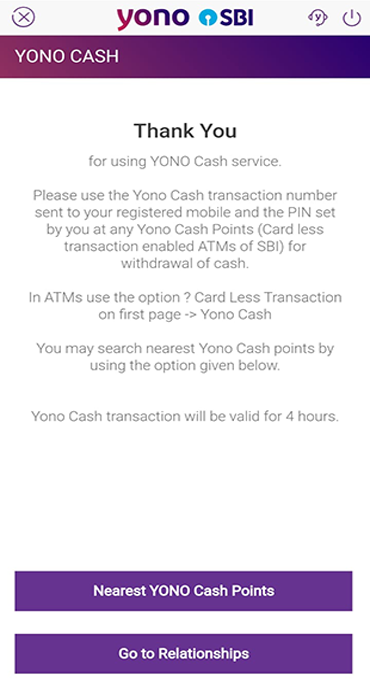

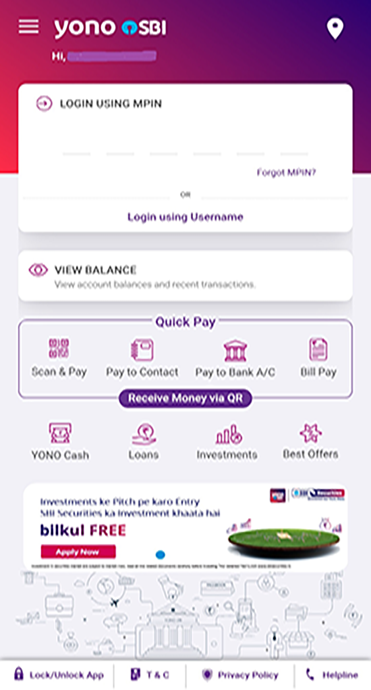

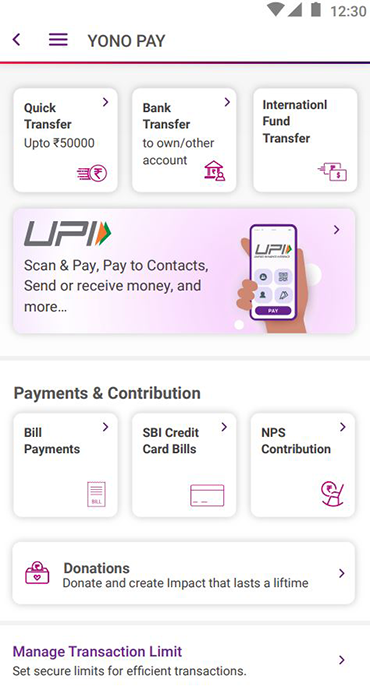

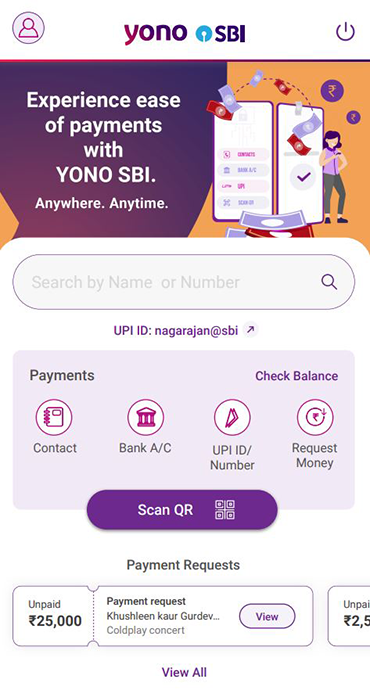

- Digital Convenience – Apply online via YONO SBI for a hassle-free experience.

Eligibility and Step-by-Step Application Process through YONO SBI

Home Loan Eligibility Criteria

Before applying, ensure that you meet the following home loan eligibility requirements:

- The loan application process is open to Indian citizens, Non-Resident Indians (NRI’s) and Overseas Citizens of India (OCI).

- Age eligibility: Minimum 18 years; Maximum 70 years at loan maturity.

- The applicant must have a stable and reliable source of income, whether as a salaried employee, self-employed professional, or business owner.

- Maintaining a healthy credit score improves your chances of home loan approval at if you maintain a healthy credit score

- A property must have a clear legal title and comply with SBI's lending criteria to be eligible for financing.

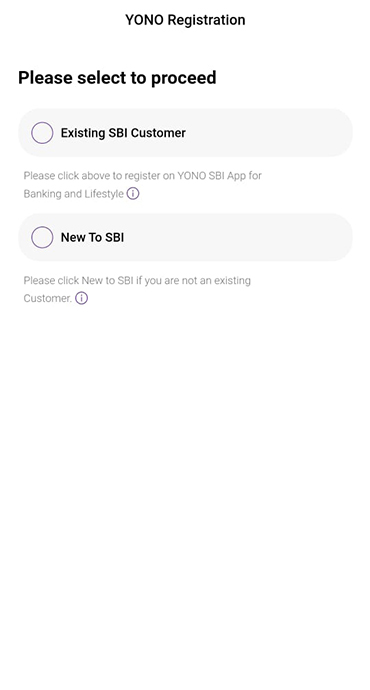

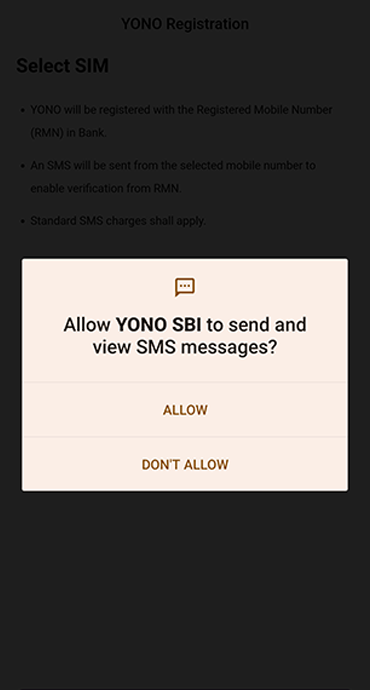

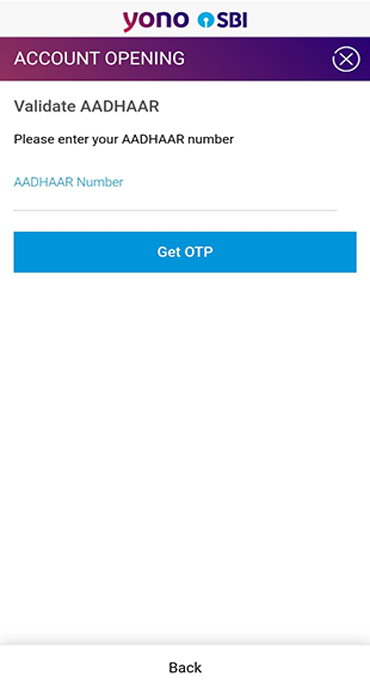

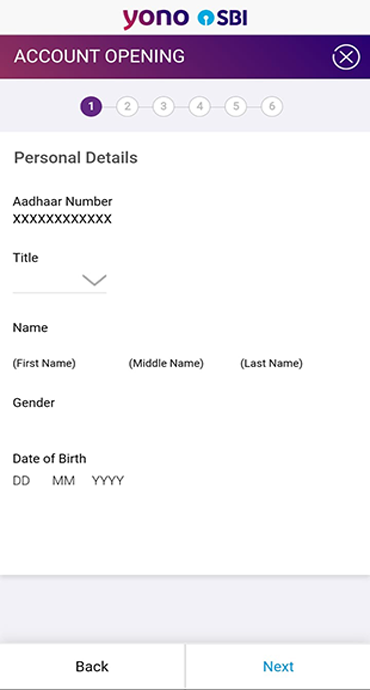

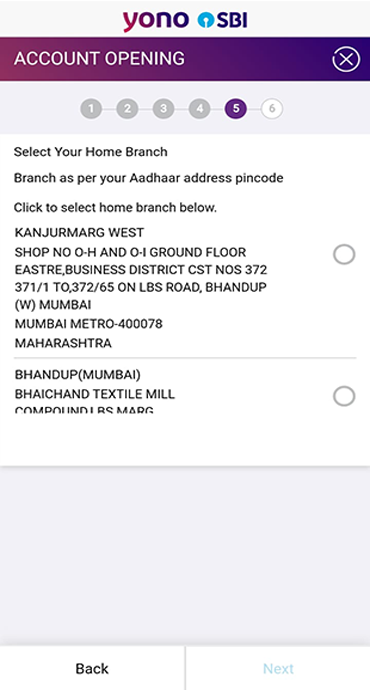

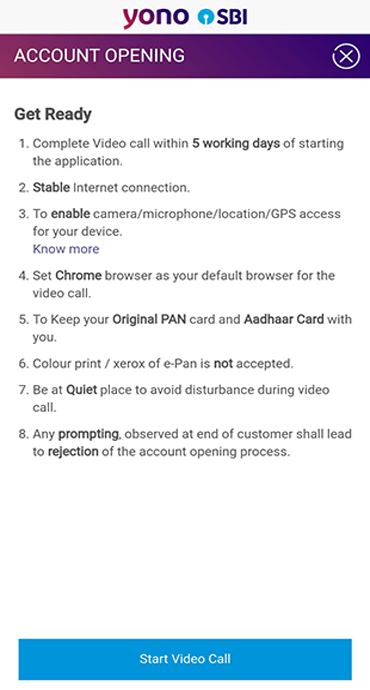

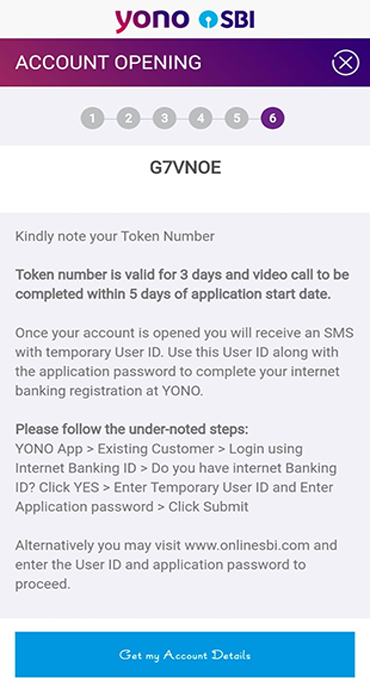

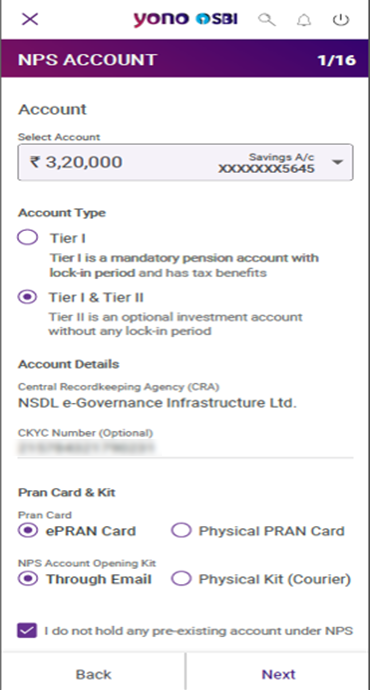

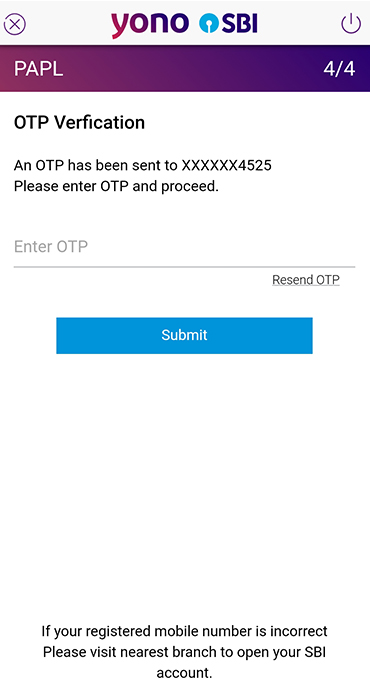

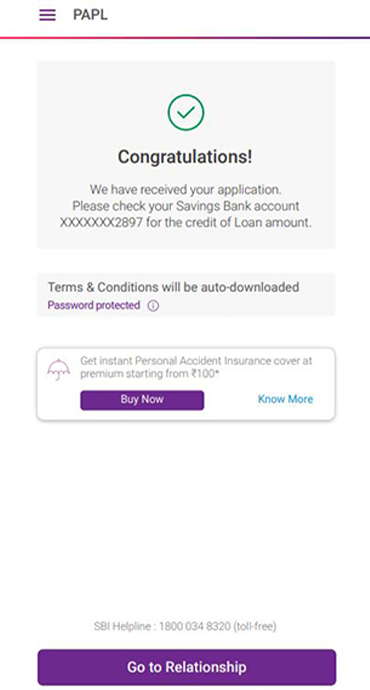

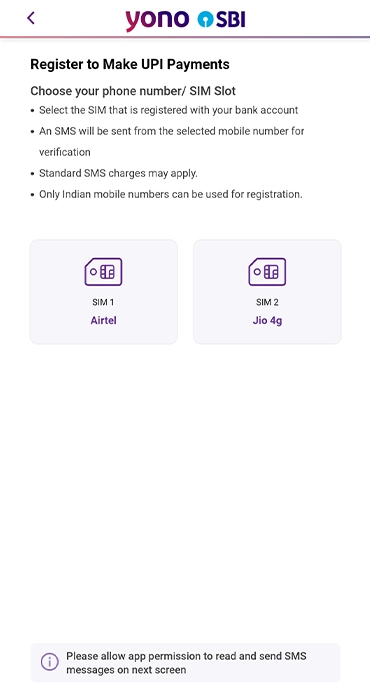

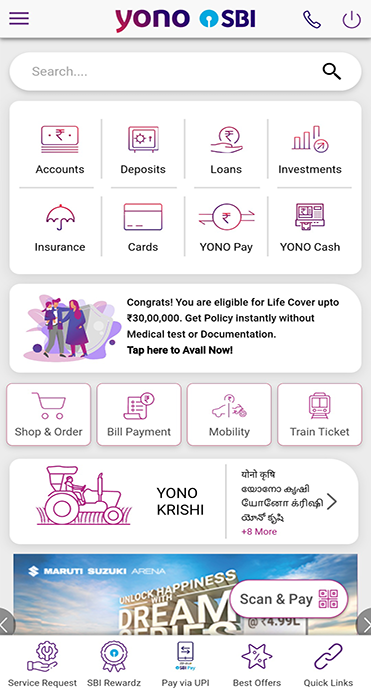

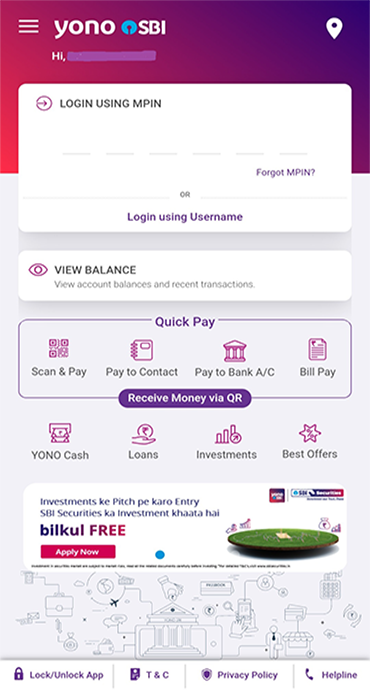

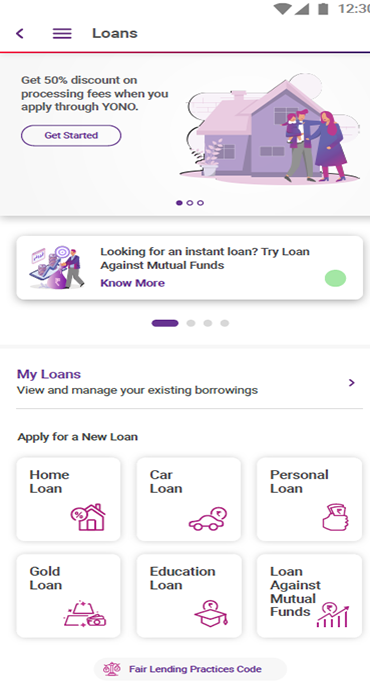

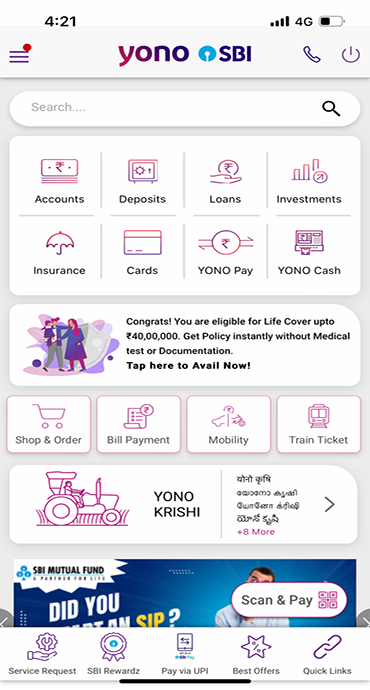

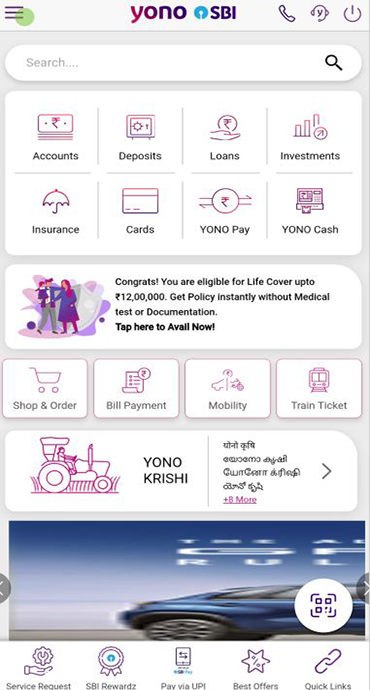

How to Apply for a Home Loan Through YONO SBI App?

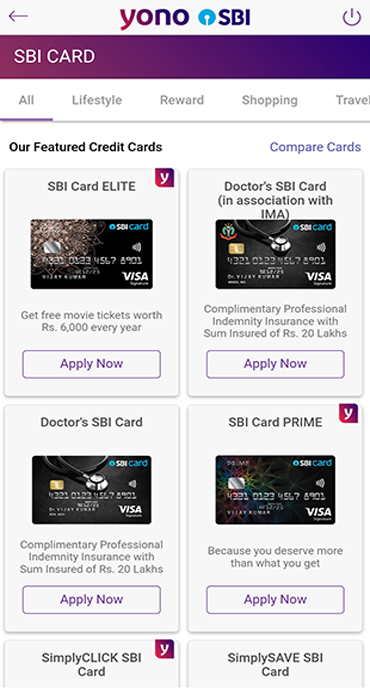

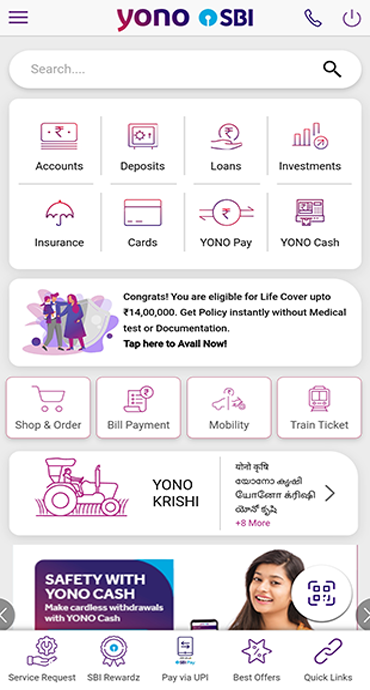

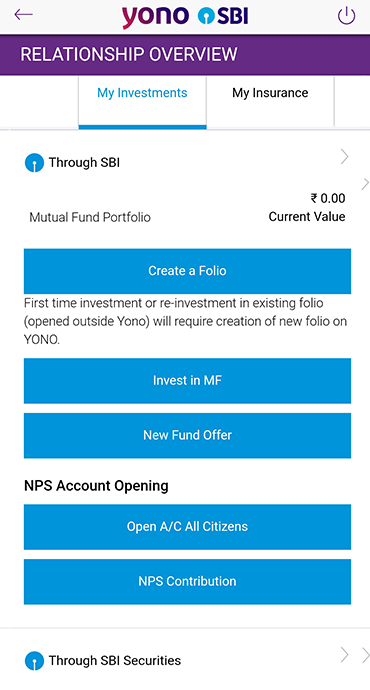

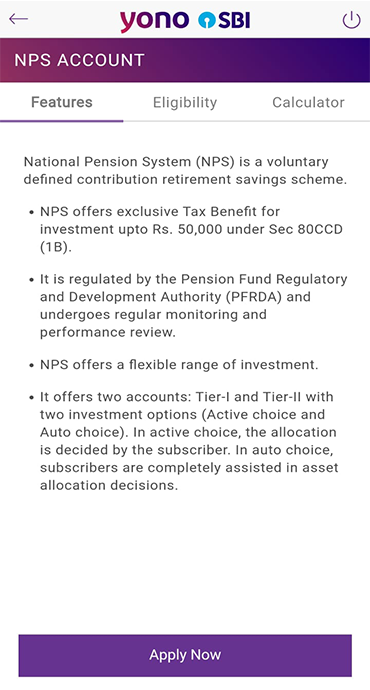

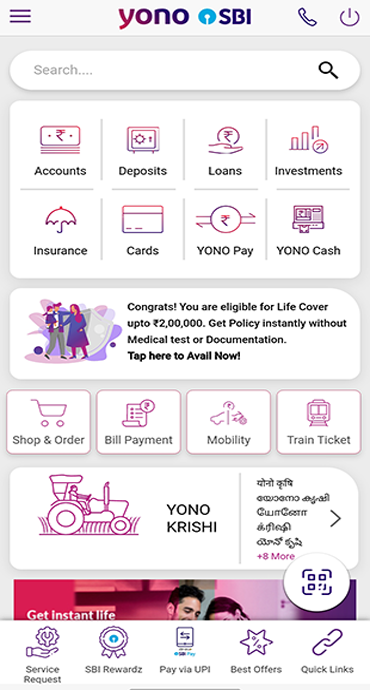

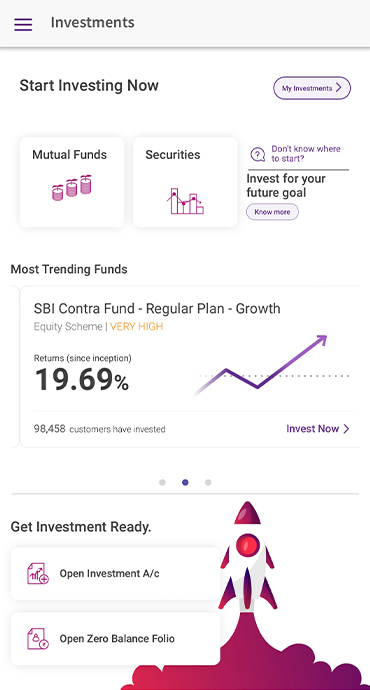

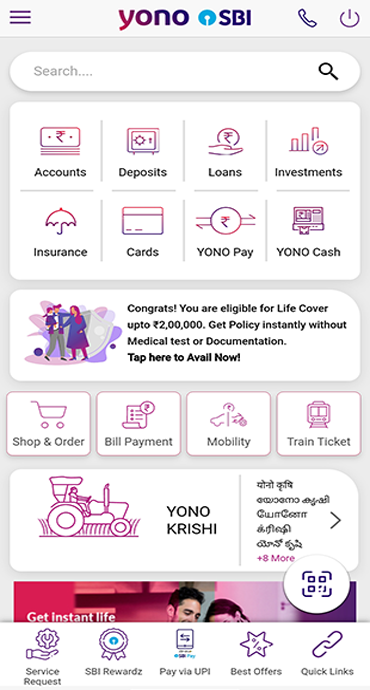

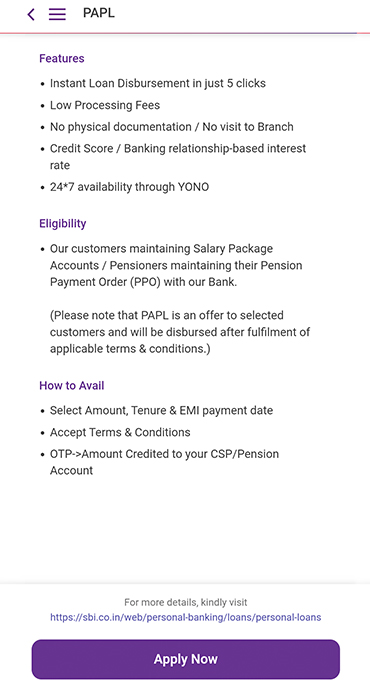

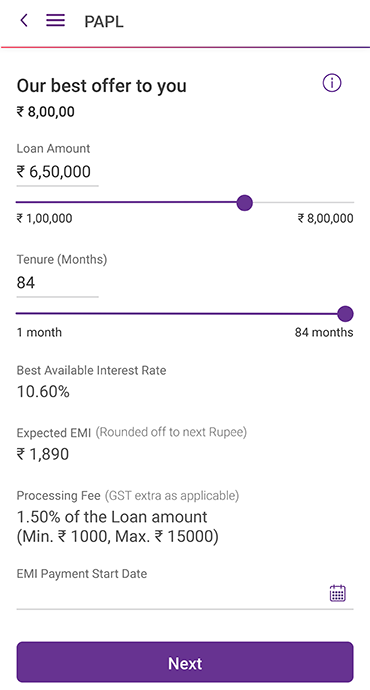

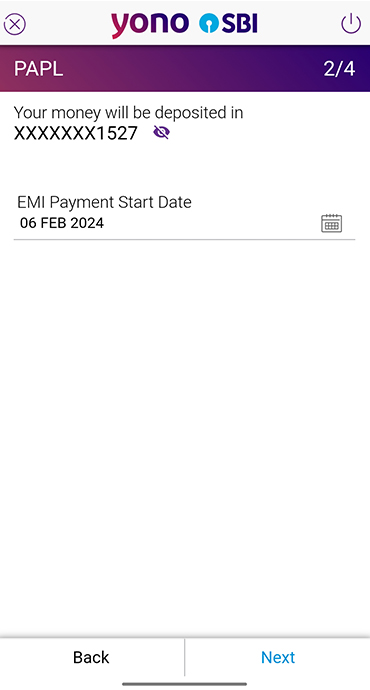

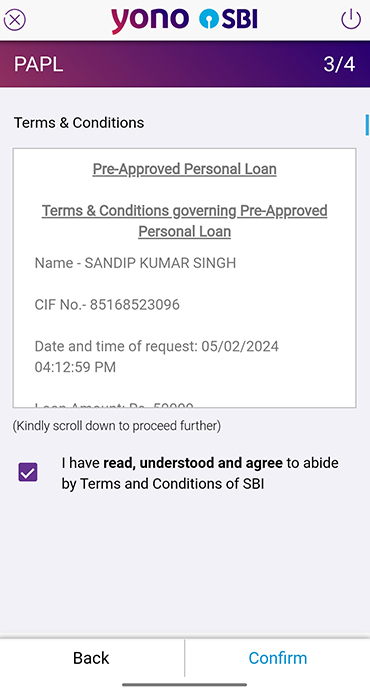

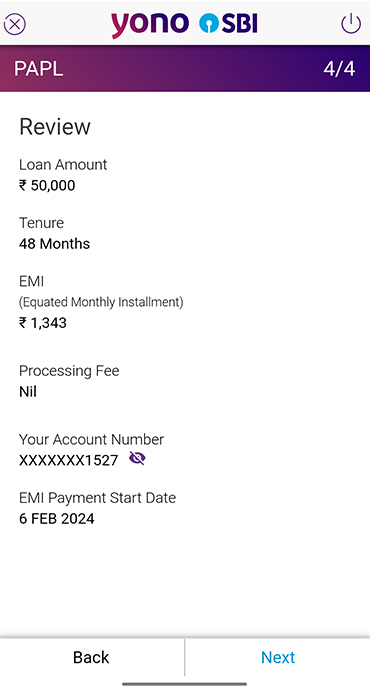

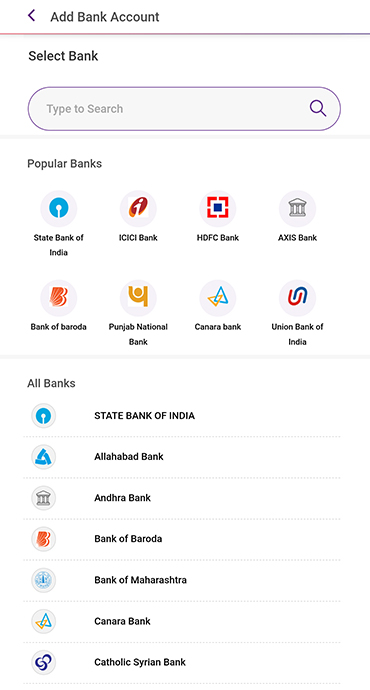

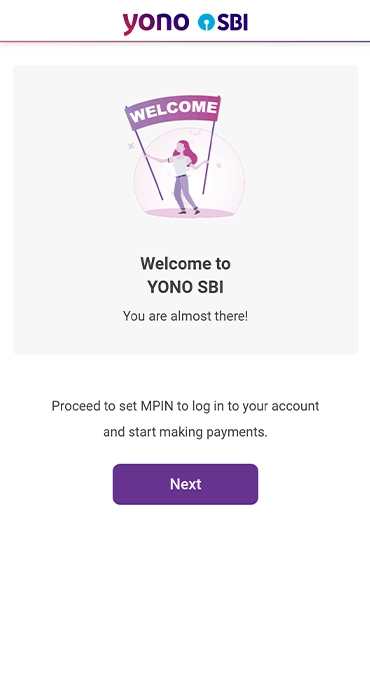

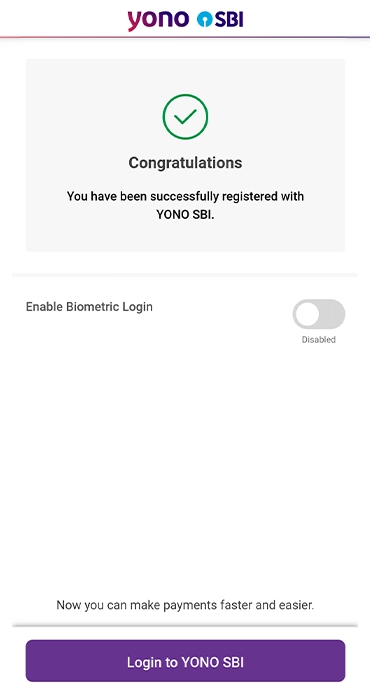

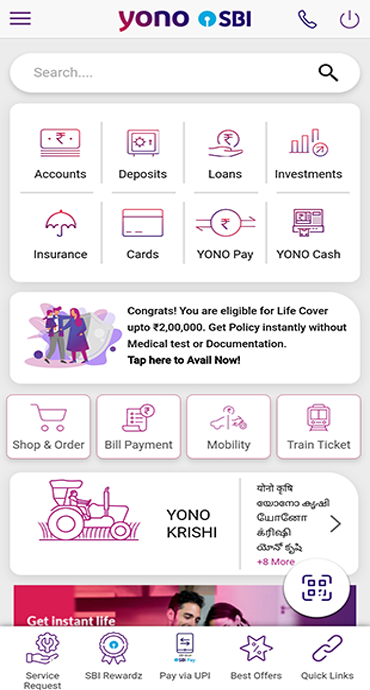

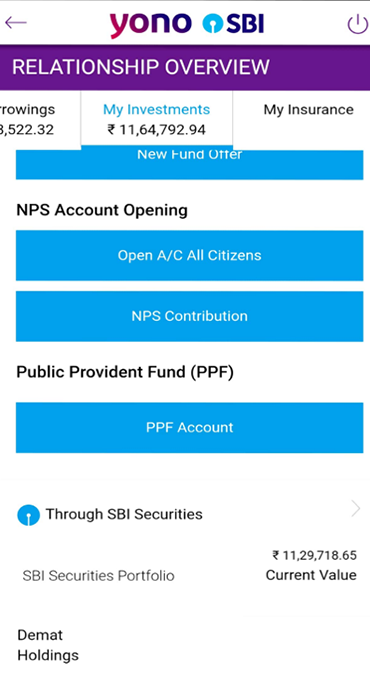

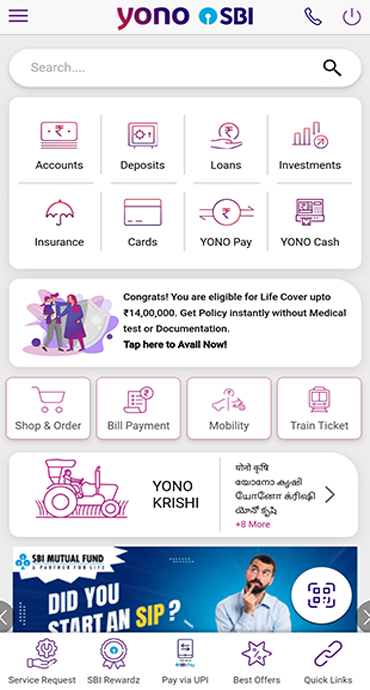

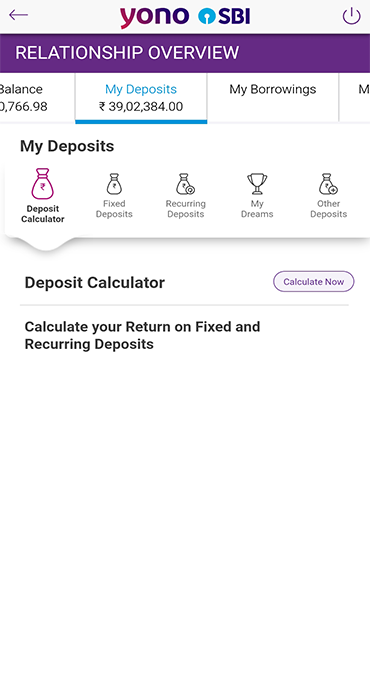

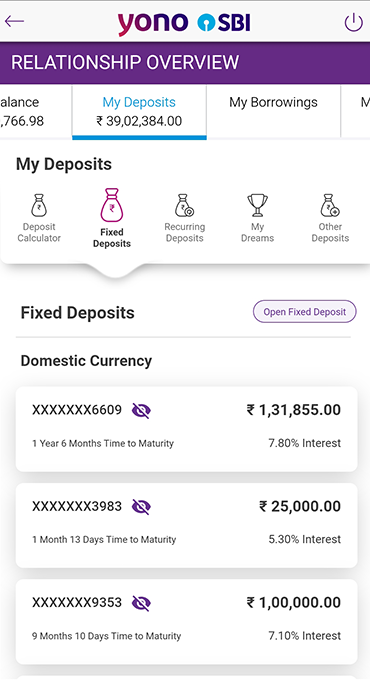

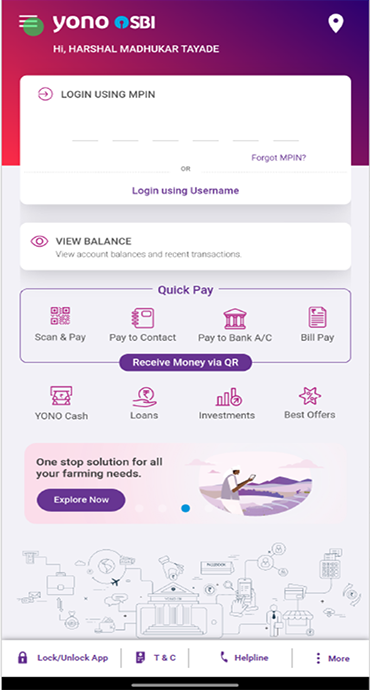

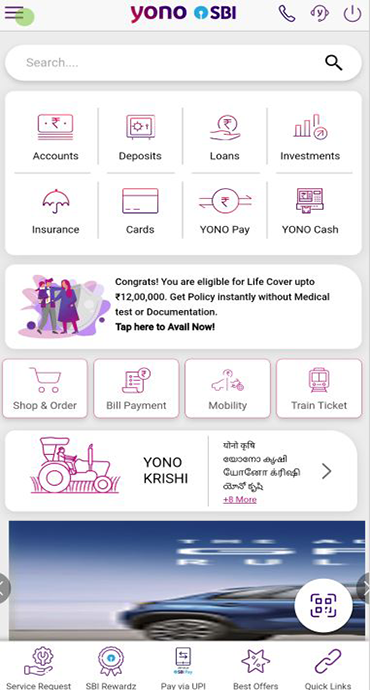

With SBI’s digital banking services, applying for a home loan is simple and quick:

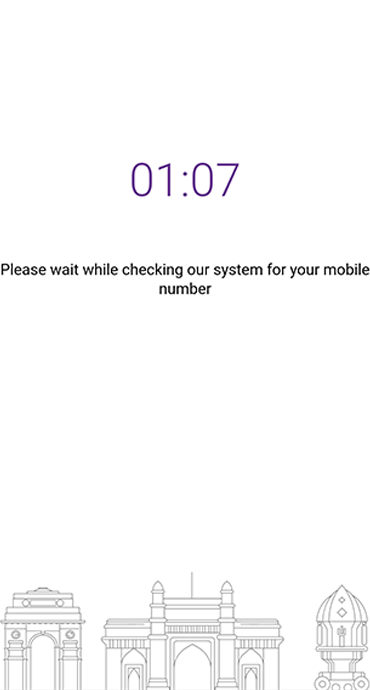

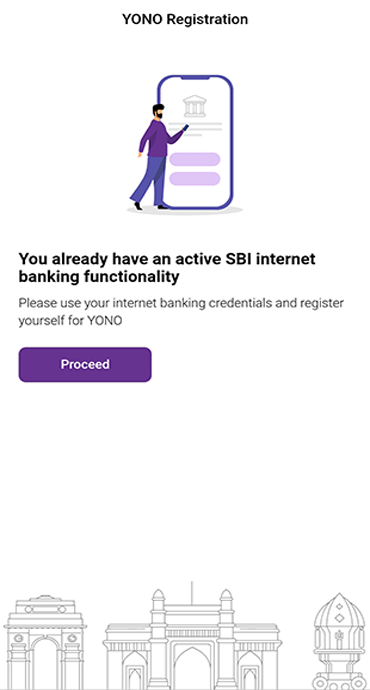

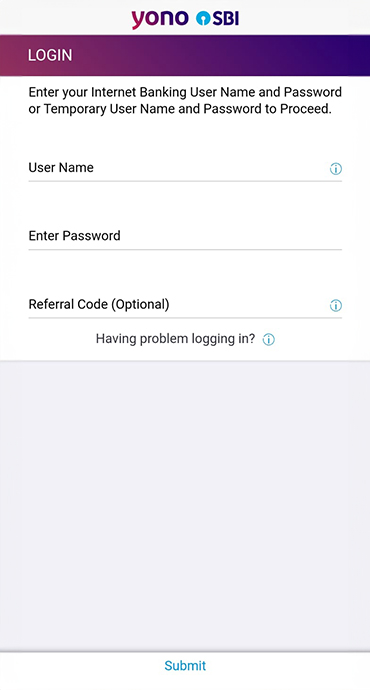

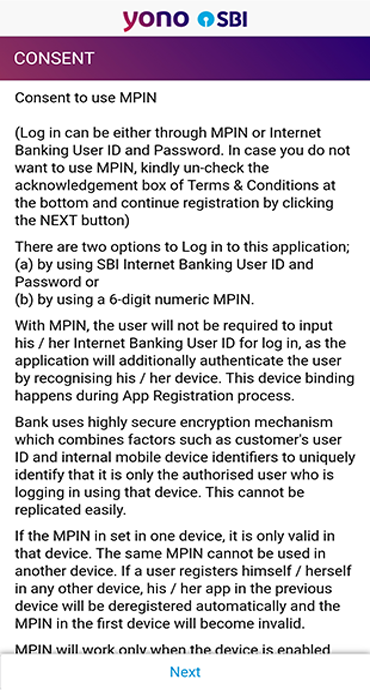

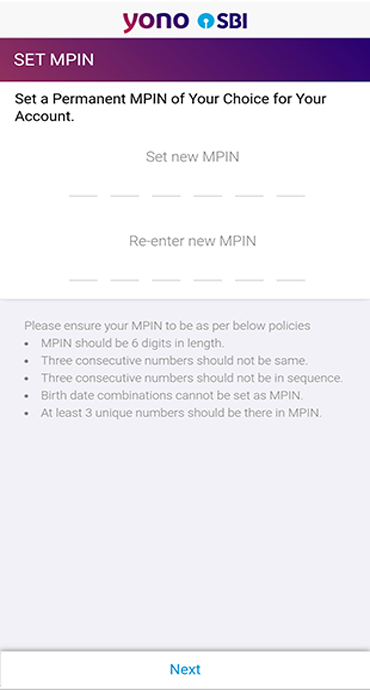

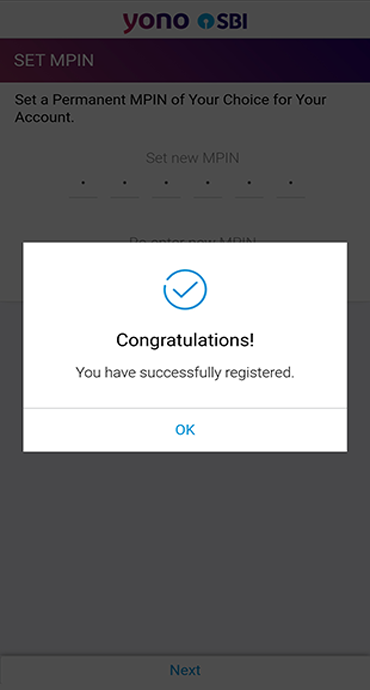

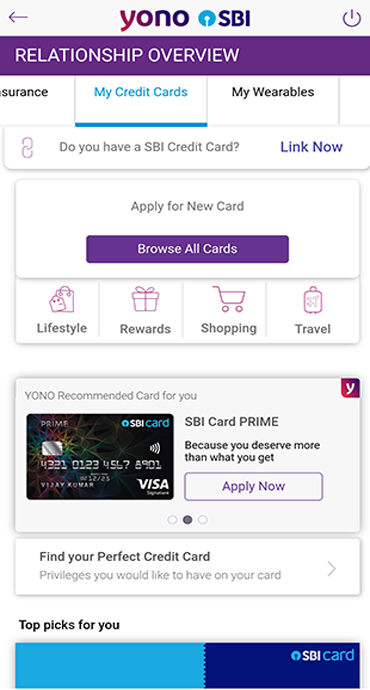

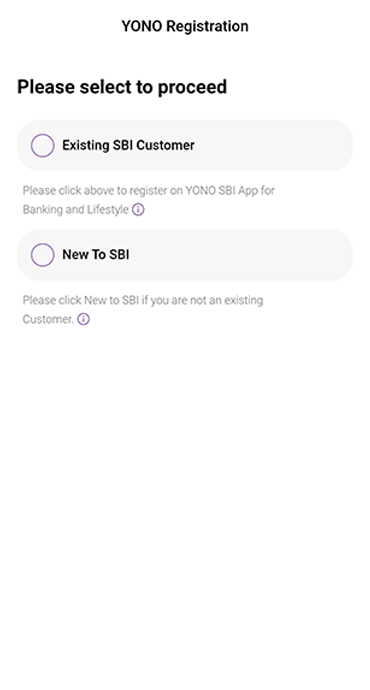

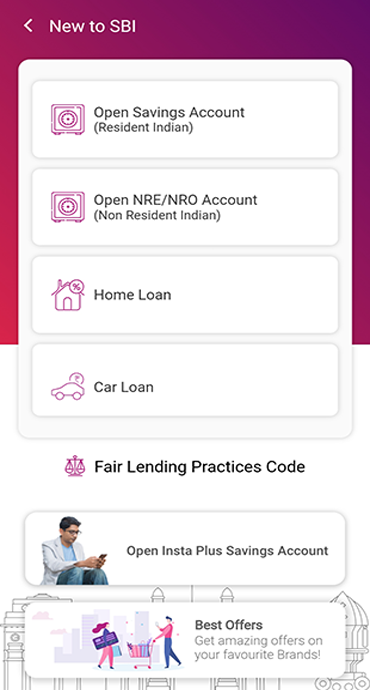

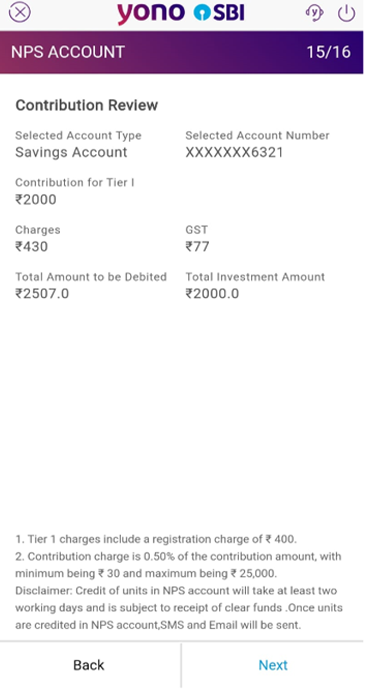

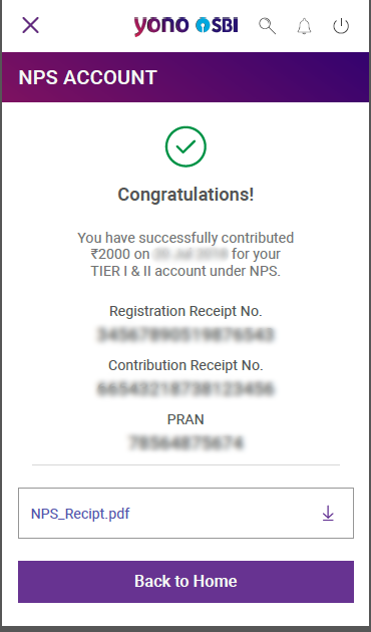

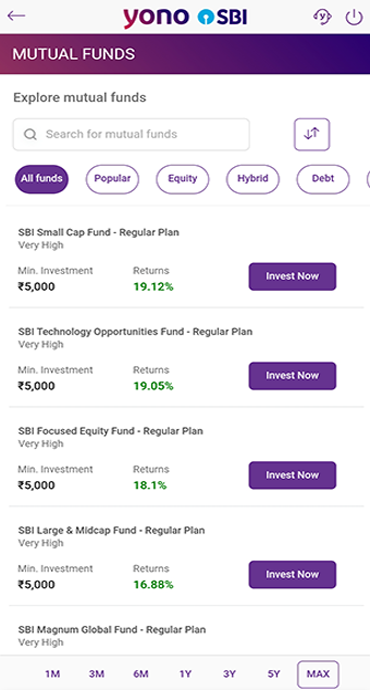

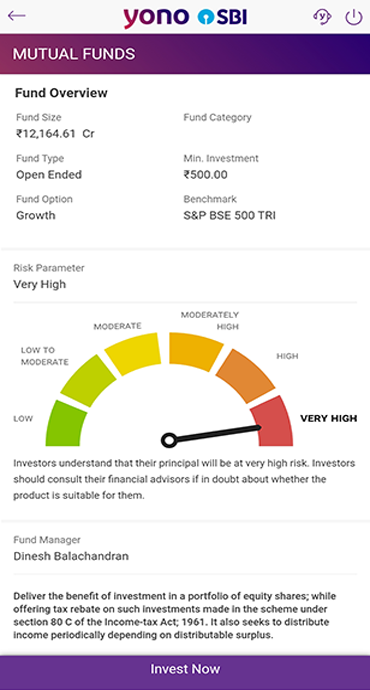

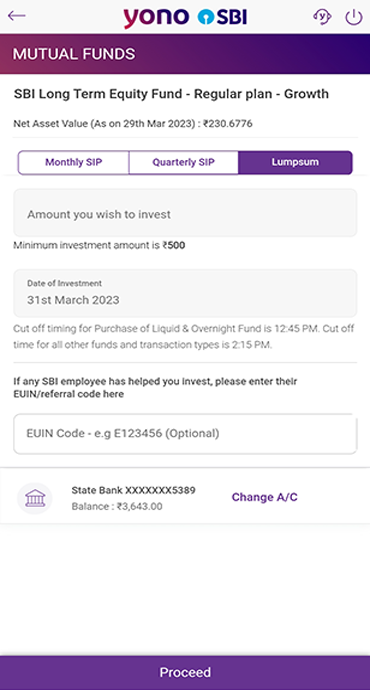

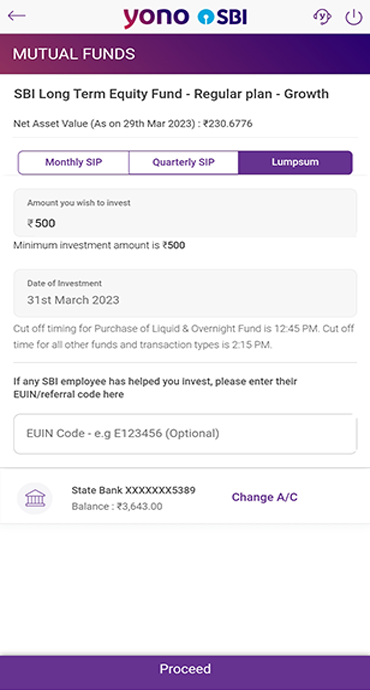

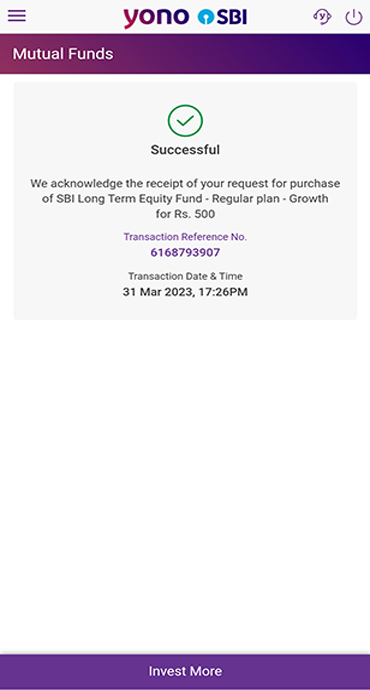

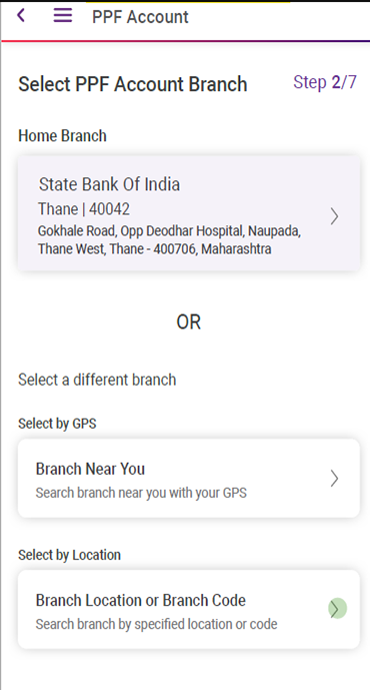

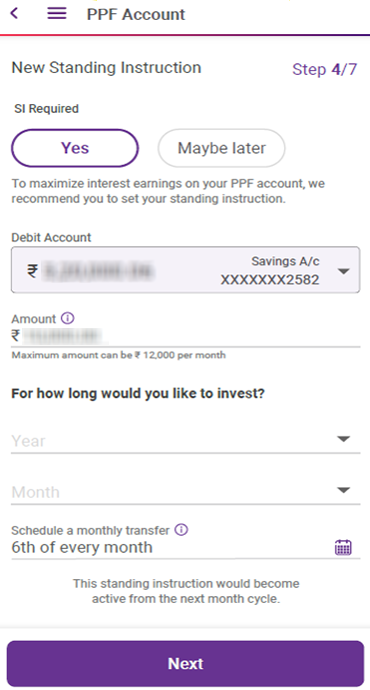

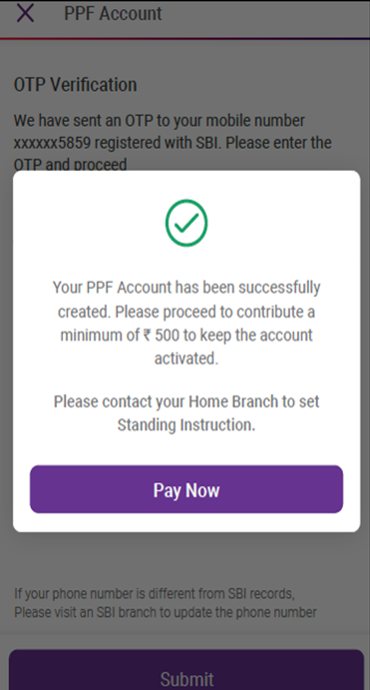

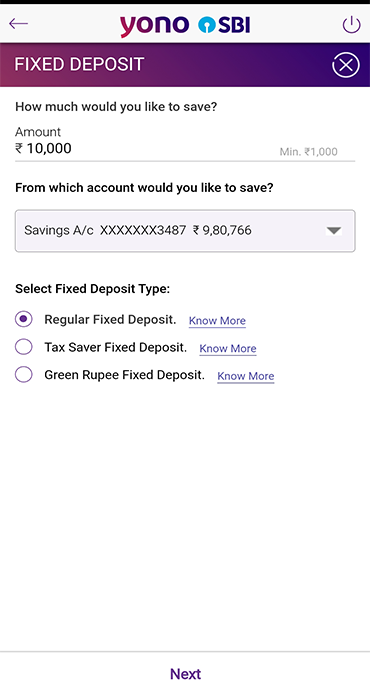

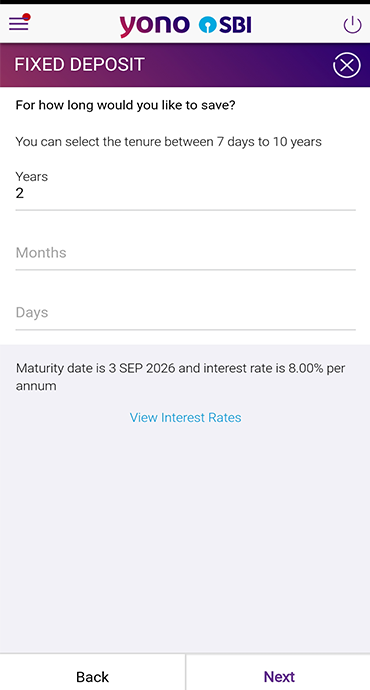

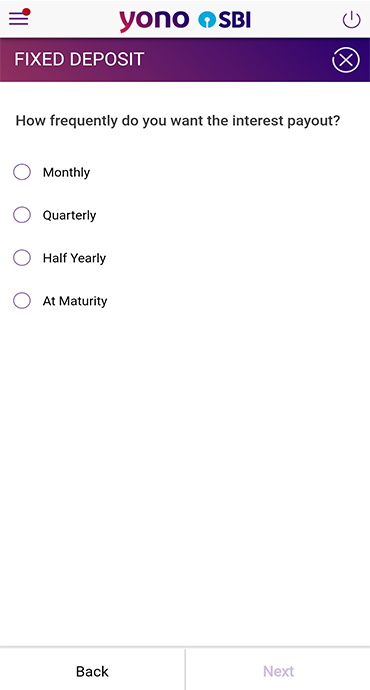

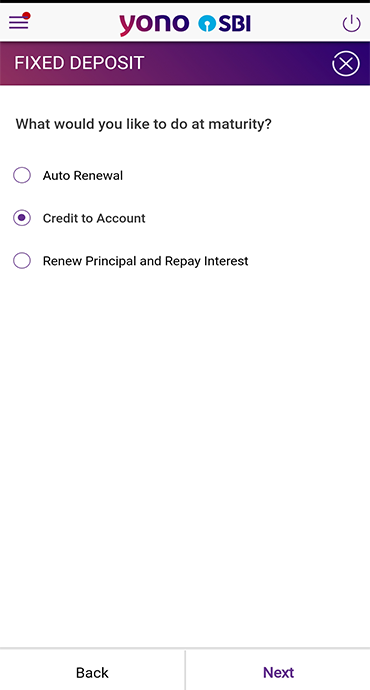

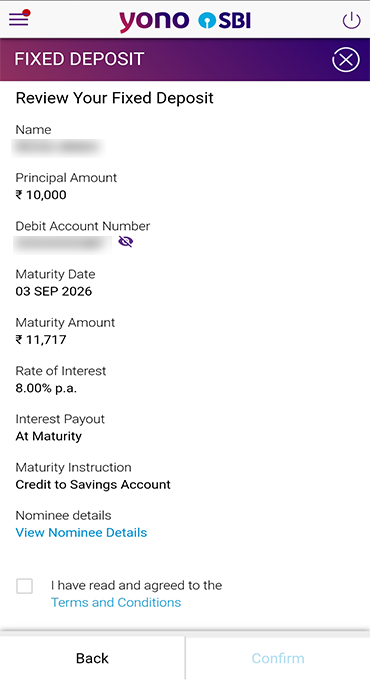

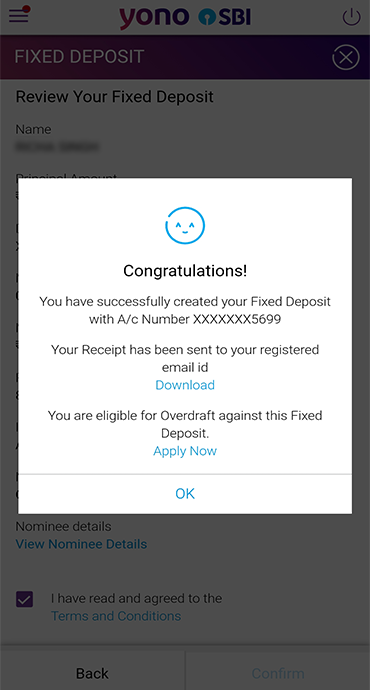

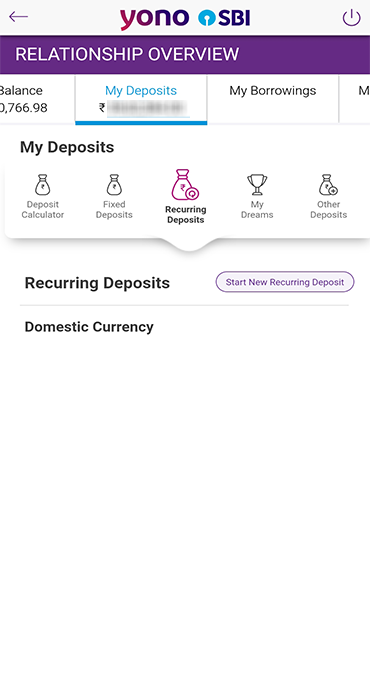

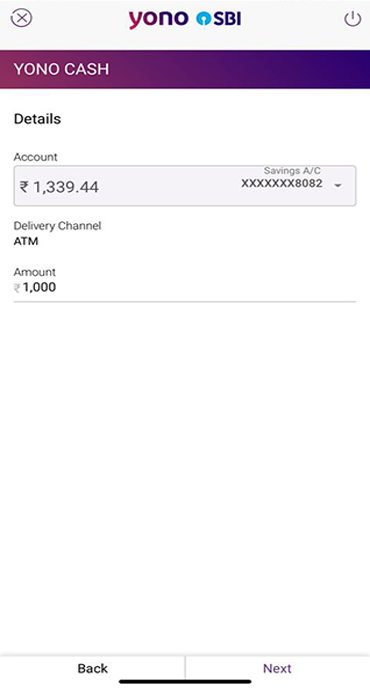

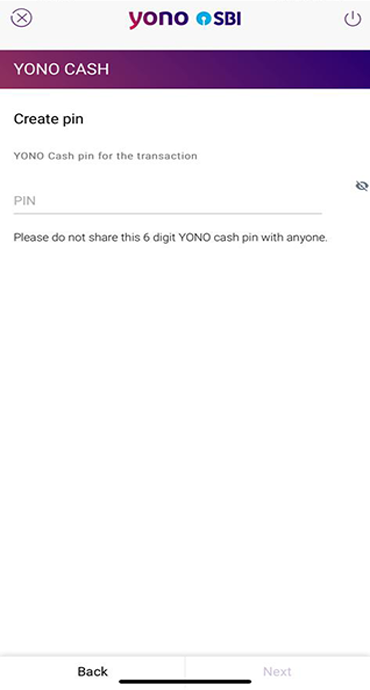

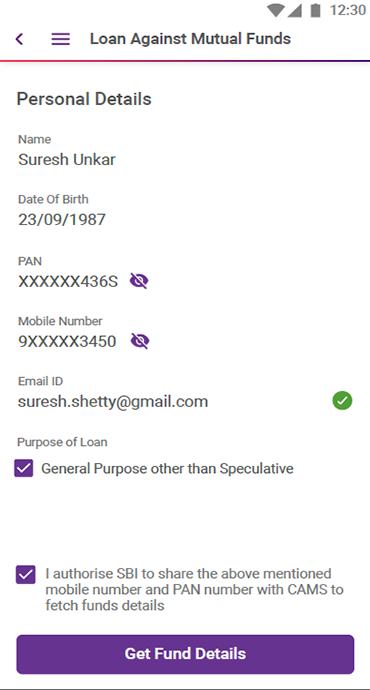

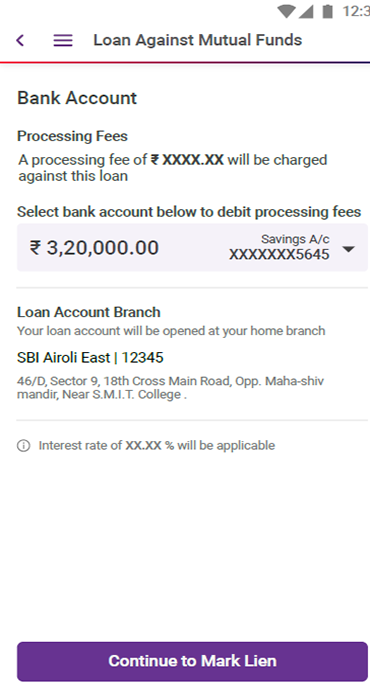

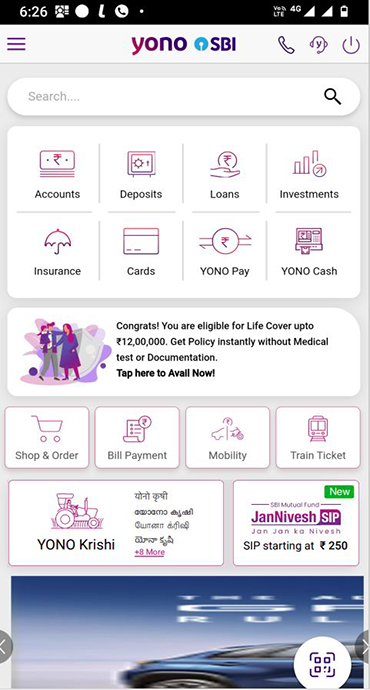

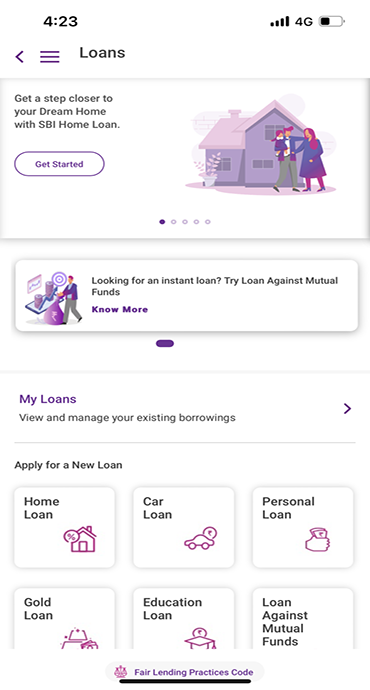

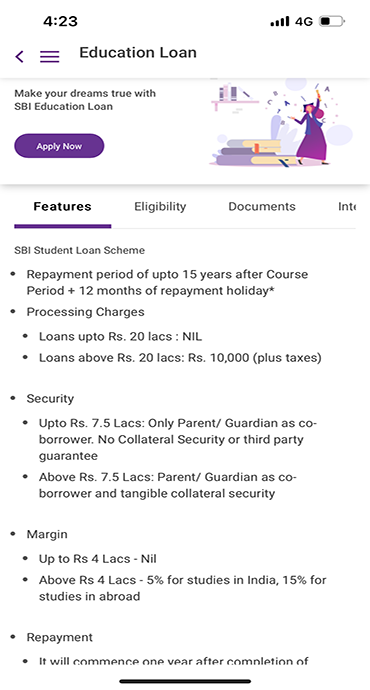

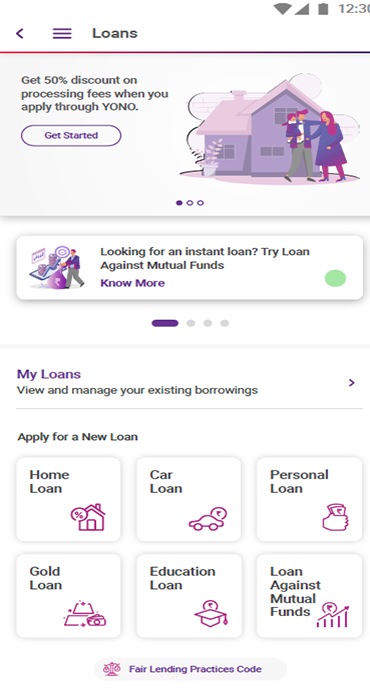

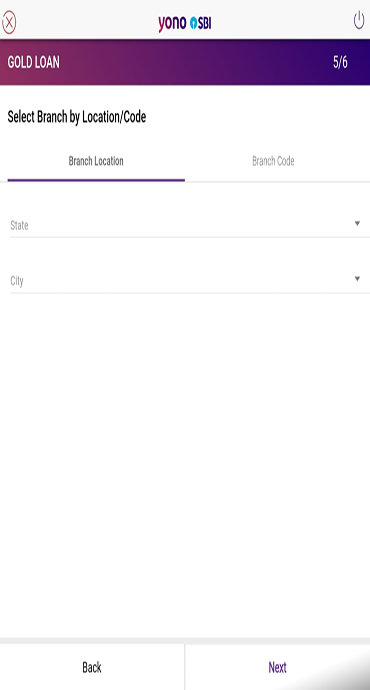

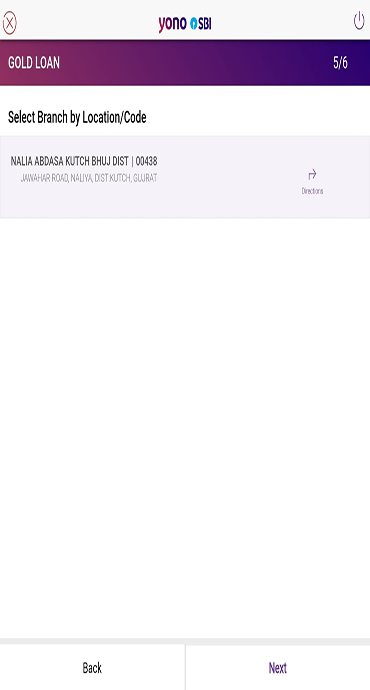

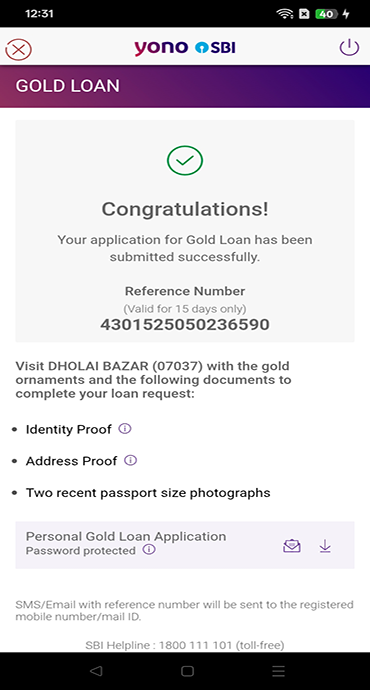

- Download YONO SBI App from Google Playstore / Appstore and login to app: Access your account using your credentials Select 'Home Loan': Navigate to the 'Loans' section and choose the 'Home Loan' option that fits your needs.

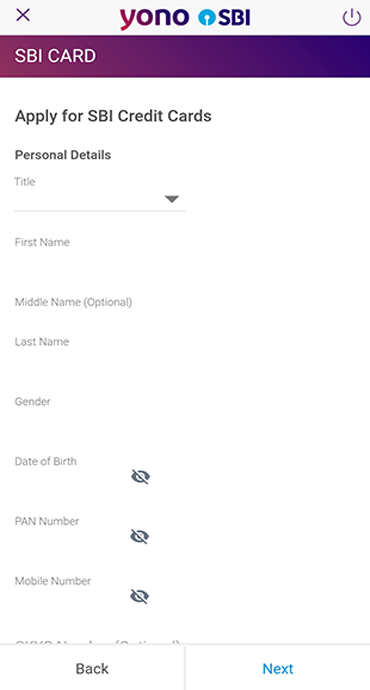

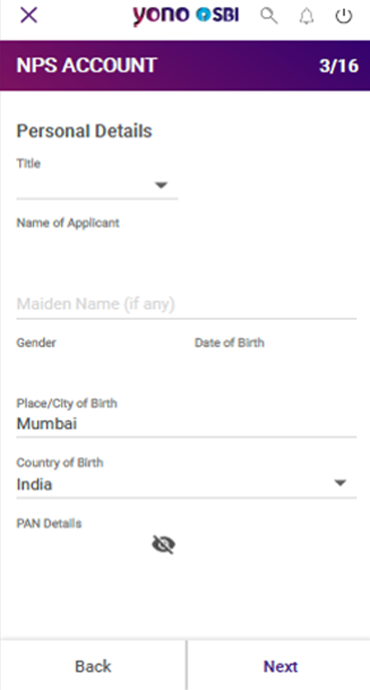

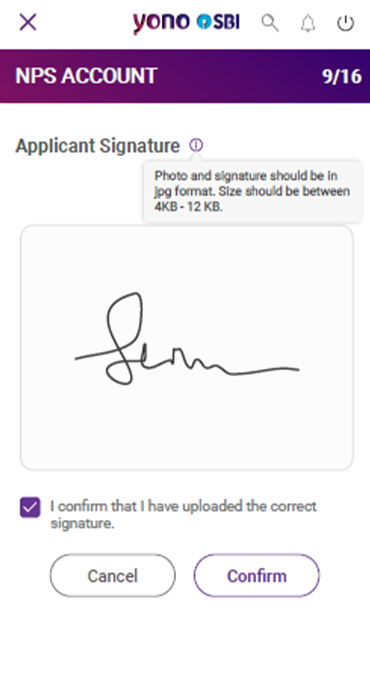

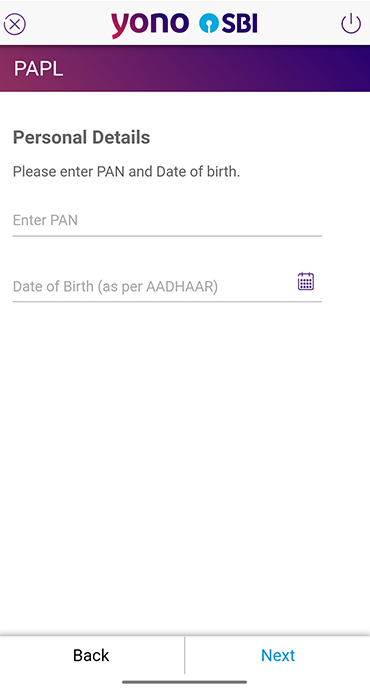

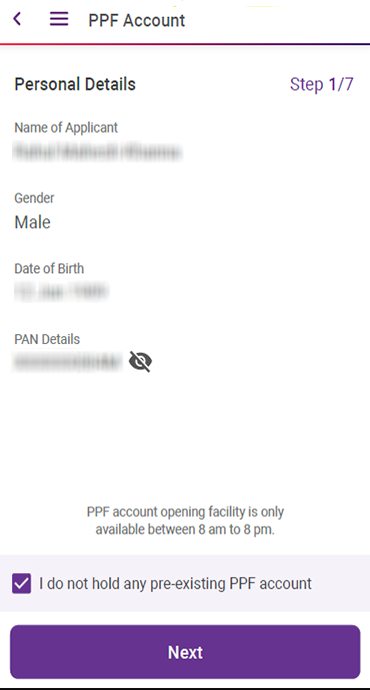

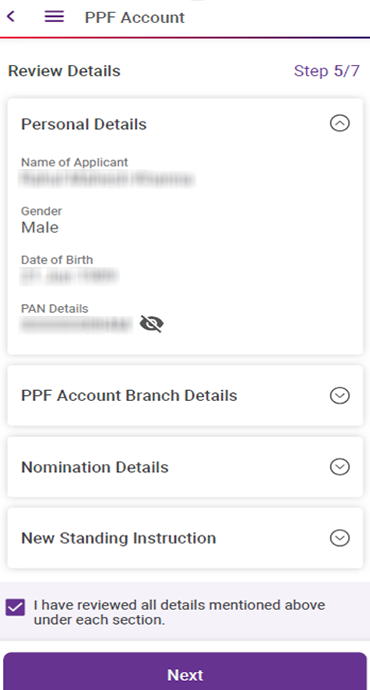

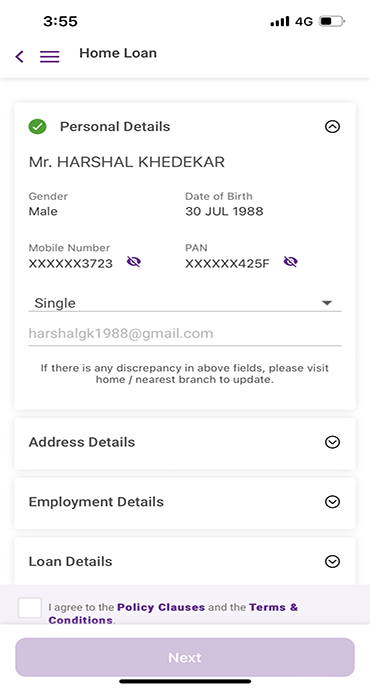

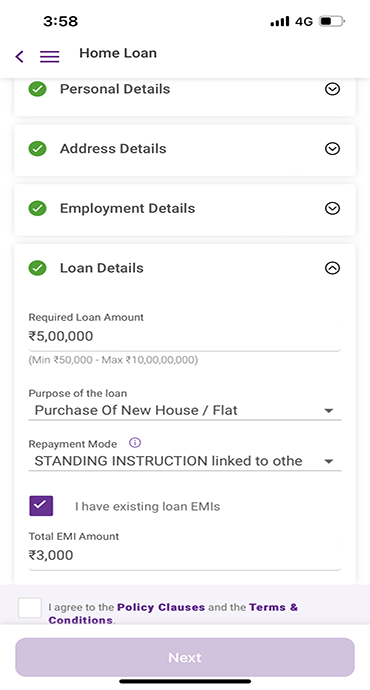

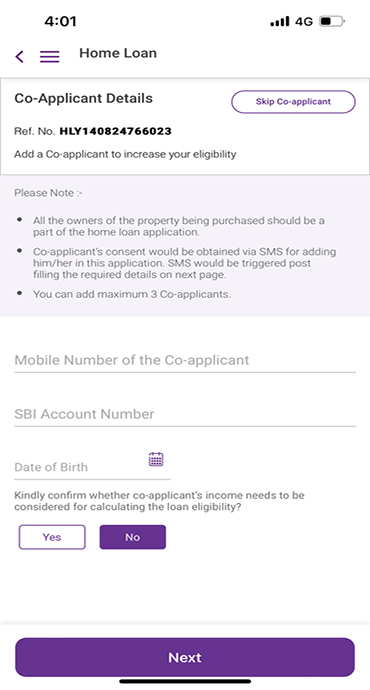

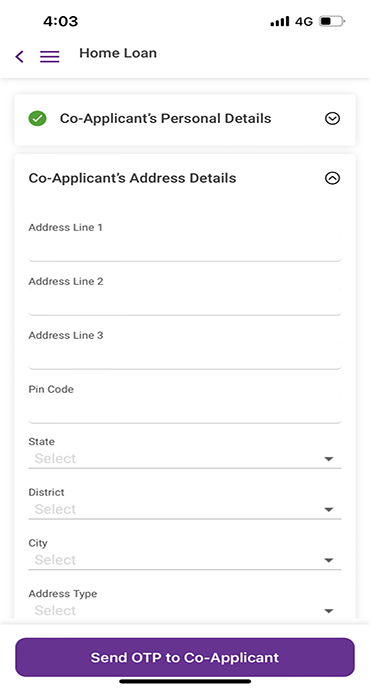

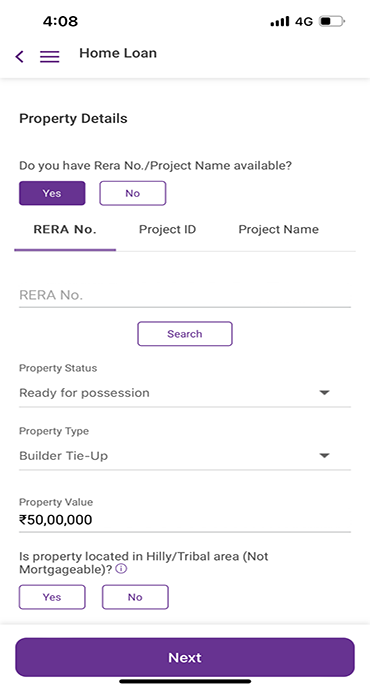

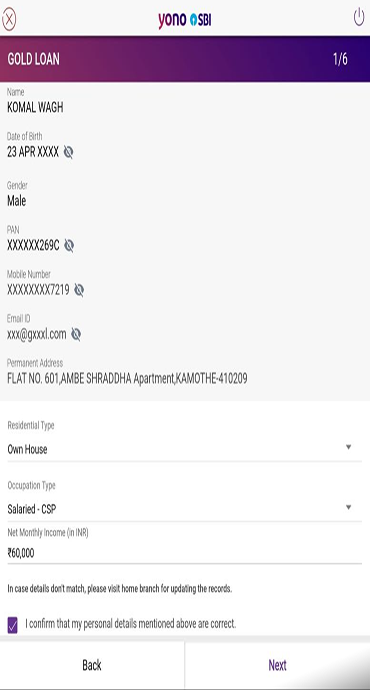

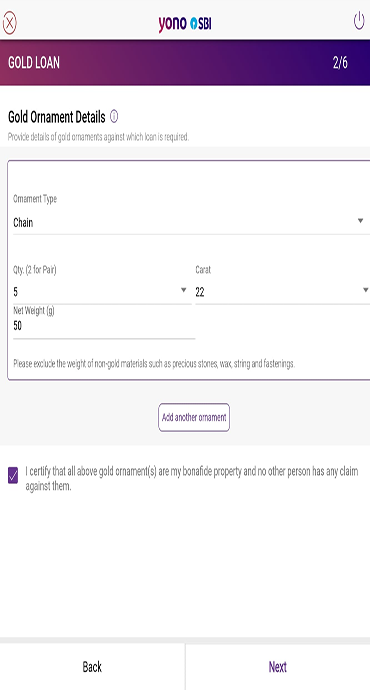

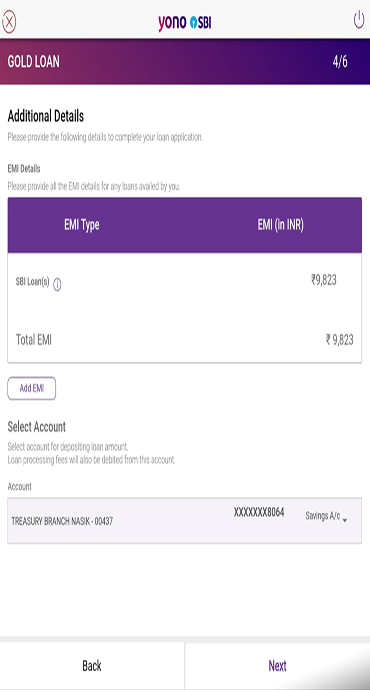

- Provide Personal and Income Details: Fill in your personal detail, address, income and loan details. Subsequently, include any existing EMI obligations and, if applicable, co-applicant details.

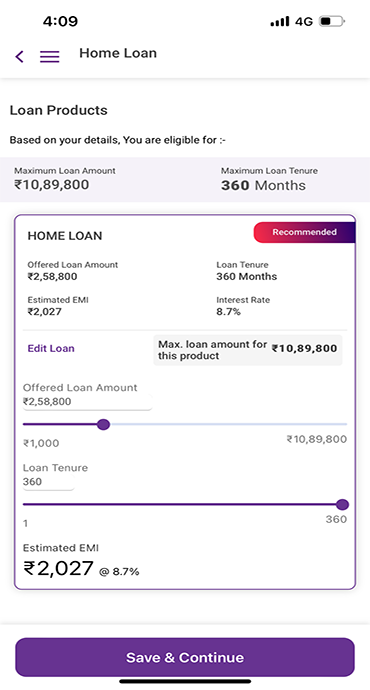

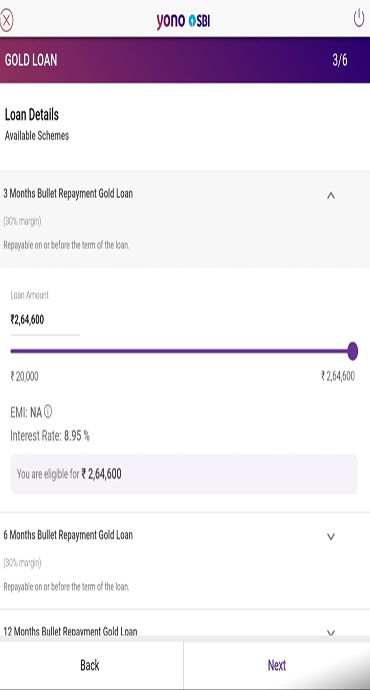

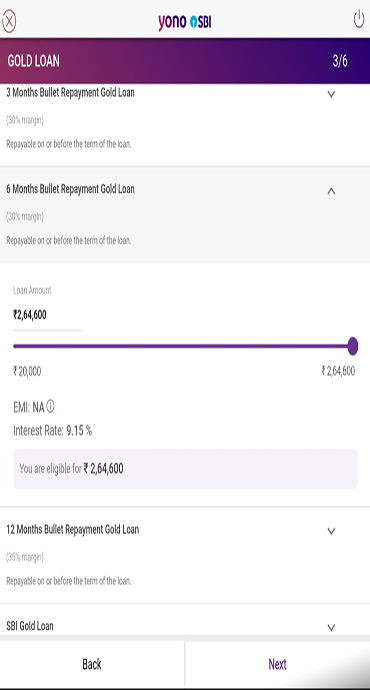

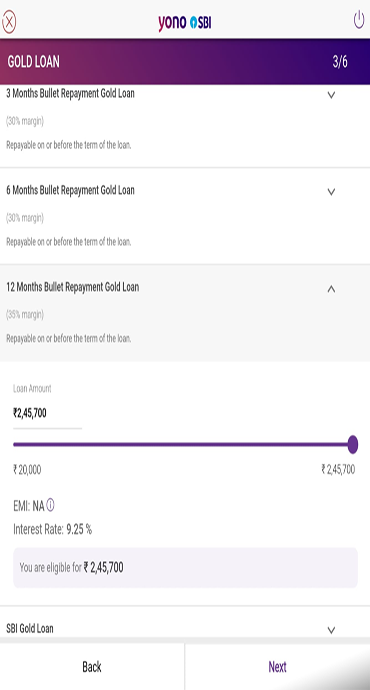

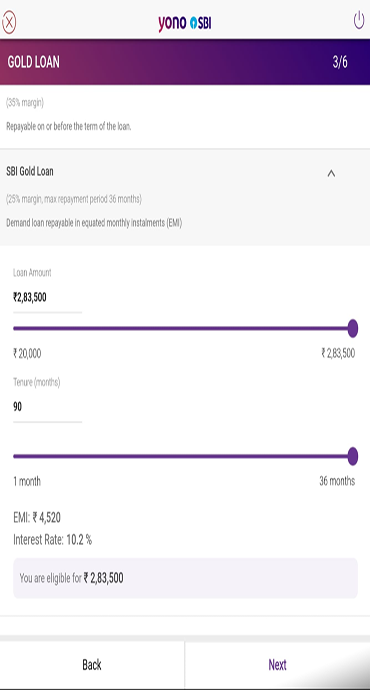

- Review Eligibility and Loan Details: Based on the provided details, the eligible loan amount, monthly Home Loan EMI, and loan tenure will be displayed, helping you plan your repayments effectively.

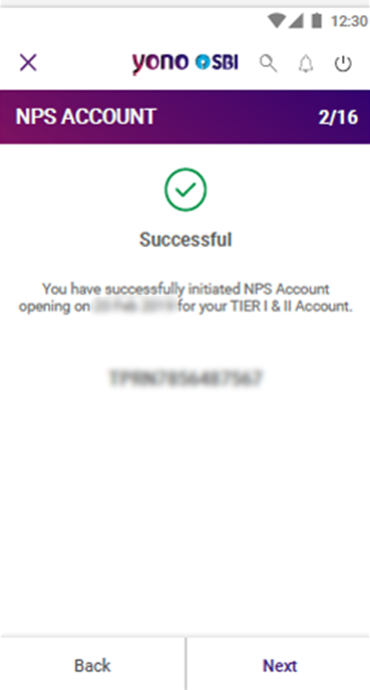

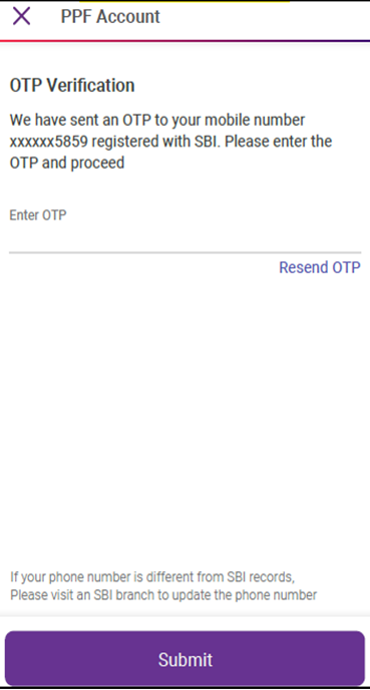

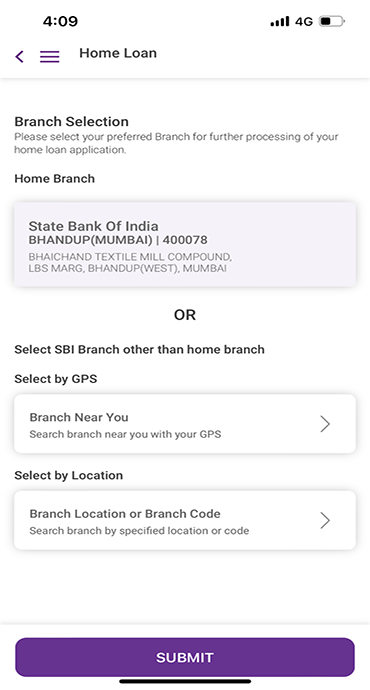

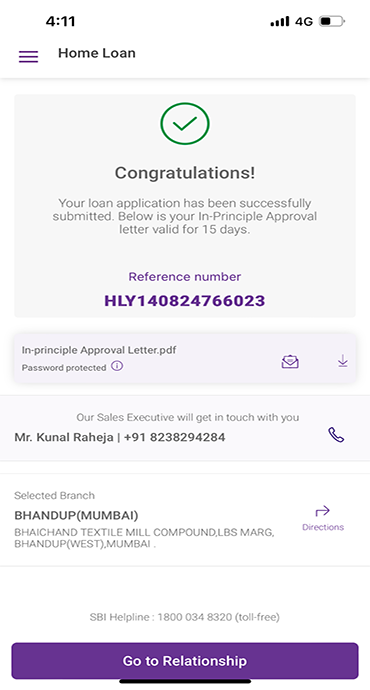

- Submit the Details: After reviewing your information, submit your request. An SBI representative will reach out to guide you through the application process.

SBI Home Loans provide a complete financing solution to ensure a smooth home-buying journey.

Tips for a Successful Home Loan Application

To increase your chances of home loan approval, consider these important tips:

- Ensure all documents (identity proof, income proof, and property documents) are complete and accurate.

- Maintain a strong credit score A good credit score enhances your chances of home loan approval and helps secure better interest rates

- Calculate affordability – Use the SBI Home Loan EMI Calculator to determine your monthly repayments.

- Reduce Existing Debt – A lower debt-to-income ratio (DTI) enhances loan eligibility.

Turn Your Homeownership Dream into Reality with SBI

Owning a home represents a lasting financial commitment rather than mere property ownership. Through SBI’s home loans you will receive interest rates along with flexible financing options and professional assistance so you can achieve home ownership.

Why wait? Take the first step today!

Explore SBI Home Loans Now Home Loan - Yono

आपकी रुचि से संबंधित ब्लॉग